Blockchain 101: Seven fundamental things to know in the drilling industry

Technology behind Bitcoin could be leveraged to create more transparency, security and lead to faster contract execution, more collaboration

By Linda Hsieh, Managing Editor

In November 2017, BP, Shell and Statoil – now known as Equinor – announced their participation in a consortium to develop a blockchain-based digital platform to modernize and transform the management of physical energy transactions, from trade entry to final settlement. Joining the oil and gas companies in the venture were commodities trading groups Gunvor, Koch Supply & Trading and Mercuria, as well as banks ABN Amro, ING and Societe Generale.

“Over time, the new venture intends to lead the migration of all forms of energy transaction data to the blockchain, improving data quality, further strengthening security and increasing the speed of settlements industrywide, while reducing the cost for industry participants,” the consortium stated in a news release.

The announcement heralded the arrival of blockchain technology into the oil and gas industry, signaling a confidence – at least by those oil majors – that there’s substance behind the buzz.

“There are a handful of industries that are ripe for using this technology to impact it in a great way,” said Adam Richard, Partner at Sutton Stone, a Houston-based company that commercializes ventures in emerging markets. He cited identity, healthcare, energy, banking, and supply chain and logistics as among the top industries poised to create an evolution in their businesses using blockchain. Areas within the oil and gas industry where applications of blockchain could lead to step-changes in the coming years include contract execution, payments, supply management and performance optimization.

In this article, DC answers some fundamental questions around this potentially disruptive technology.

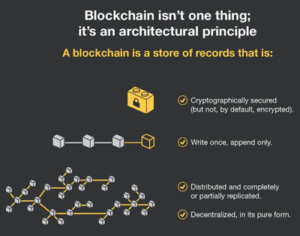

1. What is blockchain and how does it work?

For most of the general public, blockchain is probably synonymous with Bitcoin. However, the two terms actually refer to different things and are not interchangeable. Bitcoin is a type of digital currency, or cryptocurrency, that was built on blockchain. It is one out of more than 1,500 types of cryptocurrencies that can be found on the market today, albeit the gold standard among them. It is also the most well-known due to the media attention it garnered for its meteoric price surge during 2017. Since peaking at nearly $20,000 per coin in December of that year, value of the cryptocurrency has fallen and was hovering around $7,700 per coin as of early June.

Blockchain, on the other hand, refers to the architecture that lies underneath Bitcoin; in essence, there is no Bitcoin without blockchain, but blockchain can exist without Bitcoin. This fact is important, said Andrew Bruce, President and CEO of Data Gumbo, because he believes that cryptocurrencies have no place in the industrial space. “For our industry, we’re not talking about cryptocurrencies; we’re talking about the distributed ledger aspects of smart contracts that enable us to automate transactions.” Data Gumbo was founded in 2016 and provides blockchain as a service to the oil and gas industry, hosted in a virtual private cloud.

In simple terms, blockchain is an electronic ledger that can be shared among users and creates digital records of individual transactions, called a block. Each block is time-stamped, encrypted and linked to all previous blocks, creating immutable chains of digital records. A blockchain can be public or private, where a public chain is completely open and anyone can join. For business purposes, most blockchains will likely be private, where there are restrictions on who is allowed to participate and in what transactions.

2. How can industries like oil and gas use blockchain?

The nature of blockchain lends itself well to facilitating contract execution between multiple companies. “You have an agreement between two or more counterparties for the basis of a transaction, and you have an electronic source of that data. Each of the participants in the blockchain uses the same algorithm to determine the outcome of the transaction, and that transaction is also then hashed, or encrypted,” Mr Bruce explained. “As long as the hashes all match up between all the different participants in a process called consensus, then that becomes a valid transaction, which executes automatically and makes a financial transaction – whether a payment or penalty, depending on the terms of the agreement.”

Resource sharing is another common application, for example for an offshore vessel or helicopter. Blockchain can be used to divide up the billing between multiple counterparties and execute pre-agreed terms without any interpretation. “The key is that you have to be able to automatically measure the actual usage,” Mr Bruce said.

Logistics and document origin tracking are two other big categories of use cases for blockchain.

Within the drilling sector of the oil and gas industry, applications are emerging, as well. In one project that Data Gumbo undertook for an operator and drilling contractor, a blockchain-based performance contract was implemented for a land rig operating in Texas. Over a period of six months, the contract provided enough incentive for the drilling contractor to drive down its drill pipe connection times by approximately 25%, Mr Bruce said. That performance improvement also encompassed back-reaming times and tripping connections, he noted.

3. What are the potential benefits of using blockchain?

Benefits vary depending how the technology is used, but in most cases, blockchain is believed to lead to more transparency, more security and, therefore, less litigation and quicker execution of contract terms.

Mr Bruce points out that blockchain was designed to work in a trustless environment; it ensures that all parties to an agreement actually pay on the terms of the agreement. “Blockchain provides a distributed ledger where the operator and drilling contractor all have the exact same copies of the execution terms, the base data and the algorithm,” Mr Bruce said. “As operations occur, everyone knows when the drill pipe connection time improves by one minute.”

This aspect of blockchain, when it comes to performance-based contracts, should be particularly attractive to high-performing drilling contractors. “Companies who believe they are the best believe they can prove it using blockchain – and not only to prove it but also get paid for it,” Mr Bruce said. “There’s a general feeling that contractors have been squeezed to deliver additional performance but aren’t necessarily getting paid for it. This would be a way to get paid for the performance that they are already doing.”

In the example of the drill pipe connection improvements on the Texas rig, the simple fact that the performance contract was put onto a blockchain gave the drilling contractor enough confidence that their higher performance would be financially rewarded in a timely manner, thus leading to the impressive 25% reduction in connection times.

To ensure that blockchain-based contracts – also known as smart contracts – work as intended, both the operator and drilling contractor would have to ensure that those connection times, for example, are measured automatically. This can be done in different ways, Mr Bruce explained. “There’s about 40 different KPIs on a rig that you can measure that we’ve identified, and some of it is you can take direct measurements from the electronic drilling recorder (EDR) or the control system. The source of data is up to the participants… It’s a matter of whether you have sensors on the rig that can give you the information or whether you have to write some kind of state detection, as well.”

On a simpler level, another advantage of using blockchain is to enable faster payment for services rendered and performance delivered. With smart contracts, transactions and payments are all automated. As soon as the algorithms verify that conditions for payment – which are agreed upon ahead of time – have been met, payment is initiated automatically and immediately, not in 30 or 45 days. “A lot of people are looking at this technology just to reduce their receivable days,” Mr Bruce said.

4. Is it true that blockchains can’t be hacked?

Nothing is impossible, but hacking a blockchain comes pretty close. To hack a blockchain, someone would have to hack more than 50% of the nodes in a network, each one of which is encrypted. “If one period gets changed in one sentence of one smart contract, that changes the encryption and it becomes an invalid transaction that would be thrown out,” Mr Bruce explained. “It’s basically unhackable.”

However, this doesn’t mean there aren’t any weak links in the blockchain. In the drilling industry, that weak link may well be data quality. Each transaction added to the blockchain is only as good as the quality of the data being fed into the network.

At Data Gumbo, the company has developed a proprietary data platform that takes drilling data from different sources and inputs it into a standardized data model. “It’s an issue that anybody who wants to use blockchain will have to address – what is the definition of a mud pump, strokes per minute and the various fields that are required so you can take all your sources and map them to a data model.”

5. What are some challenges to implementing blockchain technology in the drilling industry?

As with any disruptive technology, the adoption of blockchain will require a learning curve. “I think the biggest challenge is around change management,” Mr Bruce said. “How do we get people’s heads around the fact that actual money will be exchanged as a result of this smart contract? People get a little nervous about that.”

Such concerns, however, can typically be allayed with testing periods where the blockchain is run in parallel with existing systems, limiting the risks involved. “It’s not like you have to go and change your ERP (enterprise resource planning) system or logistics system. You can just take data from an agreed source and feed that to an algorithm that everyone has agreed to so you can try it out,” Mr Bruce explained.

As baby steps, blockchains can even be set up within a company between different divisions to drive out internal inefficiencies, he added.

“The good news is that once the infrastructure is in place, you can add additional smart contracts using the same infrastructure without incurring significantly more time or expense.”

6. What are some possible future applications of blockchain in the drilling industry that are being explored?

Some companies are already studying how blockchain can be integrated into the well plan. “A well plan is basically a series of steps,” Mr Bruce said. “You can track who is responsible for each piece of a well plan, what their responsibility is and what the performance expectations are for each of those steps. You can then start to make payments based on that.”

He added that Data Gumbo is also talking to companies about developing advanced total well cost management tools based on blockchain. “I believe the commercial models in the drilling industry are going to fundamentally change and be driven by performance contracts,” Mr Bruce said. With the transparency provided by smart contracts and as companies are automatically paid based on actual performance, how companies work with each other will also evolve. Moreover, it will help companies to build a stronger business case for drilling automation. “If you’re being paid to be as efficient as possible, automation will really deliver that consistency of performance.”

7. How does the oil and gas industry’s willingness to try blockchain compare with that of other industries?

Awareness and understanding of blockchain within the oil and gas industry is increasing rapidly, Mr Bruce said, noting that his company has gone from just two leads in January to 27 that it’s actively pursuing today. “It’s really getting a lot of momentum.”

Compared with other industries, however, Mr Richard with Sutton Stone said he believes that oil and gas is still relatively conservative and less receptive to innovations. However, these are early days yet for blockchain, and it remains to be seen how oil and gas companies and drilling contractors will eventually learn to leverage the technology’s capabilities. Sometimes, change can ripple through a business faster than anticipated, catching companies unawares.

Look at the banking industry, for example, which was the first major industry that began to adopt blockchain, Mr Richard said. As early as 2016, a study conducted for IBM, the world’s No. 1 enterprise blockchain solutions provider, found that 91% of surveyed banks were investing in blockchain solutions for deposit taking to protect against start-up non-banks. Further, a full 15% of banks surveyed that year expected to have commercial blockchain solutions in place by 2017. “The banking industry is typically not known to be the early adopters of technology,” Mr Richard said, “but when they saw that this technology could potentially disrupt themselves, it kind of forced their hand.”

Will the same happen in the drilling industry? Only time will tell. DC

Click here to watch a TED Talk on how blockchain is changing money and business.

Click here to watch a video explaining blockchain by the Institute for the Future.