Business as usual, but with caution

Growth contributes to positive outlook for Middle East despite security concerns

By Katie Mazerov, Contributing Editor

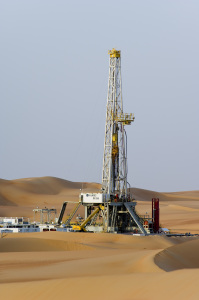

Geopolitical concerns, notably worrisome aggression from the Islamic State of Iraq and the Levant (ISIL) across northern Iraq, is signaling a cautionary mood in the Middle East. However, it is business as usual for the oil and gas industry – at least in the near term. In fact, the Arabian Gulf region is expected to enter a period of expansion.

This growth will be led by Saudi Aramco, which is making significant investments in natural gas production, including unconventional gas exploration, and ramping up oil production. Continued and stable production in Kuwait, the United Arab Emirates (UAE), Oman and Qatar also are contributing to a positive outlook. Rig dayrates so far remain stable and are even rising in some markets.

Rig counts, including units to service the world’s largest jackup market and heavy-duty rigs for deep, high-pressure gas fields, are steady and growing in some areas. Rig saturation is making investment less attractive in southern Iraq, however. Operations were suspended in Kurdistan in August due to security concerns involving ISIL aggression. In Iran, sanctions continue to inhibit production, with the future hinging on the progress of negotiations regarding the country’s nuclear program.

Rig counts, including units to service the world’s largest jackup market and heavy-duty rigs for deep, high-pressure gas fields, are steady and growing in some areas. Rig saturation is making investment less attractive in southern Iraq, however. Operations were suspended in Kurdistan in August due to security concerns involving ISIL aggression. In Iran, sanctions continue to inhibit production, with the future hinging on the progress of negotiations regarding the country’s nuclear program.

“There are definitely some bright spots in the region,” said Silvio Bresciani, VP Business Development for Nabors Drilling International. “Compared to last year, 2014 has been a growth year for Nabors. We believe 2015 will be very positive.” This year, Nabors is delivering 11 new lands rigs to Saudi Aramco, firming up the Saudi NOC as Nabors’ biggest customer worldwide. The addition of 11 new rigs will bring the drilling contractor’s total regional rig count close to 60, with 43 in Saudi Arabia.

The Nabors rig count includes four jackups – two drilling and two workover rigs – in Saudi Arabia, plus one more jackup in Abu Dhabi. Nabors says it is upgrading most of its fleet in the region with new engines, extra mud pumps, top drives and automated pipe-handling and racking systems. Some are also being outfitted with skidding systems per customer requirements, Mr Bresciani said. On the land side, rigs in Saudi Arabia vary from 1,500- to 3,000-hp units. They are being employed for workover and drilling operations for both oil and gas.

In Saudi Arabia, Nabors has commissioned three of the 11 land rigs awarded in late 2013, with the remaining eight scheduled to begin operations by year-end. “There is a big drive from our client to increase drilling activity in the Kingdom,” Mr Bresciani said. “This increase has created a big challenge for Nabors Arabia to cope with the growth of our business. Our Saudi management teamed up with various governmental entities and our client to attract, recruit and develop local employees. We also have invested heavily in hands-on training at our facility in the Kingdom.”

In a report updated in September by the US Energy Information Administration (EIA), Saudi Arabia in 2013 produced 11.6 million bbl/day of total petroleum liquids, of which 9.6 million was crude oil. The figure marked a decline of 0.13 million bbl/day from 2012, with Saudi Arabia reducing its crude oil production to accommodate production growth from the US and Canada.

Saudi Aramco investments

At the Offshore Northern Seas Conference and Exhibition, held 25-28 August in Stavanger, Norway, Saudi Aramco CEO and President Khalid A Al-Falih announced the company’s plans to invest $40 billion annually over the next decade to sustain oil production at 12 million bbl/day and to double current gas production levels. Much of the investment will go to significant offshore projects and recent offshore exploration in the Red Sea and Midyan gas fields. The company also plans to focus on technological innovations to increase oil recovery to 70%, Mr Al-Falih said.

The EIA puts Saudi Arabia’s proven natural gas reserves at 291 million cubic ft, the fifth-highest globally behind Russia, Iran, Qatar and the US. Seeking to advance Saudi Aramco’s success with unconventionals, the company’s Exploration and Petroleum Engineering Center – Advanced Research Center (EXPEC ARC), by extension through US-based R&D centers in Detroit, Boston and Houston, has included unconventionals in its research programs.

The 60,000-sq-ft Aramco Research Center – Houston was launched in September. It is focused on upstream R&D and technology for both conventional and unconventional hydrocarbon resources. Teams of researchers, scientists and engineers are taking a cross-disciplinary approach to study a variety of specialty areas, such as production management, drilling, reservoir engineering, geology, geophysics and advances related to subsurface sensing and control.

Unconventional gas development in Saudi Arabia include one that will supply a large gas plant in the southwest sector of the country on the Red Sea coast, according to Matthew Cook, researcher with global market research and consulting firm Douglas-Westwood. “Domestic demand for gas is huge, expected to double by 2030. The country needs to develop this resource to avoid importing it from Iran and Qatar,” he said. “The government has committed $3 billion for shale gas development and is looking to use carbon dioxide-based fracturing fluids due to a lack of water in the arid desert.” With oil production up, Saudi Arabia will be the region’s primary oil supplier, given sanctions in Iran, he added.

In Iraq, OPEC’s second-largest producer, oil and gas production is primarily centered in the southern sector of the country, far from conflicts in the north, Mr Cook said. Iraq currently produces just above 3 million bbl/day. “The production potential is enormous, and contracts are in place for 12 million bbl/day by 2020, but the overwhelming consensus is that is not realistic. Even before the current conflict, we were forecasting only 6 million bbl/day as the country continues to make significant investment in rebuilding its infrastructure.”

Security concerns in Iraq

“There is no reason Iraq can’t keep increasing production for the near term,” Mr Cook continued. “However, longer-term security concerns will likely hinder further investment, limiting the potential for substantial growth. Major operators are maintaining their operations with no interruptions, but whether they will sign up for another phase is unclear. Changes could be on the horizon.”

Security has interrupted operations in northern Kurdistan. This region represents approximately 10% of Iraq’s oil production, primarily from the Taq Taq oilfield northeast of Kirkuk, which produces around 230,000 bbl/day. “The field is far from the unrest now, but security could deteriorate, and a number of major operators have left the region,” Mr Cook noted. “It’s also unclear for the oil companies with whom they have production-sharing agreements. Ownership of oil and gas resources is an ongoing source of conflict between the Iraqi central government and the Kurdistan regional government.”

Kuwait plans to issue a $4.3 billion contract late this year to develop the Ratqa heavy oil field in the north, targeting 4 million bbl/day by 2020, Mr Cook said. “However, even if the contract is awarded, development may not happen due to political issues between parliament and the oil ministry.”

He cited frequent restructuring of the Oil Ministry as one factor that has generated negative investor sentiment. Another is the $2.19 billion cash settlement to Dow Chemical in 2013 as compensation for a canceled joint venture project with Petrochemical Industries Co of Kuwait, a subsidiary of Kuwait Petroleum Corp. “We expect Kuwait to miss its target figure and are estimating 3 million bbl/day by 2020,” Mr Cook said.

Continued oil sanctions enacted by the US and the European Union in 2011 remain the biggest factor in Iran. Crude production there dropped by approximately 1 million bbl/day between 2011 and 2012. Further, production is not expected to increase in the short term, said Andrew Jenkins, Researcher with Douglas-Westwood.

“The country possesses the world’s fourth-largest proven oil reserves and second-largest gas reserves. However, the sanctions are crippling an otherwise promising sector. Oil and gas export revenues have dropped by almost 53% due to significantly decreased liquids exports.”

The primary obstacle to lifting the sanctions has been the governments’ inability to reach a permanent agreement regarding Iran’s nuclear program. Negotiations for the Joint Plan of Action have been extended to 24 November. “The oil ministry has projected that production could be boosted by 700,000 boed within two months of sanctions being lifted, but the aging infrastructure will require substantial investment for production to approach anywhere near that figure,” Mr Jenkins said. “This could, however, provide numerous opportunities for independent operating companies and oilfield service providers if they are allowed to invest. Iran is already planning changes to its oil contract model to allow IOC participation at all stages of production.”

Qatar remains the region’s largest offshore producer, with the world’s largest non-associated gas field. However, a moratorium on new development projects that extends through at least 2015 could impede growth, Mr Jenkins said. “The moratorium was instituted to encourage investors to look beyond the North Field as the government seeks to increase developments in other fields. Qatar was the world’s largest liquefied natural gas producer, but Australia has emerged as a potential competitor. The country is wary of pricing that could result in a gas glut.”

Maersk Oil, now in the 22nd year of a production-sharing agreement with Qatar Petroleum, is producing approximately 300,000 bbl/day from Al Shaheen. The field represents some 40% of total oil production in Qatar, said Hans Flikkema, Drilling Manager for Maersk. After completing a 169-well development project in the field two years ago, Maersk Oil launched a new 50-well field development plan (FDP2012) last year. “In the meantime, we also are working on future plans, as this field needs continued development,” Mr Flikkema said.

Maersk Oil now has four jackups operating on the Al Shaheen field – one dedicated to workovers and three supporting the FDP2012 project. Two of the rigs, contracted from Gulf Drilling International (GDI), are brand-new and feature cyber-drilling stations, top drives and pipe-handling equipment.

“Dayrates are quite different from what they were two years ago, going from $70,000-$80,000 to the $120,000-$155,000 range,” he noted. “However, competent staffing remains the biggest challenge in light of so many rigs being built in the region, which has led to healthy competition for personnel… We are focusing much of our efforts on crew safety and skills training. Rig crews are now rotating on a 28 days on/28 days off schedule, which is providing more consistency in rig operations and improved conditions for the workers.”

Stable dayrates

Dayrates in the region vary, depending on the country and the required equipment, and are generally good. The weak spot is southern Iraq due to higher operating costs and rig saturation stemming from the influx of operators and contractors that took place several years ago, Nabors’ Mr Bresciani noted. Nabors has five rigs in southern Iraq. “From a security standpoint, southern Iraq is as stable as can be expected, and our operations are normal.”

Earlier this year, the company relocated a 2,000-hp land rig from Iraq to Oman and may move additional units to other countries due to market opportunities, he said. “We’re looking at markets where it makes sense for us to work and provides us leverage to build strong and long-term relationships with our clients.”

In Kurdistan, however, Nabors in August temporarily stopped operation of two land rigs after the customer, a major operator, suspended activity due to security concerns. “We expect to return to Kurdistan as soon as our client decides to restart operations,” Mr Bresciani said. “We are taking this opportunity to provide additional training and capacitate our Kurdish crews during this stand-by period.”

Nabors also has two rigs working for OMV in Block S2 (Al Uqlah) in the Shabwa Province of western Yemen. While there are reports of unrest in the capital, this area of operation is secure, Mr Bresciani said. “Our biggest challenge is moving our people in and out of the country. Typically, employees are transported directly to the site from the airport.”

Elsewhere, Nabors’ operations are highly stable, with one rig in Bahrain and five drilling in various regions of Oman, including the prolific Safah field. Two 3,000-hp rigs in Kuwait are drilling deep oil and gas wells. “We expect tenders for additional rigs of various capacities to be issued in the near future,” he said.

“Apart from security, which we all face and must continually monitor and act proactively, our biggest challenges in the region are personnel training and retention, especially as we bring in modernized rigs with more automation, and current market expansion,” Mr Bresciani said. “For example, most of our rigs now include new advanced equipment, sensors and fit-for-purpose technology, as well as more automation to increase our operational performance and safety, moving our employees out of harm’s way. This means specific training is needed even before we mobilize these rigs to the field.” To address that challenge, and recognizing the increasing importance of the Saudi market, Nabors has shifted the bulk of its training from Dubai to a new center in the Kingdom.

“Despite geopolitical challenges that exist in the Middle East/North Africa region, we have a positive outlook for the coming years. Nabors has a significant capital investment plan, both for additions and upgrades to the existing fleet,” Mr Bresciani added. “This will enable us to maintain a competitive edge and deliver improved efficiency and productivity to our customers in the region.”

Focus on jackup market

Shelf Drilling, established in December 2012 upon the acquisition of 37 independent cantilever jackups and one swamp barge from Transocean, is the only international drilling contractor headquartered in the UAE. The company has eight jackups operating in the Middle East, six in Saudi Arabia and two in Qatar. All the rigs are engaged in development drilling and workover operations on producing assets.

“We believe that by having a sole focus on jackup operations, we are better positioned to provide best-in-class safety and operational performance,” Shelf CEO David Mullen said. “The jackup market is sufficiently large, where we don’t feel constrained in our ability to grow. Therefore, we see no need to diversify into deepwater operations. Customers are looking more towards focused companies, especially where this focus provides differentiation in operational execution. The shallow-water segment in the Middle East is extremely prolific and produces hydrocarbons at very low break-even economics, on par with that of onshore Middle East.”

Shelf Drilling has a significant presence in Saudi Arabia, where the company has six rigs operating in the Arabian Gulf. Four of the six rigs have shallow draft capability (SDC), and two of those were recently upgraded. The upgraded rigs have been completely repowered and feature new accommodation units. Additionally, all critical drilling and well control equipment have been replaced, in compliance with the most recent Saudi Aramco standards, Mr Mullen said. Shelf invested $75 million in the High Island V rig upgrade and $110 million for the High Island IX upgrade. The remaining four jackups in operation in Saudi Arabia will be upgraded in 2015.

“The Gulf’s Safaniya and Manifa fields are both situated in very shallow pools of water, which requires shallow-draft, fit-for-purpose jackup rigs to efficiently conduct drilling and workover operations,” Mr Mullen explained.

“Newbuild rigs don’t have SDC and, therefore, are not suitable for this type of work. Some of the more highly specified newbuild rigs are well suited to exploration and development work in the region’s extremely deep and highly pressured gas wells. These wells feature a complicated well design requiring heavy-duty rigs with very large liquid storage capacity, very high hookload capacity and the capability to handle extreme pressures.”

Shelf Drilling is also building two jackups at the Lamprell Shipyard in Sharjah in the UAE. Both have been contracted by Chevron for operations in the Gulf of Thailand.

Looking ahead, the company anticipates continued opportunities for growth in Saudi Arabia, Qatar and the UAE. “We see the Middle East as a very strong market going forward, with low customer breakeven costs compared to the rest of the world,” Mr Mullen continued. “When we started this business in 2012, we had four rigs in the region. Now we have eight. Additionally, we see potential in the UAE, which is presenting multiple opportunities in the future, and we are hoping to add rigs into that market.”

I am now wondering about the 2015 plan with Drilling & Workover activities in the Region.. Considering the serious Oil slump and reduced Oil & Gas pricing by more than 50% with Crude Oil at $ 48 and below with speculations to reach even below $ 30 is a major concern for both Oil Companies and Oilfield Service companies together.. The only great expectations are that the industry still need to remain and return back more robust and smarter to handle the future with reducing cost of productions and other human error and implementing a sea change in continuous improvements on a Global scale…The World needs to learn from the best practices and get it implemented immediate in the industry… More of my breaking Oil & Gas news and posts are available on Linkedin and Oilpro for view and anyone interested can call me for ideas and insights into the Oilfield Industry business on how to Integrate and perform better by applying discipline, principle and smarter management systems and real-time tracking…enabling technology to deliver best results at all times..