Buoyed by strong oil prices and rig demand, offshore drilling to see continued comeback in 2023

Middle East, South America and US GOM are all among regions expected to see tight rig supply and rising dayrates next year

By Stephen Whitfield, Associate Editor

There is growing optimism around the global offshore drilling market and its prospects for 2023, with dayrates and utilization both expected to increase and several key markets either already rebounding or set to rebound.

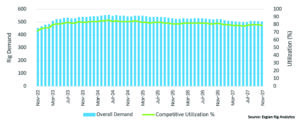

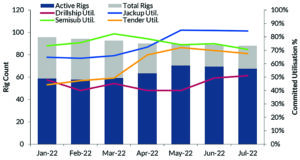

As of September, the global contracted fleet consisted of 378 jackups, 68 semisubmersibles and 73 drillships, according to Westwood Global Energy Group. The firm is projecting modest increases for each rig type in 2023, with jackups going up to 395, semis to 75 and drillships to 78. Marketed fleet utilization this year, as of September, was 87.3% for jackups, 79.6% for semisubmersibles and 93.5% for drillships. In 2023, utilization is projected to increase to 90% for both jackups and semisubmersibles and 95% for drillships, according to Terry Childs, Head of RigLogix at Westwood.

These expected activity increases will be directly tied to oil price, he added. As of 13 October, Brent crude was at $94.69/bbl, which is a high enough level to encourage operators to increase activity, and that should continue into next year.

“In most regions of the world, rig activity has picked up from increased operator demand,” Mr Childs said. “Obviously, increased oil prices play a factor, and as usual we’re seeing a bit of a lag time with that – oil prices go up, then utilization goes up and then, ultimately, dayrates go up. That’s what we’re seeing right now – oil prices have been strong, everything’s going up for most every rig type in every region, and that should continue in 2023.”

Esgian has a similar view of the offshore market. It measured the global contracted rig fleet in 2022 as averaging 317 jackups, 50 semisubmersibles and 65 drillships. Cinnamon Edralin, Head of Rig Market Research at Esgian, is also forecasting modest increases for each rig type in 2023, with jackups averaging 350, semis at 60 and drillships at 80. This will push marketed utilization for jackups from 76% to 85%, semis from 60% to 80% and drillships from 82% to 90%.

“It’s really nice to have conversations with drilling contractors where they’re actually enthusiastic and optimistic,” Ms Edralin said. “Not only are they getting to the point where they can just pay their bills, we’re now seeing that they can undertake new investment. It’s an exciting time to be in offshore drilling.”

The Middle East

The Middle East will be the biggest driver of jackup activity, with forecasts calling for 150 active rigs in 2023, compared with 120 in 2022. The bulk of this increase will come from Saudi Arabia, which is planning to double its offshore fleet to 90 jackups by the end of 2024 as part of its drive to boost production capacity by 1 million bbl/day. To that end, Saudi Aramco has awarded 30 rig contracts since March 2022, with the majority of contracts going for five years each.

Ms Edralin said this push from Saudi Arabia could have a trickle-down effect on other countries in the Middle East, particularly Qatar and the UAE. Both of those countries have also expressed interest in contracting additional rigs to bolster their production, but Aramco may effectively drive up dayrates to a point beyond which those countries are comfortable paying.

Dayrates currently average between $70,000 and $120,000 for jackups in the Middle East, and they’re expected to range from $80,000 to $140,000 next year. While Esgian does not have country-specific dayrate breakdowns, Ms Edralin said Saudi Arabia’s dayrates are generally closer to the high end of that range, while Qatar and the UAE are closer to the low end. However, with Saudi Aramco contracting higher-spec jackups in the region at higher dayrates, other countries may soon have to offer higher dayrates in order to stay competitive.

“With all these rigs going into Saudi Arabia, those dayrates are going to be higher than the dayrates you’re seeing in Qatar and the UAE, and that’s going to have a big impact on what they might do,” Ms Edralin said. “It’s putting those other countries in a sensitive area where they’re going to have to decide if they’re willing to pay higher dayrates, or are they going to stick with the fleet that they have?”

Asia Pacific

According to Westwood, the rig market in the Asia Pacific (APAC) region, which comprises Southeast Asia and Australia, got much busier in 2022, and 2023 could be more of the same, primarily due to a strong jackup market.

Marketed utilization for jackups has already improved from 78% at the beginning of the year to 90% currently, and it could increase to 95% in 2023. However, this number can be a bit misleading, Mr Childs said. Of the 45 marketed jackups in Southeast Asia that are contracted or committed, six are destined for Saudi Arabia next year as part of Saudi Aramco’s contracting frenzy. An additional four newbuilds are also slated to move there. By the middle of 2023, it’s projected that 15 jackups will have moved out of Southeast Asia for contracts with Saudi Aramco.

Dayrates for jackups in the APAC region ranged between $67,000 and $90,000 during the first half of this year, but more recent fixtures have been as high as $120,000, and that could increase further in 2023 due to the amount of potential activity. The region currently has more than 40 programs in some stage of rig inquiry, including 13 in Australia. In Southeast Asia, the largest number of jackup requirements are in Malaysia, followed by Indonesia and Vietnam.

Some of the increase in activity in this region is actually also being driven by the uptick in the Middle East, Mr Childs noted. “Some of these other operators (in the Asia Pacific) are looking at all those jackups being absorbed in the Middle East, and they’re thinking, is there anything left for us? It’s prompted these companies do some things maybe a bit earlier than they intended to,” he said.

Southeast Asia only has four active drillships, and one unit is scheduled to leave for India shortly. Dayrates for new drillship fixtures had been around $200,000, but Westwood said two recent fixtures were both over $375,000. One deal saw a rate of around $408,000, but that included managed pressure drilling (MPD) services, which can add $50,000 or more to a contract. For upcoming fixtures, dayrates will likely improve, but there are currently only 10 drilling programs planned that designate a drillship.

There are 12 semisubmersibles located in the APAC region – seven in Southeast Asia and five in Australia. Four of the seven units in Southeast Asia are working, but only two of the four are firmly contracted beyond 2022, and three of the four have options that could extend their available dates further into next year.

Dayrates for semis in this region remain below $200,000, although that will change going forward. Mr Childs noted that Southeast Asia has nine drilling programs in the rig inquiry stage, but only two of the nine are scheduled to last more than 100 days. These numbers likely ensure no semisubmersible supply growth in 2023, and some units might even leave the region next year. All four of the semisubmersibles currently working in Australia are contracted into 2024. Leading-edge dayrates have improved from around $265,000 early this year to the $325,000-$379,000 range for more recent fixtures.

South America

South America is another potential area of interest going into next year. The rig count in 2022 was not particularly high – six semisubmersibles and 12 drillships – but a number of open tenders could significantly boost those figures. For example, in September TotalEnergies announced FID on the shallow-water Fenix development offshore Argentina. Shell and Ecopetrol announced a discovery at Gorgon-2 offshore Colombia in August.

One of the main drivers in South America, however, remains Guyana/Suriname. ExxonMobil and Hess announced seven new discoveries in the Stabroek Block offshore Guyana between January and July of this year – Fangtooth, Lau Lau, Barreleye, Lukanani, Patwa, Seabob and Kiru-Kiru.

There are six drillships – four from Noble Corp and two from Stena Drilling – working for ExxonMobil offshore Guyana, with firm charters stretching into late 2025 for the Noble rigs and 2024 for the Stena rigs.

Also, ExxonMobil is looking into drilling as many as 12 further exploration and appraisal wells at the Canje and Kaieteur blocks offshore Guyana in 2023-2024. The operator has already drilled three wells in Canje and two in Kaieteur, all of which came up empty. In Suriname, TotalEnergies and Apache announced discoveries at Krabdagu and Baja in Block 58 this year.

Brazil is another key driver of South American activity. In April, Petrobras issued a tender to contract as many as eight deepwater rigs for three and four years starting in 2023, and Esgian expects Petrobras to issue more tenders next year. These tenders are expected to push dayrates upwards in the region from its current levels around the mid- to high $300,000s. Rates could exceed $400,000 next year, Ms Edralin said, adding that most of the rigs in the eight-rig Petrobras tender should remain in the mid- to high $300,000s, with one of the low-spec floaters coming in just below $300,000.

By Westwood’s count, Brazil is currently operating at 100% utilization with 25 floating rigs, and Mr Childs said it’s a certainty that the number will increase next year. There are currently 16 drilling programs for floating rigs where a rig inquiry or tender is active. Four to eight additional units could mobilize into the region through 2023.

A revised fiscal regime has been a key factor in driving operator interest to Brazil, he noted. This includes a gradual shift away from its bid round structure to the Open Acreage program, where a bid round is triggered by a company declaring interest in a particular sector.

Contracts signed under Open Acreage are concession agreements, where the winning company holds exploration rights to a block and is only required to pay a royalty to the government. The previous bidding regime required winning companies to sign production-sharing agreements, which adopt a split profit system where the government and the winning company agree to a share of the profits generated from a block.

“With Brazil, we’re seeing the reports every so often that show more and more operators being approved to bid there, so there’s clearly an interest from outside operators,” Mr Childs said. “Also, given the amount of production there, there’s no reason to think that operators won’t continue to be interested. They will definitely want to operate there as long as the terms from the government stay favorable in their view.”

The rest of the Golden Triangle

Another hub of the Golden Triangle – the US Gulf of Mexico (GOM) continues to be the leader in terms of dayrate movement. Rates for drillships in the region have reached as high as $440,000 ($480,000 including MPD services), while dayrates for jackups are around $85,000. Mr Childs believes rates for both rig types will increase in 2023 – drillships could reach $500,000, while jackups are likely to see rates in the $90,000s.

The increase in dayrates have been primarily driven by a limited rig supply. Floating rig marketed utilization has remained at 100% throughout 2022, while the 85% marketed utilization for jackups includes just one available unit. Westwood expects those numbers to continue into next year.

“Rig owners in the Gulf of Mexico have been pretty disciplined in that they haven’t brought excess equipment into the region, which has not historically always been the case. No rig owners have moved anything on speculation, so that full utilization has been able to be maintained,” Mr Childs said.

The limited nature of the US Gulf of Mexico market is driven, in part, by the US regulatory environment, Ms Edralin said. The US Bureau of Safety and Environmental Enforcement’s (BSEE) well control rule, issued in the wake of the Macondo incident, requires rigs working in the US GOM to use BOPs outfitted with double-shear rams designed to allow drill pipe to be centered during shearing operations. The costs required to comply with these regulatory standards limit the number of contractors working in the region and puts upward pressure on dayrates.

“Even if you have a seventh-generation drillship, it doesn’t mean you can just automatically come into the US Gulf and start working,” she said. “If an operator in the US doesn’t have a rig, they will have to either pay a rig contractor to get a rig ready to bring it in, or they will have to get in line and wait for one to become available. The drilling contractors have created a very tight market.”

The third hub in the Golden Triangle – West Africa – could also see some improvement in 2023. West Africa has 14 floating rigs under contract, but Ms Edralin said that number could increase to 20 in 2023, depending on certain FIDs being reached. For example, a joint venture between BP and Kosmos is expected to make FID on the Yakaar-Teranga development offshore Senegal and the Orca discovery offshore Mauritania by the end of the year.

In the near future, Africa may also see expanded E&P activity outside the traditional western zones. This year, Shell and TotalEnergies announced significant discoveries offshore Namibia at the Graff-1 exploration well and the Venus 1-X well, respectively. Shell is currently drilling its second well on Graff, while TotalEnergies is drilling its third on Venus.

Ms Edralin said both operators seem “pretty keen on moving forward with them, and they’re already looking at rigs to potentially bring over there” next year, in addition to the recently contracted Deepsea Bollsta semisubmersible, which should start work around the end of 2022.

The overall activity rebound seen in all three parts of the Golden Triangle bodes well for deepwater drilling moving forward, Ms Edralin said. “People are optimistic about deepwater again. They’re realizing that oil and gas is part of the energy transition, and now that investors are coming back, that’s making it a little bit easier for companies to pursue deepwater.”

North Sea

The North Sea region has been in flux due to energy security concerns fueled by Russia’s invasion of Ukraine in February 2022 and the subsequent sanctions on Russian oil and gas that cut off a major supplier to European markets.

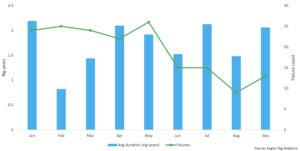

Currently, the floater market in Norway is in a significant quiet spell, but Esgian expects that market to tighten considerably in mid- to late 2023. In fact, competitive utilization should increase from the 80% range in September 2022 to the high 90% range by the end of next year. There is even potential to reach 100% utilization, if all the planned long-term development drilling programs kick off between 2024 and 2026 as currently forecasted. Dayrates for contracts on rigs scheduled to work in 2023 range between $340,000 and $400,000.

Prior to the Russia/Ukraine conflict, Norway and UK had been fueled by “a lot of idealism” about moving away from oil and gas projects, Ms Edralin said. Now, European governments are pivoting to a more balanced view of the energy transition as it faces energy security concerns.

“There’s more of an understanding that oil and gas needs to be part of the transition, so that’s leading to more collaboration between renewables and offshore oil and gas,” she said. “There are some potential projects where they’re trying to decarbonize offshore projects, either through electrification, or potentially hooking up an offshore wind turbine to the rig or a production platform, or using alternative fuels like green hydrogen. They’re realizing that they can reduce emissions on the rig while they’re producing the fossil fuels that they need, until they get to a point where renewables can meaningfully increase power generation.”

As such, emissions reduction technologies will eventually become a prerequisite for rigs working in the North Sea. Esgian notes that of the 42 active rigs around the world that have at least one kind of emission reduction system installed, 21 are working in the North Sea. Globally, of the 13 operators using these 42 rigs, nine are European-based operators. DC