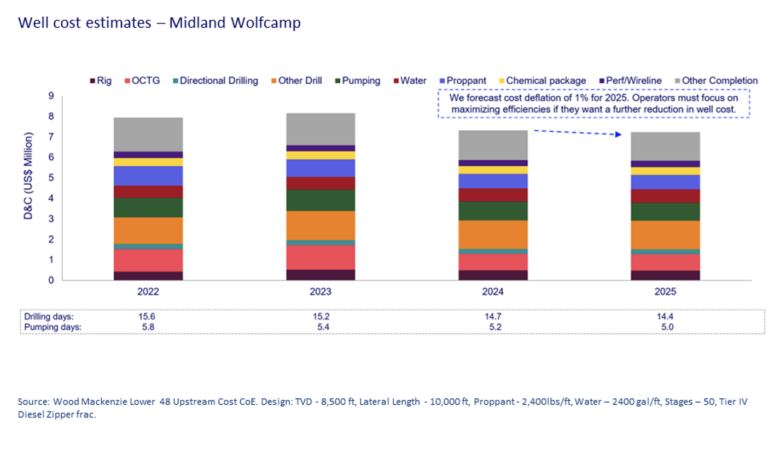

Wood Mackenzie: Lower 48 well costs expected to decline 10% in 2024

According to a recent Wood Mackenzie report, lower pricing for OCTG, proppant and diesel, combined with substantial drilling and completion efficiency gains, have helped reduce E&P costs. However, additional reduction will be difficult in this environment, as oilfield equipment and services companies (OSF) seek to keep margins high.

Wood Mackenzie forecasts that by the end of 2025, an additional 40 rigs will be active relative to current levels, led by gas plays and the Permian. However, faster drilling operations mute the need for more rigs and Wood Mackenzie estimates a 5% improvement in drilling efficiency equates to about 28 fewer rigs needed in the market.

“Both E&Ps and service providers are emphasizing significant efficiency improvements, albeit for different reasons,” said Nathan Nemeth, Principal Analyst for Wood Mackenzie. “More efficient operations are helping E&Ps drill and complete wells faster, cutting costs. At the same time, OFS firms are utilizing more efficient kit and workflows to sustain elevated prices. If E&Ps look to reduce costs more, it must come from additional efficiency improvements, as OFS pricing is unlikely to fall.”

According to the report, future cost trends depend on the outcome of the battle between efficiency and gradually rising unit pricing, meaning price trends will be operator-dependent based on the technology and equipment used.

For example, the deployment of “simul-frac” and the adoption of new electric pumping units have accelerated the trend of faster, cheaper and more reliable operations with less emissions. Since 2020, pumping efficiency has increased between 30% and 100%, depending on the technology used.

“The largest producers with the scale to commit to longer-term contracts (one to three years) for new equipment and technologies will realize additional efficiency gains and keep costs lower,” said Mr Nemeth. “Smaller producers will be most exposed to inflation headwinds — arguably motivating even more M&A activity in the region.”