Campos Basin sees diversification of operators, renewed commitment for investments to boost production

Trident Energy, Perenco and PetroRio among E&P companies joining Petrobras to revitalize the basin’s aging assets, drill new wells

By Stephen Forrester, Contributor

A lack of investments into Brazil’s Campos Basin in the past decade-plus has led to a clear production decline even while the country’s overall production has increased. However, the basin is nowhere near being put out to pasture. In fact, several independent E&Ps in Brazil, along with Petrobras, appear to have strong plans to lead a full Campos revitalization.

Some of that work has already been carried out, achieving early successes in attracting new investment and expanding the labor market, according to panelists speaking at December’s virtual Rio Oil and Gas Conference.

In particular, the acquisition of fields by independent operators – both international and local – has been a stimulant for change. Panelists also cited strategic alliances between Petrobras and other E&P companies as a key enabler. However, more work – especially through governmental and regulatory actions – is needed to attract the necessary investments, the panelists said.

Legal and public policies, especially those centered around the country’s regulatory framework involving royalties and local content requirements, already underwent major changes in 2016 and 2017. The result was better incentives for new players to operate in the Campos Basin, said Fabrício Zaluski, Legal Director for Trident Energy Brazil, an E&P company launched in 2016.

“The regulatory revolution started, but it’s not over,” he said. “The regulatory agencies must look for ways to incentivize investment and attract a higher diversity of players to increase production in the Campos Basin.”

Further, Mr Zaluski said he believes significant work must be done around aging infrastructure in Campos, noting the “need to improve the safety and integrity of the assets and operations to increase production.”

Perenco Oil and Gas is another independent oil and gas company that has turned its attention to the Campos Basin. In 2019, the company purchased the Polo Nordeste complex from Petrobras. Petrobras had made the divestiture as part of its Partnerships and Divestments Program.

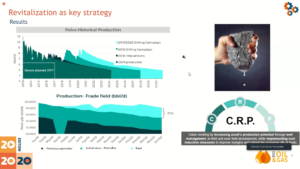

The Pargo field, part of Polo Nordeste, has become an initial point of focus for Perenco since the acquisition, said Leonardo Caldas, the company’s Director of Institutional Relations. As part of its plans to breathe new life into Pargo, Perenco decided it first needed to address infrastructure concerns with existing assets. To ensure all facilities were meeting safety and integrity requirements, some drilling operations were temporarily suspended before full flow capability was restored. “We had to update the process so that we could reach higher numbers and volumes, and we had to fix and upsize the (ESP) wells to unlock their remaining potential,” Mr Caldas said.

These efforts are leading to notable increases in Pargo’s production, which is up from 3,000 bbl/day in October 2019 to more than 4,000 bbl/day today. With further investments, Perenco said it anticipates eventually bringing production up to 20,000 bbl/day. The company is also working to extend Pargo’s production phase to 2040; it is currently set to end in 2025.

Another investment under way is the installation of an FSO, which is being made possible by a renegotiated contract with Petrobras. Once the FSO is in place – planned for 2021 – Perenco will become more autonomous in its decision making, Mr Caldas noted.

Overall, Perenco’s investments into Polo Nordeste “will guarantee operational safety and help us recover the economic character and profitability, which are still oscillating, of these assets,” Mr Caldas said. “The process will also generate jobs, providing a boost to the economy and local income generation.”

Like Mr Zaluski at Trident Energy, Mr Caldas also stressed the urgency for Brazilian regulators to implement better, simpler regulatory frameworks – something that can be discussed among all stakeholders and where a consensus can be found that is mutually beneficial for all parties.

At PetroRio, one of Brazil’s largest independent E&P companies, revitalization efforts for mature fields focus on effective resource utilization, reservoir management and production optimization, according to Francisco Francilmar, Director of Operations for PetroRio. In early 2020, for example, PetroRio acquired the Tubarão Martelo field and the OSX-3 FPSO. This enabled a tieback with the Polvo field, which is expected to reduce lifting costs, extend the fields’ commercial lifespans and decrease emissions.

Another field, Frade, has already seen a boost in production since PetroRio took over as operator in 2019. Before this acquisition, estimates had called for Frade’s production to decline to approximately 11,000 bbl/day by June 2020. However, PetroRio has been able to boost production from the field well past its initial plan of approximately 16,000 bbl/day – to nearly 20,000 bbl/day as of June 2020 – thanks to optimization initiatives.

By Q2 2021, the company will have completed a two-phase drilling campaign to further revitalize the Frade field. The first phase encompasses one producer well and two injectors, while the second phase will have three producer wells and one injector.

Mr Francilmar urged the Brazilian government to consider the time sensitivity associated with mature fields when looking at regulations. He referred to the need for “adaptive regulations,” which he said is being safe without being economically prohibitive. Further, he pointed to greater collaboration, integration, flexibility and simplification of supply chains as being necessary to reduce development costs.

Between operators, too, there needs to be more meaningful partnerships, he said. “We need to stimulate resource sharing to reduce costs. At the end of the day, this is good for everyone.”

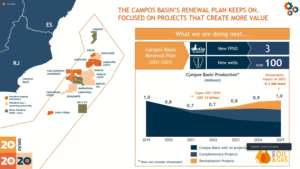

Petrobras also joined the panel session and reiterated its commitment to the Campos Basin. The company has seen its production there fall from 1.8 million BOED in 2010 to 800,000 BOED in 2020, despite investing $53 billion over the past decade, and building and tying back 269 wells in the basin. “Petrobras is not leaving the Campos Basin; we will still be a protagonist, and we understand that the basin has a lot of value to deliver to Petrobras and to society,” said Carlos José Travassos, Executive Manager of Deepwater for the Campos and Espírito Santo basins.

The operator has two primary goals for the basin: maximize portfolio value and sustain growth from high-quality oil and gas assets, focusing on deepwater and ultra-deepwater. This will require continued divestitures of certain fields to improve capital allocation, as well as a focus on value-adding projects.

Between 2017 and 2019, the company acquired 14 new exploratory blocks within Campos, covering 13,000 sq km. Three new FPSOs are planned to be launched, along with more than 100 new wells to be drilled by 2025. This is expected to return production levels to 1 million BOED by that year.

“We are focusing on a resilient portfolio, a sustainable portfolio, and this sustainability is environmental and economic,” Mr Travassos said. DC