Permian sees the start of a cautious recovery

Rig count and wells drilled are expected to rise this year, but return to pre-downturn activity won’t happen at current operator spending levels

By Stephen Whitfield, Associate Editor

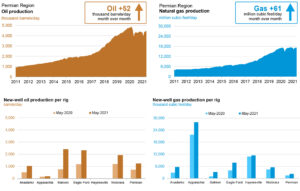

Like all other US shale basins, activity in the Permian Basin took a significant blow last year amid the oil price crash. But things appear to be looking up, with the International Energy Agency estimating a 5.5 million bbl/day rebound in global oil demand this year and WTI staying above $50/bbl since 7 January. The scene appears set for a recovery in the Permian.

However, the length of the road back to pre-pandemic activity levels is still uncertain. Permian rig count had peaked at 418 the week of 13 March last year, the same week the World Health Organization declared COVID-19 a global pandemic. It then dropped to a low of 117 the week of 14 August and stayed in that trough for a couple of months before starting to inch back up. Since then, the rig count has been steadily improving, reaching 224 as of 9 April.

Obviously, there’s still a long way to go before the rig count will reach pre-downturn levels, according to Linda Htein, Senior Research Manager, US Lower 48 Upstream Research at Wood Mackenzie. “Even now, we’re only really at half the drilling levels we saw before the price crash,” she said. The firm estimates the rig count will continue to rise at a rate of around 10 to 15 rigs per month. If that pace holds, the Permian would reach around 300 active rigs by Q4 this year.

Rystad Energy is forecasting a similar rig count, around 300, for the Permian by year-end; this assumes WTI remains close to $60 as it has in recent weeks.

This trend means that some upside in rig rates is possible for the second half of the year. Bonnie Tibbs, Senior Analyst at Wood Mackenzie, estimates dayrates for super-spec rigs in the

Permian – like others in the Lower 48 – will start around $15,000 this year and creep upwards to the high-$10,000s range by year’s end.

The number of wells drilled should see a similar bump, commensurate with the increasing rig count. Artem Abramov, Head of Shale Research at Rystad Energy, estimates the Permian will see 4,200 wells drilled in 2021, up from 3,650 in 2020. For Q2 2021 specifically, his firm is forecasting an average of 375 new horizontal wells per month, more than 20% higher than the average needed to maintain production.

The basin has also seen a notable recovery in fracking operations. Despite a severe winter storm that plagued the area in February, overall frac operations have gone up by 15% from Q4 2020 to Q1 2021. In March, the Permian saw the start of 429 new frac operations on horizontal wells, well above the 310 required to maintain oil production, according to Rystad.

Overall, there’s no doubt that the Permian is still a behemoth among North American shales plays. In its April 2021 Short-Term Energy Outlook, the US Energy Information Administration (EIA) indicated that the Permian will continue to be the primary driver for Lower 48 onshore oil production growth heading into 2022. Despite a falling rig count last year, the Permian’s share of total Lower 48 onshore production actually increased slightly, from 47% in January 2020 to 51% in April 2021.

Jeff Barron, Industry Economist at the EIA, said he expects that share to stay in a similar range this year. The EIA estimates that Lower 48 production will average 8.91 million bbl/day this year – 3% lower than 2020 production levels – before rising to 9.72 million bbl/day in 2022, assuming WTI prices stay above $50.

Spending outlook and drilling plans

With WTI improving from its post-downturn low point, there is increasing incentive for Permian producers to increase spending in preparation for the upturn. However, so far, E&P companies have remained disciplined, focused on guarding free cash flow, deleveraging and generating returns for investors.

Wood Mackenzie expects Permian producers to spend, in aggregate, $21.6 billion in CAPEX this year, which would be a slight drop from the $24.3 billion spent in 2020. In 2022, a rebound to $23.3 billion is expected. A clearer picture of the economic landscape will be formed this summer when operators release Q2 earnings reports.

The cautious approach that many operators are taking is exemplified by Occidental Petroleum (Oxy), one of the largest operators in the Permian.

The company budgeted $1.2 billion in CAPEX for the Permian this year, down from $2.2 billion in 2020. Most of that budget will be spent bringing new wells online, which will mean bringing more rigs back. After averaging two Permian rigs in Q3 and five in Q4 of last year, Oxy anticipates operating an average of 12 rigs in Q1 2021. Jeff Alvarez, Vice President of Investor Relations, said in the company’s 23 February earnings call that he does not expect that total to change much through the end of this year.

In fact, he expressed uncertainty that there would be much growth at all in the company’s Permian CAPEX moving forward. “Our capital intensity in the resources business will be half this year of what it was two years ago. It wouldn’t surprise me to see (Permian CAPEX) be a little bit higher than $1.2 billion three or four years from now, but I wouldn’t expect a meaningful change from that number.”

Apache is taking a similarly cautious approach. The company’s planned 2021 CAPEX for the Permian is $385 million, up 7% from 2020 levels. Apache suspended its drilling and completions activity in the basin in April 2020, following the onset of the oil price downturn, and maintained that suspension throughout the year.

In an earnings call on 30 July 2020, CEO John Christmann indicated that rig activity would not be resumed until the oil price had moved “well into the $50s.”

Now, with WTI staying around $60, the company expects to restart a modest drilling program. It is currently running one rig and expects to start a second rig around mid-year. On 25 February this year, Mr Christmann said in another earnings call that the company will need to add a third rig at some point to stabilize production, but he gave no timetable for doing so. The company was running six rigs in the Permian prior to the downturn.

As the Permian continues to recover, it’s also likely that certain parts of the basin will see more activity than others. Ms Htein said she believes operators will focus their drilling programs on core acreage and primary benches within the Delaware and Midland basins. Their status as known producers means that operators will see them as safer bets, she said.

“There’s more of a focus on capital efficiency, at least for this year. Operators are going to stick to what they know, so expect to see rigs returned to these core development areas, the more productive areas where drilling has been historically. There’s just not a lot of appetite for risk,” she explained. “Maybe when we get further down the road and balance sheets are in better shape, there may be potentially more of an appetite for stepping out and exploring outside of the core.”

Another trend to look for this year is how much operators will reduce their drilled but uncompleted (DUC) wells inventory in the Permian. Operators had relied on a significant backlog of DUC wells to maintain production last year as drilling activity dropped. “We’ve seen DUC inventory start to come down the past few months as the prices have come back up,” Mr Barron noted. EIA numbers show total DUC inventory in the Permian was 3,163 as of February 2021, down from a peak of 3,715 in June 2020.

M&A Activity

The past year has seen a continuing trend of M&A activity among major operators, the biggest being ConocoPhillips’ $13 billion purchase of Concho Resources in October. The deal netted the company an additional 550,000 acres and 200,000 bbl/day of oil production in the Permian. Chairman and CEO Ryan Lance, in the company’s 2 February earnings call, noted the constant need to drive for synergies in the current market.

“We’re quite excited about the upside and the opportunity to drive efficiencies, free cash flow generation, and just getting our assets on the Concho learning curve and continuing to drive the value,” Mr Lance said. The company plans to sustain the same level of capital spending it had in 2020, he added. “That gives us the chance to get really focused on driving those efficiencies and get more out for every precious capital dollar that we’re spending.”

Another significant deal was Pioneer Natural Resources’ $7 billion acquisition of Parsley Energy, which was completed in January and gave Pioneer an additional 100,000 acres across the Permian.

Speaking on an earnings call on 24 February, Pioneer executives said they hope to achieve $350 million in synergies from the Parsley acquisition overall. More than 40% of that should be realized by the end of 2021 through consolidated supply chain activities and optimized field production operations.

Pioneer, which operates exclusively in the Permian, is also leaning on its drilling and completions teams to drive cost efficiencies. The company lowered its facilities cost per well to around $1 million in 2020, $200,000 less than 2019 levels and $600,000 less than 2018 levels. Further, its production costs dropped from $8.48/BOE in Q4 2019 to $7.01/BOE in Q4 2020. After slashing its 2020 drilling and completion CAPEX to between $1.6 billion and $1.8 billion, the company now anticipates 2021 CAPEX to stay between $2.5 billion and $2.8 billion.

Ms Tibbs with Wood Mackenzie said the continuing trend toward consolidation is a mixed bag for service companies working in the Permian because the synergies that come from M&A activity often come at their expense. “As far as consolidation goes, it’s a huge risk for the OFS sector. Operators are their customers. The impact to the service companies is not something that gets talked about as much in a lot of these deals,” Ms Tibbs said.

The consolidation likely won’t have as much of an impact on drilling contractors, she said, “but in all other aspects of the more volatile services that go into drilling and completions, and even on the production side, it matters a lot, and we see that companies are hurting.”

With that in mind, it’s probably good news that operator M&A’s have already peaked. Alex Beeker, Principal Analyst, Corporate Research at Wood Mackenzie, said he expects to see a slower pace for these deals going forward, primarily because there are fewer “logical candidates” remaining for operators looking to grow their positions. On top of that, with WTI rebounding from its post-downturn low point, there is also less of a need for companies to seek mergers.

“When you look at the deals from 2017 and 2018, there was a lot of talk about continuous acreage,” Mr Beeker said. “We just didn’t see that in any of the deals this fall. It was more about cost cutting and reinvestment rates, and getting a better deal on the service sector. If you have a bigger position in the Permian, you probably have a more competitive negotiating standpoint. Just looking at the number of public operators in the Permian, we do think more consolidation is needed, but there’s probably a less pressing need for that to happen.”

Drilling contractors in the Permian are unlikely to see any uptick in M&A, Mr Abramov with Rystad said, in part because there are few companies with strong enough balance sheets to provide value in a merger. “It is a bit more difficult to communicate value creation synergies from corporate M&A in the drilling contractor segment since the market in US land is already fairly concentrated,” he said. DC