Drilling activity, rig demand on the rise across Africa amid deepwater exploration successes

While Namibia has been grabbing headlines, other countries like Mozambique, Nigeria and Angola are all adding to the positive outlook

By Linda Hsieh, Editor and Publisher

Momentum continues to build across the African continent, from emerging hotspots like Namibia to more mature markets like Nigeria and Angola, to everything in-between like Kenya and South Africa. When it comes to forecasts for E&P spending, rig demand and number of wells drilled, all numbers are trending upwards, signaling an overall optimism.

“The outlook for the African drilling market looks promising for the next two to three years,” said Eivind Drabløs, Vice President & Product Manager at Rystad Energy. “This is due to a steady increase in demand for oil and gas exploration and production drilling activities within the deepwater and onshore segments, fueled by countries trying to reduce import dependence, a heightened emphasis on energy security, relatively high oil prices, and appetite from international companies in Africa’s vast reserves of hydrocarbon resources.”

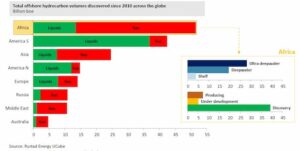

Offshore exploration has been particularly positive in the past few years. In fact, most of the world’s offshore hydrocarbon volumes discovered since 2010 have come from this part of the world, topping 50 billion boe total, Mr Drabløs noted. Key contributors to that total include Mozambique, Egypt, Tanzania, Mauritania, Angola, Senegal, Ghana, Nigeria, Cote d’Ivoire and, of course, Namibia.

“Namibia attracted global attention in 2022 when TotalEnergies announced the massive Venus oil discovery,” Mr Drabløs said. “Since then, Namibia has become one of the most exciting countries for oil and gas exploration in the world.”

Additional discoveries announced since 2022 in Namibia’s Orange Basin by TotalEnergies, Shell and Galp have only enhanced the excitement around this market. Mr Drabløs estimates Namibian oil discoveries to have a breakeven in the mid-$30s, which means that they have a good prospect of moving forward in the decades ahead even with increasing energy transition risks or in a low oil price environment.

Four rigs are currently working in Namibia: Odfjell Drilling’s Deepsea Bollsta semi for Shell; Odfjell’s Deepsea Mira semi and Vantage Drilling’s Tungsten Explorer drillship for TotalEnergies; and Odfjell’s Hercules semi for Galp. As this market continues to develop, Mr Drabløs said exploration and appraisal activities could push the rig count here up to six or seven, similar to what is seen in Guyana.

“But this depends on future exploration and appraisal success and on how the individual projects are phased and the number of operators running projects in parallel. Rhino Resources and Chevron both have up to 10 wells planned each, and we could see them award new rig contracts for work in Namibia soon. We estimate that the current discoveries could require several FPSOs and more than 100 subsea development wells to be drilled from 2026-2027.”

A total of 19 floating rigs are currently working offshore the continent of Africa – which is nearly five times the nadir of four rigs back in June 2020, when operators had suspended and canceled rig contracts during the COVID-19 pandemic. “Rystad Energy expects there is potential to reach demand for 25 floaters over the next two to three years, with rig intensity set to increase in all parts of the African continent – West, East, North and South,” Mr Drabløs said.

Besides Namibia, he added, Egypt and the Ivory Coast are also gaining momentum due to the large wave of deepwater project developments. He also expects to see increased deepwater activity in Mozambique, South Africa, Libya, Nigeria and Ghana. “We also expect robust activity levels from Africa’s largest consumer of floating drilling rigs – Angola.”

Further, there is potential to explore frontier deepwater acreages in Sierra Leone and Liberia, which have a similar geological play as Guyana, he added.

On the jackup side, activity has also continued to recover since the pandemic, albeit at a more muted level. The rig count has risen from 15 rigs working in November 2020 to more than 20 now, with the rigs mainly returning to work in Congo, Gabon, Cameroon and Angola.

“We have a stable to slightly declining outlook on shallow-water activity, as there are few new projects,” Mr Drabløs said. “The segment is expected to be focused on brownfield activities over the next two to three years, concentrated in the northern and western parts of the continent.”

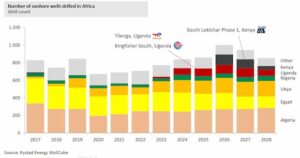

For the onshore market, Libya, Algeria, Uganda and Kenya will be key regions. “Uganda has a big project under development, Tilenga, where TotalEnergies is the operator. At Tilenga, more than 400 wells could potentially be drilled. And Kenya has a big project coming up with the South Lokichar Phase 1, operated by Tullow Oil.”

For 2024, Rystad expects more than 1,100 wells to be drilled both onshore and offshore Africa, which would be a level comparable with what was seen pre-COVID in 2019. That number had dropped to approximately 850 in 2020.

When it comes to dayrates, the western part of Africa is staying very competitive on the world stage. “West Africa is one of the three points of the Golden Triangle where floating rigs are achieving some of the longest duration and highest dayrates globally,” said Teresa Wilkie, Research Director – RigLogix for

Westwood Global Energy Group. “We actually saw the first plus $500k dayrate for work in West Africa announced in November 2023, a one-well campaign for the OceanBlackRhino offshore Guinea Bissau.”

Utilization for drillships has also risen impressively since January 2019, when it was at 65%. That rate hit 100% in late 2022 and stayed at that level through most of 2023, according to Westwood data. This year, utilization has fallen back to the 80% range.

Westwood data also show a significant recovery for semisubmersible utilization, which jumped from a meager 22% in January 2019 to 100% by May 2023. Utilization dipped later in 2023 but then bounced back to 100% in early 2024. DC