Esgian: Global offshore market should continue upward progress seen in Q1 2022

By Stephen Whitfield, Associate Editor

The upswing experienced in the offshore drilling market at the start of 2022 shows no signs of abating soon, according to analysts from Esgian. Global rig fleet enterprise value is on an upward trajectory and dayrates are beginning to see increased upward pressure. Overall, the outlook for the offshore market’s near-term future is optimistic.

Oil’s continued price recovery is a primary driver of this outlook. Brent crude closed at $104 at the end of March, marking a 31% increase since the end of December. Global fleet utilization increased by 2% over that same timeframe, from 73% to 75%, and total fleet enterprise value, or the theoretical combined purchase price of the rigs in a fleet, rose by 4.6%.

The offshore sector saw 94 fixtures across all market segments during Q1 2022, a 12% increase from a year ago. The majority of fixtures reported came from the North Sea/Norway (26), the Middle East (15) and Southeast Asia (10). A total of 57 fixtures were for jackups, while 25 were for semisubmersible and 12 for drillship. The backlog added over the quarter totaled 86.41 years, but that number has already risen to around 97 years since the beginning of April.

Esgian said it anticipates many more multi-year fixtures in the coming months, especially in the Middle East, but long-term contract will likely remain rare. “Most of the requirements we’re seeing remain short- to medium-term in nature,” said Cinnamon Edralin, Head of Rigs Research at Esgian, during a webinar held on 20 April. “Contractors are generally wanting to avoid locking in long periods when dayrates are moving up, and operators want to maintain flexibility and be more resilient compared to what we saw in past upcycles.”

The near-term future should see an increase in global rig demand – Esgian expects demand to increase by 18% from Q1 2022 to Q4 2024. Jackup demand will increase by 15% during that timeframe, and semisubmersible demand will grow approximately by 45%. Drillship demand will climb approximately by 30% by mid-2023 before seeing a slight dropoff in 2024.

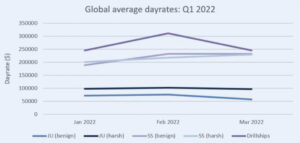

Over the next few years, Esgian said it expects dayrates for all rig types to rise, but the biggest increases will be for premium, higher-spec units – such as those with emission-lowering technologies like selective catalytic reduction (SCR) systems, energy efficiency software, heat recovery systems and hybrid power.

Ms Edralin noted that multiple jobs for seventh-generation drillships in the US Gulf of Mexico and Brazil have received multiple bids in the low-$400,000s range over the last couple of months, though no contracts have been awarded at that range yet – Esgian expects dayrates for some individual contracts to exceed that $400,000 threshold within the next year. Sixth-generation harsh-environment semisubmersibles should also see an increase within the next year, as energy security concerns generated by the Russia-Ukraine war will push up demand in Norway.

Not just in Norway but across Europe, operators are reviewing their portfolios to see where production can quickly be added, said Sarah McLean, Senior Rigs Analyst at Esgian. This expected increase in rig demand will lead to more rig reactivations . Esgian forecasts an increase in global rig requirements from 120 in 2022 to 160 in 2023, with the bulk of that increase coming from semisubmersibles.

“With the increased threats to energy security, particularly in Europe, we’re beginning to see some rig requirements being fast-tracked, and we think that trend will continue moving forward,” Ms McLean said. However, she noted that the focus on increasing European production could lead some companies to slow or pause drilling plans outside of Europe.