Oil & Gas Markets

Study shows more US LNG is needed to keep up with Asia’s growing demand, curb surging coal use

Coal use and emissions from power generation in Asia will surge in coming decades unless there is significant new supply of US liquefied natural gas (LNG), a new study by Wood Mackenzie shows.

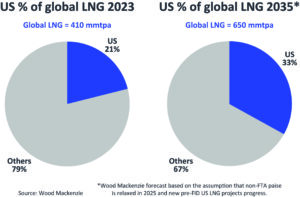

The study, commissioned by the Asia Natural Gas and Energy Association (ANGEA), modeled energy demand, power generation and the implications for gas demand for nations across Asia through 2050. It found continued growth in LNG production from the US to be essential to balancing global markets and providing emerging economies in Asia with an affordable and available alternative to coal, which is currently the region’s dominant electricity source.

Wood Mackenzie forecasts LNG demand from Asia will grow from 270 million tons per year in 2024 to 510 million tons per year in 2050. However, the continent must rely on LNG imports to meet its natural gas needs.

“Wood Mackenzie has modeled two scenarios: one where the current halt to US LNG export approvals to non-free trade agreement countries is lifted early in 2025 and another where this pause stays in place longer term,” ANGEA CEO Paul Everingham said.

“If the pause is lifted, and approvals and development of export facilities resume, then US LNG is expected to comprise a third of global supply by 2035,” he said. “But if it remains in place and planned and proposed US LNG projects are not developed, there is a risk that LNG developments in other regions will fail to keep pace with anticipated demand growth.”

He noted how uncertainty about LNG supply is impacting energy planning in Asia. Key energy decision makers in the region “want to know if the US will be a reliable long-term supplier of the LNG they seek to replace coal in power generation. If it’s not from the US or Australia, then this study shows gas would need to be sourced from less cost-competitive projects around the world, and the likely outcome would be higher LNG prices than what many South Asian and Southeast Asian nations can afford.”

If such price increases were to lower 2035 LNG demand by 30% compared with current forecasts, it’s estimated that an additional 95 million tons of coal would be used in that year alone, resulting in around 100 million tons of additional annual CO2 emissions.

S&P outlook indicates gas demand, prices in the US may begin to rebound

After extremely robust M&A activity last year, particularly in North America, the pace of M&As is slower but still relatively high, according to the S&P Global Ratings 2025 Oil & Gas Industry Outlook.

The report also noted that oil prices have retreated in the past months, mostly trading within $60-$70. “This reflects lower global demand and the reconciliation among warring factions in Libya that would return approximately 700,000 barrels per day of offline oil production,” said Tom Watters, North American Oil & Gas Managing Director for S&P Global Ratings. “We believe OPEC will not significantly resume the 2.2 million barrels per day of offline production it is considering returning next April.”

He added: “OPEC continues to support oil prices, as recent announcements show its willingness to delay reintroducing surplus capacity until global demand improves, especially with global markets likely to be in surplus in 2025.” However, it was noted that the rhetoric from OPEC members to increase production has intensified.

The outlook also noted that US natural gas demand and prices are beginning to recover. “This recovery is expected to continue through the end of the decade, driven by liquefied natural gas (LNG) and data center buildout,” Mr Watters said. “This expectation is based on the assumption that the Trump administration will unwind the LNG export pause enacted by the Biden administration.”

Other findings in the report include:

The new Trump administration will have a limited impact on US oil and gas production. The administration will likely make it easier to drill on federal lands and receive drilling permits, but economics and commodity prices will continue to be the deciding factor.

North American upstream spending will remain muted. CAPEX will likely be either flat or slightly lower due to lower oil prices and continued emphasis on generating cash flow.

If the industry shifts away from conservative financial policies and outspends cash flow, credit quality could deteriorate.