Global deepwater exploration sustains strong rig activity

Emerging East African markets add to strength of Golden Triangle

By Jerry Greenberg, contributing editor

Two years have passed since the twin Montara and Macondo blowouts. While Macondo obviously disrupted US Gulf of Mexico drilling in all water depths, deepwater exploration and rig activity remained robust elsewhere. Today, Gulf of Mexico drilling is steadily improving, as operators, contractors and regulators come to grips with post-Macondo realities.

Elsewhere, driven by healthy commodity prices and by numerous deepwater and ultra-deepwater discoveries, including in new or relatively new areas such as East Africa and the Mediterranean, the global deepwater drilling scene is more than satisfying for operators, contractors. There also have been new discoveries near established areas, such as southern Angola. Petrobras, now the center of the universe for deepwater drilling, seemingly announces a new discovery weekly.

Gulf of Mexico Reanimation

One of the more established regions, the US Gulf of Mexico, is steadily returning to pre-Macondo levels of deepwater and ultra-deepwater drilling activity. Rig activity is anticipated to reach pre-Macondo levels by the end of this year and continue growing as more rigs are scheduled to arrive during 2013. Further, operators now have a better idea what the US Bureau of Safety and Environmental Enforcement (BSEE) and the Bureau of Ocean Energy Management (BOEM) require to approve plans for exploration and drilling permits.

Other events that could portend increased drilling activity are a recent successful Western Gulf OCS lease sale and a deepwater maritime boundary agreement with Mexico.

“By the end of this year, we expect activity in the deepwater (US Gulf) to be similar to the pre-Macondo level,” said Tom Kellock, senior manager, research, for IHS Petrodata. “We are looking at a net gain of about 12 rigs this year, and it’s possible there could be more next year.

“The increase is basically rebuilding what we had before (Macondo),” he continued. “We are not looking for a huge increase over the pre-Macondo level. This is not a sudden surge of new activity.”

“A few more (rigs) are scheduled for delivery in 2013 that already have drilling contracts to work in the Gulf,” said Cinnamon Odell, analyst, rigs, for IHS Petrodata. “There are more (deepwater rigs) that are scheduled to be delivered next year that do not yet have contracts that are potential candidates to work here.”

On the other hand, she noted, not every operator will have contracted a rig to work exclusively for them. “While there still is a lot of demand and still more room in the region for more floaters, some of the demand might be filled by subletting rigs already in the area,” Ms Odell said.

Virtually all deepwater activity ceased post-Macondo. However, sublet activity recently began increasing, especially for leases that are nearing their expiration, she added.

“Rig-sharing contracts, which have been more popular in other parts of the world, are definitely gaining popularity in the Gulf,” Ms Odell said. “Ensco signed a rig-sharing contract among three operators, Anadarko, Apache and Noble Energy, for its newbuild Ensco 8505 semisubmersible.”

Ensco also has rig-sharing contracts for its Ensco 8500 semisubmersible with Anadarko and Eni, and for the Ensco 8501 with Nexen and Noble Energy.

The US Gulf rig market has morphed into a shelf market and a deep- and ultra-deepwater market. The mid-water market, generally below 3,000 ft of water, is virtually non-existent. All three mid-water depth semisubmersibles remaining in the Gulf are cold-stacked. Mid-water semisubmersibles in the past have mobilized to other regions, including Europe, Australia, Southeast Asia and India, Ms Odell said.

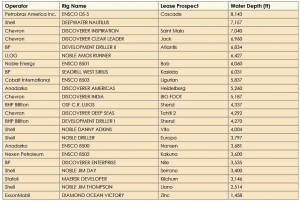

According to figures from BOEM, 23 drillships and semisubmersibles were drilling in the deepwater and ultra-deepwater Gulf in water depths up to about 8,100 ft. Table 1 illustrates deepwater drilling activity as of 26 March for water depths of 1,000 ft and greater.*

Drilling Permit Approval Times

According to BSEE, offshore permitting is nearly at pre-Macondo levels. The agency said 61 deepwater new well drilling permits were granted in the 12 months ending 27 February 2012, just six fewer than from February 2009 to February 2010 before the Macondo explosion.

This analysis, however, overlooks the fact that the approximately 18 months leading up to the disaster was a time of severe downturn for the industry because of the Great Recession. For example, the number of total well permits (shallow and deep) issued for the Gulf of Mexico during the sluggish 2009 was 294. For bustling 2007, the count was more than twice that – 618. During 2008, as the economy began staggering, 541 permits were approved.

These numbers obviously also encompass shallow-water drilling (see Editor’s Note for conflicting definitions). And for shallow water, rate of permit approval falters. BSEE’s website states that, as of 12 April, “122 shallow-water well permits have been issued since the implementation of new safety and environmental standards on June 8, 2010.” BSEE says six of those were pending, and eight had been returned to the operator for more information.

Granted, soft natural gas, the principal target in shallow water, may well have retarded permits in those water depths. Still, given current commodity prices and the strong offshore activity apparent elsewhere, comparing today’s permit level with the number issued during the depths of the greatest recession in two generations creates a poor analogy.

BSEE also says that it is reducing time for approvals and has cut average number of days to approve a new well drilling permit by about one-third. The result, however, remains well above than before Macondo. BSEE said that, in 2009, the Minerals Management Service averaged 46 days to approve a new well deepwater permit. From March 2011 to September 2011, those figures more than doubled, with BSEE averaging 97 days to approve a new well deepwater permit. However, BSEE said that, from September 2011 to mid-March 2012, approval times for new-well deepwater permits averaged 62 days.

BSEE director James Watson defended the agency’s performance in written testimony on 7 March before an Appropriations Committee Subcommittee. His testimony regarding the agency’s federal fiscal year 2013 budget request, said “the permitting environment is completely different” than before the Macondo blowout. “Comparing the pace of permitting pre- and post-Deepwater Horizon does not consider the current reality that applications must now meet a suite of new requirements that receive extremely close scrutiny by the bureau’s engineers.”

People who believe that the pace of permitting should automatically be the same as before the Deepwater Horizon accident “are ignoring the lessons of that disaster,” Mr Watson said.

Dayrates Up for Deepwater and Ultra-Deepwater Rigs

Dayrates for semisubmersibles and drillships in the Gulf generally range from the high $300,000s to the low- to mid-$500,000s, but there are indications that drilling contractors could see significantly increased dayrates when these contracts expire and new agreements are put into place.

An example of dayrates, according to contractor fleet status reports, is $530,000 for the Noble Jim Day semisubmersible,under contract to Shell from January 2013 through January 2016. The rig, which is rated to operate in up to 12,000 ft of water, will drill several wells at similar rates prior to returning to Shell.

Another Noble semisubmersible, the Noble Driller rated to drill in up to 5,000 ft of water, is contracted to Shell from late July 2011 through early June 2013 for $375,000/day while the 6,000-ft rated Noble Jim Thompson is contracted to Shell for $362,000 from April 2011 to early December 2014. And the Noble Globetrotter I, a newbuild deepwater drillship, is contracted to Shell for 10 years beginning from April 2012 to March 2022 at an initial rate of $422,000.

Ensco also has an active semisubmersible and drillship fleet in the Gulf, with dayrates ranging from the $290,000s to the mid-$500,000 range. Three of the company’s five semisubmersibles contracted to work in the Gulf are receiving above $400,000/day, including one unit being paid about $545,000/day. Its most recent delivery, ENSCO 8505, was contracted for about $474,000/day under a rig-sharing agreement.

Additionally, the ENSCO 8506, expected to be delivered this summer, will mobilize to the US Gulf for a contract with Anadarko at about $530,000/day. The contract expires in June 2015.

The company’s lone drillship in the region, the ENSCO DS-5, is contracted to Petrobras America at a rate of about $430,000/day through July 2016. The rig also is eligible for bonuses up to 17%.

Transocean has 10 drillships and four semisubmersibles in the Gulf, with most dayrates falling in the range noted earlier. However, the company has a few dayrates that significantly exceed that range. The Deepwater Champion, delivered last year, is contracted to ExxonMobil and recently drilled a discovery well in the Black Sea. Its dayrate was reported by Transocean as $690,000/day while operating in the Black Sea, although there were reports that the rate was about $703,000/day. The rig will mobilize to the Gulf this spring and command a dayrate of $640,000 until the end of its contract in September 2015.

Another Transocean drillship, Deepwater Expedition, was contracted to BHP Billiton and Petronas Carigali for work offshore Malaysia at a rate of $650,000/day. However, that contract was terminated, and the rig now is contracted to an undisclosed operator and location for $640,000/day from November 2012 for two years. The agreement also has three one-year extension options at $695,000/day. The Deepwater Expedition was built in 1999 and is rated for operations in up to 8,500 ft of water.

While there are only a handful of rigs being paid above $600,000 daily, examples of rigs contracting for dayrates approaching $700,000 could portend good news for drilling contractors as deepwater and ultra-deepwater rigs become scarcer, despite several deepwater drillships still under construction and available.

For example, Noble Drilling currently has three ultra-deepwater drillships for delivery in 2013 and 2014 that currently are available. Ensco also has one ultra-deepwater drillship set for delivery in the second half of 2013. And Rowan Companies, with it first three ultra-deepwater drillships under construction for delivery during 2014 and 2015, could be a recipient of increasing dayrates.

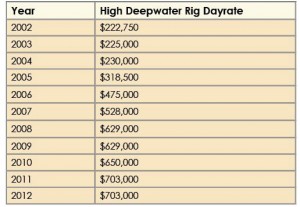

The above dayrates are not only good news for Gulf of Mexico drilling contractors but for rigs contractors operating in virtually every deepwater basin around the world. Table 2 illustrates the dayrate gains made globally during the past 10 years.

US, Mexico Maritime Boundary Agreement could Spur More Drilling

Last February, the US and Mexico signed an agreement on the exploration and development of oil and natural gas resources along the ultra-deepwater maritime boundary. The Transboundary Agreement removes uncertainties regarding development of about 1.5 million acres of the US OCS that is estimated to hold up to 172 million bbl of oil and 304 bcf of natural gas. It also opens up resources in the so-called Western Gap that were off-limits to both countries under a previous treaty that imposed a moratorium along the boundary through 2014.

The agreement establishes a framework for US operators and PEMEX to either jointly or individually develop the transboundary’s reservoirs on their respective side while protecting national interests and resources.

Deepwater Areas Around The World

While the US Gulf is an important deepwater region, it’s not the only. There are still the other two points in the Golden Triangle – Brazil and West Africa – as well as several emerging deepwater markets such as Tanzania and Mozambique in East Africa.

Brazil

It seems that Petrobras and other operators exploring deep waters offshore Brazil announce a new discovery every week. “Discoveries continue to be made, and appraisals turn out positive in most cases, so it’s still an exciting area in terms of ongoing and increasing activity,” Mr Kellock said.

Between 23 February and 20 March, Petrobras announced at least three new discoveries, in water depths of 7,050 ft, 9,148 ft and 6,650 ft. In anticipation of continued exploration successes, the company recently completed negotiations with Sete Brasil and Ocean Rig to contract as many as 28 new deepwater drillships and semisubmersibles to be built in Brazil, with a required local content ranging from 55% to 65%. Petrobras said the rigs would be used to meet the demands of its long-term drilling programs, primarily in pre-salt wells. It’s not yet clear who would manage and operate the rigs as Sete Brasil operates primarily as a financing entity for the rigs. The company was established in 2010 by Petrobras, seven Brazilian finance investors including banks, and the four largest Brazilian pension funds.

The ambitious construction schedule calls for rig deliveries within 48 to 90 months. The project also includes construction of new shipyards in Brazil, which is said to be the primary reason for building the rigs in Brazil. The initial announcement of the rig newbuilding program was made about two years ago; tenders were made, but Petrobras said the dayrates and costs were too high at the time.

The new rigs to be built under the latest program are in addition to the rigs that Petrobras has under contract now, plus several newbuilds that the operator is contracting. But it’s unlikely that the 28 rigs will satisfy Petrobras’ requirements. “It wouldn’t surprise me if Petrobras needed additional rigs” after the 28 newbuilds are delivered, and to fill the gap until these rigs are delivered, said Julian Gunther, senior specialist, rigs, for IHS Petrodata.

Just how busy Petrobras could be is illustrated in a recent contract for subsea trees from FMC Technologies. The initial call-off includes 78 trees and related equipment while the total scope of supply could include delivery of up to 130 trees. The equipment will be engineered and manufactured at FMC’s facilities in Rio de Janeiro, resulting in 70% local content. Deliveries are scheduled to commence in 2014.

West Africa

“There are two very exciting discoveries in the Kwanza Basin of Angola with two deepwater pre-salt discoveries where there has been virtually no deepwater drilling until very recently,” Mr Kellock said.

Lars Nydahl Jorgensen, head of exploration for Maersk Oil, said the Azul-1 well in Block 23 was the “first deepwater well targeting pre-salt reservoirs in the Kwanza Basin. Preliminary interpretation of a drill stem test indicated a potential flow capacity over 3,000 bbl/day of oil. Maersk plans additional evaluation of the find, including more exploration drilling.” The discovery well was drilled during summer 2011 with Diamond Offshore’s Ocean Valiant, which has moved to a HESS contract offshore Equatorial Guinea.

Cobalt International’s pre-salt discovery with the Cameia-1 well in 5,518 ft of water in Block 21 off Angola flowed 5,010 bbl of oil and 14.3 mcf/d of associated gas during a drill stem test. James Farnsworth, Cobalt’s chief exploration officer, said, “Based upon our analysis of the test data, if not limited by the test equipment on the rig, we believe the well would have the potential to produce in excess of 20,000 bbl of oil per day. In addition, we have yet to drill our deeper targets at Cameia, which, if successful, will provide additional upside potential.”

The operator planned to drill the Cameia-2 appraisal well with Diamond Offshore’s Ocean Confidence, which was expected to take 100 to 120 days, followed by an evaluation period.

East Africa

Mozambique and Tanzania have become very active following announcements of several large gas discoveries. Statoil announced that it and partner ExxonMobil had proven up to 5 Tcf of natural gas in its Zafarani well in Block 2 offshore Tanzania in about 8,470 ft of water with Ocean Rig Poseidon, which will move to a well on the Lavani prospect in the same block.

BG Group announced a fourth gas discovery from its Jodari-1 well in Block 1 off Tanzania, with gross recoverable reserves in the range of 2.5-4.4 tcf of gas. Mean total gross recoverable gas is estimated to approach about 7 tcf of gas. The well was drilled by the Deepsea Metro I, which will also drill the Mzia-1 well in Block 1.

Offshore Mozambique, Eni has a huge natural gas find with its Mamba prospect in Area 4, estimated to hold at least 40 Tcf of gas as a result of its recent Mamba North East 1 well in about 6,060 ft of water that increased the resource base by about 10 Tcf. The earlier Mamba North 1 well encountered a potential of 7.5 Tcf of gas. Eni plans to drill four more wells this year.

Anadarko also has had enormous success with its series of natural gas discoveries and appraisal wells offshore Mozambique and is planning an LNG facility to monetize the gas. The discovery wells and appraisals are being drilled by the Belford Dolphin drillship while Transocean’s Deepwater Millennium drillship is conducting drill stem and other tests. The wells so far have been drilled in water depths ranging from about 4,800 ft to 5,400 ft.

* Editor’s note: BSEE and BOEM, the agencies succeeding the Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE), which itself superseded the US Minerals Management Service, offer slightly different definitions for “deepwater.” Table 1 in this article, whose source is BOEM, cites 1,000 ft as the cut-off, the same criterion used by BSEE in its deepwater production summary by year. However, in BSEE’s GOM well permit web page, 500 ft is the limit. 500 ft was also the cut-off used by the Department of Interior when it issued its deepwater drilling moratorium in 2010. Ironically, following Macondo, IADC proposed 1,000 ft as the defining depth.