GlobalData: Production in the US Lower 48 set to continue medium-term upswing

US crude oil production has grown steadily in 2022 thanks to increased energy demand in the US and internationally. According to a new report from GlobalData, the majority of this production has been conducted in the Lower 48 region, which represented nearly 75% of total production. This upward swing to continue in the medium term. The increase in production will be seen predominantly in the Permian Basin due to sustained investment from operators in drilling and completion of wells, supported by a large skilled workforce.

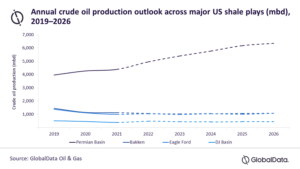

The major oil plays within the Lower 48 region include the Permian, Bakken, Eagle Ford and DJ basins. Together, they are expected to cumulatively produce around 7.5 million bbl/day of crude oil in 2022. The Permian will production approximately 5.0 million bbl/day in 2022.

Growing domestic energy demand in 2022 amid sustained economic recovery from the pandemic is expected to support steady growth in gas production across the US Lower 48. Additionally, the Russia-Ukraine conflict has prompted European gas importers to seek alternatives to Russian gas, further prompting US gas producers to lift their output.

GlobalData expects the biggest contribution to US natural gas production growth to come from the Marcellus and Permian resource plays. Marcellus, the largest natural gas formation in the country, contributed nearly one-third of the US unconventional gas output in 2021.

“Currently, shale oil and gas producers are primarily focusing on maximizing value for their shareholders,” said Ravindra Puranik, Oil & Gas Analyst at GlobalData. “This is in stark contrast to the previous oil price downturn during the 2014-16 period, when companies kept adding drilling and completion crews to drive output. The current scenario is reflected in the number of rigs, which are still below pre-pandemic levels. This indicates that operators are following a measured approach at capital spending and production growth, despite the recent surge in oil prices.”