Increased private investment needed in Mexico to meet expanding demand for energy

With a presidential election looming, Mexico is facing several energy challenges, including declining oil and gas production, a need to increase exploration activity, a high dependence on gasoline imports, a constrained power supply and public pressure to transition to renewable energy. All this is occurring as domestic demand is expected to continue to grow through the decade, according to a report from Wood Mackenzie.

“The energy sector in Mexico faces major challenges linked to the growth of demand in all sub-segments, upstream among them,” said Adrian Lara, Principal Analyst, Upstream Latin America for Wood Mackenzie. “Regardless of the presidential election outcome, there is a need for the new government to re-assess not only the role but also the terms for increasing private investment in the energy sector.

“During the last five years, the Mexican government has committed to strengthening state-owned hydrocarbon producer Pemex’s role in the energy sector. But there is a limit to how much Pemex can do with respect to taking the risk and funding the investment required to grow the industry’s infrastructure,” Mr Lara said.

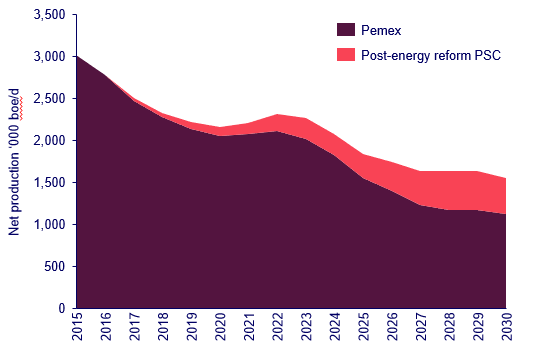

According to Wood Mackenzie’s report, “Mexico’s energy sector challenges for the incoming administration,” Mexico’s oil and gas demand is forecast to grow at 2% during the current decade. However, hydrocarbon production is set to continue to decline throughout the decade, making it difficult for the nation to meet its increasing domestic refining demands and natural gas demands in the power and industrial sectors. In this environment, Mexico will be unable to reduce gas imports.

“Although non-Pemex production through production-sharing contracts (PSCs) grows by the end of the current decade, this upside won’t be enough to counter the declining trend,” Mr Lara said. “There is a risk for a steeper decline in production post-2030 without major changes to the current government policy of forbidding new hydrocarbon bidding rounds or awarding exploration blocks.

“Mexico’s energy security requires the availability of affordable energy sources. Integration with the US energy market supplies gas at competitive prices, but we believe a new government should evaluate policies conducive to developing untapped gas reserves,” Mr Lara added.

According to Wood Mackenzie, about 60% of prospective resources in Mexico remain unawarded. Total prospective resources in the country are estimated at almost 113 billion BOE, of which 67.6 billion BOE correspond to 528 unawarded areas located across several onshore and offshore basins. Out of the volumes discovered through exploration since 2020, only 36% have been commercially viable on average. Currently, only Pemex and three other operators have committed a budget for future exploration activities.

“Hydrocarbon exploration carried out since the opening of the sector to private operators has had limited success,” Mr Lara said. “Most of the key international companies that were awarded blocks did not achieve commercial success, and with a re-start of bidding rounds still uncertain, these companies can either leave the country or look for exploration opportunities elsewhere.

“There is still a significant area of unawarded acreage and unassigned prospective resources in the country. If bidding rounds are reactivated, a full review of existing fiscal terms would ensure that Mexico remains attractive and competitive for hydrocarbon exploration. We consider that discovering additional resources is necessary even to just maintain Mexico’s oil output at current levels of 1.8 million barrels per day.”