Permian still dominates as onshore market tightens, rig rates rise

Higher dayrates, activities allowing contractors to invest in rig upgrades, re-hire employees; however, production growth may lead to oversupply and weaker oil prices later in 2018, hindering recovery

By Kelli Ainsworth Robinson, Associate Editor

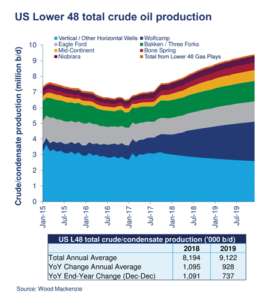

- Continued robust production growth is expected from the US Lower 48 in 2018 and 2019. The Permian will be the major driver of this growth for the next several years.

- A 10-15% cost inflation is expected to occur in the US Lower 48 as rates rise for rigs, pressure-pumping equipment, proppants.

- Dayrates have climbed 20-30% for some top-tier rigs, allowing drilling contractors to justify investments in rig upgrades.

The rig count, which stood at 665 during the first week of 2017, had risen to 1,140 by late March this year, according to numbers compiled by Baker Hughes. The number of wells drilled also shot up. Data from Wood Mackenzie shows that while only 11,400 horizontal wells were drilled in the US in 2015 and 6,900 in 2016, the well count rose to 17,500 in 2017.

“In terms of new wells being drilled and completed, last year was a big step-change from 2016, particularly in the second half of 2017,” Daniel Romero, Senior Analyst, US Upstream, for Wood Mackenzie, said. The trend is expected to continue, with 19,500 horizontal wells forecasted in the US in 2018 and 22,500 expected in 2019.

While an improvement in oil prices from a low of $27 WTI in early 2016 to $64 as of early April has certainly contributed to increased activity, efforts by the industry to reduce costs and improve returns have also been a major factor. For example, operators have been pursuing longer laterals, sometimes reaching up to 15,000 ft. A handful of wells have even been drilled with 17,000- or 18,000-ft laterals, although those are outliers from today’s average, Mr Romero noted. Advances in drilling fluid and proppant designs are allowing proppants to be pumped further into fractures in these extended wellbores. This reduces sand flowback and improves the flow of hydrocarbons from the formation. Contractors also continue to reduce flat times and, thus, drilling days by optimizing rig moves and equipment.

All of these efforts, Mr Romero said, have helped make onshore drilling in the US more economic. However, as activity has started to pick up, operators have less time to focus on costs, particularly as they’re eager to take advantage of higher oil prices. “We expect that much of what the industry has learned will be sticky in terms of better designs, but the scope for continued improvements likely has a near-term ceiling,” Mr Romero said. “All operators have voiced their best intentions to keep a laser eye on costs, but those productivity and drilling efficiency gains made in the downturn will be difficult to replicate as operators pivot to more aggressive development mode.”

The increase in activity has also tightened the market for rigs and equipment. This includes not only high-spec rigs – 1,500-hp AC rigs with walking systems and high-pressure pumps are still in high demand – but also pressure-pumping equipment, proppant and trucking. “We think the days of rock-bottom breakeven prices are a thing of the past when we think longer term,” Mr Romero said.

Overall, Wood Mackenzie expects to see 10-15% cost inflation for equipment and services over the course of 2018, with the Permian seeing the highest increases. However, “that doesn’t mean breakevens will increase by 10-15%, because we’re still finding new efficiencies and ways to produce,” he said, adding that breakevens are not likely to increase by more than $5/bbl in the near term.

In terms of production, Wood Mackenzie expects the US Lower 48 to produce 8.2 million BPD of oil in 2018 and 9.1 million BPD in 2019, compared with the 2017 production of 7.2 million BPD and 2016 production of 6.8 million BPD. Operators also began to draw down their inventory of drilled-but-uncompleted wells (DUCs) in late 2017 to take advantage of higher oil prices, which is further adding to production increases. This is expected to continue in 2018, with Wood Mackenzie forecasting that a total of 1,600 DUCs, as Wood Mackenzie defines them, will be completed in 2018 and 1,800 in 2019. There could be roughly 1,800 to 2,000 DUCs remaining at the end of 2019, although Mr Romero warned that number fluctuates and will most likely be higher at the end of 2019.

Altogether, the increased production could cause a small oversupply and a bit of price weakness toward the end of 2018, Mr Romero noted. Oil prices are expected to remain in the $60 range for the majority of 2018. However, prices in the $50s are expected in late 2018 and into 2019.

Continued Permian dominance

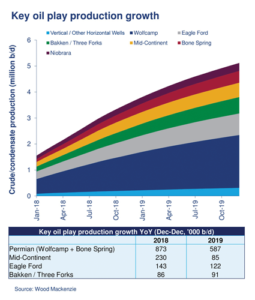

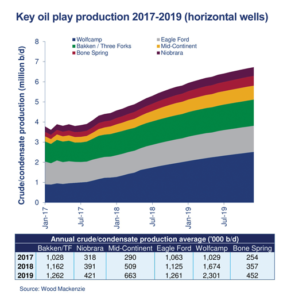

The bulk of US production growth that has occurred in the past two to three years has been driven by the Permian, specifically the Bone Spring and Wolfcamp plays, Mr Romero said. In January 2016, these two areas were producing 900,000 BPD from horizontal wells. By January of this year, production had increased to 1.6 million BPD and is expected to nearly double to 3 million BPD by the end of 2019.

Further, operators have not come anywhere near exhausting the Permian’s sweet spots and are not expected to until the early 2020s, Mr Romero said. Even when the industry gets to the point where the best Permian acreage has been drilled, the remaining acreage in the area will be comparable to that in the other major US oil plays from a production and price standpoint. “We’re really going to see the Permian drive the global oil supply in the near term and definitely the Lower 48 for the foreseeable future,” he added.

Beyond the Permian, operators have been paying attention to the SCOOP and STACK plays in the Mid-Continent region. These are among the newest tight oil plays in the US, and “operators are very much working on understanding the play’s potential, optimal drilling and completions strategies and how to best develop their assets,” Mr Romero said. While these plays show promise, Wood Mackenzie is not expecting production there to surpass 1 million BPD in the near term. Oil production from horizontal wells in the Mid-Continent region as of January 2018 was only about 100,000-130,000 BPD above January 2016 production levels. By the end of 2019, the region’s production is expected to increase to 700,000 BPD.

Further, because the SCOOP and STACK are fairly young plays, they may be hit harder by the price weakness forecasted for late 2018, while more established plays like the Permian, Eagle Ford and Bakken will have more resilience. “The overall story for the SCOOP/STACK has been bullish for a while, but when you see price weakness, it hurts the momentum to a greater degree than it might hurt the momentum elsewhere.”

Other strong basins in the US onshore are the Eagle Ford and Bakken, although operators are still favoring the Permian in the general over these regions, Mr Romero said. The Bakken’s production is expected to grow from 1.2 million BPD in December 2017 to only 1.3 million BPD by the end of 2019. Similarly, production in the Eagle Ford is only expected to rise from 1.1 million BPD in December 2017 to 1.4 million BPD by the end of 2019. “The heydays of both of those plays could be behind us,” he commented.

In the Eagle Ford, this is because most of the best wells have already been drilled, so operators are increasingly being forced to drill outside core acreage. “Your most productive areas – Karnes County, for instance – have been very densely drilled, so you don’t have a ton of running room left in the long term,” he said. In the Bakken, there’s more running room, but labor shortage is a concern due to the remoteness of the region and lack of a nearby labor pool. It may be more difficult and costly to bring in new talent if activity were to pick up, thus limiting activity increases.

Dayrates up for top-tier rigs

Contractors are following operators’ leads and focusing their efforts on the Permian. Sidewinder Drilling has consolidated its footprint and is now running rigs only in the Permian, Haynesville and Marcellus. Prior to the consolidation, the company also had rigs in the Bakken, Eagle Ford and Utica plays. “We felt like the Permian and the Haynesville would be the two strongest markets over 2017 and 2018, and that’s certainly been proven to be the case,” Anthony Gallegos, President and CEO of Sidewinder, said.

The Haynesville produced 4.6 million cu ft/day of natural gas last year from 384 wells and is expected to produce 6.7 million cu ft/day this year from 407 wells. Next year’s production is expected to reach 7.3 million cu ft/day from 324 wells, according to Wood Mackenzie.

Out of Sidewinder’s 16 rigs that are working – the majority of which are AC-powered – 10 are in the Permian, five are in the Haynesville and one is in the Marcellus. Not surprisingly, the majority of the rigs getting work today are pad-capable AC rigs. In fact, the utilization rate for rigs with these specs is nearing 100%, Mr Gallegos noted, and that has led to a 20-30% increase in dayrates over the course of 2017. Earlier in the downturn, rig demand was so depressed that operators could often get a new, high-spec rig for the nearly same price as an older SCR rig. “If you walk up to a car dealership and the fully loaded car is the same price as the standard model, then it’s obvious which one you choose,” Mr Gallegos said.

That’s not the case anymore, as most of the highly equipped AC rigs have been snatched up. Higher demand also means that there’s now more an incentive for contractors to upgrade their rigs. Sidewinder, for example, converted two of its 1,500-hp SCR rigs to AC rigs in early 2017; their mud systems have also been upgraded from 5,000 psi to 7,500 psi. The company was able to secure a higher dayrate for the rigs, allowing for the upgrades.

These upgrades add to the seven other 1,500-hp AC rigs in the company’s fleet that were built specifically for pad drilling in unconventional plays. These rigs all feature walking systems, high-torque top drives and 7,500-psi mud pumps. The remainder of the company’s 35-rig fleet are SCR and mechanical rigs that have come from acquisitions made since the company’s founding in 2011. “We were willing to make upgrades, but we had to be able to justify the investment through some sort of return,” Mr Gallegos said. “We’re now able to secure a dayrate that justifies that investment.”

Investments in rig technology have been major enablers of the efficiency gains that have been made in recent years, he added. “I would argue that a lot of the improvement we’ve seen has come from investments that the service industry has made, in particular by drilling contractors with high-spec rigs that have high-torque top drives, high-pressure mud pups and walking systems.”

In addition to technology, careful planning by contractors has also helped reduce cycle times and incidents. Sidewinder uses a planning approach called STRIKE, which requires personnel to break down the steps to complete a task, consider the tools required for the task, reveal and inspect for hazards, follow key control measures and ensure agreement. A high-risk task will involve a more detailed discussion and paperwork, but employees are also encouraged to perform mental STRIKEs before low-risk tasks.

Following this protocol has helped the contractor achieve a total recordable incident rate (TRIR) of just 0.6, compared with a US onshore average of 1.2, according to the most recent IADC Incident Statistics Program report. Sidewinder was also able to sustain this rate even while it tripled its rig count and doubled its headcount over the past 18 months, Mr Gallegos said. The company believes its safety record and culture will continue to help it address challenges resulting from deep personnel cuts made during to the downturn, as well as attrition from the great crew change, he added.

Beginning with new-hire orientation, the contractor’s crews are regularly trained to identify and mitigate risks and follow the STRIKE protocol. New-hires are also assigned an experienced mentor to work with during their first six months on the job. Each rig and crew is audited annually to assess crew competency and compliance with safety procedures and protocol. Through these safety measures, the company aims to create a culture where workers feel safe and valued, increasing retention. “We want employees focused on safety – not only their safety but also the safety of everyone around them,” Mr Gallegos said. “We’ve worked hard to create a culture that people will be drawn to.”

Integration and automation

Contractors are putting rigs back to work at a fast pace, and they’re starting to hire and train personnel in large numbers. Precision Drilling processed 38,0000 applications and onboarded 2,000 new employees in 2017, Fawzi Irani, Vice President of Sales and Marketing-North America, said.

While it’s a been a significant task to onboard and train these employees – half of the 2,000 hired last year were new-to-industry – Precision believes that the process has been successful as a result of its business process of retaining employees in key leadership positions, like office managers, field superintendents, rig managers and drillers, during the downturn. “It helps to retain a lot of strength and talent that is required to lead the crews on location,” Mr Irani said. “When we hire, we hire for lower or entry-level positions and put them through our robust training program.”

Classroom training is held in Houston or in Nisku, Alberta, which focuses on safety, tools and equipment, as well as teambuilding. Each facility also has a fully functional high-spec AC rig for hands-on training. Depending on the specific background and experience of the individual, he or she may be assigned initially to work at one of the two facilities or may receive extended on-the-job training.

The busiest market for Precision is currently the Permian, where it’s running 36 rigs. That number is up significantly from a year ago, when the company had 27 rigs in the Permian. Precision is also running 21 rigs in the Montney and Duvernay in Canada.

Overall, out of a fleet of 256 rigs –103 of which target the US, 136 that target Canada and 17 that are being marketed for work outside of North America – the contractor has 70 rigs working in the US, 37 rigs working in Canada and eight rigs drilling in other markets, mostly in the Middle East.

Precision offers its Super Series rigs in the Super Single, Super Triple 1200 and Super Triple 1500 designs. The Super Triple 1500 – a 1,500-hp AC rig with a walking system and 7,500-psi fluid system – is seeing the most demand, as it’s equipped to drill in some of North America’s busiest areas. “They’re more aligned with the deeper projects, for example, the Permian and most US shale plays, as well as the Duvernay in Canada,” Mr Irani said. “The industry is going toward extended-reach horizontal wells and multiwell pads, and the Super Triple 1500 and the Super Triple 1200 are suitable for those applications across North America.”

The Super Single rigs, on the other hand, are designed for vertical, slant and horizontal drilling in shallower plays, like the Viking, Cardium and heavy oil plays in Canada. In the US, these rigs are also well-suited for shallower and batch-drilling surface-hole applications. The Super Triple 1200 is capable of drilling applications in the Permian, the eastern Oklahoma Woodford, Niobrara-DJ, Marcellus and the Canadian Montney.

Throughout 2017, Precision also saw growing demand for its rigs equipped with the Directional Guidance System (DGS). This system uses the abbl directional advisor supplied by Schlumberger through Pason’s digital infrastructure. First tested with Precision Drilling in 2016, the system uses intelligent algorithms to provide steering instructions based on real-time downhole measurements. The steering instructions are validated or may be overridden by the directional driller, who doesn’t have to be located on the rig. While Precision initially ran the system with the directional driller on the rig in order to help the crew and operators gain confidence, the directional driller has been moved off site. A single directional driller is now monitoring an average of five rigs from one of the contractor’s remote monitoring centers, located in Houston and Nisku, Alberta.

The system has taken some time to gain traction, Mr Irani acknowledged. “It was a new approach, and a lot of operators weren’t eager to be first movers, especially in a downturn environment,” he added. However, as the system has established a proven track record and as oil prices have picked up, demand for the system has steadily increased. In 2017, Precision used this service to drill 70 wells across the US and Canada. Already in Q1 2018, the contractor is on track to surpass that number, Mr Irani added. In total, the company has drilled close to 2 million ft using the DGS.

The contractor has also been rolling out a Process Automation Control (PAC) system built on the National Oilwell Varco (NOV) NOVOS system on its Super Triple 1500 and the Super Triple 1200 fleet over the past 14 months. Through this process, Precision is focused on automating a number of drilling functions, including 14 steps that the driller must take – including opening slips, starting the mud pumps and top drive, lowering the bit to bottom and hoisting off bottom – into a single instruction. The company began the deployment of this technology with a pilot project in the Permian in Q4 2016, the results of which were presented at the 2017 IADC Drilling Onshore Conference.

In the pilot, Precision found that process automation improved connection times by 30% compared with a driller executing the process manually. “We see excellent value in automation providing consistent predictable, repeatable results, and we believe that we can replicate the best drillers with the system, eliminate the human variance and remove the risk of human error,” Mr Irani said. Additionally, he said, the system frees the driller up to focus on higher-level tasks. “They can further focus on the crew’s safe execution of drilling the well versus toggling between buttons and screens.”

In late 2017, the system completed a 14-month field-hardening process. It is now moving into full commercialization and has been installed on 21 of the company’s Super Triple 1500 and Super Triple 1200 rigs, which have drilled in the Permian, STACK, SCOOP, Marcellus and Utica in the US and the Montney and Duvernay in Canada. “We wanted to get exposure to most of the basins to validate the benefits we believe this system can deliver,” he said. Precision plans to install the PAC system on 106 Super Triple AC rigs equipped with the NOV AMPHION control system over the next two to three years. DC