By Maggie Cox, editorial coordinator

Chevron is set to deploy the first dual-gradient drillship, the Pacific Santa Ana, in the Gulf of Mexico by summer 2011. Currently sitting in the Samsung Heavy Industries shipyard in Geoje, South Korea, the Pacific Santa Ana will have the ability operate in 12,000 ft of water and drill wells over 35,000 ft deep. Chevron has been working in conjunction with AGR Drilling Services, GE Oil and Gas and Pacific Drilling to develop this dual-gradient system and drillship.

According to Ken Smith, manager of dual-gradient drilling project implementation, Chevron, dual-gradient drilling is going to be the eventual industry “norm” – not single-gradient drilling.

“The world is changing, and I truly believe that someday we will see dual-gradient equipment is just some of your normal deepwater complement, just like a BOP. It’s the beginning of something different and will change the way we drill,” Mr Smith said.

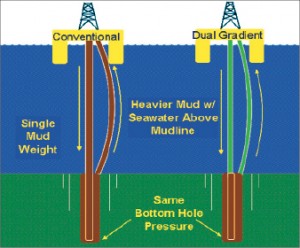

Dual-gradient drilling promises to overcome the limitations imposed by sending drilling mud through thousands of feet of drill pipe and riser. This tremendous volume of fluid creates a huge hydrostatic head that can induce fracturing, particularly in shallow zones. Dual-gradient techniques dramatically change the physics of the drilling process, such that the rig effectively sits on the seafloor, rather than at its actual physical location thousands of feet above on the sea surface. In dual gradient, the mud column extends only from the bottom of the hole to the mudline. Subsea pumps are used to reduce the hydrostatic head from the mudline to the surface.

Benefits include reducing the number of casing strings, enabling the use of larger completion strings for increased flow capacity, improved drilling efficiency and decreased mechanical risk.

Prior efforts from Chevron resulted in one well drilled using dual-gradient technology in 2001. The first dual-gradient field test commenced in the Gulf of Mexico in 1,000 ft of water. The capital and labor investment required to implement this type of drilling was not available when it was originally tested.

“From our perspective, we are very confident in the technology, but it really takes a very large portfolio of wells to justify the investment in both capital and people. It is expensive,” Mr Smith said. “You don’t just say, ‘I’m just going to rent this and put this on my well for a while.’ You have to put together a campaign of wells to spread the cost around and, in 2001, people just didn’t have that.”

Preparations that must be made before using dual-gradient drilling on a rig are the two circulating systems, one mud and one sea water. The sheer weight of the mud pump also must be considered.

Today’s drilling risers are not equipped to handle a mud and a sea water power line, Mr Smith explained. “Everything else gets down to equipment handling. We’re not using much more power, we’re just transferring it to the mudline. Rigs are not designed to accommodate the BOP and LMRP while using the mud pump, so you have to modify your rig for that.”

The Pacific Santa Ana crew will be given a three-week training session to introduce them to the procedures and concepts of this type of drilling. Mr Smith believes that there may be some initial “teething” issues with new crews and equipment but that the challenges of using this technology will be minimal. “Their safety and efficiency is just as important to us now than it ever was, and they will be appropriately trained,” he said.

The mud pump that the Pacific Santa Ana will have will enable faster kick detection and measure oil in gallons, not barrels. “(We) see kicks very fast and have (the well) completely shut in and measured quickly. We always call it dual-gradient drilling, but it’s actually MPD in a subsea environment. There’s a very quick detection of things, very quick reaction of things and very quick control of things.”

The idea of drilling 30,000-ft to 35,000-ft wells when this technology was first implemented was incomprehensible.

Today, with the industry’s eye on deepwater and ultra-deepwater drilling, dual-gradient technology may be the next step in drilling techniques. “We’ve gotten very good at running into a barrier and working our way around it and extending our limits,” Mr Smith said. “We’re pretty close to how far we can go with conventional drilling, and it’s definitely time to do something just fundamentally different.”