Trend toward multistage open-hole completions, plug-and-perf advances help boost recovery, economics

By Katie Mazerov, contributing editor

A decade ago, the oil and gas industry married horizontal drilling and hydraulic fracturing to create the shale boom that has revolutionized the hydrocarbon landscape in North America and beyond. Since that step-change, operators and service companies have learned important lessons about unconventional production, specifically new ways of optimizing horizontal completions to boost recovery. These include the now-common practice of multistage fracturing, improvements in plug-and-perforation methods, a growing trend toward multistage open-hole completions, development of more conductive proppants, advances in materials science, and new ways of better understanding complex unconventional reservoirs to place fracture stages more strategically.

Operators also have learned that methodologies that work in one unconventional reservoir or wellbore may not work in another. Further, while a host of new technologies have descended onto the marketplace, success in achieving the optimum completion is not simply a matter of deploying the latest and greatest tool.

“The only constant in unconventional reservoirs is that they are not constant,” said Isaac Aviles, global portfolio manager, multistage stimulation, for Schlumberger. “These plays vary a lot, and the economics are very tight. Customers need production that comes from well-engineered tools run in sync with what a particular reservoir’s needs.”

The evolution of horizontal completion technology has helped drive activity in the North American land market, Mr Aviles continued. “Fifteen years ago, horizontal wells were a niche market. Today, the number of fracturing stages in horizontal wells drilled in North America land far exceeds the number of stages in vertical wells. Of these horizontal wells in unconventional shale plays, nearly 100% involve multistage stimulation. In 2000, multistage meant a few stages per well, which took a week to accomplish. Now, we commonly perform 30 stages per well in a continuous 24-hr operation in two to three days, with the ability to accurately target specific zones with high reservoir and completion quality characteristics.”

Although the number of stimulation stages has been on the rise for several years, that approach is not necessarily successful for every well,. Mr Aviles cited a study in the Bakken comparing the number of fracture stages to production. “In some places, customers were increasing the number of stages without seeing increased returns. It’s the combination of innovative technology, knowing where to initiate the fractures and stimulate the reservoir, and flawless execution that generate ultimate value for customers.”

To achieve this, Schlumberger focuses on two major themes for the unconventional market: producing more with less resources and creating value through decision-making. “In the conventional and offshore markets, it is generally accepted that decisions create value,” said Jeff Meisenhelder, vice president, unconventional resources for Schlumberger. “In the unconventional world, early breakthroughs with unexplained results drove the industry to walk away from decision-making and instead rely on efficient execution to create value for development. We’ve since caught up in our understanding of shales, and with sufficient data, we can now make informed decisions.”

Another important evolution has been integration, in terms of both technology and discipline. “Given that shales are very heterogeneous, they require significantly more cross-disciplinary collaboration – production and reservoir engineering, geology, petrophysics and geophysics – to be successful,” Mr Meisenhelder said. “Taking a single measurement, such as a core, and converting that into a decision on where to drill a well is impossible. We need to integrate that core data with logging and seismic data in these expansive shale plays that cover thousands of square kilometers.”

Open-hole trend

Among the trends that have evolved from empirical data over the years is the multistage, open-hole sliding sleeve completion, where the wellbore is not cemented. Advantages include good access to the reservoir and the ability to continuously drop balls to open sliding sleeves. The “plug-and-perf” method involves fracture-stimulating each stage, shutting down the fracturing operation, running a bridge plug to isolate the interval, perforating the next stage, exiting the hole and starting the pumping equipment to fracture-stimulate the next stage. Open hole also eliminates the need for overflushing, a technique used in plug-and-perf operations to convey wireline tools into the horizontal section of the wellbore.

Canadian operator Trilogy Energy has been using multistage open-hole completions since 2008 in the Kaybob area of Alberta. Most of the company’s activities have focused on the Montney formation, which is characterized by tight oil and gas sand reservoirs. Production from the Montney formation varies geographically. North of the town of Fox Creek, the Montney primarily produces light crude oil with associated solution gas; south of Fox Creek, the formation generally produces liquids-rich natural gas.

“For us, the biggest advantage of the multistage open-hole approach is the ability to stimulate long horizontals in a more efficient and cost-effective manner,” said Tim Wood, drilling and completion manager for Trilogy Energy. “The typical horizontal wellbore is approximately 1,600 meters (5,250 ft) in length, and now we are able to fracture the horizontal well every 75 to 100 meters (246 to 328 ft) along its length in just one day. We also have used the ball-drop technology on extended-reach horizontal wellbores that have been drilled to almost two miles in length. Typically we also are able to fracture-stimulate these longer wells in one day,” he noted.

One key to the successful application of this completion technique is the relatively consistent geology in the Montney formation, which has been explored and developed conventionally since 1962. “We’re actually applying open-hole completion technology to the tighter areas of traditional reservoirs,” Mr Wood explained. “We have a wealth of vertical completion information available to us, so we have a lot of knowledge about the reservoir’s permeability, porosity and which stimulation strategies will work best.”

Trilogy also has opportunities in the emerging Duvernay shale, which has the potential to produce dry gas, liquids-rich hydrocarbons and oil depending on location within the basin. A back-to-the-drawing-board approach will determine the best completion practices to recover the resource from this play. “The Duvernay is in an early stage of development, and we still don’t know how to effectively fracture-stimulate the reservoir,” Mr Wood said–.

“Companies in the US are shifting from the cased-hole ‘plug and perf’ completion technique to open-hole completion methods while we have moved from open-hole to plug-and-perf operations as we progress the Duvernay shale play. The plug-and-perf method offers more control with fewer variables, but it comes with additional costs.”

Trilogy is also running smaller operations in other plays, including the Gething and Dunvegan formations in the Kaybob area and the Nikanassin formation in the Grande Prairie region. “We try a few wells each year in these formations to gauge how production is going to be,” Mr Wood said.

Alongside open-hole multistage completion is a blending of technologies to optimize production, said Dan Themig, CEO and president of Packers Plus, a provider of open-hole multi-stage fracture-stimulation systems. “By using open-hole systems with solid element packers, we can access the reservoir more effectively and create better complexity in the fracture by targeting better rock. In most reservoirs, we’re seeing that by just eliminating cement, we can increase ultimate recovery by 30% to 50%.” In the Eagle Ford from April 2012, a region where cementing remains common, production rates over a six-month period were 35% higher in an open-hole well that was directly offset to a well that had been completed using a cemented liner plug-and-perf method by the same operator. The improved production rates added $2.6 million in revenue for the operator, Mr Themig noted.

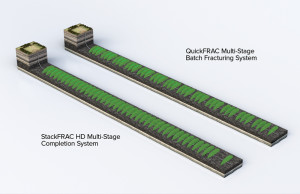

Packers Plus used its StackFRAC HD multistage fracturing system, an open-hole system that uses mechanical packers, to complete the 26-stage Eagle Ford well with a vertical depth of 8,516 ft (2,596 meters), a measured depth of 14,460 ft (4,407 meters) and average stage spacing along the 5,525-ft (1,684-meter) lateral of 206 ft (63 meters).

The SF Cementor, a hydraulically activated stage collar, was used to cement the system through the build and vertical sections up to surface. The tool allows operators to complete the well using a single string of casing from surface to total depth, Mr Themig said. Applications include vertical and horizontal open-hole wells, monobore well design and cementing-back of the vertical and build sections. The system can help to minimize well construction costs and reduces debris and the need for post-cement clean-out operations.

Higher stage counts are increasingly required in plays such as the Bakken, which is characterized by laterals that are reaching 15,000 ft, and other challenging regions, such as the Duvernay in Alberta, Canada, a deep, high-pressure, high-temperature (HPHT), high-liquids play with high fracturing pressures that requires multiple stages.

In the Bakken, multistage fracturing has “gone from a dream to standard operating procedure,” Mr Themig said. “Drilling these longer laterals simply requires more fracture stages. We have used various techniques to install systems that have more than 60 fracture stages.” For operators looking to extend lateral reach in the Bakken, Packers Plus deployed the StackFRAC HD system in conjunction with high-strength balls and FracPORT sleeves with 1/16-in. ball seat increments to fracture a 34-stage well with a lateral length of approximately 8,960 ft (2,731 meters) and measured depth of 21,800 ft (6,645 meters). All 34 stages were completed in 2 ½ days.

Open-hole multistage fracturing systems also save water use by reducing the flush volumes required for each stage. “In some cases, we’ve seen water usage reduced by more than 10,000 bbl/well,” he said. The StackFRAC system also facilitates water shutoff after the initial completion.

QuickFRAC, a multiport system that opens multiple pre-sized ports while fracturing and allows for simultaneous fracture stimulation of three or four intervals, is also used for multistage fracturing. Part of the system, the QuickPORT V sleeve, is undergoing enhancements to enable tighter control when the ports open, reduce the drill-out requirements and increase total stage count.

Production enhancement cycle

CARBO Ceramics, a provider of proppants and hydraulic fracturing design services, has adopted a production enhancement cycle to determine the optimum completion strategy: design the completion and fracture treatment, deploy the correct proppant and then analyze the completion. “Historically, unconventional reservoirs have been developed with the drill bit — by drilling a horizontal well, spacing out the fracture stages a set number of feet and employing the same fracture treatment in each stage, with very little regard to the reservoir or geology,” said Terry Palisch, CARBO’s director of petroleum engineering.

“We are now beginning to incorporate reservoir understanding into completion design,” he continued. “This reservoir knowledge allows us to choose the appropriate completion technology, thereby improving the long-term productivity and viability of the well. It is imperative to understand the impact of both the reservoir and the completion on a given well’s performance.”

With the production enhancement cycle, the company’s StrataGen consulting and engineering division uses well data and neural network analysis (DANA) to combine input from the reservoir and the well completion to predict how the well should flow. Fracpro software determines fracture placement, spacing and methodology, which have become increasingly important as industry moved to multistage fracturing, Mr Palisch explained.

“To date, we have developed models specifically for the Bakken and the Eagle Ford plays, which allow clients to design and optimize their completions based on common information learned about the reservoir,” he said. “We then run sensitivity tests to determine the correct number of stages and spacing, the optimal number of perforation clusters, the amount and type of proppant and the type of fluid system to help operators optimize the completion without the need for a well log.”

On the proppant side of the business, CARBO provides high-quality proppant in all three product tiers – uncoated white stands, resin-coated sands and ceramics. The latter is engineered for long-term durability and conductivity. “The shift from gas to liquids-rich and oil plays has driven the need for greater conductivity, or flow capacity,” Mr Palisch said. “It is much harder for liquids to flow through proppant than it is for dry gas. To meet that challenge, we have moved from small-mesh products to larger-diameter ceramic proppants. That has also resulted in a change in fracturing fluids, from slickwater to crosslinked fluids, to place the larger-diameter proppants.”

CARBO also has developed a scale-inhibitor deployment product, ScaleGuard, in which scale inhibitor is infused directly into the proppant. The service has been beneficial in the Bakken, where barium sulfate and calcium carbonate scale can occur when water used for fracturing mixes with reservoir water. Scale blocks flow in the fracture and wellbore and deposits in the tubulars, casing and production facilities, causing flow restriction, he explained. The product line could eventually include other production enhancement chemicals.

In response to environmental concerns, the company provides a non-radioactive traceable proppant, CARBONRT, to understand the height of fractures, as well as which perforations have taken the proppant. Traditionally, the industry has used radioactive tracers pumped with the proppant in conjunction with gamma ray logs to determine these parameters. “With this technology, we can put a non-radioactive taggant into every proppant grain and run a neutron log any time after the treatment to determine the location of the proppant,” Mr Palisch said. The technology has been used in the Middle East, Asia and Africa where radioactive tracers are prohibited; he also believes it is gaining traction in North America as more operators are choosing not to pump radioactive tracers, he added.

Material gains

As the industry continues to push efficiency, the discipline of materials science also has made significant strides in terms of improvements to swellable packers and the development of degradable materials in the ball-drop systems used for multi-stage open-hole completions, Schlumberger’s Isaac Aviles said. “New swellable materials, such as our water-swell packers, are shorter, stronger and more durable than conventional swell packers and are able to swell greater distances between the casing and borehole, then solidify and maintain long-lasting integrity.

“The use of degradable material in combination with novel ball-seat engineering in the Falcon multistage stimulation system overcomes the problem of balls becoming jammed into the seats and plugging the well, and eliminates the need for milling runs altogether,” he continued. The company’s ELEMENTAL alloy ball degrades in a rapid and predictable manner in a wide range of temperatures and fluids, in both cemented and un-cemented systems. “The advances reduce risk in completions and eliminate downtime to gain efficiency,” Mr Aviles said.

Plug-and-perf technology also has improved and is still used for cemented completions, relying on overflushing to convey tools downhole. Operators also are experimenting with plug-and-perf open-hole completions in place of ball-drop systems to convey tools in horizontal sections, he noted.

The Schlumberger KickStart pressure-activated rupture disc valve for cemented multistage fracturing opens ports at the toe of the well, allowing the operator to fracture-stimulate the first stage; this is otherwise done via mechanical intervention/coiled tubing to push the guns down to the first stage. After the first stage is stimulate, the second stage proceeds with standard pumpdown perforating guns. This eliminates the need for coiled tubing or tractors, reducing time, cost and risk. Cabot Oil & Gas used the system in several Eagle Ford wells, saving an estimated $1.4 million in intervention costs.

Schlumberger’s Mangrove reservoir-centric stimulation design software plug-in module for Petrel E&P software platform ensures the optimal placement of perforations, or fracturing ports, based on reservoir- and completion-quality criteria. Following a study that revealed an average 35% of perforations were not contributing in a given lateral, a consortium of four operators in the Eagle Ford compared an engineered completion method using the Mangrove Completion Advisor technology with a non-engineered approach on a group of offset wells.

The Completion Advisor grouped perforations into clusters with similar stresses, mechanical rock properties and estimated fracture initiation pressures so they can all be fractured at the same time and contribute to production. Except for distribution of laterals, the parameters were the same in both groups. Production logs for the engineered wells showed an average 82% efficiency while the offset wells had an average 64% efficiency rate.

“Over the years, the industry has developed a lot of technology in the realm of efficiency to optimize cost and recovery,” Mr Meisenhelder said. “Now, we’re developing fit-for-purpose tools, like Mangrove, for effective decision-making in shales. The key to the future will be to make smart, data-driven decisions that add value while continually improving on the efficiency side.”

Falcon, ELEMENTAL, Mangrove, Petrel and KickStart are marks of Schlumberger.

Fracpro is a registered term of CARBO Ceramics; CARBONRT is a registered term of CARBO Ceramics.

StackFRAC HD, SF Cementor, QuickFRAC and QuickPORT V are trademarked terms of Packers Plus.