Pressures mount as industry goes deep into survival mode

Operators urged to look to collaboration, efficiency to reduce costs instead of squeezing service sector

By Alex Endress, Editorial Coordinator

The upstream oil and gas industry has gone into survival mode, and analysts appear to agree that things are going to get worse before they get better. With low and volatile oil prices leading to more and more postponed drilling projects and lower and lower rig counts, operators, drilling contractors and service companies alike are cutting costs wherever possible. However, it’s the drilling contractors and service companies that have bore the brunt of these reductions, and analysts are urging the industry to increase collaboration to reduce costs in a balanced manner.

“There are limits to how hard you can push these companies,” Wood Mackenzie Upstream Research Manager James Webb said. “We’ve already seen large job losses and rigs being decommissioned or taken out of the market, and eventually the service sector will contract.”

The service sector’s profit margins have been severely pressured thus far, but simply asking drilling contractors and service companies to cut prices will not achieve the level of cost reduction necessary to achieve a sustainable business structure. “It has to be a collaborative approach,” Mr Webb said.

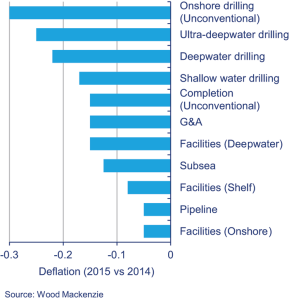

He points out that a contracted service sector would cause E&P companies to lose purchasing power and, in the end, would likely lead to just an average 10-15% reduction in costs from the supply chain, Wood Mackenzie estimates. But analyses show that the industry actually needs 20-30% in cost reductions to make the at-risk upstream projects economically viable again. “When companies have purchasing power, they have the ability to go out and drive a good price for the services they want,” Mr Webb said. “In the event of an oil price recovery, or uptick in activity, you could see a reversal of this deflation environment, where prices start to rise again just because the service sector has contracted so much.”

In the meantime, the industry must work to survive the current downturn. Since September 2014, the global offshore rig count has dropped by approximately 125 units, according to IHS. For the onshore side, US drilling contractors have been hit hardest, with more than 1,000 rigs idled between September 2014 and September 2015.

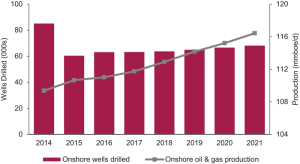

Douglas-Westwood is forecasting that, by the end of 2015, there will have been 200 fewer wells drilled offshore this year compared with 2014. For onshore, the forecast is down by nearly 25,000 wells. Further, the firm is projecting stagnant levels of activity into 2016 for both offshore and onshore, although the number of wells drilled may increase slightly in the latter part of 2016 as the gap between production and demand narrows.

Global production is forecast to remain on the rise, however. This year’s production is expected to average 157 million BOED, up from last year’s 153.8 million BOED.

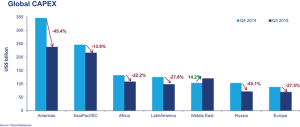

Reducing costs collaboratively

In response to dramatically lower oil prices this year, upstream capital investment is now expected to decline by a total of $220 billion over 2015 and 2016 compared with pre-downturn projections, Mr Webb said. Already, a total of 46 conventional projects have been deferred since 2014. Many of these were “projects that didn’t work or struggled to work out at $100 per barrel, like the Canadian oil sands,” he explained.

Deepwater projects, however, made up the biggest proportion of these deferred projects. “When we see such a large collapse (in the oil price), the industry goes into survival mode. Companies look to cut costs where they can, and one of the easiest costs to remove is uncommitted capital relating to big projects such as deepwater,” Mr Webb said. However, analyses show that, while most deepwater projects are uneconomic at $50 oil in the current cost structure, they can become viable again if E&P’s are able to cut costs by the 20-30% mentioned earlier.

In fact, Mr Webb said he believes deepwater projects are the ones that companies should be taking advantage of during the downturn. Because there is an extended lag time between drilling and recovery in deepwater wells, companies should capitalize on the low-priced environment by investing in deepwater now, he advocated. “You do have to be a little brave and invest in a down cycle when you know your revenues are being damaged by this low oil price. If you can invest countercyclically, then you are in this sweet spot to take advantage of cost reduction.”

The 20-30% cost reductions can be achieved, he believes, if operators work with drilling contractors and service companies to improve the efficiency of the overall operation. “When you design a project or development for an oilfield at $100 per barrel, that is not going to be the same fit-for-purpose design as it is at $50 per barrel. It’s a change in mentality,” Mr Webb said. In particular, he suggested collaboration between operators and service companies for more streamlined subsea kits, with infrastructure that would allow operators to pursue harder-to-reach reserves when the price of oil recovers.

One example of collaboration this year has been Shell’s Appomattox project in the US Gulf of Mexico deepwater. “Shell sanctioned the Appomattox project with a 20% cost reduction. They achieved that partially through making supply chain savings – squeezing the service sector a little bit – but they also made a lot of their cost savings by redesigning the projects, drilling fewer wells and having less subsea infrastructure. It is achievable… Operators can work toward these numbers to make these projects more economical and get them over the threshold of investment.”

However, making these reductions last will happen only with a sustained low oil price, and with Wood Mackenzie predicting that oil prices will begin to recover in 2017, time is tight to get more collaborative projects off the ground. “Things like standardization of subsea kits or industrywide standards for certain services, that will only be brought on by real pressure in the E&P business and the service sector.”

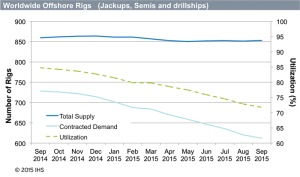

Depressed rig count continues into 2016

Despite the offshore rig market already being oversupplied, more than 200 additional newbuilds are still in the pipeline. “We’ve got a continuing problem here with decreasing demand, increasing supply and very limited attrition, so things are definitely going to get worse before they get much better,” IHS Energy Offshore Rig Consultant Tom Kellock said in a presentation at the 2015 IADC Asset Integrity and Reliability Conference on 17 September in Houston.

Particularly onshore, contractors in the US lower 48 face an almost dire oversupply of rigs. “There are so many rigs available and so many companies offering rigs in the US that you can pretty much get what you want when you want it. Overseas, competition tends to be more limited, and the contractors have a little more bargaining power.” The good news is, Mr Kellock said, that the US land rig count may have already bottomed out, with around 800 rigs in use. The bad news is, IHS also does not expect any upticks any time soon. “There is no reason why we should see a sudden return to higher levels of drilling activity,” he said.

Offshore, the overall supply of rigs has remained fairly steady for the past year at around 850. Total rig utilization, however, has tumbled from 85% in September 2014 to 71% in September 2015, according to IHS, with the number of contracted rigs falling to approximately 600. That’s compared with 725 contracted floaters and jackups in fall 2014.

Looking at jackups specifically, the worldwide utilization rate has also decreased from 85% to 71% since September last year, Mr Kellock said, with the number of contracted units shrinking from 450 to 390. For floaters, utilization declined from 85% to 72% during the same time period, representing a fall from 280 contracted units in September 2014 to 225 this year.

To rebalance this lopsided market, Mr Kellock is urging contractors to consider scrapping more rigs. He points to the fact that there were already 275 rigs stacked as of September 2015, up from 150 a year ago. And don’t forget the more than 200 new offshore rigs still under construction – 48 drillships, 22 semisubmersibles, nine tender-assists and 127 jackups. Cancellations of these construction contracts are not expected in any significant numbers, he commented, and even if one is canceled, that doesn’t mean the rig won’t get built anyway. “Examples of this are the Cobalt Explorer drillship and West Mira semisubmersible. Both construction contracts were canceled by the companies ordering the rigs, but both rigs are effectively complete,” he noted.

To rebalance this lopsided market, Mr Kellock is urging contractors to consider scrapping more rigs. He points to the fact that there were already 275 rigs stacked as of September 2015, up from 150 a year ago. And don’t forget the more than 200 new offshore rigs still under construction – 48 drillships, 22 semisubmersibles, nine tender-assists and 127 jackups. Cancellations of these construction contracts are not expected in any significant numbers, he commented, and even if one is canceled, that doesn’t mean the rig won’t get built anyway. “Examples of this are the Cobalt Explorer drillship and West Mira semisubmersible. Both construction contracts were canceled by the companies ordering the rigs, but both rigs are effectively complete,” he noted.

Mr Kellock also referenced what he sees as a false sentiment among some sectors of the industry that many of the 70 or so jackups under construction in China won’t enter the global fleet, due to perceived quality problems. On the contrary, “the majority of these are rigs are being built to well-known designs and accepted traditional standards. You can’t just discard them simply because they are being built in China,” he added. An IHS survey of 46 jackups that were built in China over the past 10 years concluded that all but four were either working or had a contract on hand.

Only 52 offshore rigs have been decommissioned in the past two years, which Mr Kellock said is not nearly enough to rebalance the market. “Things are not just going to get better on their own,” he said. “What we need to have from the drilling contractors is a concerted effort to scrap. Without that, this downturn is going to continue longer than it would otherwise.”

Slight gains in wells drilled, production

Data from Douglas-Westwood shows that the number of onshore wells drilled globally will shrink from 85,006 in 2014 to 60,342 in 2015, driven primarily by reductions in the US. “Many companies have significantly slashed their budgets – released a lot of their rig fleets trying to steady the ship, and we’ve seen a more consolidated focus on the highest-quality acreage in the US shale plays, as these are the areas that are cheapest to drill,” Douglas-Westwood Analyst Matt Cook said. The firm is slightly more positive about 2016, based on the EIA’s forecast of a possible leveling off of oil prices between $55-60 by mid-year. This could push onshore drilling up by approximately 5%, he projected.

Similar to onshore, the number of offshore wells drilled is expected to be lower this year compared with 2014, and the biggest driver here is a drop-off in shallow-water development drilling offshore Thailand. “Last year, Chevron drilled 585 wells in the Gulf of Thailand,” Mr Cook explained. With a lower operating budget this year amid low prices, that number is certain to decline.

In 2016, Douglas-Westwood expects the number of offshore wells drilled will increase slightly, from 2,312 to 2,402. “Our numbers will increase steadily through the (five-year) forecast, but they’re not going to reach anywhere near 2014 levels in our forecast period, so I don’t know if you can call it recovery,” he commented.

Looking at the market in terms of production, Douglas-Westwood expects global production to increase from last year’s 153.8 million BOED to 157 million this year, despite fewer wells being drilled. The biggest driver, not surprisingly, is US shales. “You had record drilling onshore in the US last year,” Mr Cook said. By 2016, however, US onshore production could start to decline. His firm is projecting 14.5 million BOED from US onshore in 2016, down from 15.2 million BOED in 2015. “The reason that production kept going up even though prices are going down is that a lot of these onshore US producers had hedged their production, and now a lot of those hedging contracts have expired.”

By 2021, global production is forecast to reach 172.8 million BOED. Offshore production gains, especially from deepwater, will play a part because so much more recovery is possible on a per-well basis. “You could drill a small fraction of the (shale) wells in deepwater plays and get hundreds of times more oil out of them,” he said.

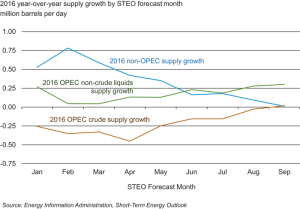

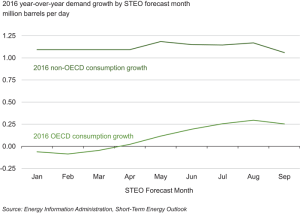

Possible oil price increase in 2016

The US Energy Information Administration (EIA) predicts world oil prices may increase from $45-$50 in Q4 2015 to $55-$60 by mid-2016. That price range should be able to bring US shale plays back into an investment “sweet spot” by Q3 of next year, according to EIA Oil and Gas Economist Grant Nülle. “When there is a change in oil prices, it takes about two to four months for rig counts to respond,” he said. “We’ve seen rig counts rise in July and August of this year, and that was largely in response to oil prices being in the $55 or $60 range in March and April, but now that we’ve seen oil prices fall down to the $40-$50 per barrel range for a couple months, we’re starting to see the rig counts fall again.”

He noted that crude production from the US onshore has been falling since April, and overall US production began declining in May. The agency is projecting an average 9.2 million BPD for US crude in 2015 and a lower 8.8 million BPD in 2016.

“As rigs are laid down, there are fewer wells being drilled and completed, and we’re now just starting to see the consequence of that,” Mr Nülle commented. The decline in US crude production is expected to continue until Q3 2016, and that’s only if oil prices climb back to $55-$60. “If oil prices stay in the $40-$45 range for the next six to nine months, we may see US production continuing to fall throughout.” Mr Nülle said it is possible US onshore production could decrease by 30,000 BPD each month relative to the current forecast throughout 2016 if prices stay in the $40-45 range.

The silver lining to these difficult market conditions is that the downturn will likely trigger additional technological innovations, Mr Nülle said. “What’s remarkable with shale is how quickly they’re cutting down the cost curve,” he said. “It was brought about during a period of low prices, and now this new period of low prices is just causing more innovation to be done more quickly because there’s a true necessity to get the cost curve down.” DC