Onshore drilling to stay flat in 2024, but rosier outlook is on the horizon

By Stephen Whitfield, Associate Editor

If there was one word summarizing analysts’ views on the global onshore drilling market as it heads into 2024, it’s “transition.” While there are things under way that will increase takeaway capacity and ultimately boost drilling activity, like new LNG terminals and gas pipelines coming on stream, the drilling sector will likely not see the impact of those projects until the end of next year heading into 2025. So, for now, the onshore market in 2024 will be the same as it was this past year.

“Much of our outlook for onshore drilling activity remains in line with what we were expecting last year,” said Ben Wilby, Senior Analyst at Westwood Global Energy Group. “When you look at all the numbers, it’s just been a period of stability.”

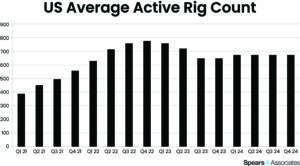

Analysts’ forecast numbers bear out the picture of a market marking time. In the US, John Spears, President of Spears and Associates, is forecasting the average active onshore rig count will drop from 697 in 2023 to 674 in 2024. That would mark a 3% year-on-year decrease. However, he noted that the 2023 rig count totals were boosted by high numbers in Q1 (761 rigs, the second-highest total seen in the last 12 fiscal quarters to that point) and Q2 (722 rigs). Since then, the rig count has seen a steady decline over the rest of the year, moving from 772 rigs on 6 January to 622 rigs on 13 October.

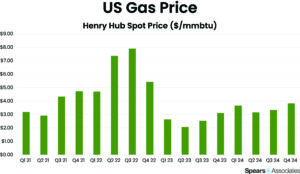

From Q2 to Q3, the rig count fell by 69 units, driven in part by lower-than-expected gas prices that discouraged production. A warmer-than-expected winter had led to excess gas supply, causing Henry Hub prices to drop from $5.53/million Btu in December 2022 to $2.15/million Btu by May 2023, the lowest monthly average since the COVID-19 pandemic.

Since then, the Henry Hub has moved up to $3.19 as of 19 October, and Mr Spears said it should hover around $3.50 in 2024. And when comparing anticipated rig counts in Q4 2023 vs Q4 2024, Mr Spears said he’s forecasting a 4% increase.

He also expects the WTI, which was trading at $85.85 as of 17 October, to stay around that level for much of 2024 – it could dip down to around $81.50 in Q4 this year before rising back to $85.50 by Q4 next year.

“When natural gas prices got so weak early on in the year, the expectation was that we’d really see gas drilling activity weaken in all the gas-prone areas but that, if oil prices stayed in the $80 range, then the rig count should still stay strong in the Permian and the oil-rich areas,” he said. “But we’ve seen rig count come down everywhere. I think there are a lot of operators who may be drilling oil wells that produce a lot of associated gas, but if there’s no way to get that gas to the market, then the operators are not going to get too aggressive about drilling. The oil price may be great, but if they can’t sell the gas, they’ll stay disciplined on the capital spending side. That all goes into the decision on how active they’re going to be.”

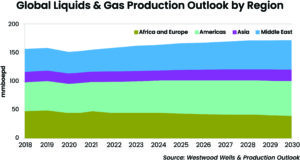

Onshore drilling in other regions around the world is also set to see gains over the next few years, with the Middle East, China and Latin America viewed as key drivers.

In July, for example, Saudi Aramco extended multiple onshore rig contracts and announced a new charter for up to 10 onshore rigs from Arabian Drilling, adding to the operator’s current fleet of 38 land rigs. Contracts for the Arabian rigs range from three to seven years, and they are expected to work on the Jafurah unconventional program. China is targeting major discoveries in the Sichuan Basin, and Argentina’s Vaca Muerta pipeline should make the country a major exporter of natural gas in South America, possibly pushing drilling activity there.

“There’s always the risk that OPEC or Saudi Arabia might do something unexpected, but right now, it looks like it’s going to be another good year,” Mr Wilby said. “There are a lot of places we can look at in 2024 and say they could become hotspots. We would need to see some real activity growth before we get particularly bullish, but there’s certainly a lot of positivity around the market.”

In its most recent Wells and Production Outlook for 2023-2027, Westwood is forecasting that an average of more than 50,000 wells per year will be drilled onshore globally in that time period, similar to the levels seen in 2022 and 2023. Average rig count is expected to rise by a small percentage, from 4,590 in 2023 to 4,780 by 2027. Onshore activity is expected to represent around 70% of global production of crude, condensate, natural gas and natural gas liquids by 2027, helping to drive total liquids and gas production to 171 million BOED by 2027, up 7.5% from 159 million BOED in 2022.

North America onshore outlook

The primary metrics in the US onshore market will see little to no change from 2023 to 2024. Average US oil production reached 12.8 million bbl/day in 2023, up by 6.9% from last year. Next year, it’s expected to stay at the same level. Gas production was at 103.0 billion cu ft/day in 2023, a 5.0% increase from last year, and Mr Spears forecast that production will be only marginally higher in 2024, reaching 103.1 billion cu ft/day.

Wells drilled in the Lower 48 onshore is expected to total 17,900 in 2023 and stay around the same number next year, again only moving up marginally to 18,000. Lower 48 land rig utilization is estimated to average 80% in 2023 and stay the same in 2024. That means leading edge dayrates will still hover within the low-$30,000 range it has been at since 2021, with an estimated average of $32,000 next year.

“We’re pretty much at the low point from a rig activity standpoint,” Mr Spears said. “I think we’ll begin to build from here, but we’ve fallen so much that I think the drilling contractors won’t see dayrates change very much next year. We have to get the rig utilization into the 90% range before we begin to see the rates move, and we’re only at 80% now. We probably have to grow activity for the full year before we begin to see anything happen on the dayrate side. Next year’s going to be pretty flat.”

The Permian Basin will continue to lead the Lower 48 market, accounting for about half of all drilling activity in 2024, but like the wider unconventionals market, it will be in a holding pattern for the next year as operators wait for major gas pipeline projects to come on stream. Mr Spears forecasts there will be an average 340 active rigs in the Permian in 2023 and between 375 to 380 rigs in 2024. Wells drilled will move from 8,000 in 2023 to 9,000 in 2024.

The Matterhorn Express Pipeline is one of the key pipeline projects under way. It is a joint venture among WhiteWater, EnLink Midstream, Devon Energy and MPLX and is expected to enter service in Q3 2024. Another project is Kinder Morgan’s Permian Pipeline Expansion, which is set to start operations in December this year.

While projects like those are expected to help push US gas takeaway capacity up to 2.5 billion cu ft/day by Q4 2024, from 1 billion cu ft/day in Q4 2023, their impact on drilling activity will take months to accrue. That means any rig count increase that may result from extra takeaway capacity will likely not be seen until the end of 2024 and beyond, Mr Spears said.

“I think the Permian will depend on how quickly these new gas pipelines get hooked up and put into service. There are some that are coming on this fourth quarter, and then there are more due in the latter half of next year. That will really help the Permian story, but it will probably help the Permian story more in 2025,” Mr Spears said.

The next two largest gas-producing basins outside of the Permian – the Marcellus/Utica and the Haynesville Shales – have different outlooks, according to Mr Spears. One is promising, while the other is not so promising. The Marcellus/Utica, where no major pipeline projects are scheduled to come online next year, is unlikely to see any change from the 27 active rigs it’s expected to run by the end of 2023.

The Haynesville, on the other hand, has a growing midstream infrastructure and is expected to see a 10% increase in rig count, from 52 rigs in 2023 to 57 rigs in 2024. The Gillis Lateral pipeline from Enterprise Products Partners and the associated expansion of the Acadian Haynesville Extension mean this region will be well positioned to take advantage of gas production hikes as prices recover in 2024. Three other pipeline projects — Williams’ Louisiana Energy Gateway, Momentum Midstream’s New Generation Gas Gathering and TC Energy’s Gillis Access — should also increase US takeaway capacity further when they come on stream in the latter part of 2024, but the full impact of those projects will probably not be seen until 2025.

“When you look at the Marcellus, the situation there is that they’re not going to get any relief in terms of pipeline capacity anytime soon, so they’re just in maintenance mode,” Mr Spears said. “The Haynesville has been really soft this year, but I think it will be in a position to come back.”

Like the US, Canada also saw very little change in drilling activity from 2022 to 2023, and Mr Spears does not anticipate that story changing in 2024. By the end of this year, Canada will have seen 175 active rigs and 6,200 wells drilled – both numbers are up 3% from a year ago – and no change is forecast for 2024.

This holding pattern will continue until Canada’s two major planned LNG terminals come on stream. Phase 1 of the Shell-led LNG Canada project will ship an estimated 14 million tonnes/year of LNG upon startup in 2025. And construction only recently began in September on the McDermott-led Woodfibre export facility, with a capacity of 2.1 million tonnes/year, and startup isn’t scheduled until 2027. Neither drilling activity nor gas production are likely to increase until those facilities are complete, Mr Spears said.

“Canada’s all about the LNG terminals. They would love to join the game because they’re seeing what it’s done for the US market, but they don’t really have any LNG export capacity,” he explained. “They really won’t begin to get new capacity on the line again until the end of 2024 or early 2025. With regard to LNG, the only thing they can do is just fill up the terminals in place right now. However, once the new pipelines come on stream in 2025 to 2027, that capacity will really help with their drilling activity and certainly their gas production numbers. You’re just not going to see much of that in the coming year.”

Global onshore outlook

The onshore drilling market remains hot in the Middle East. The Gulf Cooperation Council (GCC) countries – the UAE, Bahrain, Saudi Arabia, Oman, Qatar and Kuwait – averaged around 300 rigs this year and are expected to average 500 rigs by 2027. Wells drilled will rise from 1,900 in 2023 to 2,700 by 2027.

These numbers each represent around a 40% increase during Westwood’s forecast period of 2023-2027, driven by higher crude oil production targets set by all the major onshore producers in the region. Multiple new projects have already passed final investment decision to support those targets.

“In a continuation of 2022, Middle Eastern countries have been awarding multibillion dollar contracts at an unprecedented rate,” Mr Wilby said. “There’s been numerous big contract awards in every quarter this year, and there’s been continued investment in the construction of new high-spec rigs, as well. It’s a market that’s really heating up and where everyone’s heading to at the moment.”

Elsewhere in the wider Middle East and North Africa (MENA) region, North Africa saw an average of 135 land rigs in 2023, while there were 82 in the non-GCC Middle East nations, including Iraq and Iran. Rig counts for those two segments are expected to grow by 24% to 168 and by 54% to 126, respectively, over the forecast period.

Rig utilization in the GCC states is expected to increase from 53% in 2023 to 78% in 2027. Across the rest of MENA, that number is expected to go from 34% in 2023 to 45% in 2027. Westwood also noted that Algeria is emerging as a new hotspot for gas exports to Western Europe as that part of the world deals with gas supply shortfall following EU sanctions of Russian gas. The rig count in Algeria is expected to go from 50 in 2023 to 80 in 2027, wells drilled from 162 to 236, and utilization from 31% to 50%.

“Algeria is an important gas hub. We’ve seen a lot of investment from Eni and Sonatrach to raise that gas production and even the liquids production incrementally,” Mr Wilby said.

In Western Europe, onshore domestic production is likely to remain miniscule over Westwood’s forecast period – rig count is expected to move from nine rigs in 2023 to seven rigs in 2027, and wells drilled will move from 65 to 40 – in part because of significant political and societal pressures to meet ESG obligations.

Mr Wilby noted the hesitancy of banks to invest in oil and gas projects due to local opposition to the industry, as well as the numerous windfall taxes passed by European governments over the past year. Over the past two years, the UK, Austria, the Czech Republic, Italy and Finland have all passed windfall taxes specifically targeting oil and gas profits, while Germany has passed taxes for profits from energy producers, including oil and gas companies.

“I just don’t have much optimism for oil and gas drilling onshore Western Europe. I think the depth of feeling about oil and gas projects is a real sticking point,” Mr Wilby said. “When we’ve seen talk of new development – like with the Rosebank field offshore UK – the response has been quite vitriolic. That’s quite common across Europe. I don’t think there are many countries where you could really ramp up onshore activity without it causing an issue. There might be little pockets of activity, but not enough to materially change our view on that market.”

Russia remains a wildcard for the global drilling market. Official data from the country is hard to come by, as the country’s oil and gas statistics have been classified. However, Bloomberg reported in July that the country drilled 14,700 km of production wells in the first half of 2023, an 8.6% increase over the same period in 2022.

Even though that figure does not distinguish between onshore and offshore drilling, Mr Wilby said it does indicate that a fairly high number of wells are still being drilled, despite Western nations’ sanctions on the Russian oil industry. Restrictions on supplies of energy equipment and technologies were intended to cut into the country’s ability to drill and pump oil, a key source of revenue for its national budget.

The Russian government had also ordered production cuts of 500,000 bbl/day following the imposition of Western sanctions – those sanctions were initially designated to last for a few months, but they were subsequently extended until the end of 2024 in coordination with OPEC+ production cuts.

“In both 2022 and 2023, Russia ramped up drilling activity beyond historic levels. We expect this to be a short-term boost, however, with activity beginning to drop next year,” Mr Wilby said, noting that Westwood estimates the country will drill 8,000 onshore wells this year with 1,300 rigs. “Part of it could be that they’re just drilling as many wells as possible while they have the income, and even as that income tapers off they can still produce from those existing wells. Perhaps, with the pullout of Western companies, that has reduced some expertise and they’re having to drill more wells to counteract that and keep their production high. Or it could simply be a show of strength.”

By 2027, Westwood forecasts that the number of Russian wells drilled will drop to 6,000 and the number of rigs to 1,000. “I think the big question that arises is just, can they really maintain that long term without getting the kind of economic return they need to? Personally, I don’t see how they could. I think we’re going to see that drop off probably starting next year. They will still drill a huge number of wells, but not quite of the same magnitude.”

China also looks to be another wildcard. In August, Sinopec announced a 30.6 billion cu/m discovery at the Bazhong gas field in the Sichuan basin. Bazhong is the third tight sandstone gas field discovered by Sinopec in the basin.

While the size of this discovery, as well as CNPC’s drilling of a pair of 10,000-m wells in the same basin this year, are positive signs for increasing drilling activity in China, Westwood’s forecasts for the country are more muted, taking a more wait-and-see view. It’s only forecasting slight increases in rig activity in China – from 1,215 in 2023 to 1,340 in 2027 – and in wells drilled – from 14,400 in 2023 to 15,000 in 2027.

“China has done this in the past where they announce big discoveries, but then nothing will have happened after several years,” Mr Wilby said. “There’s a difference between drilling one well and commercially developing some of these complex reservoirs. They’re so deep, and they’ll require high-spec land rigs. It’s potentially feasible, but I think we need to wait and see what happens long term, whether they really are going to commit to doing the work they need there, and potentially what the costs of that are.”

In South America, Argentina is going to be the primary driver of onshore activity – Mr Wilby estimates the country will average 125 operational rigs by 2027, up from 100 rigs this year. Wells drilled in Argentina will move from 1,000 in 2023 to 1,260 in 2027. Westwood’s optimism in the country is due to the start of operations for the first section of the Vaca Muerta gas pipeline in July. According to the state-owned Energia Argentina, the pipeline moved 11 million cu m/day of gas to the central Buenos Aires province in its first month of operation. The addition of compression plants is expected to increase the flow of that section to 22 million cu m/day by the end of this year.

Mr Wilby said the increase in takeaway capacity will lead to a jump in production, which means an increase in drilling.

The government for the Neuquén province, home to most of the Vaca Muerta’s in-development acreage, has set a target of boosting gas output to as much as 160 million cu m/day by 2027-2028, which would increase the country’s potential for exports to neighboring countries.

“It’s a good sign that the pipeline’s under way,” Mr Wilby said. “That was one of the key stopping points in analyzing them in the past – what were they going to do with all that production? They could drill more wells, get more hydrocarbons out of the ground, but where does it go? The pipeline helps alleviate a lot of that concern over offtake capacity, and it’s certainly a region that needs gas production.” DC