Oil & Gas Markets

US LNG, AI growth among noteworthy energy trends

Wood Mackenzie recently highlighted five significant trends that are reshaping the energy and resources sector, with two macro themes: the intensifying rivalry between the world’s two superpowers, and Europe’s mounting competitiveness challenges amid ongoing industrial decline.

US LNG: The US has emerged as the world’s hydrocarbon superpower, exemplified by its meteoric rise in the LNG market. By 2030, the US is projected to account for 30% of global LNG output.

The US also leads global oil production, including oil, condensate and natural gas liquids, delivering one-fifth of the world’s volumes. Its closest competitors, Saudi Arabia and Russia, produce 65% and 50% of US volumes, respectively.

Rare earth elements: Rare earth elements, which are used in renewable energy technologies, advanced weapon systems, electronics and semiconductors, have moved to the center of global trade negotiations. China currently commands an extraordinary strategic advantage, accounting for almost 90% of the world’s refined rare-earth supply. This leverage is striking given that the US was the world’s leading producer until the late 20th century.

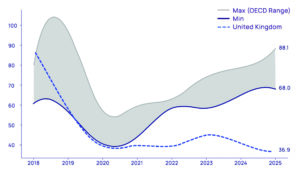

National value destruction in the UK North Sea: The UK oil and gas sector has become an outlier among OECD countries due to persistent fiscal and regulatory uncertainty. The Implied Long-Term Oil Price for transacted UK North Sea assets is charting around $40 per barrel, a 40% discount compared with the OECD average of roughly $70 per barrel. This discount reflects the upstream industry’s declining interest, spurred by major changes to the fiscal system mixed with regulatory uncertainty. (Read about the UK government’s decision to maintain the Energy Profits Levy for 2026 on Page 44.)

Petrochemical clear-out: Europe is driving down emissions, but industrial activity is also transferring to other regions. Global ethylene manufacturing capacity shows a pattern of closures in Europe contrasting sharply with growth elsewhere, especially in China.

AI growth: The AI megatrend is driving growth in power demand. The US power market, a low-growth zone for decades, is forecast to see its AI-driven power demand grow at a compound rate of 20% to 2030. There is a growing call for gas-fired power, but with rising gas prices and the rapid inflation of build costs for new power plants, power prices are expected to rise. Since about half of data center operating costs are typically power-related, electricity prices will play a crucial factor in the global AI race.

More than $300 million in high bids generated by Big Beautiful Gulf 1 lease sale

Under Lease Sale Big Beautiful Gulf 1, the first offshore oil and gas lease sale required under the One Big Beautiful Bill Act, $300,425,222 in high bids were submitted for 181 blocks across 80 million acres in federal waters of the US Gulf. Thirty companies submitted 219 bids totaling $371,881,093. The lease sale was held on 10 December.

The Bureau of Ocean Energy Management (BOEM) offered approximately 15,000 unleased blocks across the Western, Central and portions of the Eastern Gulf Planning Areas. To encourage participation, a 12.5% royalty rate was applied for shallow and deepwater leases, the lowest deepwater rate since 2007.

The US Gulf’s Outer Continental Shelf spans 160 million acres and holds an estimated 29.59 billion barrels of undiscovered, technically recoverable oil and 54.84 trillion cubic feet of natural gas.

BP was the top company in the sale, submitting 51 high bids totaling more than $61 million. Chevron followed with 24 high bids of more than $53 million. Other operators in the top 10 were Murphy E&P, Shell, Repsol, Talos, LLOG, Woodside Energy, Anadarko and Equinor.

In its analysis, Wood Mackenzie noted that the number of bids declined by 37.8% compared with the most recent lease sale 261. Most of the bids were focused near infrastructure and adjacent to existing acreage positions, and companies continued concentrating bids on the emerging 20K Paleogene play, as was seen in lease sale 261.

The single highest bid came from Chevron for Keathley Canyon Block 25, for more than $18 million. The block is located just 31 km north of BP’s Kaskida project.

Woodside and Repsol also spent more than $30 million for three blocks containing the Novak prospect on Walker Ridge.

Wood Mackenzie also noted the trend of more collaborative strategies among operators, with Repsol partnering with Woodside, Talos and LLOG across multiple joint bids, while private capital joined operators like LLOG, Murphy and Talos to secure exploration positions.