Higher oil prices foster optimism for recovery in offshore drilling market

Industry is hopeful that investments in offshore E&P will grow as geopolitical events put new spotlight on energy security

By Stephen Whitfield, Associate Editor

The offshore drilling sector has had a challenging few years. When energy demand fell off rapidly at the onset of the COVID-19 pandemic in 2020, operators’ appetite for investing in offshore projects also dropped off dramatically. However, in recent months, as production levels have increased again to pre-COVID levels and with the oil price continuing to recover, there is renewed optimism in offshore E&P activity among drilling contractors.

Another factor at play is that geopolitical events have sent oil prices shooting upward. Brent crude price reached a 2022 peak of $127.98 on 8 March, two weeks after the onset of the conflict in Ukraine. Although that price has since fallen to $111.16 as of 17 April, overall oil prices are still at a level that encourages significant investment. Moreover, the war in Ukraine highlighted for many countries the need for energy security, encouraging them to reduce their reliance on imports. This could lead to a more favorable environment for offshore development, some drilling contractors anticipate.

“The industry saw post-pandemic recovery with a clear uptake in the market,” said Eirik Reinertsen, Chief Commercial Officer at Stena Drilling. “The offshore industry has already and, we believe, will continue to see an uptake in activity. That should see increased investment, both in renewables and in the oil and gas sector. I think that the future looks brighter for the energy sector as a whole.”

While the Ukraine conflict created spikes in the oil price, it had been on a steady upward trajectory for the past two years – Brent crude rose from a post-downturn low of $24.81 on 19 April 2020 to $94.05 on 23 February 2022, the day before the Russian invasion. With the oil price increasing and operators looking to ramp up drilling activity, drilling contractors are seeing more opportunities to get their rigs back in the market.

“We’ve seen some increased market inquiries and tendering starting around the end of last year,” said Clay Coan, President of Northern Offshore, whose fleet of jackups are working in the Middle East. “Operators are showing an increased willingness to add additional bidders to their approved list of rig contractors. That response, as much as anything, is indicative of the operators’ thoughts on the market. When you see them inviting new bidders to tender, then you know that the market’s improving – rig supply is decreasing, so they’re looking to expand the pool from which they’re choosing.”

Deepwater exploration

Operators have also established what Mr Reinertsen termed a “new baseline oil price” for triggering investment that is lower than what it had been prior to the downturn. A key enabling factor for this has been the cost reductions that the service sector undertook in the wake of the 2020 downturn. The lower baseline price means that the threshold needed to make brownfield and greenfield deepwater projects profitable is also lower.

For deepwater, better economics are then leading more operators to move forward with FIDs on major projects. Mr Reinertsen said he expects the oil price to remain at a more stable level for the foreseeable future, which should encourage increased long-term investment in deepwater.

“For operators to sustain investment levels over time, we need to see a healthy oil price over a long period of time. Ultimately, our concern is, how do we grow within the offshore drilling sector? As a company, we believe that creating long-term relationships with major operators, working with them and adopting to uncertainty can help remove some of the obstacles.” he said.

One approach is to adjust contract terms. While the conventional dayrate contracting model days are not over, he thinks incorporating KPI-based incentives and market-based adjustment systems within contracting terms could help drilling contractors and operators hedge against pricing uncertainty.

“With (Stena) being a privately held independent drilling contractor, we can obviously afford ourselves some flexibility in coming up with commercial solutions, and we have proposed several different models where we could integrate on services or take over some services that would traditionally fall under the remit of the operator. While I think the most likely solution going forward is the dayrate model, we’re going to continue offering integrated bolt-on services tailored to each client,” Mr Reinertsen said.

To help advance these goals, Stena Drilling has also worked in the area of smart contracts. Last October, the company announced a partnership with blockchain technology startup company SmartChainServices. The companies are working on a smart contract solution that automates the payment cycle, as well as new contractual models based on KPIs such as drilling speed, carbon intensity and fuel usage, all of which can be automatically validated.

These three KPIs will be critical in helping the industry lower emissions from its offshore drilling operations. This means the offshore sector needs to deploy low-carbon drilling solutions in the immediate future, particularly as operators focus on reaching their emission-reduction targets, Mr Reinertsen said. To that end, Stena Drilling announced in January 2022 that its fleet had achieved ISO 50001:2018 accreditation, which specifies requirements for establishing, implementing, maintaining and improving an energy management system. The intended outcome is to enable an organization to follow a systematic approach in achieving continual improvement of energy performance and the energy management system.

“It’s important that we continue to improve our practices, and that means improving our drilling techniques to reduce the time spent on a well. The less time you spend on the well, the fewer emissions you have. I think most major drilling contractors have been moving in that direction,” Mr Reinertsen said.

Stena Drilling has also been focusing its activities on Guyana, with the Stena DrillMAX and Stena Carron drillships working in the area. The Guyana/Surname region has been a major offshore hotspot in recent years, dominated by ExxonMobil through a slew of discoveries since May 2015, most recently with Fangtooth and Lau Lau, announced in January.

Other operators are also starting to make progress there. Following positive results from the Kawa-1 exploration well, CGX Energy and Frontera Energy announced in February that they would focus on exploration at the Corentyne Block offshore Guyana in 2022.

“I think anyone in the offshore drilling industry would agree that what we’ve seen coming out of Guyana and Suriname are very promising results that have already led to a lot of activity,” Mr Reinertsen said. “The area’s certainly a hotspot, and we all feel optimistic that this high level of activity will continue.”

Stena has also recently picked up various contracts for its two semisubmersibles on the UK Continental Shelf (UKCS). While operator investment in the region is still low, Mr Reinertsen said he believes interest could improve in the coming years. “We’re seeing more work manifest on the UKCS instead of being postponed year-on-year. That’s a cause for optimism, to actually see more activity. We’ve seen some of the bigger fields owned by the larger operators now going through the approval process internally, and there have been rumors that several operators are relooking at the figures to see what’s feasible. That’s another reason to be optimistic.”

Developing mature assets

In recent years, the UKCS has become somewhat of an afterthought in the North Sea drilling landscape, especially compared with the prolific Norwegian sector. The bulk of conversation on the UKCS has centered around decommissioning, plugging and abandoning mature assets. However, things are changing with the Ukraine crisis highlighting the need for energy security, both in Europe at large and particularly in the UK. The latter imported 37% of all oil and gas consumed in 2021, according to the latest Business Outlook released on 29 March by the Offshore Energies UK (OEUK), formerly Oil & Gas UK.

Although the UK government has said it is still committed to developing renewable energy for a low-carbon future, the country is encouraging more short-term oil and gas exploration and development to help reduce its reliance on foreign imports.

“Given all that’s going on, the industry has a very important role to play,” said Deirdre Michie, CEO of OEUK. “What’s become clear is that energy security is a matter of national security. We can be part of the solution here.”

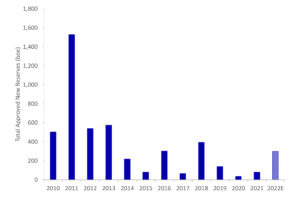

The group’s Business Outlook noted that the number of approvals for new oil and gas projects on the UKCS has been falling consistently through the past decade. One reason is the maturity of the basin has limited the investment opportunities under consideration. Additionally, operators and investors have been concerned about the level of political and public support for offshore exploration. Only 80 million BOE of new UKCS resources were approved for development in 2021, of which 35 million BOE were for gas fields. Developing these reserves will take approximately $975 million (£750 million) of new capital investment from operators, according to OEUK.

“We know the basin itself is in decline, and we need to actively manage this by investing in new projects, as well as existing ones. If we don’t, we’ll be even more reliant on other countries – up to around 80% of our gas and around 70% of our oil (by the 2030s). That’s a heavy exposure,” Ms Michie said.

With 10 new fields set to start up in 2022 and early 2023, OEUK expects sufficient production to come on stream to maintain output in line with 2021. Combined with the fields that started production in late 2021, this will result in approximately 450 million BOE in new reserves (split roughly 50/50 between oil and gas) and peak production rates of around 250,000 BOED. This would offset declining production from existing assets, according to OEUK.

Further, the group is forecasting a 10% increase in exploration and development drilling on the UKCS this year compared with last year, as well as a 5% increase in UKCS oil and gas production over the next two years. The rise in production is attributed to operators accelerating smaller work scopes and launching brownfield infill drilling campaigns to extend the productive life of mature assets.

Production is still expected to decline in the long term, of course. Based on current levels of investment, the expected rate of decline is between 7% and 10% by the end of the decade. However, it’s important to note that the rate of decline could jump to 15% if no new investments are made in the next two years.

A focus on new licensing and exploration can help balance this decline in the coming years, with OEUK emphasizing the need for a new licensing round to be announced this year. Its Business Outlook shows that operators are planning nearly $26.13 billion (£20 billion) in CAPEX on the UKCS from 2022 to 2026. New projects under consideration for development could bring up to $4.57 billion (£3.5 billion) annually in new investments if approved, unlocking around 300 million BOE per year in new reserves.

Contractors not feeling full benefit yet

Like with Stena Drilling, Mr Coan with Northern Offshore sees an upward trend for the offshore drilling sector. While it is unclear what kind of long-term impact the Ukraine conflict will have on the oil price, Mr Coan said he feels the price will remain at a level that will encourage operator investment in new projects.

“Speculating the future of oil prices will always be difficult, but I do think it’s reasonable to expect that prices will remain at a level that will continue to prompt investment by our customers. Whether that means oil prices settle to the $70-80 range or they remain north of $100, I don’t know, but I am confident they will be at a level that encourages operators to go out and drill more wells,” he said.

However, drilling contractors have yet to feel the full benefit of that upward trend – dayrates are still not at a high enough level to enable significant reinvestment into upgrading rig fleets, and existing terms for contracts signed earlier in the oil price recovery timeline have not been adjusted to reflect higher prices.

“When oil prices crash, some of the oil companies are quick to ask their service contractors to adjust their rates downward accordingly. When oil prices increase significantly, the oil companies generally have to go through a budget cycle before funds are approved to tender for new rigs,” Mr Coan said. “The tendering process itself can take many months before a contract is awarded. So, while the market is improving, it hasn’t yet had a material impact on the number of rigs contracted or market rates. We often say that we take the slow elevator up and we take the stairs down.”

The downturn also forced drilling contractors to stack or retire a number of rigs. However, Mr Coan said it is unlikely the recovery will spur a newbuild cycle anytime soon.

“The severity of the most recent downturn is probably going to limit investors’ appetite for newbuilds. There are just too many rigs out there that are still available that need to be put to work first. It is both faster and cheaper to get those rigs up and running than it would be to invest in a newbuild,” he said.

Northern Offshore’s fleet of four jackups are currently working under long-term contracts in the Middle East. The Energy Embracer, Energy Enticer and Energy Edge are working for Qatar Petroleum through Q4 2023, Q3 2024 and Q4 2024, respectively. All three contracts began in either late 2020 or early 2021. The fourth jackup – the Energy Emerger – is working for an unnamed operator offshore the UAE through Q4 2022. That contract started in mid-2021.

Three of those four contracts were awarded prior to the oil price downturn, while the contract for the Energy Emerger was announced in October 2020. Since then, operators in the offshore space and particularly in deepwater have been hesitant to award long-term contracts.

Mr Coan said he’s hopeful that, as oil companies’ confidence in a sustained high oil price environment grows, more long-term contract opportunities will become available. But for now, when making strategic contracting decisions, drilling contractors must decide whether to bid low enough to secure short-term work or hold out for longer-term contracts with improved dayrates.

“Each contractor has their own strategic objectives. For us, we had to have the long-term contracts. We couldn’t justify taking delivery of a newbuild rig and investing the money required to deliver the rig to our customers for short-term work. Therefore, we had to be selective for the right opportunity to take delivery of our rigs and put them into the market.” DC