Wirelines

BOEM to hold Lease Sale 257 on 17 November, including 15,000+ blocks in GOM

The US Bureau of Ocean Energy Management (BOEM) announced on 30 September that it will hold an oil and gas lease sale for the Gulf of Mexico on 17 November, in compliance with an order from a US District Court.

Lease Sale 257 will be the eighth offshore sale under the 2017-2022 Outer Continental Shelf (OCS) Oil and Gas Leasing Program. It will include approximately 15,135 unleased blocks located from 3 to 231 miles offshore in the Gulf of Mexico with water depths ranging from 9 to more than 11,115 ft.

The Gulf of Mexico OCS, covering about 160 million acres, is estimated to contain about 48 billion barrels of undiscovered technically recoverable oil and 141 trillion cu ft of undiscovered technically recoverable gas.

BOEM will include lease stipulations to protect biologically sensitive resources, mitigate potential adverse effects on protected species, and avoid potential conflicts between oil and gas development and other activities and users in the Gulf of Mexico.

Fiscal terms include a 12.5% royalty rate for leases in less than 200 m of water depth and a royalty rate of 18.75% for all other leases issued pursuant to the sale. Of note, BOEM will only accept bids by mail for Sale 257.

Report details benefits from offshore oil & gas projects

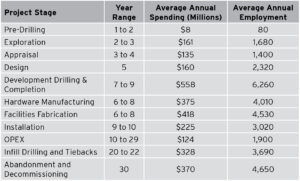

A new study commissioned by the National Ocean Industries Association (NOIA) details the multitude of jobs involved in the exploration, development and production of American offshore oil and natural gas. It shows how the 30-year lifecycle of each offshore oil and gas project serves as an economic engine for American investment.

NOIA President Erik Milito said, “Government policy should continue to encourage investment in the US Gulf of Mexico energy sector to secure the tremendous energy, climate and national security benefits for American citizens, as well as help avert potential inflationary risks associated with high energy costs.”

More than 200 types of jobs are identified that are directly involved in offshore oil and gas projects. Further, the quality of employment is well above the national average.

For the model deepwater project, total lifetime spending over $8.8 billion is projected, with $3 billion in total direct wages. Average annual spending is projected at nearly $295 million. Total annual supported employment is estimated to average nearly 3,640 jobs. During the most active years, employment impacts peak at nearly 14,450 jobs.

For the model shallow-water project, projected total lifetime spending is over $1.3 billion, with $485 million in total direct wages. Average annual spending is projected at $45 million. Total annual supported employment is estimated to average nearly 615 jobs. During the most active years, employment impacts peak at nearly 1,800 jobs.

Click here to access the report.

IADC joins lawsuit challenging leasing ban

In August, IADC joined API and 11 other energy industry trade groups in filing suit in the US District Court for the Western District of Louisiana, challenging the US Department of the Interior’s moratorium on federal oil and natural gas leasing. IADC President Jason McFarland issued the following statement: “Oil and gas leasing on federal lands and water is a congressional responsibility that is critical to the US energy ecosystem. IADC welcomes the opportunity to join our industry partners in pushing for the continued application of long-standing federal law. We aim to continue to be a resource for the administration and urge the Department of Interior to move expeditiously to fulfill its obligations under the Mineral Leasing Act and Administrative Procedure Act.”

BSEE shares findings after risk inspections

The US Bureau of Safety and Environmental Enforcement (BSEE) recently concluded two weeks of performance-based risk inspections offshore and compiled several findings, including:

• Operators practiced good barrier management while lifts were taking place and in the presence of moving equipment on the rig floor; however, on lifts not associated with the rig floor, restricted access areas need improvement.

• Most operators did not have specific training requirements to prevent dropped objects for personnel at the facilities.

• There were no recent management of change programs associated with mounting new fixtures to existing structures or equipment.