After slow period, South America now brims with potential

With exploration activity picking up in key areas, drilling contractors position themselves to take advantage of operator demand

By Stephen Whitfield, Associate Editor

As 2020 kicks into full gear, some of the more intriguing prospects in the drilling market lay in South America, where offshore exploration and production activity has heated up, and some of the onshore prospects hold great potential. New projects in Brazil and Guyana figure to provide a boost.

In February, Petrobras announced a production record from Q4 2019, with more than 3 million BOED, in large part due to the ramp-up of platforms in the prolific pre-salt reserves. ExxonMobil shipped its first oil from Guyana in late January, and it continues to announce new discoveries on the Stabroek Block.

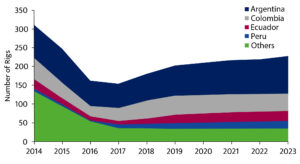

- Argentina is expected to drive rig demand on the continent through 2023, with much of that activity coming in the Vaca Muerta.

- With discoveries continuing to rack up in the Guyana-Suriname basin, particularly in the Stabroek Block, highly specialized deepwater rigs should be in high demand in the coming year.

- The relaxation of local content laws and the reduction of royalties for mature basins continue to make Brazil a more attractive prospect for operators.

The political situation in Argentina may be uncertain, but the Vaca Muerta’s vast resources have long been coveted, and the implementation of a new petroleum law could provide the certainty operators need to proceed in the area. The area is expected to drive rig demand in South America in the coming years, with Shell’s planned developments in the three blocks – Sierras Blancas, Cruz de Lorena and Coiron Bitter – expected to require 300 wells drilled by 2025, among other prospects. Even countries like Colombia and Peru have companies interested, with new drilling either in the works or already in action.

Contractors on the continent report varying degrees of success in the present and anticipation of the near-term future. A number of outside factors in each major area will determine how that near-term future, and long-term future, pans out.

Guyana-Suriname: Hotbed of activity

One of the hottest areas on the continent is the Guyana-Suriname basin, where ExxonMobil has been making news throughout the past couple of years with numerous large discoveries on the Stabroek block. The operator has made 15 discoveries on the block through year-end 2019, with recoverables totaling more than 8 billion BOE. As of February 2020, recoverables from the latest discovery, the Uaru exploration well, had not been added to that total.

Stena Drilling has been active in Guyana, with the Stena Carron arriving there in 2016. Stena said that the managed pressure drilling (MPD) system it used on Stena Carron was the first contractor-owned closed-loop MPD system installed on an ultra-deepwater drillship, as classified by DNV GL.

Carl Minikes, Marketing and Proposals Manager at Stena, said he hopes further operator interest in Guyana could lead to more work for the company there.

“Obviously we hope the journey for us will continue there,” Mr Minikes said. “We’re not experts at discoveries and reserves and things like that, but it’s been high in the news, and the prospects certainly seem good for operators. Hopefully, there will be a prosperous future for everyone there.”

In Suriname, Noble Corp’s drillship, the Noble Sam Croft, drilled the Maka Central-1 well on Block 58 offshore for Apache and Total in early January 2020. Apache, the operator, announced a major discovery from the well, encountering significantly overpressured oil-bearing reservoirs at approximately 20,670 ft in the lower Santonian interval. The Sam Croft is scheduled to drill the next wells in the block, having started on Sapakara West-1 in February.

Together with its other drillships – Noble Bob Douglas, Noble Tom Madden and Noble Don Taylor – that are currently working for ExxonMobil in Guyana, the deployment of the Sam Croft to Suriname has transformed this region into a significant concentration of high-specification drillships for Noble.

“The opportunity to operate four of our sister-rigs in such close proximity gives us the ability to make use of economies of scale in our operations, inventories of spare parts and operating philosophy,” said Joey Kawaja, Noble’s Regional Manager for the Americas.

Marcelo de Assis, Head of Latin America Upstream Research at Wood Mackenzie, said that Guyana-Suriname offers an encouraging environment for drilling companies because there’s a base demand in the area. However, whether that demand materializes into rig contracts will depend on whether any new discoveries in the area are justifiable for development.

Mr de Assis also said that Wood Mackenzie sees the basin competing with the US Gulf of Mexico, Brazil and Norway for highly specialized deepwater rigs that should be in high demand in the coming year.

Mr Kajawa agreed. “Everybody’s got a different definition of what ‘high-spec’ is, but when you’re talking about deepwater requirements, that 500-kips, DP3, two-stacked, dual-derrick would be your preference as an operator, regardless whether you’re in Guyana or Suriname. I think those assets are going to be in high demand,” he said.

Argentina: Vaca Muerta

When one thinks of Argentina, the first words that may come to mind are “Vaca Muerta.” The formation, characterized by large volumes of reserves and geological heterogeneity comparable to the Eagle Ford shale in Texas, is one of the most promising areas of unconventional development in South America. It holds more than 308 trillion cu ft of natural gas and 15 billion bbl of oil and condensate within its 8.6 million acres. Argentina’s Energy Secretariat estimated that the Vaca Muerta could lead to a doubling of the country’s overall production to 1.1 million bbl/day by 2030.

While the potential of the area has been known for a while, the first inklings of that potential are still just taking root. According to the US Energy Information Administration (EIA), only 4% of the Vaca Muerta’s acreage has entered development phase.

There are a number of factors behind this sluggish pace, a primary one being the lack of infrastructure needed to support a significant increase in production. Much of the Neuquén province, the location of the Vaca Muerta, is desert landscape isolated from the rest of the country, and getting equipment to a well can be extremely difficult compared with other shale plays.

Greg Helmen, Vice President of Land Drilling at DLS Archer, Archer’s land drilling service, said establishing export markets for Vaca Muerta’s output will be critical in spurring infrastructural investment.

“What is being done to make the product of the Vaca Muerta competitive on an international market, like with pipelines, refineries and LNG?” Mr Helmen asked. “A lot of the midstream development that is required to provide the infrastructure seems to be lagging behind. Getting the wells drilled is one thing, and commercializing our product is one thing, but there’s a piece in the middle where I don’t see much happening right now. That seems, to me, to be as much of a limiting factor as anything else.”

Recent government action has added some uncertainty into the operational equation, leading many companies to put investments on hold. In August, former President Mauricio Macri announced a 90-day freeze on diesel and gasoline prices, driving the domestic price of crude to $49.50/bbl, a drop of more than $10/bbl from the Brent Crude price. Argentina’s current president, Alberto Fernández, extended the freeze upon taking office on 10 December 2019.

President Fernández said in January that he is working on proposals to incentivize conventional and shale developments across the country, not just in the Vaca Muerta. As of February, however, he has yet to announce a plan. This has not completely stifled work in the Vaca Muerta. In January, representatives from Equinor, Shell and Total confirmed their plans to continue with shale projects following meetings with Omar Gutiérrez, the governor of the Neuquén province.

Gov. Gutiérrez said at the time that Equinor will drill six more wells in the Bajo del Toro block, adding to the two it already has in production. He also said that Shell plans to complete five pre-development wells on Bajada de Anelo in July, a final step before evaluating whether to move into full-scale production on the block.

Mr Helmen said a clear plan from the government would have a positive impact on development.

“In my experience, operators can adapt activity and investments to any situation as long as they know what it is. It’s really a waiting game right now to see what the new petroleum law for Vaca Muerta is going to look like. The government is working on one, but nobody knows exactly what it will look like yet. This uncertainty makes it difficult for the operators to make decisions. Our clients need to understand the new law before they can develop their investment plan, and the industry will adapt activity to whatever the law is,” Mr Helmen said.

Archer currently owns eight rigs located in the Vaca Muerta. In November 2019, it signed a five-year drilling contract with YPF for three of those rigs. The contract called for upgrades to meet technical specifications for YPF’s extended well design. These modifications included:

- The installation of a 7,500-psi circulating system;

- A 90° rotation of the substructure; and

- An extended walking distance from 20 m to 50 m on the x-axis and from 9 m to 20 m on the y-axis.

Two of the three rigs in the YPF contract are already on site. Mr Helmen said the third of those rigs is undergoing upgrades and was planned to spud in the first week of March.

DLS Archer Rig 165 is also in the midst of a three-year contract with Pampa Energy that commenced in August 2018. That rig was also upgraded, from 5,000 psi to 7,500 psi, and retrofitted with a walking system as part of the deal.

Two of Archer’s Vaca Muerta rigs are warm-stacked, and two more are looking for new contracts. Mr Helmen said he expects the number of rigs looking for contracts to increase over the next few months as existing contracts expire.

“I don’t think anybody expects to see any significant upswing in activity until very late this year, or really early next year,” he said.

“It’s really a waiting game right now to see what the new petroleum law for Vaca Muerta is going to look like. … The uncertainty makes it difficult for operators to make decisions.”

– Greg Helmen, DLS Archer

With fewer rigs in use, Mr Helmen said 2020 provides a good opportunity for Archer to upgrade its rigs to higher specs, which he estimated will become more in demand once activity picks up in the region. According to Westwood Energy Group, only 32% of identified rigs in Argentina rated at 1,500 hp or above and only 31% were equipped with top drives.

Outside of the Vaca Muerta, the prospects offshore Argentina provide a moderate opportunity for companies looking at a potential long-term play. While significant drilling activity is still a few years away, one operator is moving quickly: Echo Energy began drilling the first well in its Santa Cruz Sur prospect, CLix-1001, in late December.

Brazil: On the rebound?

Like Argentina, Brazil holds a lot of potential for a spike in drilling activity after a period of transition. Whether that potential is realized depends on operator appetite for potentially large development projects.

The short-term outlook is not optimistic. According to Baker Hughes’ December 2019 rig count, Brazil had 13 offshore rigs in service, a slight increase over the low-point of eight, reached at various points in fall 2018 and summer 2019, but still well below its pre-downturn levels, as well as the rig count in both Argentina and Colombia. However, over the past four years, the country has mostly addressed long-standing regulatory issues that had previously kept major discoveries undeveloped and reduced the attractiveness of exploration acreage to multinational companies.

The relaxation of local content laws, the reduction of royalties for mature fields, Petrobras’ divestment plan and the decision to allow non-Petrobras operators in the pre-salt reserves have made Brazil a more interesting prospect, and major companies like ExxonMobil have built up significant portfolios of offshore blocks. This may portend good things for the drilling market.

“Today, we’re seeing many oil platforms on the Brazilian coast, and the growth trend reinforces that the market has been preparing for this moment,” said Heitor Gioppo, Executive Managing Director of Ocyan. “Despite the fact that the market for rigs worldwide is undergoing an oversupply, in Brazil we see the market heated, due to the resumption of exploration, especially from Petrobras fields, by 2021.”

Mr de Assis said there should be a lot of activity in 2020. Shell plans to commence exploration drilling at the Saturno Block in the Santos Basin. Petrobras plans to drill up to eight wells this year, mostly in the pre-salt area. Premier Oil contracted the Valaris DS-9 drillship to drill the Berimbau/Maraca stacked prospects on Block 717 in the Ceará Basin; that well is expected to spud in Q3 2020.

Ocyan’s Norbe VI semi began work in January on the Tartaruga Verde field, located in the Campos Basin, with its first activity being the decommissioning of well 3-RJS-670.

“We know the potential of the field, and we are prepared for the challenges,” Mr Gioppo said.

Norbe VI is one of Ocyan’s five deepwater drilling rigs, all of which have been hired by Petrobras. It was one of six rigs Petrobras contracted in July at dayrates ranging between $135,000 and $160,000. Mr Gioppo said the current rates reflect an oversupply of drilling units.

“I understand that, for the next few years, there should be an improvement in the conditions,” he said.

Mr de Assis said Brazil should become more desirable for non-local contractors seeking work for their rigs in the near future. Although all six of the July charters went to Brazilian companies, he said that dwindling local capacity will open the door for others.

“Some of the Brazilian companies at that time had parts of their fleets that weren’t in use. Now they have contracts, and I think there’s not a lot of additional local capacity, or a local fleet of rigs, that’s going to be leased to the operators. I do not see a lot of spare capacity in the local market, and also you have to consider the prices offered by international companies. I think that will be the balance,” Mr de Assis said.

Peru: Block Z-38

Another area of note is Block Z-38 in the Tumbes Basin, offshore northwest Peru, where the Stena Forth drillship spudded the Marina-1 well for Karoon Energy.

The Marina prospect is a large fault-bounded structure with targets at multiple levels ranging from 2,952 ft to 9,514 ft (900 m to 2,900 m) in the Tertiary Pliocene La Cruz to Cardalitos formations. Karoon estimated that potential resources from the prospect may reach 256 million bbl of oil. The planned total depth of the well is 9,927 ft (3,026 m).

The initial exploration work did not produce the desired results, however. On 17 February, Karoon announced that Marina-1 did not encounter significant hydrocarbons and that the well would be plugged and abandoned.

Marina-1 was the first well drilled in Z-38, and as such it will be an important calibration point for the geology of the block. At the time it took control of the Stena Forth, Karoon said in a statement that it would use information from the well to help assess other prospects and leads in the block, which holds more than 1 billion bbl in gross prospective resources over its 1,882.2 sq miles. The operator said in February that the well had provided a large amount of valuable data for the geological setting of the region of the Tumbes Basin on which it had drilled.

Karoon is analyzing the well results, and no further drilling is planned for Block Z-38 in this current campaign.

Peru’s offshore production has been fairly modest in recent years, but Perupetro, the country’s national oil and gas agency, estimates that the country will have the potential and reserves to produce more than 100,000 bbl/day of oil from its onshore and offshore blocks by 2023. That total would more than double the country’s 2019 output.

Mr Minikes said that Stena is optimistic that Peru can become part of the company’s long-term strategy, like Guyana, but it is still too early to tell how much fruit its efforts will bear in the region.

“We obviously hope Peru is the same as Guyana, but it’s early stages. It’s a bit difficult to take the same position down the line. We’ve been in Guyana for four years. Peru is a different time line for us,” Mr Minikes said. DC