Land market steadies after late 2018 dip

High-spec rig market recovering well, with both rig demand and dayrates expected to remain healthy for remainder of 2019, although contractors may delay rig upgrades as cash flows tighten

By Linda Hsieh, Editor & Publisher

When oil prices took a sudden and surprising dip in late 2018 after what had been a relatively strong and stable year, it caught the industry off guard. It also led to a bit of panic in the industry, with worries that the price slump would lead to another market downturn in 2019.

“Fortunately, it did not. It rebounded,” Chris Menefee, Senior Vice President of Business Development for Independence Contract Drilling (ICD), said. “But it still caused some uncertainty… and it couldn’t have come at a worse time,” he added, noting that it led E&P companies to adopt a more conservative approach as they finalized 2019 budgets. Some rigs also were cut when oil prices dropped. “In our business, it just takes a little while to get that going again,” Mr Menefee said.

For contractors with high-spec rigs – or super-spec rigs, as people are referring to them – that segment of the market appears to have seen limited contraction. In the first quarter of 2019, demand for these rigs has remained healthy. “They’re at 100% utilization, and they’re keeping their dayrates steady where they’ve been throughout 2018,” Scott Forbes, Vice President, US Upstream Costs with Wood Mackenzie, said.

Another piece of good news is that the majors aren’t slowing down, as some had anticipated. “A number of majors are increasing their activity levels, while the independents and private companies are cutting back to stay within cash flow,” Mr Forbes said. “This is something different we hadn’t really seen before.”

-

Operator CAPEX generally down 6-7%, although majors haven’t shown signs of slowing down their activity.

-

Inquiries for rigs in the Eagle Ford are increasing as lower service prices prompt operators to consider new projects.

-

Operators are releasing older rigs without ‘super specs’ as contracts expire; rates for these rigs have fallen as contractors compete to keep them working.

The market, however, has been less favorable for rigs that are not high-spec and unable to drill the long laterals that operators want. A number of these units have been released by operators as their contract terms expired, Mr Forbes noted. Further, the potential to invest in upgrades for these rigs has dimmed, due to the large upfront capital commitment required. “Rigs were being upgraded in 2017 and 2018, but I don’t hear as much about upgrades now because the money’s got so tight in the last few months.” Rates for these lower-spec rigs have also waned as drilling contractors compete to keep them working, he added.

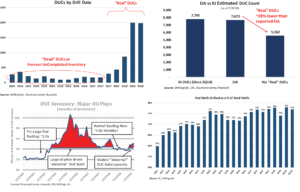

Wood Mackenzie is also starting to see operators allocate more of their capital plans toward completions, a trend that will continue in the second half of 2019. The number of drilled but uncompleted (DUC) wells is estimated to be in the 8,000 range.

Marshall Adkins, Managing Director for Raymond James and Associates, says he believes the number of DUCs may be misleading, however. Many of the wells that are being counted as DUCs are actually lame or dead wells, he asserted. “The untold reality is that the industry still drills a small amount of ‘problem’ wells that have officially started the drilling process but are failed wells that will never be completed,” Raymond James wrote in its 25 March industry brief. “These failed wells could be due to tools lost in the hole, sidetrack problems, lost-circulation issues, stuck pipe, or a myriad of other real-world problems. We believe that a proper DUC count should not include wells that will never get completed or ones that are uneconomic to complete.”

An increase in the number of the DUCs is also the natural result of operators’ adoption of pad drilling. “Logistically, as operators move into manufacturing mode and place more and more wells on centralized pads, the time between initial drilling and final well completion will naturally increase. In other words, working inventories of wells ready to be completed must increase to keep the factory optimized,” the Raymond James brief stated.

Rystad Energy agreed that there was not any “abnormal” growth of DUCs last year, with the ratio of drilled but uncompleted wells to drilling activity staying relatively flat. “When the rig count goes up, it is just normal that the inventory of drilled but uncompleted wells increases proportionally,” Artem Abramov, Rystad Energy partner, said.

With drilling activity and DUCs increasing, it’s also natural that production will rise. As of January 2019, the Lower 48 was producing an estimated 9.6 million bbl/day, according to Rystad. That compares with just 7.9 million bbl/day a year ago, representing an impressive 1.7 million bbl/day year-on-year growth. In terms of annual production, Rystad is forecasting 2019 to average 10.1 million bbl/day, compared with 8.7 million bbl/day in 2018 and 7.2 million bbl/day in 2017.

Drivers for these production increases include technical improvements and lower service prices, both of which enhanced the commercial prospects of drilling projects and led to a steep ramp-up in activity.

“We’ve also seen quite a few new companies coming in and starting development of oil and gas reservoirs, both in West Texas and many other regions,” Mr Abramov said. Further, better oil prices in 2017 and 2018 triggered activity on acreage positions that had been put on hold in 2015 and 2016, and these projects also contributed to production increases.

Looking further into 2019, Mr Abramov said he expects the number of total wells drilled and completed to be on par with last year, even though operator CAPEX has generally declined by 6-7% compared with last year. This doesn’t mean there will be lower activity this year; it simply came about because the cost of wells drilled will be lower this year, he noted. This is a reversal from 2018, when average cost per well rose by 11% to $7.1 million from 2017’s $6.4 million.

Part of last year’s increase came from higher pressure-pumping and proppant costs, which have been trending the other way since late 2018. “The pressure-pumping market is oversupplied, and prices declined by anywhere between 5-20% since the peak in 2018,” Mr Abramov said.

The same story is observed in the proppant market. It’s extremely oversupplied now with new sand mines in West Texas coming online. Operators are rapidly adopting in-basin sands, essentially eliminating transportation costs from the supply chain.”

Another cost component is OCTG, where prices increased in the range of 20-30% last year. “The industry had to deal with new steel tariffs, but now that has already been absorbed by the market. This year, there are no changes expected,” Mr Abramov said.

Unlike well costs, however, breakeven prices are likely to rise slightly this year, Mr Abramov said. “Breakeven prices always follow the activity level. If you could drill more wells, you have higher average breakeven prices because more wells means higher activity outside of the core acreages.” Nowadays, operators can pick their drilling locations based on the oil price, simply because there are still so many years of inventory of sweet spots from which to choose.

“The main message is that the US oil industry is now able to respond to any price fluctuations in a very flexible way by high-grading or down-grading their activity.”

As of early 2019, breakevens in the Bakken, Permian/Delaware and Niobrara are all averaging around $40/bbl, according to Rystad.

Increasing Inquiries for Rigs in the Eagle Ford

Out of ICD’s 32 marketed rigs, only two are available today, making for a nearly 94% utilization. “We’re going to have some transitional periods between contracts, but overall we feel like the opportunities that we’re seeing for work are going to continue to get better,” Mr Menefee said. “As long as oil stays at $60-65, we’ll be 90% utilized.”

The majority of ICD’s rigs are in the Permian, and the rest are in the Haynesville. The contractor is also fielding increasing inquiries for the Eagle Ford, Mr Menefee said, as interests for drilling there increases. “Although the bottlenecks of the pipeline infrastructure in the Permian has gotten much better, they don’t have those challenges in the Eagle Ford.”

Softness in the rig market may also be leading operators to consider taking on new projects in the Eagle Ford. “Because of the dip in commodity prices, the rig market was softer, and dayrates were lowered. Now they’re actually beginning to recover back to levels seen in the first half of 2018,” he said.

Drilling contractors may hold off on rig upgrades until dayrates continue to stabilize, he added. “As an industry, we’re becoming more cautious of CAPEX and making sure that we get a return for what we spend. For both E&Ps and drilling companies, there has been a push to make sure we’re giving back to shareholders and living within cash flow. If we do spend to upgrade a rig, we’re going to make sure that we’re getting something in return for it.”

However, Mr Menefee also noted that returns on investment must be quantified on the front end. “If we can determine that adding additional equipment will keep the rig working for a good customer for a longer period of time, then we are able to ensure we’ve gotten the returns expected.”

ICD currently has four walking SCR rigs that require AC upgrades to make them high spec. “We have plans to upgrade those throughout the year. At that point, the whole fleet would be considered pad optimal.”

Better Collaboration and Training for Better Technology Adoption

Like many other drilling contractors, Precision Drilling sees the Permian as the continued hub of US onshore drilling, with over half of its rigs operating in this basin. As of early 2019, the company had 43 rigs working in the Permian, which compares with 36 a year ago. “The Permian is where we see the strongest demand for the second half of the year, especially with new takeaway capacity coming online to alleviate some of the bottlenecks that we saw last year,” said Fawzi Irani, Vice President of Sales and Marketing North America for Precision.

Out of the company’s 257 rigs, 104 are in the US, 115 in Canada and the rest spread across various other countries. For its US fleet, utilization at the start of 2018 was around 60%. “We peaked throughout the year to about 77% utilization before we saw a drop late last year,” Mr Irani said. “But this year we started strong at 76% utilization, and we now have 80% of our fleet in the US active.”

Besides the Permian, requests for rigs are also coming from the Eagle Ford, Haynesville and Marcellus/Utica, although contracts will likely be for shorter durations until operators see more stability in commodity pricing, he said. In terms of rig types, Mr Irani said the strongest demand from operators is for the Super Triple 1500 AC rigs that are equipped with walking systems and 7,500-psi fluid systems.

Precision is also pushing forward with its digitalization initiatives, which include process automation control, drilling performance applications, directional guidance system, and data analytics and optimization. “All of these technology platforms allow us to deliver consistent, repeatable and safe operations. That’s really the next step in terms of what the industry is looking for in order to lower overall well costs,” Mr Irani said.

Challenges to these efforts remain, however, “especially when we’re talking about process automation control taking over some of the tasks that have historically been supervised by the field.” To promote further collaboration with operators and boost their adoption of new technologies, Precision is focusing on providing additional field-level technical support. “We determined that we need to accelerate the training and certification of Precision’s field automation engineers and have expanded our in-house training and support processes.”

Another avenue that Precision is pursuing to close the gap with its customers is to offer them both classroom and on-the-rig training for the new process automation control platform. This training has “proven to be extremely valuable for managing change. It increases the level of understanding of the system’s capabilities, brings alignment in terms of the objective, and improves buy-in from all levels within the organization.”

The contractor has been inviting field engineers, office engineers, field superintendents, office managers and drilling managers to these training sessions, ensuring that all stakeholders have increased visibility to the technology platform.

Precision currently has 31 rigs with process automation deployed in the field, as well as two training rigs that are similarly equipped. “The industry is seeking the next step-change, and we believe this is it. Further adoption from the industry through collaboration and by bringing in new drilling performance applications will improve overall efficiency.”

Crew retention is another area of focus for Precision, especially for motor hands and roughnecks in West Texas. The company was finding that employees would often leave after being onboarded because they realized that the working environment wasn’t what they anticipated. This can be costly for the employer. To address this, Precision has altered its hiring process by incorporating a psychometric questionnaire to assess job applicants.

Developed in partnership with academia, the questionnaire evaluates the likelihood of the individual being suitable for the role, and vice versa. An algorithm is used to rank the applicants’ work attitude, dependability, stress tolerance, teamwork and other behaviors. This assessment has now been built into Precision’s hiring process for all entry-level positions. “The results seem promising so far,” Mr Irani said, and the company plans to continue its use in 2019 and beyond.

Newbuilds Amid a Steady Market

Supported by 100% utilization of its rig fleet, which Scandrill has enjoyed for more than two and a half years, the company embarked on the construction of two newbuilds, with some repurposed components, last year without any contracts. The first of those two, a Norseman II Series 2,000-hp AC rig called the Scan Titan, was completed in early April. It is going to work for KJ Energy in East Texas under an initial term of six months, although Scandrill hopes that term will extend out to a full year, said Paul Mosvold, President and COO. The super-spec rig can drill to a maximum of 26,000 ft.

The Scan Titan adds to the company’s 15-strong fleet, 10 of which are located in the Permian and five in East Texas. “Overall, we’re seeing a steady market, and we’re anticipating this year to remain flat, maybe with a slight uptick in rig rates,” Mr Mosvold said, noting that he’s already seen a small resurgence in the East Texas market due to demand for LNG.

He also expects the industry will continue to high-grade its rigs as operators drill longer laterals and more complex wells. Other than the newly delivered Scan Titan and two existing super-spec AC rigs that are working in the Permian, all other Scandrill rigs are what Mr Mosvold calls “SCR rigs on steroids.” This means they’re traditional brake-handle rigs, yet have 7,500-psi pumps, walking systems and “all the technical capability to drill the super-laterals that are required,” he said.

The second newbuild that’s under way is the Scan Legacy, which will be similar in specs to the Scan Titan but will be one-of-its-kind in the sense that it will be partly powered by lithium batteries. Scandrill is partnering with Caterpillar on this “experimental rig,” where a 25% savings on fuel costs will be possible, Mr Mosvold said. “When you need massive power for short periods of time, those short spikes of power will be supplied by the battery, versus having an additional engine running in case you need power for a short time.” The diesel engines will charge the battery. Both new rigs are equipped with Caterpillar’s dual-fuel DGB systems.

Scandrill is currently marketing the rig, which will be available for a field-test with the new battery power technology by August.

Moving from Gulf Coast to the Permian for Better Prospects

Gulf Coast-based Nicklos Drilling recently made its entry to the Permian market with Rig 6, which began working in March under a two-well contract. The rig is among four 1,500-hp walking SCR units that are being acquired from Cyclone Drilling; each is being upgraded with 7,500-psi mud pumps and automatic catwalks, said Jim Nicklos, President. The second of these four rigs has moved to Odessa, Texas, and will spud its first well of a six-month contract in late April.

Work to acquire and upgrade these rigs from Cyclone began in 2018, and the company moved the first rig to the Permian in November in preparation for a contract that was delayed when oil prices slipped in December. Nicklos then secured the current two-well contract and has since signed two additional six-month contracts.

“We do see an uptick in the Permian, and the dayrates have increased a little bit from late last year, so the outlook there is terrific,” Mr Nicklos said.

Onshore outlook by the numbers

- In January 2019, the Lower 48 was producing an estimated 9.6 million bbl/day, compared with 7.9 million bbl/day a year ago.

- Breakeven prices are likely to rise slightly this year. As of early 2019, breakevens in the Bakken, Permian and Niobrara averaged around $40/bbl.

- Softness in the market has not hit the super-spec rigs, whose utilization remains at or near 100%.

“We’re seeing a lot of new private equity money going out to the Permian. People want to drill out there.” DC

DC Associate Editor Sarah Junek contributed to this report.