Offshore, oversupply means 2019 optimism still bound by caution

Global rig supply continues to cast shadow on recovery prospects despite positive signs in steady oil prices, increased rig demand in spots

By Rick Von Flatern, Contributor

- Utilization unlikely to reach 85% in ’19, so no big dayrate increases are in the cards.

- All 12 jackups in US GOM now have contracts and backlogs, and dayrates are hitting up to $85,000.

- Rates are moving up for harsh-environment semis in Norway, signaling increasing demand; but most floating units will see only modest improvements next year.

- Construction of many newbuilds have been delayed but may be resumed anytime a company decides to take the rig over.

Petroleum sector analysts, pointing to a contradictory mix of market forces, paint a picture of a global offshore drilling industry that is likely to experience slow but steady growth in 2019.

In its quarterly Drilling and Production Outlook report issued at the end of September, Spears and Associates predicted that international oil prices will remain strong in response to continued global oil demand growth, low global oil inventories and increased geopolitical uncertainty. The report also concluded that, although US oil prices will rise relative to international prices, “US operators are expected to maintain a high degree of capital discipline going forward, slowing the rate of growth in US drilling activity.”

In 2019, the global offshore drilling market seems destined to not differ substantially from 2018, as operators labor to control costs even as global demand for oil continues to grow. The result is likely to be a slow and steady growth, constrained by an oversupply of drilling units but encouraged by steady oil prices and cautiously optimistic operators.

“It is a mix of things,” Senior Rig Analyst at IHS Markit Cinnamon Edralin said of activity drivers for 2019. “Right now, operators are looking at their budgets for next year. Over the past few years, there has been a lot of pressure on companies to meet shareholder requirements, so they have really had pressure to keep costs down.”

Ms Edralin believes operator efforts to minimize costs and increase efficiency will play major roles in shaping 2019 capital budgets. That means activity levels in the new year will likely mimic those of 2018, with perhaps some small gains from operators on the lookout for opportunities in the current low-cost environment.

A persistent oversupply of both floating and jackup rigs has created stiff competition among contractors for any drilling programs that operators do eventually bring to the market, which essentially allows operators to dictate terms.

“Operators can be pretty choosey when it comes to making awards,” Ms Edralin said. “They have the leisure to say, ‘We have this many contracts to award, and we’ve got this many bids, but we think you can do better. Come back to us with another offer.’ ”

Adding to market pessimism has been a dearth, in recent years, of operator final investment decisions (FIDs). The lack of commitment and direction has caused operators to delay development drilling projects and leave the pipeline of future work empty.

“That is why you are seeing some rigs that were contracted years ago for long-term contracts that were either canceled early or the rigs are now idle for part or the remainder of its contract,” Ms Edralin explained. “At the time they were signed to multi-year contracts, operators assumed they would have development work to fill out the schedule, but when the downturn came, operators shelved their plans for some projects and no longer had enough work to fill the rig charters they’d previously signed.”

In the offshore arena, the time between when an FID is taken and operations actually commencing is extended by time-consuming steps to perform complex planning and to obtain numerous permit approvals. Even if operators do make decisions in late 2018 to go forward with drilling programs, they are unlikely to commence until late 2019 or even 2020.

Because utilization rates remain relatively low, drilling contractors will likely have to continue accepting dayrates far below those seen during the peak years. And dayrates will not climb significantly until the market reaches about 85% utilization, which is far above current utilization rates.

“It is going to be extra hard to reach that rate,” Ms Edralin said. “There are lots of idle units – hot- and cold-stacked rigs around the world. A number of the floaters on contract now are rolling off contract next year and will have to compete with the inventory of stacked rigs.”

Little Movement in Jackup Dayrates Expected

According to RigLogix data, worldwide jackup utilization is 67.3%, with 338 of the 502 available rigs under contract. However, neither supply nor demand alone, said RigLogix headman, Terry Childs, can fix the current state of underutilization.

“Typically, utilization must reach at least 85% for dayrates to move substantially,” Mr Childs said. “For jackup utilization to move 18%, demand alone would have to increase to 427, and an 89-rig increase is simply not going to occur anytime soon.

“Conversely, supply would have to decline to 398 for the existing level of demand to result in 90% utilization, so scrapping 104 jackups is not going to occur in the next year either. In addition, there are still 79 newbuild jackups sitting in various shipyards with nowhere to go, so that just means attrition would have to be far larger than what is likely possible. The bottom line is that there is still a long way to go for an 85% jackup utilization.”

Mr Childs said he expects to see some combination of rising demand and decreasing supply in 2019. But, he added, “unless there is an attrition increase or demand increase of historic proportions, 85% utilization rates will not be reached in 2019. Therefore, little reason exists to expect jackup dayrates to move upward next year.

In the Gulf of Mexico, the jackup market consists of 12 rigs that are all under contract, with a backlog of work. In the Middle East, which has become the largest jackup market in the world, Mr Childs said, more than 100 rigs are competing for work, leaving some rigs idle. This means that dayrates are expected to rise modestly in the US Gulf while contractors in the Middle East have little reason to expect their dayrates to change.

“In most regions, dayrate trending is a flat line,” Mr Childs said. “For jackups, rates in the US Gulf recently hit $80,000 to $85,000, and that will have a positive impact on upcoming contracts for other rigs. Jackup rates elsewhere in the world have stayed pretty much within the same ranges for at least the past year.”

While all regions have unique sets of circumstances that contribute to supply and demand and dayrates, no region is entirely isolated from nearby and worldwide market forces. In India in 2017, for example, jackups were put to work under contracts with dayrates of about $25,000, when dayrates elsewhere in the world were significantly higher. While some contractors are willing to accept such low rates over idling their rigs, the choice to do so can impact nearby markets.

Anecdotal evidence, for instance, is that subsequent contract dayrates in the Middle East were at lower rates than expected. A similar concern may exist for contractors in the Gulf of Mexico in 2019, Mr Childs said, as bids are coming up in nearby Mexico.

“The US Gulf and the Mexican Gulf are obviously next-door neighbors,” he said, “so it will be interesting to see if the trend in the upper regions being signed in the US will affect Mexico.”

“In some parts of the world, utilization is decent, but dayrates are not responding because there is always one or more contractors willing to trade rate for term,” Mr Childs said. “They take a lower dayrate for a longer contract term because if they can make a little money or break even but keep the rig busy for a longer period, they will do that.”

While some geographical regions are more attractive than others, the offshore drilling market is global. More widespread upward pressure on dayrates may come about if operators mobilize rigs from one region to another. Operator may choose a long-distance rig mobilization, for example, if it is the only way to obtain a rig that fits specific drilling requirements. They may also find it makes economic sense to move a rig the company already has under contract from one region to another rather than hiring a new unit locally.

“We were at five (jackup rigs) about a year ago and are at 12 now,” Ms Edralin said. “Because that is all the rigs actively marketed in the Gulf now, a couple of operators are looking for rigs. So they have to reactivate something cold-stacked or have something brought in from outside the Gulf of Mexico.”

Mr Childs said he anticipates that as many as three jackups will be moved into the Gulf of Mexico by late Q2 2019, and Ms Edralin said that several rig contractors were in discussions with operators to move jackups to the Gulf.

Ms Edralin also reported that Enterprise Offshore Drilling’s Enterprise 263 jackup was recently reactivated from cold stack; some rig contractors have also indicated plans to reactivate other rigs in either late 2018 or early 2019. Reactivations are interpreted by analysts as indicators that rig contractors are optimistic about the terms they will receive for their mobilized and reactivated units.

A Few Floater Newbuild Orders Likely

The market for semisubmersibles and drillships once sent dayrates for the newest vessels to $500,000. While those days are long gone, the impact of those rates are still felt today in the floater market, particularly for high-end drillships, which is suffering from a significant oversupply.

Still, dayrates are not moving downward, as the offshore drilling industry has begun what most experts say is a slow but steady recovery. Dayrates for floaters in the Gulf of Mexico, including drillships, for instance, have edged up in recent months to between $130,000 and $140,000 from approximately $125,000.

Globally, Ms Edralin said, the trends for floating units in 2019 seem to be modest improvements in utilization rates and contract terms.

“It is not improving as much as the industry would like to see because we still have an overcapacity problem,” she said. “However, we do expect to see an increase in FIDs, which will drive work for 2020 and beyond.”

While 2020 will likely be a better year for offshore rig contractors worldwide, Ms Edralin also cautioned that “it will be a ways off before we see meaningful increases in dayrates because you first have to get utilization rates up before you can begin to push rates up.”

A Spears and Associates analysis indicates utilization rates, which dropped precipitously in 2015 from their peaks in 2014, continued to fall through 2016. In 2017, the utilization turnaround was significant, growing by nearly 25% from 2016 levels. Spears is projecting there will be growth through 2020, albeit at a much slower pace.

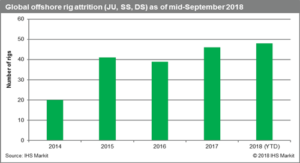

Ms Edralin said she expects some rig attrition in 2019, as well as a few newbuild orders, likely for harsh-environment drilling. Further, the industry may see more rig sales as some contractors sell off a segment of their operation or when entire companies pull out of the industry.

Current utilization, according to RigLogix data, Mr Childs said, is 61.6%, with 151 of 245 units under contract. “In the past year, the floating rig market that’s most been in the news has been the harsh-environment semi fleet in the Norwegian North Sea,” he said. “Rates for these rigs have moved up substantially for the same reason as those for jackups in the Gulf of Mexico – a high level of demand versus available supply.

Even though a few units have recently completed contracts, there are work schedules for some contracts that do not start until next year and, in one case, in 2020. Demand here is strong enough that the first new semi order since December 2014 was for a harsh-environment unit destined for the North Sea.

“In the Gulf of Mexico, there are 23 marketed drillships and 18 under contract, so you still have five idle drillships sitting around,” Mr Childs continued.

“In such a small market, that is a lot, so until the excess supply is absorbed, dayrates will not likely see significant upward movement. Over the next few months, there are two more units scheduled to leave, with a third possible. There are two units currently outside the Gulf that have Letters of Award (LOA) signed for work in the Gulf, but they will not mobilize until if and when final contracts are signed.

“The most recent floating rig dayrate resulted in a $15,000 increase from the same rig’s previous contract, so the bar there has been reset a bit higher, but overall we could see slight upward movement in some contracts, but we do not expect much more upward movement for a while,” Mr Childs said.

Generally, however, floating rig rates for most regions are seeing little improvement, he added. In the UK North Sea, dayrates in 2018 have generally ranged from $115,000 to $135,000.

“We saw $140,000 to $160,000 and thought that was the bottom,” Mr Childs said. “But then the low point fell to around $120,000, and a couple of floater contracts in India went even lower at around $108,000.”

Although utilization and dayrates have not taken off, Mr Childs does see cause for optimism among floating rig contractors in other regions.

“There is rig work coming up from operators in Central and South America, including programs offshore Mexico, Brazil, Colombia and Suriname,” he said. “Several operators have rig requirements, so we are likely to see dayrates reaching or even exceeding $200,000 next year.”

The recent Transocean/Petrobras blend-and-extend deal for the Petrobras 10000 drillship reportedly pushed that rate to $300,000, but these types of contracts are not indicative of typical market dayrate. Nevertheless, that deal could accelerate the rate increase in the region, he continued.

Mr Childs reported that floating rig demand offshore Africa is rising, “but with 11 warm-stacked and six cold-stacked floaters, the market as a whole remains oversupplied.” He also noted he is convinced that market dayrates have bottomed out but cautioned that he still does not envision rates in most regions rising significantly in the near future. The trend is for a general rate improvement.

“However,” he said, “it only takes a few dayrates either well below or above the current market for other rates to follow suit. In the meantime, a $10,000 or $20,000 increase, while not large, may be the difference between breakeven or making a profit for some contractors who are currently paying to maintain stacked rigs.”

Newbuilds

As is to be expected during a time of oversupply, newbuilds have been scarce in recent years. But, Ms Edralin said, there are some hopeful signs, including rigs fitted with 20,000-psi BOPs that will be required for some ultra-deepwater Gulf of Mexico applications.

“Instead of reconfiguring an older rig to accommodate this new BOP, some operators are talking to contractors about newbuilds,” she said, explaining that opting to build new rather than retrofit is an economic decision driven by market conditions. “Cost is a big factor. A rig using a 20,000-psi BOP would also require other high-specification equipment. Retrofitting an older rig might not be cost-effective at this time, especially when taking into consideration all of the open slots at shipyards and the number of rigs still in the partially built phase.”

Newbuilds on analysts’ lists include some on which construction was started and halted before they were completed. As the market improves and demand rises for newer-generation rigs, these rigs may eventually be brought out of the shipyard by new owners.

One driver for newbuild floaters that may overcome contractor reluctance to invest in them is an aging fleet that is gradually being scrapped. In addition, some rigs under construction before the last downturn are still in the shipyard awaiting completion. “There is no reason they can’t just resume construction,” Ms Edralin said. “Someone will take them over. Rigs that are in the building stage have a strong likelihood they will be delivered at some point. Just don’t be surprised about the delivery schedule being pushed back.” DC