Oil & Gas Markets

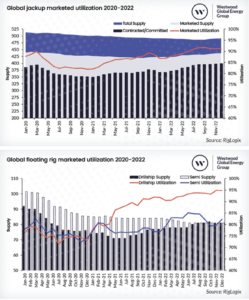

Westwood forecasts marketed utilization of offshore rigs will average 95% this year

Offshore rig activity was robust in 2022 and will likely remain so throughout 2023, according to recent insights shared by Westwood Global Energy Group’s Head of RigLogix, Terry Childs.

On the jackup side, marketed utilization reached 91% in December, and 398 of 437 marketed units were under contract or committed for work. This ramp-up was led by the Middle East, with a large number of jackups – including existing units that had been stacked as well as newbuilds – receiving multi-year contracts. Mr Childs also noted that jackup dayrates have increased in almost all markets, mostly growing by double digits.

This year, he expects global marketed utilization for jackups to increase to an average 95%, up from 90% last year.

For floating rigs, marketed utilization ended last year at just under 90% in December. However, if viewed separately, drillship demand was much stronger at an average 93% utilization for the year, while semis saw a much weaker 82% utilization rate.

The US Gulf of Mexico and South America both led the way in terms of floater demand; the former even saw 100% marketed utilization for the nearly entire year, from February through December. Dayrates also improved throughout 2022, particularly for drillships. The average fixture rate for drillships rose to just under $360,000, up from around $230,000 in 2021.

Mr Childs noted his continued expectation for decreased floater availability in 2023. For drillships, the marketed supply and demand will remain tight, keeping utilization around 95%. Demand for semis may be impacted in the North Sea due to the UK windfall tax, he said, where some operators have said they’re reconsidering previously planned drilling programs, but globally the marketed utilization is still expected to average 94%.

Longer-term contracts may offer more stability as Europe grows LNG imports

The competition for LNG between Europe and Asia is growing and set to intensify in the next two years, according to Shell’s LNG Outlook 2023. European countries, including the UK, imported 121 million tonnes of LNG in 2022, an increase of 60% compared with 2021. This enabled the country to withstand a slump in Russian pipeline gas imports. A 15 million tonne fall in Chinese imports combined with reduced imports by South Asian buyers helped European countries to secure enough gas, but Europe’s rising appetite for LNG pushed prices to record highs and generated volatility in markets around the world.

LNG is becoming an increasingly important pillar of European energy security, supported by the rapid development of new regasification terminals in northwest Europe.

Steve Hill, Shell’s Executive Vice President for Energy Marketing, said the war in Ukraine and resulting impacts on energy security has “underscored the need for a more strategic approach – through longer-term contracts – to secure reliable supply to avoid exposure to price spikes.”

Total global trade in LNG reached 397 million tonnes in 2022. Industry forecasts expect annual LNG demand to reach 650 million or even surpass 700 million tonnes by 2040.

More than 65% of UK project starts from 2023-2027 expected to be in upstream

The upstream segment dominates upcoming oil and gas projects in the UK, accounting for more than 65% of the total project starts anticipated between 2023 and 2027, according to GlobalData.

Its new report shows that, of the 94 projects expected to start operations in the UK during that time period, 61 will be upstream projects. Many of them will be in the North Sea’s shallow waters, said Himani Pant Pandey, Oil & Gas Analyst at GlobalData. “The shallow waters of the North Sea still have an important role to play in promoting the UK energy security, especially in the context of weaning away from the Russian oil and gas supplies.”

Rose Bank will be a key project, with a total production capacity of 121,000 bbl of oil equivalent per day. To be operated by Equinor, the project is expected to commence operations in 2026.

“Despite concerns from the climate activists and an increase in windfall tax by the UK government on the oil and gas sector, the latest North Sea oil and gas licensing round in 2022 attracted around 115 bids, an increase of 11 when compared to the previous licensing round in 2019,” Mr Pandey said. “The latest licensing round reflects efforts of the UK government to boost oil and gas production in the country.”

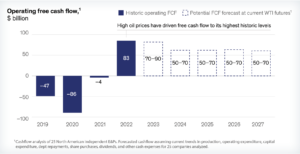

High cash flows among North American E&Ps likely to drive new consolidation wave, McKinsey report shows

McKinsey and Company says it expects a fresh wave of M&A in the North American upstream market in the coming years, fueled by high operating free cash flows. In a new report, the firm analyzes historical cash flows and projected operational and financial performance for the leading 25 North American E&P companies. Operating cash flows are projected to remain high, with levels between $70-$90 billion in 2023 and between $50-$70 billion to 2027 – even if oil prices drop to $65 to $70/bbl.

The E&Ps analyzed are expected to generate a total of $140-$200 billion in operating cash flow in 2023. Operators are taking advantage of these high cash flows by pulling all the traditional levers of capital management. For example, industry debt load decreased by $25 billion from 2021 to 2022 and is forecast to fall by an additional $15-$20 billion by 2027. With debt burden reduced, returning shareholder value will be priority, and McKinsey expects dividends to climb to between $30-$40 billion over the next year. But with a high volume of cash, these traditional levers will hit a natural cap. McKinsey’s analysis shows that only inorganic growth is unbounded going forward, suggesting that cash will be deployed through M&A.

Tom Grace, Partner at McKinsey & Company, said, “Even after these uses of cash have been exhausted, the industry is likely to remain cash-flow positive in 2023 and beyond, with a ‘war chest’ of $100-$230 billion. The primary tool left in the corporate finance toolkit is deployment of cash through M&A. A common refrain from industry veterans discussing M&A is, ‘You are either at the table, or you’re on it.’ This is a harsh reality, but companies with strong M&A capabilities and bold strategies often exit the cycle fully fed and healthy.”

Industry trends suggest that multiple M&A strategies are driving this next wave of consolidation. Basin consolidators will likely look to add scale and leverage operational advantages to achieve outsized returns. Integrators may seek to add assets in adjacent portions of the value chain to expand margins and increase resilience. The bold will probably use a portion of their cash to seed businesses to reshape their portfolios and position for the energy transition.

“The oil and gas industry is entering a period of unprecedented uncertainty characterized by the energy transition, evolving investor sentiment, and mounting energy security concerns,” said Jeremy Brown, McKinsey Consultant. “Now is not the time to bask in the glow of recent success. As in the past, successful industry players will work tirelessly to define and deliver a strategy rooted in sound M&A investments to accelerate their future growth and performance.”

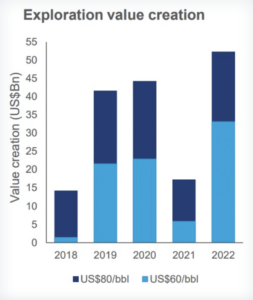

2022 discoveries drive value creation of exploration projects to record levels

The global oil and gas exploration sector had its strongest year in 2022 in more than a decade. In its work to improve portfolios by adding lower-carbon, lower-cost advantaged hydrocarbons, the sector created at least $33 billion of value and achieved full-cycle returns of 22% at $60/bbl Brent prices, according to a recent report from Wood Mackenzie.

It states that exploration well numbers were less than half the numbers during pre-pandemic years, yet the total volume of 20 billion bbl of oil equivalent matched the average annual volumes of 2013-2019.

“Explorers were able to drive very high value through strategic selection and focusing on the best and largest prospects,” said Julie Wilson, Director of Global Exploration Research at Wood Mackenzie.

The highest value came from a new deepwater play in Namibia, as well as resource additions in Algeria and other deepwater discoveries in Guyana and Brazil. “The average discovery last year was over 150 million barrels of oil equivalent, more than double the average of the previous decade,” she said.

National oil companies and majors continued to lead in exploration, accounting for almost three quarters of new resources discovered. These include companies like TotalEnergies, QatarEnergy and Petrobras.