Simplicity leads subsea technology innovations

Shape-memory polymer technology, electrohydraulic downhole flow control and monitoring, dissolvable tools, and large-bore subsea safety system among innovations making waves in subsea completions

By Karen Boman, Associate Editor

- Industry likely to look to pure subsea factories within next 5 to 7 years.

- Move toward simplicity and modularization has become a common theme in today’s subsea environment.

- Adoption of big data strategies represents next significant opportunity to enhance subsea completions.

- Tech developments are driven by need to reduce cost of capture, increase reliability and prepare for the digital oilfield.

If marginal offshore fields are to become economic, the next wave of subsea completion solutions must continue to focus on lowering costs and boosting efficiencies.

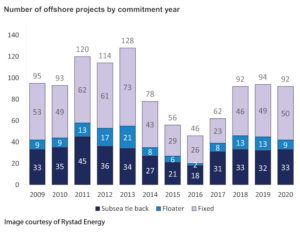

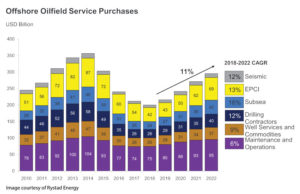

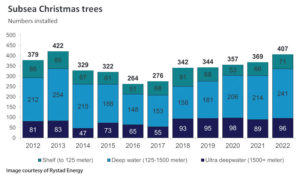

As oil prices recover and operators are successful in their efforts to reduce offshore field development costs, the amount of subsea equipment orders is expected to rise in 2019. In fact, for the foreseeable future, spending on subsea equipment is expected to increase, according to an analysis of industry trends from Rystad Energy. Demand for subsea equipment will come from major field development projects, such as Shell’s Vito project in the US Gulf of Mexico and Equinor’s Johan Castberg field offshore Norway.

“Of course, then you have lots of small development, and also brownfield projects, where operators didn’t want to replace subsea infrastructure and drill incremental wells during the downturn,” Audun Martinsen, Partner and Head of Oilfield Services Research at Rystad, said. “Now that we are seeing oil prices at $70/bbl or $80/bbl, instead of $40/bbl or $50/bbl, it makes sense to drill another well and buy another piece of subsea equipment to complete the well.”

Subsea boost pumps and long-distance power and communication capabilities have enabled Chevron to execute longer tiebacks in the deepwater US Gulf, allowing the company to extend its reach and further leverage existing infrastructure, Jay Johnson, Executive Vice President Upstream Chevron, said during the company’s 2018 Security Analysts Meeting, held on 6 March in New York.

“We’re lowering our cost in deepwater through efficiency, technology and standardization,” Mr Johnson said. As a result of this strategy, Chevron has reduced its well completion time in the US Gulf by more than 40% since 2014.

For future developments, all-electric subsea infrastructure and self-managing wells are field development solutions that are being considered.

“Operators are looking at how to handle more demanding operations with fewer people handling equipment – not only reducing HSE risks but also the cost of flying workers to and from offshore platforms,” Jim Sessions, Vice President of Sales and Commercial for the Completions and Well Intervention product line at Baker Hughes, a GE company (BHGE), said. Further, improvements in streaming video and audio capabilities will allow subject matter experts to consult from central onshore facilities and monitor platforms, according to Mr Sessions.

However, additional development of subsea technologies – specifically the creation of low-cost, robust seabed generators and transformers for the separation of oil and water – is needed before subsea factories will become more widespread.

“Due to cost, full subsea processing field development will only be conducted on select offshore fields,” Mr Martinsen said. “As oil prices recover, operators will start to think in terms of those lines and develop that business case better.”

Rystad expects to see more conventional subsea developments taking place over the next five years, such as wells tied back to floating production storage and offloading vessels.

Pure subsea tiebacks are more lucrative for operators because their investment can be recouped within five years, as opposed to a decade for traditional offshore field development. Subsea projects can also better compete financially with the short cycle times of onshore shale developments.

Within the next five to seven years, the industry will most likely look to pure subsea factories – as long as oil prices are high enough to support them.

“If they succeed on that, that would unlock Arctic subsea development because they won’t have surface exposure to icebergs,” Mr Martinsen said. Rystad estimates that oil would need to remain around the $70/bbl mark to make these sorts of unconventionals attractive.

Forming Electric Subsea Well Completions

BHGE has focused on subsea completions technologies that lower lifting costs for wells in higher-pressure, higher-temperature reservoirs. They aim to make field development projects economic at lower oil prices and will ultimately come together to form electric subsea well completions. However, these technologies won’t be deployable until after 2019, Mr Sessions said.

“The intent is you can take not just a well but a field, and you can pull in data to monitor the field’s health,” Mr Sessions said. “Production versus injector wells can be monitored, production in different parts of the field regulated and well zones closed off or opened up. What you have is field optimization without any intervention.”

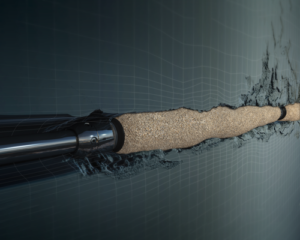

To address operator challenges surrounding subsea completions, BHGE plans to release several technologies throughout 2019. For the reservoir, the company has developed GeoFORM – a sand management solution that uses an advanced shape-memory polymer technology to conform to complex well profiles, multilaterals and ultra-fine sand formations. Its polymer technology enables operators to produce from long, zonal intervals of 1,000 ft to 3,000 ft of reservoir, while preventing sand migration into the wellbore. This allows for more sustainable production with significantly reduced risk during installation, and eliminates voids in conventional gravel packs.

The technology also eliminates the need for typical gravel-pack operations, which can involve a crew of 10 engineers and field specialists, as well as specialized blending and pumping equipment.

“Fluid always takes the path of least resistance and will flow up through the annulus until it hits a packer or obstruction, causing the majority of the production to enter the wellbore at a single spot,” Mr Sessions said. “What happens is you have a massive flow through a concentrated area, which can cause erosion and loss of sand control.”

If sand gets into the well, it can destroy tubulars, as well as surface equipment or infrastructure, he added. Traditionally, gravel is packed across the reservoir to eliminate annular production flow and sand erosion to prolong the integrity of the well and surface equipment. However, gravel packing is a time-consuming process that also requires significant pumps and other surface equipment.

The expanding polymer works by being heated and compacted to a smaller outside diameter (OD) size compared with a wellbore. The polymer material is then placed onto a perforated base pipe and deployed downhole. After the polymer is sent into the well, an activation agent is pumped down, which triggers the polymer to return to its original OD.

When the material returns to its larger diameter, it forms a tight seal against the wellbore, providing total conformance, regardless of any hole irregularities. The polymer maintains a positive stress against the formation, which stabilizes the near-wellbore region.

Field trials of GeoFORM, conducted at three offshore gas wells across five production zones in several water zones, resulted in a 40% reduction in rig time, compared with the time required for a conventional cased-hole frac-pack operation. The trials also showed that, by enabling higher production, the operators were able to achieve an estimated cost savings of $5 million per well, according to BHGE.

From an efficiency perspective, the company believes the technology will be a game-changer, particularly in remote areas where the infrastructure doesn’t exist for pumps and crews to be mobilized, Mr Sessions said.

“What’s significant is you no longer have to gravel-pack these wells, and a special intervention tool is not needed,” he added. “That means there’s significant cost savings for operators. Better reservoir contact also can be achieved through more even coverage of the reservoir.”

Since the new system is relatively simple to use, heavy expertise is not needed at the surface for deployment, he noted. The move toward simplicity is a common theme in today’s subsea environment and in the oil field in general, Mr Sessions said.

In addition, the adoption of big data strategies – coupled with emerging technologies, like artificial intelligence and self-learning algorithms – are enhancing subsea completion solutions. The ability to delve into terabytes of well data represents a major opportunity for the oil and gas industry, according to Mr Sessions.

Still, despite the plethora of information provided on a daily basis, the oilfield still has “a lot to learn in terms of data analysis,” Mr Sessions said. Data harvesting is the first step, but how the industry takes this data and turns it into executable actions to improve efficiency, reduce risk and improve production is the future.

“As the oil and gas industry recovers from the 2014 oil price crash, the technology bells and whistles once mandatory as selling points are today perceived as an extra element of risk,” Mr Sessions said. “Today, it’s more about fit-for-purpose design without extras. We just need to continue that trend of simplicity … and figure out how to better utilize data analytics, software and IT infrastructure that what we have at our disposal.”

Less Intervention, Fewer Umbilicals

Reducing cost of capture, increasing reliability and deployment flexibility, and preparing for the digital oilfield are drivers behind the development of subsea completions technology at Schlumberger, according to Steve Dyer, Technology Manager for Reservoir Monitoring and Control for the company’s completions portfolio.

To simplify subsea well completions and start-ups with less intervention and fewer umbilicals, Schlumberger developed the Proteus electrohydraulic downhole flow control and monitoring system. It is expected to reach the commercial market in 2019.

The system enables monitoring and control of up to nine well zones with only two hydraulic lines and one electrical line, depending on the well configuration. The electrical line delivers data from pressure and temperature surveillance sensors and controls the actuation of the flow control valves so that an interval producing unwanted water or gas can be choked back without disrupting production from other intervals. Individual zones or compartments can be dynamically tested without intervention, minimizing the impact on production.

The system combines a downhole control module, dual pressure and temperature quartz gauges, a field-proven control valve, and an absolute position sensor in a single compact assembly. The position sensor directly measures and manages the choke position unit and is controlled from surface using a user-friendly operating system.

The system has been enhanced for subsea and allows the multi-dropping of flow control and ball isolation valves, or barrier valves, on the same electrohydraulic umbilical.

Typically, hydraulic or electrical umbilicals are run and clamped to the outside of a wellbore’s tubing. For conventional control systems, each time a control device is installed, at least one more umbilical must be added for each well zone. Each time a connection is added, more splices – or a connection between two umbilicals – must be made. The system greatly reduces the number of lines, clamps and splices, making running in the hole a smoother and more efficient operation.

“Traditionally, intelligent completions have been limited to two zones in a subsea environment, using a combination of annular and in-line, or shrouded, flow control valves,” Mr Dyer said. “While exceptions do exist –there is an extensive track record of three- and four-zone subsea intelligent completions in the North Sea, for example – the cost, time and risk associated with running, splicing and testing additional umbilicals have remained a deterrent. But we are confident we have now removed that hurdle.”

In a field trial of the technology, in a dry tree application, Schlumberger helped an operator monitor and rapidly control production flow from each leg of a multilateral well, while minimizing completion complexity.

The trial was conducted in the Middle East, and it showed that the technology could be used to complete up to five zones with only three control lines instead of six, saving almost two days of rig time. The operator also saved 3.6 hours of rig time in cycling all well zones, compared with the 45 to 50 minutes per zone required to actuate conventional hydraulic flow control systems. On top of these installation and operational time savings, the well has produced for more than 2.5 years with no issues, according to Schlumberger.

Setting Production Packer Without Intervention

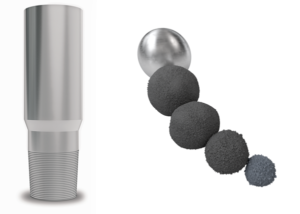

To meet operators’ subsea completion needs, National Oilwell Varco (NOV) continues to develop technologies that increase efficiency and reliability. Earlier this year, the company conducted field trials of its packer-setting system featuring the i-Seat ball, the latest innovation from its d-Solve dissolvable platform. The integrated system allows a production packer to be set without intervention, eliminating the need for multiple slickline or wireline tractor runs.

The technology is deployed by installing a profile below the production packer, then deploying the dissolving ball, which is designed to hold pressure for certain amounts of time. The ball dissolves over time, allowing well production to be started without having to remove a plug. To help the balls dissolve in the presence of chlorides in the wellbore fluid, NOV selected a combination of metallic materials, Tom Koløy, Regional Head of Sales for NOV’s Completion Tools business unit, said.

NOV worked with a North Sea operator during the field trials to eliminate the cost and risk associated with the wireline and tractor run involved in setting production packers and removing the equipment prior to well startup. A typical packer-setting operation involves a wireline run to pull the downhole safety valve hold-open sleeve; a tractor run to pull the check valve below the production packer; and a wireline run to set and pull a shallow set plug.

For the trial, the operator needed the dissolvable ball solution to hold 5,000 psi for 30 minutes, then pass through the ball sub within 24 hours. In a comprehensive full-scale testing and qualification program performed in simulated downhole conditions, the solution was qualified to the required conditions and operating range.

The packer-setting kit has been run on three wells since August. All have been successes, and the tubing and annulus test confirmed that the packer had been set. Using the combined NOV technologies eliminated the requirement for up to six days of rig time per well versus operations typically involved with conventionally set production packers. It also eliminated the cost and risk associated with typical packer-setting operations. The solution can also be run as a contingency setting method for hydrostatic set packers.

“In the North Sea, those rigs typically cost anywhere from $200,000 up to $300,000/day, so saving six days of rig time is considerable as our clients strive to complete more efficient wells,” Mr Koløy said.

Additionally, NOV is working with a major North Sea operator to jointly develop the ReAct completion circulation valve, a remotely operated circulation device run above the production packer to enable more efficient subsea completion processes. The operator has plans to install the valve technology on one of its larger subsea developments in 2019. The valve can be deployed above any packer and is run in the closed position to allow for packer setting and packer/tubing testing. The design allows bypass of up to six control lines for gauges, control valves and other downhole equipment. Once the packer is set, the operator can pressure-test the tubing against the closed valve.

Applying increased annulus pressure opens the ReAct completion circulation valve to allow communication between tubing and annulus. Heavy fluid can then be circulated out to a light fluid, allowing the well to flow naturally once put on production. The application of a pressure signal to the onboard ReAct module signals the valve to close. After a pressure test, the well can be put on production.

“Basically, we are combining a mechanical sliding sleeve with electronic pressure gauges to create the ability to remotely signal the mechanical device to perform certain operations,” Mr Koløy said. “We are signaling it from the surface to open up, then pumping light fluid down the tubing to remove heavy fluid in the completion. Then we signal to the tool to close.”

Although many subsea projects still fall into the standard pressure and temperature category, NOV is also developing HPHT solutions, 15K pressure-rated systems, and the infrastructure to obtain real-time subsea completions data through the company’s wired drill pipe technology.

Subsea Safety is Paramount

Not only must subsea completion technology meet the industry’s need to reduce costs while boosting efficiency, but it also must maintain safe operations. In 2019, Halliburton will release updated versions of its VETO direct hydraulic and DASH electrohydraulic large-bore subsea safety systems for well completions.

Both systems are run with either horizontal or vertical subsea production trees and integrated with the tubing hanger running tool to allow for control of a well’s upper completion. The two technologies are offered as 6 3/8-in. systems rated to 15,000 psi and 7 3/8-in. systems rated to 10,000 psi.

VETO direct hydraulic subsea safety systems let operators conduct well tests, deploy completion and perform workovers. The system consists of a subsea test tree, a retainer valve, a lubricator valve, as well as other ancillary parts comprising a standard subsea landing system.

In shallow-water operations, the VETO system controls the umbilical from the surface using direct hydraulics. Because deeper waters require longer umbilicals, which delays response times, the 7 3/8-in. system is fully compatible with the company’s DASH electrohydraulic controls.

For deepwater, the system is used to control the umbilical by converting the command to shut in a well into an electrohydraulic response using an electric cable.

The system can also shut in production from subsea wells in emergencies in as little as six seconds and conduct an emergency quick disconnect within 10 seconds. Currently, industry best practices are around 15 seconds, Richard Broad, Subsea Strategic Business Manager with Testing and Subsea at Halliburton, said. The system also allows for real-time data and sensory understanding of what’s happening.

“So instead of using an 8,000- to 10,000-ft umbilical to communicate and operate the tools, we are now taking that control to the tool regardless of water depth, basically on top of the tool itself, while uniquely still providing full direct hydraulic redundant control of all functions. This increases system reliability and provides cost-efficient operations,” he said.

Electrohydraulic controls can be used for well shut-ins during emergency conditions, such as adverse weather, loss of positioning or a well control situation where an emergency barrier must be placed in the wellbore, ultimately closing the subsea test tree.

Through linking with downhole and surface read-out control, the system can enable analysis for optimal performance to avoid nonproductive time, maximizing efficiency during complex deepwater completion landing string operations. The system delivers a high speed of response to critical well isolation, as well as pressure containment and emergency disconnect functions.

The combination of the VETO and DASH technologies provides insights into the BOP to check pressure, temperature, orientation, inclination and tension across systems. By using a sensor sub, the position and orientation of the completion landing string relative to the BOP and tubing hanger, tension compression of up to 100 lb, and the torque within the string can be actively monitored in real time.

Halliburton conducted a field trial of its DASH system in November and December 2016 in the US Gulf of Mexico, where an operator needed to plug and abandon two deepwater wells.

The company was able to deliver a fully customized solution using the DASH completion landing string in less than 30 days after conducting a full electrohydraulic system integration test in four days. A comparable hydraulic subsea safety system would have taken more than three months. No safety issues occurred, and no nonproductive time was incurred during the trial.

Halliburton’s next step is to further develop the two technologies, Mr Broad said. This continues the theme of modularization and lowering the overall complexity of system and controls to of reduce operational rig time, minimizing risk and maximizing the customer’s asset value. DC