Forecasts through 2050 suggest balanced mix of fuel sources while underscoring need for continued investments in hydrocarbons

Natural gas likely to emerge as biggest energy source beginning in 2026, peak in 2030s

By Katie Mazerov, Contributing Editor

Increasing demand moderated by gains in efficiency. The rise of renewables as global climate objectives come up short. Development of conventional versus unconventional resources. Political tension between developed and emerging economies. These are some of the complex forces shaping the long-term global energy outlook, according to experts and trends outlined in two comprehensive reports released this year. The global energy transition forecasts present both opportunities and challenges for an evolving oil and gas industry over the next 20 to 30 years.

“The world is producing and consuming more oil today than ever, and yet oil resources are still reasonably abundant,” said Dr Scott Tinker, State Geologist of Texas and Director of the Bureau of Economic Geology at the University of Texas. “However, as the demand for energy continues to increase globally, with more people emerging from energy poverty, oil and coal – the traditional forms of energy for transportation and electricity, respectively – are declining as a percentage of the total energy mix. That’s because other forms of energy, including natural gas, nuclear, hydro-electricity, geothermal, biofuels and renewables, are becoming increasingly viable.”

The underlying certainties are that the energy system is transitioning and the world will need all forms of energy to power the future. However, the dynamics of what that scenario will look like remain uncertain.

Understanding the Uncertainties

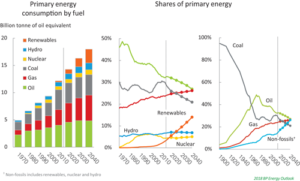

“What we don’t know about the energy system of the future is far greater than what we do know,” said Mark Finley, General Manager, Global Energy Markets and US Economics for BP. Understanding those uncertainties is a key objective of the BP Energy Outlook, 2018 Edition, which describes a scenario where, by 2040, the world’s energy mix will be the most diverse in history. In that scenario, oil, natural gas, coal and non-fossil sources each account for 25% of the energy mix. The report also ranks renewables as likely to be the fastest-growing energy source by far, increasing five-fold and providing about 14% of primary energy by 2040.

“The purpose of the report is not to predict but to better understand and identify the issues – overall economic outlook, the economics of various energy forms, rate of technological change, changing social preferences – explore various assumptions and then monitor how the energy transition unfolds in the years ahead,” Mr Finley explained.

The study, which was first published in 2011, examines energy transition by sector (industry, transportation, buildings and non-combusted), region and fuel type in a variety of scenarios. An Evolving Transition (ET) scenario suggests increasing global energy demand and consumption due to a doubling of world gross domestic product (GDP) by 2040, a trend driven by growing prosperity and productivity in India, China and other fast-growing Asian markets. While those markets account for two-thirds of the growth in energy consumption, energy demand in developed regions, including Europe, North America and Japan, will flatten, the report notes.

“Energy demand in the OECD (Organization for Economic Cooperation and Development) countries has been flat for almost a decade, reflecting that those countries’ economies are growing less rapidly than fast-growing emerging economies, as well as a greater focus in the developed world on policies to use energy more efficiently,” Mr Finley said.

At the same time, oil demand is plateauing in the ET scenario. “As a percentage of the world’s total energy mix, oil has been losing market share for 40 years,” Mr Finley said. That trend will likely continue through 2040, he suggests, citing reduction of growth in demand in the transportation sector as the biggest factor, even outweighing the uptake of electric cars. “The biggest driver of that shift is likely to be dramatic improvements in fuel efficiency of the global vehicle fleet.”

While scenarios for oil demand range from continued growth to an eventual peak and decline, even the most conservative viewpoints on potential decline rates agree that continued investment in hydrocarbon production will be needed going forward.

“The world has plenty of oil and gas resources in the ground, particularly in countries that hold a lot of conventional resources,” Mr Finley said, citing a recent BP white paper contending that the global mindset has shifted from an era of perceived scarcity of resources to an “age of abundance.”

Further, while the rate of penetration and uptake of wind and solar grow with cost reductions, particularly in richer markets, oil and gas together will still account for more than 40% of the world energy mix in 2040, even in a scenario consistent with meeting global sustainable development objectives, BP’s study suggests.

Despite a more diverse energy mix and improvements in energy efficiency, the world is currently not on a trajectory to meet climate objectives, indicating more significant changes in the energy system, including policy and technology, are still needed, Mr Finley said. “This goes to the heart of the dual challenges the industry faces – how to transform the energy system in a way that is more sustainable in terms of carbon emissions, but at the same time achieve the objective of continuing to provide energy to meet the basic needs of transportation, food preparation and heating and cooling, and raise billions of people out of poverty in emerging economies.”

Declining Consumption by 2030

In another outlook report, Energy Transition Outlook 2018, international advisory and classification society DNV GL predicts that growth in population and industry are driving energy demand up. However, beginning in 2030, the world will consume less energy, a trend that has never occurred historically, notes DNV GL Executive Vice President Ernst Meyer. “Rapid efficiency gains, technology, a continuing shift from manufacturing and heavy industry to more service-oriented economies, even in developing countries, and a decline in population growth, due to a rise in female education, will contribute to this dynamic,” he said.

The annual report, which was first released in 2017, uses a comprehensive model, with sub-models, based on assumptions to forecast energy trends through 2050. “We predict that primary energy supply will peak in 2032, after which there will be a declining need for oil and gas as a result of less absolute demand and loss of market share to renewables due to price and the need for decarbonization,” Mr Meyer said. “The in-mix of renewables is around 20% today and will grow to about 50% by 2050.”

By 2050, the primary energy mix will be split equally between fossil and non-fossil sources in the two main energy sectors: electricity/power, traditionally fueled by gas and coal, and transportation, which historically has relied on oil, the report states. Both sectors are undergoing significant transformation.

“The power sector will move in the direction of natural gas and an in-mix of renewables by as much as 20%,” Mr Meyer said. “Coal, which is currently peaking with record demand in 2018, will soon decline as coal-fired plants in large-scale countries like China modernize and transition to gas-fired plants.”

The transportation sector is also seeing a significant uptake in natural gas, but the biggest revolution is occurring with the shift to batteries as major car manufacturers develop electric and hybrid vehicles, Mr Meyer believes. “By 2033, half of all light vehicle sales will be electric.”

Despite a decline in market share, oil demand will continue to grow for another 10 years before it peaks, and then start to decline in absolute terms. Natural gas will emerge as the biggest energy source beginning in 2026 and peak in the 2030s, Mr Meyer said. “However, significant production of oil and gas will occur through 2050. Further, existing oilfields will deplete at a faster rate than the decrease in oil demand, so the industry will need to explore and drill for new oil.”

After 2035, the most efficient producers in terms of both cost and the carbon footprint from the production itself will see the biggest opportunities for growth, he added.

While the report projects that the world’s energy system will become cleaner, as well as more affordable and reliable, a significant additional uptake in technology and policies will be needed to meet the current climate goal of 2°C or less. Toward that objective, the developing world may already be leading the way.

“The ability to develop solar and wind power, along with small-scale, stable power plants to serve villages and towns, is allowing these countries to leapfrog traditional large infrastructures and transmission lines,” Mr Meyer said.

A Complex Interplay of Dynamics

The dynamics of the global energy transition pose other critical implications for the oil and gas industry going forward, suggests Dr Tinker, who also chairs the nonprofit Switch Energy Alliance, which creates non-partisan, film-based energy education materials. “The interplay of technology, demand, price, costs and policy is complex and varies globally.

“Not long ago, producers thought oil was running out – that is, until the North American unconventional boom changed that view,” he continued. “However, there is tension between North America, where producers are looking at how unconventional reservoirs can be produced economically, and many other parts of the world where conventional production is still robust. The North American industry is trying to determine when and where the rest of the world will begin to develop shale and what will motivate that.”

The political dynamic between developed and undeveloped, or emerging, markets over the use of fossil fuels and the environment is also complex. “In the West, coal and oil are often viewed as dirty and renewables as clean, but in the developing world, all forms of energy are seen as good,” Dr Tinker noted. “Carbon dioxide emissions in the developed world have been flat or declining for 40 years but are rising steeply in developing markets, especially Asia.

“Coal is lifting China and other nations from poverty, but it has emissions and mining downsides,” he added. “Developing countries are just starting to shift away from coal. In China, which still gets 65% of its energy from coal, increased production from nuclear energy, natural gas, hydro-electricity and renewables resulted in a decline in coal consumption last year.”

The renewables sector will grow – if the resource circumstances are right, Dr Tinker suggests. “In terms of atmospheric emissions, renewables are much better than fossil fuels, but scale is a problem, and the collectors – solar panels and wind turbines – required to capture the sun and wind are not renewable; the impact on the land is significant. Solar and wind energy collectors require mining, the manufacture of backup systems, such as power plants and batteries, and eventually disposal in landfills.”

Going forward, efficiency, through conservation, better lighting, heating and insulation, improved vehicle mileage and other measures will play a significant role in meeting the world’s energy needs.

“Technologies that allow us to do more with less and that can be exported to emerging economies to accelerate growth with less consumption can translate to 30%, 40% or even 50% less energy used to do the same amount of work,” Dr Tinker said. “That’s good for poverty and the environment.” DC