Wood Mackenzie outlines 5 key changes in US Gulf of Mexico

The oil price crash has come at a time when the US Gulf of Mexico is leaner and nimbler and is better prepared to weather the storm compared to the last downturn. “The region is resilient at low oil prices, and nearly 82% of oil production has a short-run marginal cost of $10/bbl Brent,” Mfon Usoro with Wood Mackenzie’s Gulf of Mexico upstream research team, said. “On top of this, over 60% of rig contracts are short-term, which gives operators the flexibility to defer CAPEX and maintain positive cashflow.”

She continued: “Although the US Gulf of Mexico remains afloat, budget cuts in the region have been swift, and some fields have been shut in due to the unprecedented low oil prices. Investment, exploration and project sanctions have all seen major recalibration. We used Lens Upstream to highlight how US Gulf of Mexico operators have responded to the latest oil price crash.”

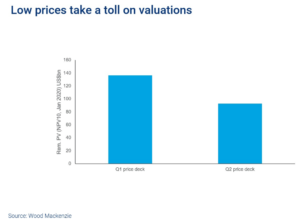

Low prices have wiped 30% off the remaining value from the US Gulf of Mexico deepwater asset base

“In analyzing the full impact of the downturn, we must isolate the effect of the fall in the oil price,” Ms Usoro said. “We changed our long-term Brent oil price assumption from $60/bbl to $50/bbl and updated the 2020-2022 forward curve prices.”

“This change alone, not accounting for changes to production or costs profiles on the assets, wiped off roughly 30% of the remaining value from the US Gulf of Mexico deepwater asset base,” she added.

Roughly $4 billion in investment has been cut from 2020, a 22% reduction from 2019

“Depressed commodity prices have an obvious knock-on effect on corporate investment priorities. Taking into account dampened demand as a result of coronavirus and the initial lack of OPEC agreement, we expect CAPEX to fall from our pre-COVID-19 projections by roughly 35% to $7.4 billion. This represents a 22% decline from 2019 investment,” Ms Usoro said. “Both the under-development and on-stream opportunity sets have felt the pinch.”

Production could decrease for the first time since 2013, but recovery awaits in 2021

“The fall in investment caused us to revise our production outlook, as new projects, drilling campaigns, and brownfield phases have faced delays and potential changes of scope,” Ms Usoro said.

“At the start of the year, we predicted production of 2.2 million BOED, which would have been another production record in the US Gulf of Mexico. But our forecast has fallen by 200,000 BOED.”

“A recovery in production is expected in 2021. This is because near-term major project start dates have not shifted,” she said.

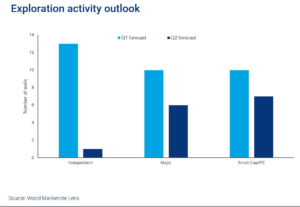

Exploration will drop to historic lows in 2020, and a rebound will take time

“We were expecting exploration activity in 2020 to be on par with 2019, which was the first year that exploration saw an uptick in over three years,” Ms Usoro added. “But in response to announced budget cuts, we have reduced our exploration forecast by 55% to 15 wells. This will be an historic low in the region and the recovery will be anything but quick. The downward revision was largely dominated by Independents, while the Majors and small privates have forged ahead with exploration plans, albeit slightly scaled back.”

No greenfield projects will be sanctioned in 2020; subsea tieback projects could struggle

Ms Usoro said that momentum had been building in US Gulf of Mexico project sanctions, and Wood Mackenzie expected a new record in 2020 with three greenfield projects requiring total investment of around $10 billion. But the oil price crash quickly halted FID plans globally due to the heightened risks.

“As a result, we do not expect any US Gulf of Mexico project to be sanctioned in 2020,” she said. “But, unlike the last downturn, where some projects were cancelled, this time project FIDs have simply been deferred. This is attributed to the relatively competitive economics of the pre-FID projects in the region, which could come down even further with cost deflation.”