Oil & Gas Markets

Co-location with renewables, CCS will be key to energy super basins of the future, Wood Mackenzie says

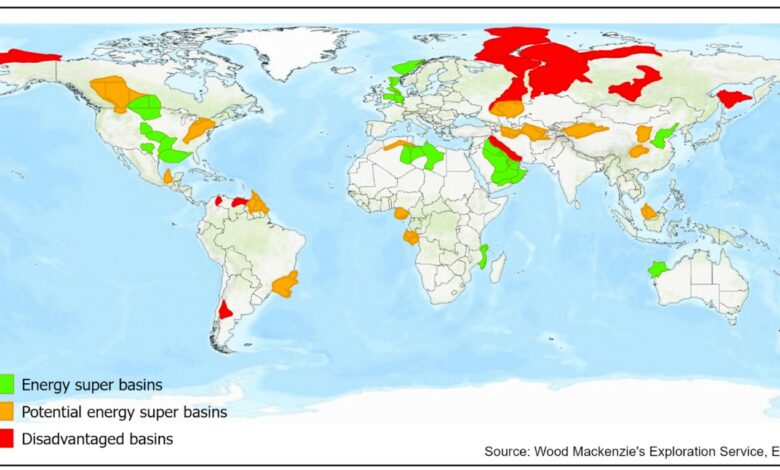

Energy super basins of the future will need to fulfill three key criteria: abundant resources, access to low-cost renewables and hub-scale carbon capture and storage (CCS) opportunities, according to a report by Wood Mackenzie.

The world’s need for sustainable energy is set to change the geography of the oil and gas industry, increasingly entwining it with renewables.

Fewer than 50 traditional super basins supply more than 90% of the world’s oil and gas. These are defined as basins originally holding more than 10 billion BOE resources, of which more than 5 billion BOE remains. “Of the remaining resources from traditional super basins, only 1,453 billion BOE, or half, have been identified as future-fit energy super basins,” said Andrew Latham, Wood Mackenzie Vice President.

Much of the world’s production is operated by companies with net-zero targets for Scope 1 and 2 emissions by 2050 or earlier. Electrifying operations using renewable energy is one of the fastest ways to eliminate emissions. “The co-location of low-cost renewables with low-cost oil and gas is key,” Mr Latham said.

Examples of future energy super basins include the Gulf Coast and Permian in the US. Both offer plentiful clean electricity from solar power potential and additional renewables from wind. Wood Mackenzie expects a substantial CCS industry to emerge, based on hub-scale CO2 sources from refining, petrochemical and other industrial facilities around the Texas coast.

Other examples of future energy super basins include the Rub al Khali in the Middle East, the North Sea, and Australia’s North Carnarvon.

Westwood: Asia Pacific sees increasing rig activity

Rig activity in the Asia Pacific region has become much busier in 2022, according to Westwood Global Energy Group’s Terry Childs, Head of Riglogix, and Paul Ezekiel, Senior Rig Analyst. Marketed utilization is near 90% and could hit 95% by the end of the year, according to their analysis, issued in July.

In terms of floating rigs, there are only three active drillships in Southeast Asia, two of which are working. Dayrates for new drillship fixtures this year have been in the $220,000 range, but upcoming rates are likely to be closer to $270,000. There are 12 semisubmersibles, five of which are marketed and four of which are working. Only three new semi contracts have been signed this year, with dayrates still below $200,000.

In Australia, there are five semis, three of which are contracted into 2024. Of the three new semi contracts signed in 2022, the most recent fixture hit $379,000, well above the previous high of $265,000.

On the jackup side, marketed utilization has improved to 90%. However, many rigs in the Asia Pacific are destined for work outside the region. Six of the 45 marketed rigs in Southeast Asia that are contracted or committed will be going to Saudi Arabia. Four newbuilds are also expected to move there. By the end of 2022 or early 2023, 15 jackups will have departed Southeast Asia for contracts with Saudi Aramco.

A couple of recent four-year jackup contract awards have seen dayrates in the range of $105,000. For shorter-term contracts, dayrates have ranged from a low of $67,000 to a high of $90,000. In Australia, 2022 fixtures have seen rates in the range of $112,000-$118,000.

The APAC region currently has over 40 programs in some stage of rig inquiry, including 13 in Australia. In Southeast Asia, the largest number of jackup requirements are in Malaysia, followed by Indonesia and Vietnam.

The analysts also noted that inflation may accelerate the use of local crews and supplies where possible.

UKCS decommissioning costs down 25% in past 5 years

The cost of decommissioning oil and gas infrastructure on the UK Continental Shelf (UKCS) has been cut by 25% in the past five years, according to the North Sea Transition Authority’s (NSTA) Decom-missioning Cost Estimate Report 2022. The forecast fell by £1.5 billion to £44.5 billion last year, contributing to a total cut of £15 billion (25%) since 2017, when the NSTA introduced a baseline estimate of £59.7 billion and set a target of reducing costs by 35% to £39 billion by year-end 2022.

Decommissioning spend is expected to ramp up to a peak of more than £2.5 billion/year over the next two decades, offering a long-term opportunity for the supply chain to develop cost-efficient services. Challenges in the short term will include market inflation and competition for resources from other energy sectors.