A rising tide for offshore drillers

Cost cutting, technical innovations and better all-around efficiency position the offshore market for growth, even at lower prices

By Katie Mazerov, Contributing Editor

After years of market contraction and aggressive cost cutting, the global offshore oil and gas market is showing signs of an upward tick. Analysts are now projecting an increase in spending – even at oil prices considerably lower than those seen in 2014. However, as operators begin ramping up exploration and development campaigns in key basins, especially deepwater, the story looks markedly different from a decade ago. Back then, prices were well over $100/bbl, rig rates were at all-time highs, and shipyards were enjoying an unprecedented construction boom as contractors prepared for operators’ anticipated foray into complex, risky and ultra-deep frontiers.

Today, much of the focus is on drilling easier wells, many of them in mature fields with existing infrastructure, and launching exploration and appraisal campaigns with high reward but lower risk profiles, analysts say. The rig market also remains overbuilt, with many rigs still stranded in cold storage or shipyards and rig rates still not much higher than OPEX levels.

-

Operators continue focus on drilling easier wells in fields with existing infrastructure.

-

Greenfield projects could drive deepwater revenue growth in 2019; key markets include Ghana, Guyana and East Africa.

-

Growth in Saudi Arabia, North Sea and Asia will keep the shallow-water market stable.

-

To boost revenue despite low dayrates, drilling contractors are negotiating more performance-based incentives.

However, there are factors contributing to a better long-term outlook. These include years of belt-tightening across the board, incentive-based contracts, rig sharing, a push for greater efficiency, and licensing rounds that are attracting major international operating companies (IOCs) to high-profile deepwater arenas.

The industry is also pondering what impacts will come from the merger between Ensco and Rowan Companies, which was completed in early April. The new company, Ensco Rowan, reportedly will have a fleet of 82 rigs, including 28 floating units and 54 jackups.

According to information released by both companies, 25 of the 28 floaters are capable of drilling in water depths greater than 7,500 ft. The combined company has the second-largest fleet of the highest-specification drillships, of which 11 are seventh-generation ultra-deepwater rigs. The combined jackup fleet includes seven ultra-harsh environment units and nine modern harsh-environment rigs.

50% Reduction in Offshore Costs

“With more wells, more fields, more rigs and more vessels this year than last, we’re predicting 6% revenue growth offshore for the service sector, including drilling, at an estimated $205 billion,” said Audun Martinsen, Partner and Head of Oilfield Services Research for Rystad Energy.

“Offshore operators have reduced costs by 50%. That, along with new rig technology, automation and efficiencies resulting in faster drilling and use of sophisticated downhole tools enabling faster completions, is allowing the sector to grow even at current prices,” he said. “After so many years of intense price squeezing and with budgets dropping to a 10-year low last year, it doesn’t take a lot of activity to drive up the market, and we can’t expect things to get cheaper.”

The service sector, especially maintenance and labor-intensive services, will benefit the most from the increased investment, with drilling accounting for 7% of the growth.

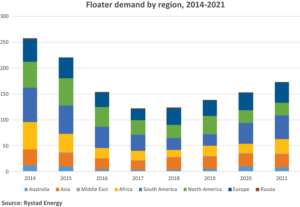

“Contractors have more rigs in action, but average dayrates are coming down, despite the fact that rates for newly contracted rigs are increasing,” Mr Martinsen said. He cited recent dayrates averaging between $240,000 and $250,000 for semisubmersibles and $330,000 for drillships. “We see growth throughout 2019 for drillers, and rates are improving in the Gulf of Mexico (GOM) and the harsh-environment sector.” Since 2014, the number of active deepwater floating rigs has dropped to 123 from 258.

At $60/bbl oil (Brent), offshore project sanctioning could reach its highest level since 2013, he continued. “In the deepwater sector, most of the revenue growth in 2019 is being driven by greenfield projects. About 105 projects will be sanctioned this year, compared with just 46 in 2016. However, drilling typically doesn’t commence until the second, third or fourth year of development, so the rig market will remain challenged.”

Key greenfield markets will be Ghana and eventually Nigeria in West Africa, as well as Anadarko/Chevron’s big liquefied natural gas development in East Africa, which will require drillships. In Latin America, ExxonMobil is expected to utilize multiple rigs for drilling phases two and three of the massive Liza project and the Payara field offshore Guyana, Mr Martinsen added. Earlier this year, ExxonMobil brought the number of discoveries on Guyana’s Stabroek Block to 12. “If oil prices remain stable or go even higher, we will eventually see more brownfield exploration,” he said.

The more stable shallow-water market, which did not experience quite as steep of a downturn as the deepwater sector, will see growth in Saudi Arabia, as well as in the North Sea and Asia. There was demand for 285 jackups last year.

“Global jackup demand is expected to increase from 285 to 310 units this year,” he said. High-spec jackups are now getting $110,000/day, up from $50,000 to $80,000 in 2018.

There has also been some movement toward joint ventures (JV) and other alliances between operators and drilling contractors. However, Mr Martinsen sees this as primarily a short-term strategy that is highly dependent on what happens with rates. “Operators may want to contract rigs for a short duration to keep prices competitive, and rig companies don’t want to tie in for a long duration at low rates,” he said. “With the market uptick, rates likely won’t be getting cheaper, which may lead to more lock-in of suppliers.”

In February, Seadrill and Empresa de Serviços e Sondagens de Angola, an affiliate of Sonangol, announced the formation of a 50/50 JV called Sonadrill, with plans to operate four drillships in deepwater Angola over a five-year term. Seadrill is providing two drillships from its existing fleet, and Sonangol is delivering two seventh-generation, ultra-deepwater drill ships from the DSME shipyard in South Korea.

Contract Incentives, Rig Sharing

Deepwater exploration that was postponed during the downturn is driving an anticipated increase in well demand, or the number of exploration, appraisal and development wells that will be drilled, beginning this year and into 2020, said Leslie Cook, Principal Analyst, Upstream Offshore Supply Chain for Wood Mackenzie. “Operators know they need to fill up that reserve base again. Last year was a banner year for subsea tree awards, which suggests an increase in development drilling as trees for those projects take a couple years to build,” she continued. However, these won’t be the 50-well “mega projects” with two or three floating production storage and offloading facilities of the past. “The highest development well count we’re seeing is 28.”

Continued drilling and development of fields at lower prices depends on whether cost reductions will be market-driven versus sustainable, Ms Cook said. “We won’t see oil prices recover to $100, or even $80, anytime soon, so those reductions likely will become ingrained and sustainable as long as pricing stays down. Some cost savings are because operators are drilling easier wells in mature fields and doing tiebacks with existing infrastructure. The industry hasn’t drilled in complex new frontier areas in the last four years, so the next few years will be telling as operators move back to high-pressure, high-temperature GOM fields and ramp up in West Africa, which is typically a higher price point because of infrastructure costs.”

The 70% reduction in floating rig rates, from $500,000 to $600,000 at its peak to less than $200,000 in some cases, even for top-tier rigs, has profoundly impacted costs, she said, noting that the service sector has experienced about a 30% decline in fees.

As dayrates stay low, contractors are eyeing new terms around performance through increased efficiency and reduced drilling time. “A top contractor may negotiate a $180,000 dayrate but include performance-based incentives to make more money on the back end,” Ms Cook said.

Additionally, as operators focus on cost with readily available rigs, they may engage in rig-sharing programs, which ultimately leads to fewer rigs needed. For example, “in the North Sea, we’ve seen independents form rig-sharing consortia,” she noted.

Lack of experienced crews is a big concern going forward, she said. “As rigs come out of cold storage, contractors must bring in personnel who may lack training on the latest technological advances.”

While the new-generation rigs have yet to completely implement full automation, most are equipped with digital control systems that can combine large amounts of data with modeling techniques and visualization tools to enable condition-based monitoring of critical-path equipment in real time, she added.

New Deepwater Opportunities for IOCs

With the licensing rounds that occurred during the downturn, IOCs are venturing into markets like deepwater Mexico and Brazil, said Ms Cook, who sees greenfield development as more of a post-2020 trend, with Latin America poised to be the biggest growth area. “Wells in Brazil are less complex than those in the GOM. The operators coming in have extensive deepwater experience, and Petrobras has learned a lot about the pre-salts.”

In Mexico, Talos Energy is moving forward with the Zama discovery appraisal program, and last year BHP Billiton was the first international operator to drill an appraisal well in deepwater Mexico, she noted.

Advances in seismic technology could further open up opportunities for ultra-deepwater drilling in Mexico, Ms Cook said. “Service companies are doing a lot more with seismic, which is always the first step in any enhanced technology step-change,” she said, noting that use of advanced seismic imaging technologies was instrumental in ENI’s recent deepwater oil discovery in Angola.

“We’re also seeing Asian national oil companies like CNOOC (China) and ONGC (India) starting to invest more in deepwater development,” she continued. “Norway will stay strong and steady with the opening of the Barents Sea.”

Brownfield activity, which has been focused on the North Sea and Asia, is expected to grow in the US GOM, Australia and West Africa to ensure that “gas capacity stays filled through the giant hubs that were built,” she added.

Redeveloping Mature Fields in GOM

The offshore downturn, while generally a negative story from an exploration standpoint, has given rise to a renewed focus on development drilling in regions such as the US GOM.

Nabors has seen an increase in activity here over the past 12 months. The company currently operates five owned platform rigs in the GOM, as well as one labor contract rig on a deepwater SPAR. Most of the rigs are doing development drilling on producing fields, according to Matt Thomas, Area Manager, US GOM Offshore for Nabors.

Since Q1 2018, Nabors has added three rigs, including two modular offshore dynamic series (MODS) AC rigs. These include MODS-202, a 2,000-hp AC rig working the edge of the GOM Shelf in over 1,000 feet of water, and MODS-400, an ultra-deepwater platform rig currently working on the Big Foot tension leg platform (TLP) in 5,200 ft of water. The third is Super Sundowner XIV, a 1,000-hp workover and light-drilling rig designed with modular components for flexibility and efficient rig-up, which is doing recompletion work in the GOM’s East Breaks area.

“We’re seeing a trend of independents acquiring fields originally developed by the majors 10 to 15 years ago, and redeveloping these mature fields using the latest drilling and completion technologies,” Mr Thomas said. “These companies, which don’t have to compete internally for capital against other global and shale projects, are enjoying good returns on investment, while the majors are seeking more lucrative deepwater and ultra-deepwater opportunities or short-cycle shale opportunities.”

Platform rig utilization in the GOM is currently nearing 70%, compared with less than half that in 2016, he noted, and dayrates are attractive, even with the capital improvements that are required for platform modifications and refurbishments.

The MODS rigs were designed to be easily configured and installed on existing platforms and are engineered to withstand the dynamic wave action that impacts SPARS and TLPs. Long-proven in the field, the rigs are equipped with 7,500-psi mud systems and AC drive power, which provides better control of drilling parameters – with a key objective being cost reduction and efficiency, Mr Thomas said.

“Our customers care about development costs, second only to safety and compliance,” he explained. “The best way to reduce development costs is to reduce the number of drilling days. Drilling represents 30% to 40% of the daily cost, while other variable costs, such as directional drilling, casing running, managed pressure drilling (MPD), blowout preventer (BOP) testing and mud engineering, account for the remainder.”

As operators continue to focus on efficiency, he sees continued technical upgrades on the horizon for the platform rig sector. “Historically, offshore rigs were on the cutting edge and much more state-of-the-art than land rigs. However, since the downturn redistributed investment from offshore to land, land rigs have surpassed the offshore sector in many ways,” he said. “This is evidenced with the introduction of advanced control systems, integrated services, automated drill floors and pipe-handling systems and process automation of both repetitive tasks at the surface and complex downhole tasks that improve efficiency and make wells more economical.”

Mr Thomas said he believes the development of the SmartRig land fleet, ongoing innovation and integration of services through Nabors Drilling Solutions and strategic technology acquisitions through Nabors’ Canrig Robotics rig equipment subsidiary, position the company well to take offshore rig capabilities to the next level.

“While focusing most of our time on safety, compliance and operations excellence, we’re also looking to do opportunistic upgrades to our offshore fleet that match the increased efficiencies we’ve seen on our land rigs by providing better performance in an integrated fashion and eliminating performance variability from crew to crew. Reducing drilling time by just one day can amount to a savings of $150,000 to $200,000.”

Automated, Intelligent MPD

While advances ranging from downhole seismic tools to smart rig designs that speed up the drilling process are resulting in significant cost savings, offshore operators also are turning to existing technologies that have proven effective and, in some cases, are being enhanced to meet the demands of a challenging and high-stakes environment.

Among the drilling methods seeing an uptick in the deepwater sector is MPD, which has been used in the land market for some 50 years but has seen slower adoption in the offshore market. The closed-loop system using a rotating control device (RCD) to control downhole pressure and mitigate the risk of well control events is moving from niche to mainstream as operators increasingly recognize its value in driving safety performance and reducing equipment costs and rig time.

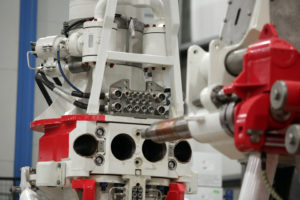

Weatherford this year introduced a step-change to the technique with the launch of an intelligent MPD system featuring a deepwater riser that uses a robotic arm combined with automation and digitization, fiber optics, condition-based maintenance and advanced sensors to streamline operations and significantly reduce installation time.

Offshore outlook by the numbers

-

Global jackup demand is expected to increase from 285 last year to 310 this year. High-spec jackups are now getting $110,000 per day, up from $50,000 to $80,000 in 2018.

-

Recent floater dayrates have averaged between $240,000-$250,000 for semisubmersibles and $330,000 for drillships.

-

Compared with 46 deepwater projects that were sanctioned in 2016, this year will probably see 105.

-

A 6% growth in offshore revenue is expected this year for the offshore sector, at around $205 billion.

-

Platform rig utilization in the GOM has more than doubled from 2016 levels to almost 70%.

-

Since 2014, the number of active deepwater floating rigs has dropped to 123 from 258.

The new riser, which will see its first deployment in the Caspian Sea later this year, is officially being rolled out at the 2019 Offshore Technology Conference. The company is building several additional units in response to an increase in tenders from operators asking for MPD on board, said Anthony Spinler, Weatherford’s Vice President, MPD. Some offshore operators are even requiring MPD on all rigs to minimize losses, he noted.

“MPD initially was intended for wells with very tight pore pressures and low fracture gradients. However, we’re now seeing that it has multiple secondary and tertiary benefits,” Mr Spinler said. “Safety and reliability have always been top operator priorities, and having an RCD in the flow path up the riser to divert gas influxes improves safety on the rig by preventing costly well control events and the need to close the BOP. A single deepwater well control event can result in seven or more days of downtime and cost millions of dollars.”

The approach offers a number of other benefits. “By using MPD to maintain the correct and constant bottomhole pressure, operators gain the added benefits of better well construction, faster rates of penetration and the ability to drill longer lengths and eliminate casing strings, which cost hundreds of thousands of dollars in equipment and drilling time,” Mr Spinler explained.

Developed during the downturn using data and learnings from more than 7,600 MPD operations conducted by Weatherford since 2014, the new riser system addresses the long installation times required with conventional MPD systems that lack modern sensors and high-end data systems in an industry increasingly relying on artificial intelligence, he continued.

“The robotic arm can connect a single subsea control umbilical, flowlines and electrical and fiber optics in less than 20 minutes, a process that used to take two days on top of a three-day BOP and riser installation. Two days of savings offshore is significant, and getting a five-day weather window is tough.” The system is designed with a hands-free spool for all weather conditions, eliminating the need for personnel to work over the moonpool to make connections.

The quick rig-up/rig-down feature gives operators more options for effectively incorporating MPD into the drilling program. “If a customer is drilling for a year and only using MPD on some sections, installing and uninstalling the system to return to conventional drilling takes multiple days,” Mr Spinler noted. “With this system, the driller can use MPD 10 times in a year and save 20 days of rig time versus a conventional system.” DC

MODS, SmartRig and Super Sundowner are trademarked terms of Nabors.