Can’t keep the offshore industry down

Rig utilization, dayrates continue ascent in vibrant global market

By Katherine Scott, associate editor

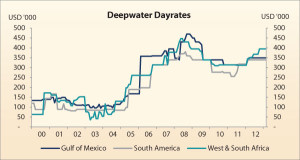

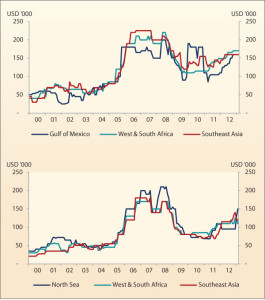

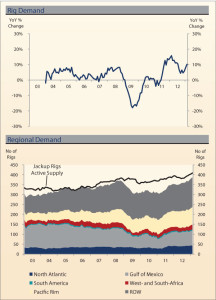

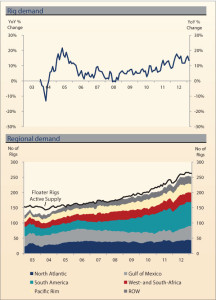

The global offshore industry is undeniably enjoying another renaissance. Both the deepwater and jackup segments are benefitting from high utilization and climbing dayrates in almost every market around the world, and few doubt this positive outlook will continue for the foreseeable future. In deepwater, prospects continue to soar as operators and contractors subtly shift focus from exploratory drilling to development drilling – even while a vast amount of untapped deepwater acreage still awaits development. For jackups, which appear to be operating at a historically high point globally, demand is exploding and dayrates have in some cases nearly doubled versus just two years ago.

“The general feeling is it’s still very much vibrant. E&P spending is still rising, perhaps not as fast as last year, but somewhere close to 10% is expected for 2013,” Sven Ziegler, head of offshore research for RS Platou, said. “When it comes to offshore and the rig universe, global utilization is still very high for both jackups and floaters.” As of March, utilization for the worldwide jackup fleet was around 93%, with full utilization for modern units. “And floaters are basically fully booked, so at the moment it’s good for rig owners.”

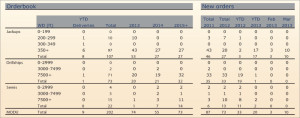

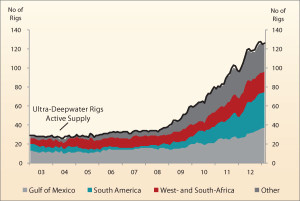

RS Platou defines shallow water as up to 400 ft, mid-water from 400 ft to 3,000 ft, deepwater from 3,000 ft to 7,500 ft and ultra-deepwater as deeper than 7,500 ft. Mr Ziegler noted that although the offshore industry is continuously progressing deeper, most ultra-deepwater units today are still operating only in deepwater. “Units that have over 7,500-ft capability are mainly being used between 3,000 and 7,500 ft… Ultra-deepwater is still coming. Once the deepwater discoveries become smaller and less frequent, then companies will move to ultra-deepwater.”

For the wells that are being drilled in deepwater, Mr Ziegler noted that more contractors are turning their focus to development drilling. “Oil companies are likely to reallocate drilling resources (rigs) from exploration to development. If they can’t do that, they have to go into the market and find new ultra-deepwater rigs. At the same time, dayrates in ultra-deepwater have gone up basically 50% to around $600,000 in the last year and a half.”

Opportunities abound not only for drilling contractors but operators as well, with a vast amount of deepwater and ultra-deepwater “virgin territory” remaining in the Gulf of Mexico (GOM), African east and west coasts, Brazil, the Mediterranean, Australia and parts of Asia. “One thing that is certain: Oil companies see the deep and ultra-deepwater discoveries as very attractive investments,” Mr Ziegler said. “At the same time, many of these discoveries that have been made in the last five to 10 years are moving into the development stage now.”

Ultra-deepwater

For companies interested in the promises of ultra-deepwater, the focus remains on drillships, Doug Halkett, COO for Vantage Drilling said. “Unless you need a rig for harsh environments, the drillship is definitely the ultra-deepwater rig of choice just because it’s more flexible, you can put more equipment onboard and transit is better. There are not very many semisubmersibles being built, certainly not for international operations.”

A relatively new company, Vantage Drilling became operational in February 2009. “Since we started, I don’t think there have been many other start-up drilling contractors offshore. I think people have learned that it’s not very easy to start an offshore drilling contractor. It takes a lot of money, and it takes a huge amount of effort to build the systems and to get the teams together,” Mr Halkett said.

Vantage Drilling currently owns and manages four jackups and three drillships in different parts of the world, including Thailand, Malaysia, Indonesia, the Ivory Coast, India and the GOM.

A newbuild drillship, the Tungsten Explorer, is expected to be delivered at the end of May in South Korea. It has a contract for an unnamed operator for two years, plus two years of options, commencing in mid-2014 in West Africa. Prior to that contract commencement, Vantage is marketing the rig for short-term “fill in” work. The rig is being built by Daewoo Shipbuilding and Marine Engineering (DSME); it will be capable of drilling wells up to 40,000 ft deep and operating in up to 12,000 ft of water.

Vantage also won a contract last year from Oro Negro, a Mexican drilling contractor, to manage four jackups in Mexico for PEMEX. “We get to expand our operating fleet size without spending our capital,” Mr Halkett said of the contract. “The management business is a little bit trickier, and there are not many drilling contractors interested in that, but we are one of those that are interested.”

New ultra-deepwater rig design, record signal more to come

Frigstad Engineering, a Cyprus-based offshore rig engineering company, recently launched its latest D90 design for a new ultra-deepwater semisubmersible that the company calls the world’s largest. “The D90 has an extremely neat, open, large deck with a focus on rational logistics solutions, which makes it perhaps also the most efficient rig in the world,” Øystein Bondevik, the company’s managing director, said.

Frigstad started with the base of its current design, the recently delivered Scarabeo 9, then scaled it up by approximately 25%. “We worked together with Aker and NOV in order to develop a drilling system that we feel was more efficient than any other existing rigs. We see the trend going towards deeper water and that you’re going to operate for a longer period on your own. It has to be more efficient because you’re further from the shore for the operation, and the rig has to be self-sustaining for a certain period of time,” Mr Bondevik said.

Frigstad Deepwater, a privately owned strand of the Frigstad Group, has already ordered two D90s that are being built at CIMC Raffles in Yantai, China. The order includes options for four more units. Deliveries are scheduled for Q4 2015 and Q2 2016, respectively.

The D90 will be able to operate in up to 95% of ultra-deepwater basins around the world, Mr Bondevik said, although the current D90 rigs on order will not be prepared for the Arctic. “Right now, most ultra-deepwater rigs are drilling in deepwater and mid-water, so there’s still an untapped demand for ultra-deepwater newbuilds. Plus, most newbuilds are based on an older design, and when they upgrade, it can make the rigs not as efficient,” he said. The two new D90 rigs are built around an NOV Dual Activity Rig with 2 x 1,400 ton lifting capacity and two 7-ram BOPs. They will have the capacity to operate in up to 12,000 ft of water and a 53,000-ft drilling depths, with a vertical racking capacity for 10,100 ft of drilling riser in 106-ft stands and 53,000 ft of drill pipe in quad stands.

Frigstad’s design also took into account the need for more people onboard as contractors bring in further service personnel. “On smaller rigs, it used to 100, then it came to 150. We have accounted for 200 people onboard, which can also be increased.” The rigs will have 200 single beds, each cabin with its own window for crew comfort and safety.

Taking notice of the opportunities present in deeper waters, India’s ONGC set a record earlier this year for drilling a well in the deepest water. The operations were conducted using Transocean’s Dhirubhai Deepwater KG1 (DDKG1) drillship in a water depth of 3,165 meters (10,385 ft). “This is a back-to-back deepwater record for India, as the previous water-depth record was held by rig DDKG2 at 3,107 meters (10,194 ft) in Cauvery Basin, also on the east coast of India. These developments show that Indian operators are very optimistic about the deepwater future in India and is sure to revive the interest of international players in Indian deepwaters,” Shashi Shanker, ONGC director of technology & field services, said. “The ultra-deepwater market has expanded over the initial years in India but is presently at a plateau. However, in coming years, it is expected to boom again.”

To achieve the deepwater drilling record, the DDKG1 drillship was provided with additional inputs, including mobilization of 2,000 ft of risers and upgrading telemetry cans of the ROV for increased water depths, as well as a risk-sharing model to address issues such as repair of the subsea BOP and its control system at great water depths. The rig, contracted to ONGC until July 2013, was designed for well depths up to 37,500 ft and water depths to 12,000 ft, Mr Shanker said. He added that the record set this year was the 19th well drilled by DDKG1 and that ONGC plans to use the rig to drill more wells in waters beyond 10,000 ft. ONGC also has another ultra-deepwater rig, Vantage Drilling’s Platinum Explorer, on contract until December 2015.

Jackups

Although the industry spotlight often shines on ultra-deepwater activities, the strength of the jackup market is also formidable. In the global jackup market, approximately 50 newbuilds are under construction, of which roughly 40 will be delivered in 2013, Greg Lewis, research analyst with Credit Suisse, stated.

Hercules Offshore has seen jackup activity explode, especially outside the GOM. “There’s more jackups working outside the US Gulf of Mexico than there ever has been. We’re at an all-time peak globally; there are 375 jackups working outside the Gulf of Mexico, and you’ve got a global demand in excess of 400 rigs,” John Rynd, president and CEO of Hercules Offshore, said.

Every major jackup market is short on rigs, he noted. “If you look globally, there are three companies that use the most rigs: PEMEX, Saudi Aramco and ONGC. They will run easily 25% of the world’s jackup fleet, and they all need more rigs,” he said. “The first place you look is what are the demands from the big consumers, because if they’re letting equipment go, that’s going to cause weakness in the markets. But if they’re trying to grow rigs, they’re going to attract rigs and tighten the market up.”

Hercules Offshore currently has 38 rigs in its global fleet. In the Gulf of Mexico (GOM), 19 are under contract (18 operating and one set to enter service in May 2013) and 10 are cold-stacked. Outside the GOM, nine rigs, of which six are on contract, are spread out in Myanmar, Cameroon, Saudi Arabia, Gabon, Bahrain and Malaysia.

Hercules Offshore also has 32% ownership in a new company called Discovery Offshore that was established in 2011. “We’re building two high-capacity, harsh-environment HPHT jackups that can work anywhere in the world except for Norway,” Mr Rynd said of Discovery Offshore. The rigs are under construction at the Keppel FELS yard in Singapore, with deliveries set for June and October of this year. Both will have a 2-million-lb hookload drilling system, 15,000-psi blowout preventer systems and will be capable of operating in water depths up to 400 ft and drilling wells up to 35,000 ft.

“We’re close to securing work for them when they come out of the yard, targeting the Middle East and the North Sea,” Mr Rynd said.

Improvement in dayrates is another metric that’s pointing to a continued positive future for the global jackup market. “As an example, dayrates for standard jackups in the North Sea have climbed significantly to the $160,000 range from mid-$80,000 or lower two or so years ago, so they’ve had quite a bit of improvement in their demand. It’s rather a very dynamic market right now,” Paul Ravesies, senior vice president of marketing and business development for Northern Offshore, said. Mr Ravesies also believes that, despite an increasing supply, jackup dayrates have significantly increased in other markets around the world as well.

Northern Offshore currently operates two jackups in the Danish sector of the southern North Sea, a mid-water semisubmersible in India and a mid-water drillship offshore Vietnam. “There is a limited supply of rigs that are qualified to work in the North Sea, and the barriers to entry are rather high. We were fortunate enough to get through the low point in 2009 to 2010 when there wasn’t a lot of work, and now we are benefitting from increased demand and higher dayrates,” he said. “In 2010, the North Sea standard jackup market was $65,000 to $80,000 a day, which is really not much more than your operating costs. Currently, rates are in the range of $155,000 to $165,000, and we’re seeing longer-term contracts of a year or more being tendered for.”

Although Northern Offshore believes that the continued addition of larger, heavy-duty jackups to the global market will not significantly impact its current fleet, the company does see a need to eventually transition to a newer asset base. “As we move into the next phase, we expect to open up other geographic areas, and we will grow the organization as we need to. But we’re not going to get ahead of ourselves, so our focus is and will remain to manage an efficient, lean and professionally run operation.”

Mr Halkett of Vantage Drilling, which has four jackups operating in Thailand, Malaysia, Indonesia and the Ivory Coast, said that just four or five years ago, ultra-premium jackups were considered special in the market. “Now, those rigs have become the standard jackup rig that many operators want to use; they are the workhorse of the industry. It’s become more of the standard rather than the exception. Ultimately, the 30- to 35-year-old jackups will be forced out and retired because they’ve become too expensive to maintain and less efficient to operate.”

Currently, older equipment is spread out between West Africa, the Middle East, Asia and the Gulf of Mexico, he continued, noting that he foresees “a gravitation of some of the newer jackups to all of these areas over the coming years” in addition to the North Sea.

Another changing trend within the jackup market is construction location. Although most new jackups are still built in Singapore, more work is now moving to Chinese shipyards. “Singapore has really been the shipyard location of choice for many people to build jackups, but they’re going to partly see that market eaten up by the Chinese,” Mr Halkett said. “The Chinese are aggressive pricing-wise and can also potentially bring some financing. That attracts some drilling contractors, but it also attracts a lot of the speculators. They think they can order a cheap rig with low down payments and then sell it on for a profit later to more established drilling contractors at $20 million to $30 million more later.” (Read more about the shipyard boom on Page 62.)

Regional outlooks

In a recent discussion with investors, Kevin Robert, Ensco SVP of marketing, described a “very bullish outlook in terms of customer demand for both deepwater and shallow-water offshore markets. We expect that visible demand should keep the market fairly balanced for the foreseeable future, even with the increase in rig supply resulting from newbuild deliveries,” he said.

For the US Gulf of Mexico, jackups ENSCO 86, ENSCO 90 and ENSCO 99 all recently obtained six- to nine-month contracts at approximately $110,000/day, which represented increases of up to $30,000/day from their previous contracts. “We expect the US Gulf jackup market to remain strong in 2013 as drilling activity continues to be bolstered by strong oil prices and a lack of available rig capacity. We expect the floater market in the US Gulf to remain very active during 2013. More than a half-dozen clients are looking for rigs to drill programs starting this year,” Mr Robert stated.

In Mexico, the UK North Sea, Denmark and the Middle East, Ensco also expects strong jackup demand. “PEMEX plans to add six to eight incremental jackups to its fleet of rigs currently under contract. PEMEX’s increasing demand for jackups enabled us to extend all four of Ensco’s 250-ft independent cantilever jackups working in Mexico at rates in the low $90,000s. PEMEX is also planning to add to their mid-water fleet,” he continued.

In the Asia Pacific region, Ensco believes jackup dayrates will continue to increase, as evidenced by contracts obtained on its premium rigs. “We expect the Asia Pacific jackup market to remain tightly balanced in 2013 even after considering 34 competitive newbuild jackups delivered this year, since we believe the majority of these rigs are already committed. The Asia Pacific region has always been an active floater market and is now showing some deepwater growth,” Mr Robert reported.

Turning to the West Africa floater markets, Mr Robert said the company continues to see high levels of tender activity for floaters commencing operations into 2015. Final contract approval for the ENSCO DS-7 drillship in Angola was received in February. “The dayrate will average in the high $640,000 range over the three-year term. We agreed with the client on the dayrate in the third quarter of 2012, and it took some time to receive all the necessary approvals. Looking ahead, we believe Angola still has unfulfilled demand of four to six floaters, and we expect other countries in West Africa to pick up three to five rigs in 2013.”

In New Zealand, the company contracted ENSCO 107 to OMV for the Maari Field development at $230,000/day, plus mobilization and demobilization costs. “This is a significant contract for many reasons,” Mr Robert explained. “The presence of ENSCO 107 in New Zealand is expected to attract other operators to utilize the rig, resulting in a longer-term stay in the country than the initial 10-month term. And the dayrate is a leading-edge rate for this rig class and approaches the peak rate achieved during the last market up cycle, which bodes well for the future jackup market in the region.”

Global offshore technology & HSE

Drilling offshore is not without its challenges, but industry is proactively developing solutions. At Chevron, well control is a significant focus area. “Chevron Drilling and Completions is formulating a comprehensive well control assurance process called WELLSAFE, which holistically focuses on critical aspects of well control for the operations we manage, including influx prevention, equipment integrity, procedures and personnel competency,” Eric Wagner, Chevron general manager, Global Drilling & Completions Category Management, said. “Another critical challenge is equipment reliability. Operators and their drilling business partners need to continue to collaborate in eliminating significant events and reducing nonproductive time.”

Pacific Drilling’s Pacific Santa Ana drillship commenced its five-year contract with Chevron in March 2012 and began operations in the US Gulf of Mexico in May that year.

Chevron currently has 34 offshore rigs on contract with a mix of base business, major capital projects and exploration activities in areas including the US Gulf of Mexico, Canada, Brazil, the UK sector, West Africa, Thailand, Indonesia, China and Australia. Mr Wagner said he believes the “hot spot” markets of West Africa, US Gulf of Mexico and Brazil will continue to remain robust for the industry, and Chevron expects to add ultra-deepwater rigs in Indonesia and West Africa at the end of 2013 and the beginning of 2014. “We see the current offshore dayrates as steady and have cooled off from the 2012 market demands, but we are closely monitoring the market through 2014, when a significant number of newbuild rigs arrive on the market.”

The company’s strategy, Mr Wagner said, is to implement the most advanced technology and to contract recently constructed rigs. “In addition to safety and environmental protection, reducing between-well cycle time, increasing up-time on the rig operation’s critical path and preventing significant lost-time events are all important drivers for us. We believe cutting-edge technology and newer assets advance these objectives.”

In today’s offshore markets, in whatever part of the world with whatever rig, operators want increased reliability, Thor Arne Haverstad, executive vice president and head of drilling technologies for Aker Solutions, said. “The really big step-change that we are trying to work with is to look more into the efficiency picture, which for a drilling contractor means better uptime and more stable income, but if you ask the oil companies, it’s about deliverable wells, and that’s where MPO (managed pressure operations) technology fits in.”

Aker Solutions recently acquired Managed Pressure Operations International, a company that specializes in continuous circulation, riser gas handling and managed pressure drilling (MPD) systems. In offshore operations globally, Mr Haverstad said, Aker Solutions has seen that MPD is becoming an increasingly common request from oil companies and that they will need it more and more going forward. “We are sure about that, so in a way we found a competent environment with some clever people that could help us.”

Especially in deepwater, MPD is more and more being used to enhance kick detection, Charles Orbell, president and CEO of Managed Pressure Operations, noted. “With the deal with Aker Solutions, it allows us now to build an integrated MPD system rather than offer separate services.” The system, which is still under development, can isolate the well in five seconds, he said, which could be especially useful for fractured carbonates in Angola, Asia or Brazil. “There’s a step-change coming in understanding from the operators and the drilling contractors for this type of technology.”

Mr Orbell believes new rig designs will require both riser safety systems and MPD systems built into the rig. “You look at the rigs coming out of shipyards now with the same technology we had 20 years ago for monitoring the well, and the operators are no longer going to accept that. We’re sitting on 12,000 ft and already people are looking out to 20,000 ft – what do we need to do to get there? There are ongoing projects looking at what technology we need to drill in those environments. I believe personally, in the coming years, that if drilling contractors want their deepwater rigs hired, they will have riser safety systems and MPD built into the rig.”

Regardless, companies will want to build flexibility into new rigs, Glenn Ellis, senior vice president and head of Aker Solutions’ drilling technologies business in the US, said, even if rigs are built against a contract. For instance, consider the US GOM being shut down after Macondo. Mr Ellis believes that flexibility of the rigs provided contractors and operators the opportunity to move them out of the Gulf and into another market to continue working. “They need to have options… Ultimately, the strategy is to develop something that is global.”

Like technology, safety is another evolving element of offshore drilling being pushed to adapt to increasingly harsh drilling environments and complex operations. In To further enhance offshore drilling safety, contractors with multinational operations have been working to develop HSE programs that can be used across the whole organization. Odfjell Drilling, which predominately operates on the Norwegian Continental Shelf, decided to develop a standardized QHSE program when three of its newbuilds were contracted to new operational regions. “Two years ago, we had three newbuild units, the Deepsea Metro I in Tanzania, the Deepsea Stavanger in Tanzania then to Angola, and then we had Deepsea Metro II in Brazil,” said Tove Spjeld, manager of QHSE competence & improvement for Odfjell Drilling. “We saw that we needed to be hands-on with regards to establishing a common HSE culture and to give qualified support to the units.”

Just launched this year, the Odfjell Drilling coaching program started with the company’s core values: to develop committed and motivated employees, to be safety conscious, to be creative in handling challenges, to be competent and result oriented, as well as having a desire for open communication lines. “When we are open, then we can really get a chance to move forward,” Ms Spjeld said.

The program’s curriculum includes offshore leadership, a buddy system, permit to work, housekeeping, managing risk and safety tools like safety checklists, stopping the job and HSE meetings. Employees undergo the program before the rig is mobilized to the operations, and it can take months to cover the rig’s entire crew. “We know, due to studies, that implementing an HSE culture takes time; it takes years if you’re not putting any extra effort into it. We want to be ahead of that and put an extra effort in and implement the HSE culture as early as possible.”

Odfjell Drilling’s goal is to achieve its QHSE principles by developing an HSE culture based on competence, involvement and commitment in applying company HSE rules, Ms Spjeld said, which are: “I will always comply with rules and procedures. I will always risk assess my work, and I will always act when I see unsafe behavior and conditions.”

The company believes that openness, dialogue and exchange of views and experience are important requirements for continual improvement within all operations. “When we are implementing our HSE culture, we are expecting the same from every operation, and we do have the same requirements, so we stay ahead. When we are open with our reporting, then we can really get a chance to move forward,” Ms Spjeld said. “This is a prerequisite for our growth and strategy as a company that we are able to operate in the same safe way whatever country or region that we operate in.”

D90 is a trademark of Frigstad Engineering.