Transocean to sell 38 shallow-water rigs to Shelf Drilling

Transocean has reached agreements to sell 38 shallow-water drilling rigs to Shelf Drilling International Holdings for approximately US $1.05 billion. The newly formed Shelf Drilling is sponsored equally by Castle Harlan, CHAMP Private Equity and Lime Rock Partners. The sales price includes approximately $855 million in cash and $195 million in seller financing in the form of preference shares issued by an affiliate of Shelf Drilling. The transactions are expected to close in Q4 2012. “This agreement marks an important milestone in our asset strategy to increase our focus on high-specification floaters and jackups, improving our long-term competitiveness,” said Steven L. Newman, Transocean president and CEO.

Transocean has reached agreements to sell 38 shallow-water drilling rigs to Shelf Drilling International Holdings for approximately US $1.05 billion. The newly formed Shelf Drilling is sponsored equally by Castle Harlan, CHAMP Private Equity and Lime Rock Partners. The sales price includes approximately $855 million in cash and $195 million in seller financing in the form of preference shares issued by an affiliate of Shelf Drilling. The transactions are expected to close in Q4 2012. “This agreement marks an important milestone in our asset strategy to increase our focus on high-specification floaters and jackups, improving our long-term competitiveness,” said Steven L. Newman, Transocean president and CEO.

David Mullen, president and CEO of Shelf Drilling, added, “This is an exciting opportunity with great potential. Our strategy will be to maintain an exclusive focus on shallow-water drilling, leveraging decades of complementary industry experience of management, three leading investment firms, and our employees, to provide best-in-class drilling operations for our customers.”

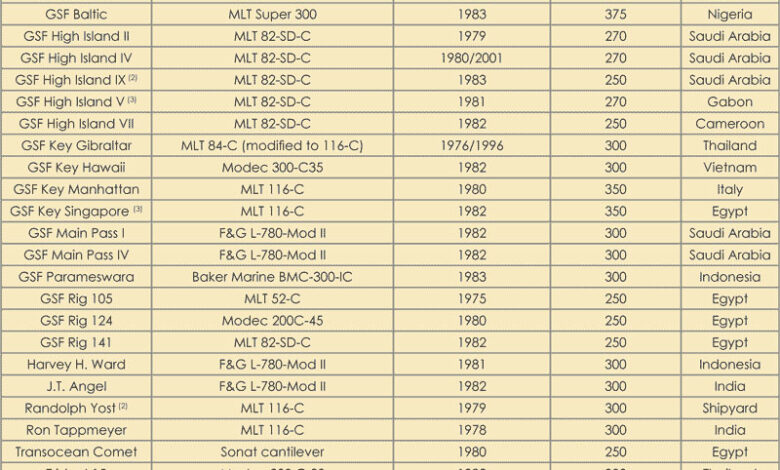

As of 10 September, Transocean owns or has partial ownership interests in, and operates a fleet of, 115 mobile offshore drilling units consisting of 48 high-specification floaters (ultra-deepwater, deepwater and harsh-environment drilling rigs), 25 midwater floaters, nine high-specification jackups, 32 standard jackups and one swamp barge. Included in the 115 drilling units, the company has 32 standard jackups and one swamp barge classified as discontinued operations. An additional 12 standard jackups have been classified as held for sale. The company also has two ultra-deepwater drillships and three high-specification jackups under construction.

Upon the closing of the transactions, Shelf Drilling will own 37 standard jackup rigs and one swamp barge. It will operate throughout Southeast Asia, India, West Africa, the Middle East and the Mediterranean.