Oil & Gas Markets

Analysis: Deflation for rig, other costs to help operators offset tariff-related inflation

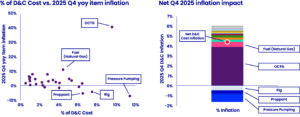

US Lower 48 tight oil well costs will see pressures from tariffs, but significant increases will be offset by cost deflation elsewhere, particularly in declining prices for rigs, proppants and pressure pumping, according to a recent analysis by Wood Mackenzie.

The report states that tariffs on consumables such as imported steel, OCTG, cement and drilling fluids will result in near-immediate price increases that will see higher costs passed directly to operators. Quarterly fluctuations will be more pronounced, with Q4 2025 drilling and completion costs rising by 4.5% year-over-year due to tariffs. OCTG prices are expected to be 40% higher year-over-year in Q4 2025, adding 4% to total well costs.

Annual increases are expected to stay flat in 2025 but will see a 2% increase in 2026 as tariffs are fully realized.

“Tariffs are creating significant cost pressures, particularly for consumable inputs like imported steel and OCTG,” said Nathan Nemeth, Principal Analyst, Wood Mackenzie. “However, there is nuance to the story. While operators are facing inflated costs in some areas, much of this will be offset by deflation in other areas. Declining prices for proppant, drilling rig and pressure pumping are all areas that will yield lower costs this year.”

According to the report, Lower 48 rig activity is expected to gradually fall through 2025-2026, primarily due to declines in oil plays. The oil rig count is projected to be 45-50 rigs below its April 2025 outlook, but a gradual rise in natural gas rigs will offset part of the drop, leading to a net decline of around 30 rigs from March to July 2025.

“While tariff-driven well cost inflation is undesirable, it is manageable,” Mr Nemeth said. “However, broader economic weakness and lower commodity prices would force difficult decisions and activity reductions.”

Innovation, more exploration spending needed to help US prolong energy leadership

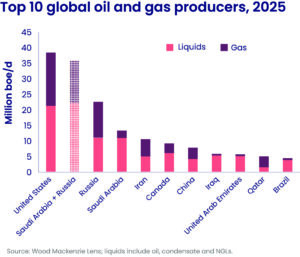

The US faces significant challenges in the coming decades to maintaining its leadership position in global oil and gas production, according to a report from Wood Mackenzie. US production is set to decline in the 2030s, while the rise of low-carbon energies across the globe, particularly in China, could leave the US exposed.

Maintaining its energy dominance will require addressing several key challenges, including resource maturation and an ongoing global shift toward lower-carbon energy sources.

The report highlights that US oil and gas production is projected to decline by about 1.7 million barrels of oil equivalent per day (boed) between 2035 and 2040. But if demand expectations erode prior to this and a drop toward $50/bbl becomes embedded for crude, declines would occur much sooner and be more severe. This decline could have far-reaching implications for the industry’s ability to raise capital and maintain export relationships.

Simultaneously, China is rapidly advancing in low-carbon technologies such as electric vehicles, battery storage and solar cells. China’s global market share in these technologies is greater than the American share in oil and gas production.

Despite the challenges, the report highlights several ways the US could prolong its energy leadership:

Fostering innovation collaboration, particularly in shale technology. Innovative subsurface diagnostics and reservoir models could lower the cost of supply by redesigning wells and pads in near-real time to eliminate nonproductive CAPEX.

Reinvigorating grassroots shale exploration. Exploration spending has fallen by 65% since 2012. Within 10 years, Wood Mackenzie models suggest the industry will have drilled nearly half of all its remaining low-cost tight oil locations.

Implementing supportive regulatory and fiscal policies. The Trump administration has embarked on reform of federal permitting frameworks, with the aim of creating a faster path to infrastructure expansion, which could help relieve constraints on long-haul interstate pipeline expansions and boost the profitability of high-potential supply projects.