A slowdown in the Permian

As investors demand more capital discipline from operators, drilling contractors face growing pressures on rig utilization, rates

By Linda Hsieh, Editor & Publisher; and Sarah Junek, Associate Editor

Although the Permian Basin still dominates US land drilling and will continue to do so in the near future, the pace of growth in this region has slowed significantly since late 2018. While it was infrastructure that constrained activity last year, this time it’s uncertainty in commodity pricing and investor sentiment that appear to be the main drivers for operators’ pullback in capital spending. In turn, this reduction in activity has flooded the market with available rigs, putting tremendous pressure on contractors’ utilization and dayrates.

“Everyone’s being pressed on price in all places,” said Kyle Blevins, Marketing Manager for Cactus Drilling, adding that short-term contracts, oftentimes for less than a year, have become the norm. Operators are able to contract this way because the rig market is so saturated in the Permian. Plus, E&Ps want to stay nimble in a declining market in case dayrates fall even further. “There’s no stability right now,” Mr Blevins said.

Certainly, the Permian remains among the hottest and most lucrative plays in US shales, and rig utilization in the high-spec segment is still sitting at a healthy 90%, according to Artem Abramov, Partner and Head of Shale Research for Rystad Energy. But it should be noted that around this time last year, utilization was much closer to 100%. Since then, drilling contractors have been mobilizing their assets to this region, anticipating rises in drilling activity and rig demand. The arrival of these new rigs, coupled with operators cutting spending, naturally resulted in more rigs than work.

-

High-spec rig utilization has fallen from nearly 100% in mid-2018 to around 90%.

-

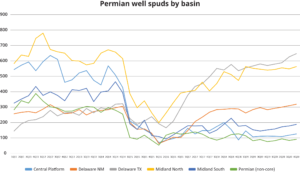

The prolific Delaware Basin continues to account for a growing portion of the total Permian well count at the expense non-core acreage.

-

Operators are asking contractors to focus on lowering personnel turnover, bolstering training and improving equipment maintenance programs.

-

Production was close to 4.4 million

bbl/day in July and could be up to 5.1 million bbl/day by mid-2020.

However, Mr Abramov noted that most of the decline in the working rig count – which is off by about 10% since January – has been shouldered by older equipment. “Most of the high-spec rigs are still working. In fact, rig counts and rig rates for high-spec rigs in West Texas have been very flat lately,” he said.

High-spec units are commanding approximately $25,000/day, while all-in rig revenues for smaller and older rigs are more variable, typically getting around $15,000 to $16,000/day.

“Last year, rig rates were increasing continuously, but in the last few months they’ve flattened,” Mr Abramov said. “As we move toward the end of 2019, I believe that most of the year-over-year gains in dayrates will diminish completely, and selected drillers expect modest declines in the second half of the year.”

The number of wells drilled is also expected to dip, although not as much as the rig count has. Rystad forecasts that 6,900 wells will be drilled this year in the Permian, including West Texas and New Mexico. That would be a 3% reduction compared with the 7,100 wells drilled in 2018. “Essentially, an average rig is able to drill more wells this year,” Mr Abramov said.

About 3,350 of the 6,900 wells are expected to be located in the Delaware Basin, 2,800 in Midland and the remaining 750 spread out across the rest of the Permian. These numbers illustrate a clear shift toward the Delaware side of the region, he added, which began back in 2017. “If you look at 2016, the Delaware accounted for only 34% of the total well count, whereas last year it was more like 47%. This year we’re expecting another modest increase.” The growth in Delaware’s share of wells is coming not at the expense of the Midland Basin, however, but at the expense of non-core acreage.

“Every quarter it becomes more evident that the Delaware offers really large potential for the most prolific well locations in the US,” Mr Abramov said. A lot of zones in the Delaware haven’t been really tested with modern well and frac designs, so there is high potential for operators to go in and unlock new premium or tier-one inventory by using new well configurations, he explained.

In addition to this shift toward the Delaware Basin, there is also a continuing trend for operators to take on large-scale development projects, rather than individual wells. Developments with 10-20 wells on the same pad, all being drilled and completed simultaneously, are becoming much more common. “There is no clear consensus yet within the industry about the advantages of this approach,” Mr Abramov said. “Some operators say this strategy can cause inefficiencies in logistics, but the operators who are executing this type of project say they see clear benefits in wells cost and productivity.”

Encana and QEP Resources have been pioneers in this project strategy, and “this year we see that more and more operators are adopting this approach,” Mr Abramov said. “Concho Resources, for example, has allocated 85% to 90% of their budget this year to large-scale developments.”

Regardless of whether operators pursue large developments or single-well pads, production from the Permian will remain strong, even with fewer rigs drilling fewer wells. As of July, the Permian was producing close to 4.4 million bbl/day, an increase of 350,000 bbl/day just since the beginning of 2019 and 900,000 bbl/day above July 2018 production. By this time next year, the Permian could be producing up to 5.1 million bbl/day, according to Rystad.

Market Becoming Tougher for Contractors

For contractors like Cactus Drilling, the pinch from lower dayrates hurts, even if its West Texas division is still running at 100% utilization. The company has 25 rigs working in the area, mostly drilling extended-lateral wells in the Delaware Basin. Over the past year, Cactus has moved five rigs into the Permian from other markets; three went into the Delaware and two to the Midland Basin.

Because market fluctuations and supply/demand are out of the company’s control, Cactus is focusing on areas where it has more influence: people. “It’s extremely difficult to retain good people in West Texas,” Mr Blevins said. Having a strong company culture has helped, but the company has also helped retention by creating new rig-moving crews, sometimes from rig crews whose rig is no longer working. “This allows us to have 10 hands during the day to help mobilize rigs to new locations and still have a five-man crew at night, so we can continue to do work outside of the usual 15-hour window.”

It has also helped that most of the necessary rig hardware upgrades have been completed over the past couple of years, so no extensive capital requirements are needed now. “Where we’re gaining the most efficiencies now is having good people in the right positions and having great leadership,” Mr Blevins said.

Cactus is also identifying ways to improve its maintenance program by taking a more proactive approach to scheduled downtime and pre-positioning of critical equipment. “That’s a big efficiency we’re trying to bring to the table for the operator.”

San Angelo, Texas-based Sendero Drilling is currently marketing eight rigs, all in the Permian. Utilization is fluid because most contract awards have short durations, but the company expects at least six of those rigs will be working at any one time, according to Andrew Kelley, Business Development Manager for Sendero.

It’s been a struggle this year, however. “When there are so many rigs available, there’s no reason for someone to sign up a rig for a long term.”

Within the Permian, the contractor says it is seeing more of its customers moving to the Midland Basin, drilling 20,000- to 25,000-ft wells with laterals that can go out to 2.5 miles. Sendero has three larger, 1,500-hp rigs in its fleet that are capable of drilling such wells, while the others are smaller rigs more suited to drilling shallow horizontals.

To keep pace in this ultra-competitive market, Sendero has been adding bigger mud pumps, walking systems and automated drilling controls to its rigs wherever possible, although Mr Kelley noted that low dayrates are making such investments more difficult.

Software, not Hardware

Process automation and improved analytic algorithms are key focus areas for improvement on Ensign Energy’s 45-50 rigs currently working in the Permian, according to Michael Nuss, Executive VP US.

The majority of these rigs are super-spec – 1,500-hp AC walking rig with 7,500-psi mud systems and expanded racking capacities – so they’re already decked out with all the necessary hardware. It’s the software side that Ensign is now pushing, through its EDGE drilling control system, to drive enhancements in safety, reliability and performance.

With this control system, a multitude of software are being developed, either by Ensign or third parties, to improve performance on EDGE-equipped rigs. “We have what I think is a unique ability to basically plug in other people’s apps by using our software delivery kit,” Mr Nuss said. “We can integrate advanced data analytics with rig control automation to help our drillers make better decisions.”

Earlier this year in the Delaware Basin, Ensign was able to achieve an ROP of more than 1,000 ft/hr while maintaining 10% weight on bit set point tracking in an intermediate section. This was done through the use of analytics and process automation, in conjunction with an aggressive bit design. “It allowed us to push performance dramatically while limiting the risk of bit or BHA damage because we had better control of the system,” he explained.

Another benefit is reducing tortuosity in the curve of the lateral section, resulting in a smoother wellbore that facilitates casing running. Further, the consistency and preciseness enabled by automating the bit’s return to bottom means less risk of bit whirl or bit balling.

Ensign is now testing a new real-time downhole hydraulic model app that provides information on the condition of drilling fluid and drilled cuttings; the goal is to ensure good hole cleaning. “It allows for reliability and performance because you can actually see what’s going on in the hole with regard to the job the drilling fluid is doing and what it’s doing with the cuttings,” Mr Nuss said. This leads to more consistency in hole conditioning and contributes to better drilling algorithms.

Investor Sentiment Driving Capital Discipline

From the operator’s perspective, investors’ focus on cash flow and corporate returns has made cost reductions an imperative this year, even in the lucrative Permian Shale. For Pioneer Natural Resources, which holds approximately 680,000 net acres in the Midland Basin, “we’ve been aggressively working to reduce our breakevens and increase our corporate-level return by lowering our well costs and reducing our cost structure, including reducing G&A costs,” said Bonnie Black, Vice President of Drilling. “We have to return free cash flow to our investors.”

In November, Pioneer announced that it was divesting its pressure-pumping business for $400 million. More recently, in its Q2 earnings report, the company stated that it has been able to reduce the top end of drilling, completion and facility capital spending by $100 million within its 2019 budget. This was attributed to increased efficiencies in drilling/completions, as well as accelerated use of less expensive West Texas sand for its fracturing operations.

The operator started 2019 with 24 rigs and plans to average 21-23 rigs for the year, all in the Midland Basin. With these rigs, it plans to deliver 265 to 290 wells to production this year, with an average EUR of 1.6 million barrels of oil equivalent. Approximately 35% of its wells will be in Wolfcamp A, 45% in Wolfcamp B, 15% in the Spraberry and the remaining in other parts of the Permian.

“In the second quarter of 2019, we produced 330,000 BOE per day, which was about 206,000 barrels of oil per day,” Ms Black said. “In the Permian, we expect to grow production by between 12% and 17% during 2019 over 2018. In fact, we’re expecting mid-teen production growth for the next several years.”

Looking at its drilling operations, Ms Black noted that it’s important for drilling contractors to work on minimizing personnel turnover. While advances in drilling automation and control systems are welcome, ensuring more consistency among people on the rig – and ensuring that they are fully trained – will be key to maximizing the benefits of any new technology, she said.

Having robust repair and maintenance programs is another critical focus area for improvement, Ms Black added. “At Pioneer, we make sure that we have open dialogue with all of our contractors on key performance indicators. They all work in tandem to minimize nonproductive time.”

Waiting for Natural Gas Prices to Adjust

Privately held Admiral Permian Resources (APR) has responded to the market this year by letting its last rig go in June; the operator is currently not drilling. “We are slowing down for a few months as gas prices adjust,” said Michelle Estes, Vice President of Operations for APR.

A year ago, the operator had two rigs drilling. “We will add a rig in the beginning of the fourth quarter,” she added.

APR, a relatively new startup, acquired its assets from Three Rivers Operating in April 2018, including more than 59,000 net acres in Reeves and Culberson counties in West Texas. Its currently producing from Wolfcamp A and B.

“We hit the ground running last year, put together a really good team and made some good wells, but the market’s not necessarily cooperating,” Ms Estes said.

“We remain confident in the wells we’re making… but when you’re not getting the best price for your crude or gas, it makes it difficult to bring more wells on.”

“Every quarter it becomes more evident that the Delaware offers really large potential for the most prolific well locations in the US.”

Something that would help with project economics is if drilling or fracking companies could make more use out of operators’ field gas, she said. “That would be a bigger impact to us than selling the gas on the market at today’s prices.”

APR is also working to build out more field infrastructure to better handle its crude and natural gas production. “We’re building out a system from scratch,” Ms Estes said, noting that the company will be better-positioned to increase drilling and fracking activity once these facilities are completed later this year. The company is currently trucking 100% of its crude but should be on pipe gathering by the end of 2019. DC