Environment, Social & Governance

DNV: Global CCS capacity to quadruple by 2030

Cumulative investment in carbon capture and storage (CCS) is expected to reach $80 billion over the next five years, according to a new DNV report. Moreover, capture and storage capacity is expected to quadruple by 2030.

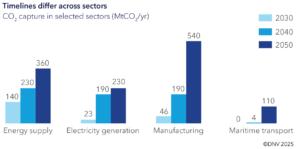

The immediate rise in capacity is being driven by short-term scale-up in North America and Europe, with natural gas processing still the main application for the technology. From 2030 onwards, hard-to-decarbonize industries such as steel and cement are forecast to be the main drivers of CCS growth, accounting for 41% of annual CO2 captured by mid-century. Maritime onboard capture is expected to scale from the 2040s in parts of the global shipping fleet.

As the technologies mature and scale, the average costs will drop by an average of 40% by 2050. However, the roll-out of CCS is still reliant on policy support, and recent political turmoil and shifting budgetary priorities pose a risk to future deployment.

DNV forecasts that carbon dioxide removal will capture 330 MtCO2 in 2050 – one-quarter of total captured emissions. Bioenergy with CCS is cheaper and will be used primarily in renewable biomass for power and manufacturing. Direct air capture costs, on the other hand, will remain high at around $350/tCO2 through 2050, but voluntary and compliance carbon markets will still ensure the capture of 32 MtCO2 in 2040 and 84 MtCO2 in 2050.

Political priorities shift from decarbonization toward affordability, security

Equinor recently released its Energy Perspectives 2025, presenting four scenarios for the future world economy, international energy markets and energy-related greenhouse gas emissions.

The report emphasized the significant shifts under way with both global markets and geopolitics, noting that political priorities affecting global energy markets are shifting away from decarbonization toward energy affordability and security of energy supply.

A global energy transition roughly in line with the ambitions of the Paris Agreement has become severely delayed and more fragmented, and global greenhouse emissions continued to increase last year, the report stated. It also noted that macroeconomic, political and geopolitical realities are increasingly characterized by lack of trust, cooperation and burden-sharing, which are slowing down the pace of change. With short-termism and local and regional priorities dominating policy making, the necessary global changes in the direction of truly sustainable development, balancing the different concerns in the energy trilemma, will be further delayed.

The Energy Perspectives 2025 report presents various scenarios that aim to show how divergent drivers in the energy trilemma – energy security, affordability and decarbonization – affect long-term developments.

There are three forecast scenarios – Walls, Silos and Plazas – which aim to highlight the large gap between the relatively slow changes that characterize the energy transition and the radical and rapid changes needed to move the world onto a path aligned with the 1.5°C ambition. A fourth scenario, BridgesEP23, is a normative backcast scenario demonstrating the changes needed to stay within the 1.5°C goal.

Click here to access the Energy Perspectives 2025 report.

1st European-built offshore CO2 carrier for CCS launched

INEOS Energy and Royal Wagenborg launched and named the first European-built offshore CO2 carrier to enable carbon capture storage across Europe. The launch and naming of Carbon Destroyer 1 marks a milestone in the development of Project Greensand and the EU’s first commercial-scale carbon capture and storage (CCS) value chain.

“Carbon Destroyer 1 will transport captured CO2 from across Europe, creating a virtual pipeline between the point of capture and permanent storage deep beneath the seabed of the North Sea. The delivery of the first dedicated offshore CO2 carrier is a prerequisite for commercial scale CCS across the continent,” said Mads Weng Gade, CEO of INEOS Energy Europe.

The vessel is expected to be fully operational by the end of 2025 or early 2026 – when Project Greensand is due to begin permanent commercial-scale CO2 storage operations. The vessel will operate between the Port of Esbjerg in Denmark and the Nini West offshore platform.