Halliburton launches new casing annulus packer to prevent sustained casing pressure

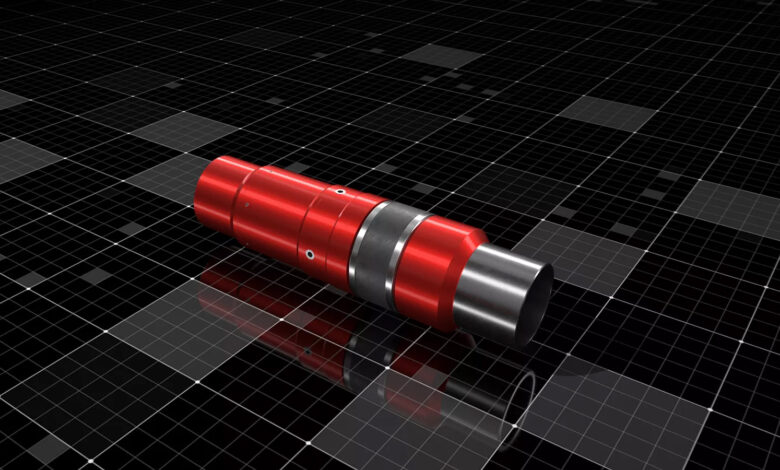

Halliburton introduced Obex EcoLock, a new compression-set packer that helps prevent sustained casing pressure (SCP). The packer “serves as a cost-effective mechanical barrier to mitigate low pressure gas or fluid migration and deliver isolation assurance,” according to the company.

The packer is built upon Halliburton’s gas-tight, V0-rated Obex GasLock packer design. The Obex EcoLock packer provides V6-rated isolation and can support multiple-stage cementing with optional integral cementing ports and an internal closing sleeve. It is currently available for 7-in. and 9 5/8-in. casing designs with additional sizes in the future.

“Obex EcoLock is an excellent economic alternative to inflatable and expandable packers to deliver isolation assurance independent of losses or circulation pressures,” said Matt Lang, VP of Cementing at Halliburton. “The addition of this tool to our Obex packer portfolio enables us to deliver a suite of API/ISO validated casing annular barriers to keep pressure away from the surface and support cemented barriers.”