Oil & Gas Markets

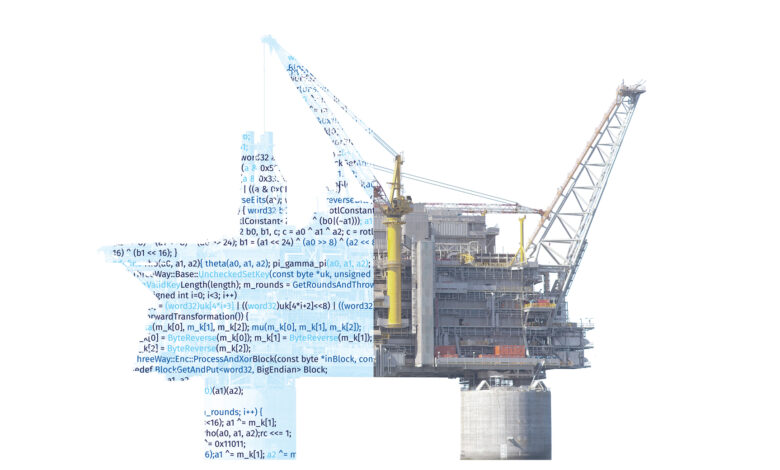

DNV survey: 57% of professionals say they believe cyber attacks on energy industry will cause loss of life

Energy executives are anticipating life-, property- and environment-compromising cyber attacks on the sector within the next two years, according to DNV research.

The Cyber Priority report finds that more than four-fifths of professionals in the oil and gas, power and renewables sectors believe a cyber attack on the industry is likely to cause operational shutdowns (85%) and damage to energy assets and critical infrastructure (84%). Three-quarters (74%) expect an attack to harm the environment, while more than half (57%) anticipate it will cause loss of life.

Two-thirds (67%) of energy professionals also say that recent cyber attacks have driven their organizations to make major changes to their security strategies and systems. However, less than half (47%) of energy professionals believe their OT security is as robust as their IT security.

Six in 10 C-suite level respondents to DNV’s survey acknowledge that their organization is more vulnerable to an attack now than it has ever been. Even so, there are signs that some companies are taking a “wait, see and hope for the best” approach. “This draws distinct parallels to the gradual adoption of physical safety practices in the energy industry over the past 50 years,” said Trond Solberg, Managing Director, Cyber Security, DNV.

Less than half (44%) of C-suite respondents believe they need to make urgent improvements in the next few years to prevent a serious attack on their business, and more than a third (35%) of energy professionals say their company would need to be impacted by a serious incident before investing in their defenses.

One explanation for the hesitance to invest in cybersecurity may be that most respondents believe their organization has so far avoided a major cyber attack.

DNV recommends that the first step to strengthen defenses is to identify where critical infrastructure is vulnerable to attack. The report reveals that, while many organizations are investing in vulnerability discovery, these efforts are not being sufficiently extended to their supply chain. Just 28% of professionals working with OT say their company is making the cybersecurity of their supply chain a high priority for investment. This contrasts with 45% of OT-operating respondents who say expenditure in IT system upgrades is a high investment priority.

The report is based on a survey of more than 940 energy professionals around the world and in-depth interviews with industry executives.

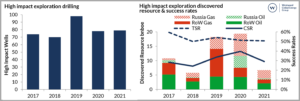

Report: High-impact exploration drilling levels didn’t fall in 2021, but success rate did

New analysis from Westwood Global Energy Group reveals that, despite challenges due to COVID-19 and the accelerating energy transition last year, high-impact oil and gas exploration drilling maintained its momentum in 2021.

However, while high-impact drilling levels in 2021 were similar to 2020, performance sank significantly. Discovered resource dropped by 65% in 2021 to 6.7 billion BOE. The commercial success rate also fell by 11% year-on-year, from 40% to 29%. This is due to a reduced number of giant discoveries greater than 500 million BOE and some unsuccessful play extension tests in recently opened emerging basins.

The new research also confirms that companies with a significant proportion of infrastructure-led exploration in their portfolios delivered a higher commercial success rate and a more predictable finding cost, despite lower discovery sizes. Access to funding also meant that supermajors and national oil companies accounted for 68% of high-impact well equity in 2021 compared with 47% in 2018.

“The results of our latest State of Exploration report present a promising outlook for exploration, having bounced back from COVID-19 and despite significant headwinds against exploration for fossil fuels,” said Graeme Bagley, Head of Global Exploration and Appraisal at Westwood. “As we stride toward a cleaner energy mix, however, the crucial requirement is for low emissions intensity developments for all future exploration opportunities.

“Looking ahead, we’ll be seeing scrutiny of the success case impact on company net-zero targets, with ESG considerations and the time to breakeven becoming increasingly important when it comes to prospect selection.”

McKinsey research: Oil demand may peak by 2025

This year’s Global Energy Perspective report by McKinsey & Company shows that oil demand could peak this decade, perhaps as soon as 2025. Global energy markets are facing unprecedented uncertainties even while the long-term transition to low-carbon energy systems continues to see strong momentum and acceleration. Key findings include:

- Going forward, the global energy mix is projected to shift toward low-carbon solutions, with a particularly strong role for power, hydrogen and synfuels:

- Renewables are projected to grow three times by 2050, accounting for 50% of power generation globally by 2030 and 80-90% by 2050;

- Hydrogen demand is expected to grow four to six times by 2050, driven primarily by road transport, maritime and aviation;

- Hydrogen and hydrogen-derived synfuels are expected to account for 10% of global final energy consumption by 2050;

- Rapid technological developments and supply chain optimization have collectively halved the cost of solar, while wind costs have fallen by almost one-third. As a result, 61% of new renewable capacity installation is priced lower than fossil fuel alternatives. Battery costs have also fallen by nearly half in the past four years;

- Global oil demand is projected to peak in three to five years, primarily driven by the uptake of electric vehicles (EVs);

- By 2050, carbon capture, utilization and storage could grow more than 100-fold from an almost non-existent footprint today, with investment opportunities exceeding LNG markets today;

- Growth in energy investments will almost entirely be driven by renewables and decarbonization technologies;

- Despite net-zero commitments, an 85% renewable power system by 2050, and rapid advances in EVs and decarbonization technologies, global warming is projected to exceed 1.7°.

Long-term LNG contracting off to a fast start this year

Demand for long-term LNG contracts continues to gain momentum. According to Wood Mackenzie, more than 10 million tonnes per annum (mmtpa) have been signed to end-market users in 2022.

“The Russian invasion of Ukraine has had a dramatic impact on long-term LNG contracts,” said Daniel Toleman, Wood Mackenzie Principal Analyst. “Many traditional LNG buyers will neither procure spot gas or LNG nor renew or sign additional LNG contracts with Russian sellers. Spot prices have also been high and volatile, pushing many buyers toward long-term contracts. Additionally, some buyers are returning to long-term contracting on behalf of governments to protect national energy security.”

The result is rising prices for long-term oil-linked contracts under negotiation. Between 2020 and early 2021, long-term oil-linked contract prices have been in the 10% range, levels not seen in 10 years.

Chinese buyers continue to dominate the market, signing more than 8 mmtpa of new LNG sale and purchase agreements this year. Most new contracts are from US supply, and all these contracts are linked to North American prices.

The only non-Chinese deal with an end-user was the first Europe LNG deal since the start of Russia’s invasion of Ukraine. Engie signed up to 1.75 mmtpa for 15 years from NextDecade’s Rio Grande project.

More oil/gas companies see CCUS as revenue stream

More and more oil and gas companies are seeing carbon capture, utilization and storage (CCUS) as a path to generating additional revenue, according to GlobalData.

“Many oil and gas companies developed CCUS knowhow by way of EOR projects simply to boost production,” said Miles Weinstein, Energy Transition Analyst at GlobalData. “Today, that knowledge has new value, as oil and gas companies have begun selling their CCUS knowledge in the form of technical advisory services or in developing their own emission reduction projects. Additionally, there is evidence that CCUS projects could generate large amounts of revenue through the growing carbon offset market.”