Deloitte: Despite low prices, shale gas stands as game-changer for US energy producers

By Katie Mazerov, contributing editor

Favorable pricing and American ingenuity triggered the shale gas revolution, and those forces will drive a resurgence in the future. That was the consensus of executives from Deloitte during a webcast presentation, “Shale Gas: Leveraging this Boom to the US Economy,” on 22 November.

With US natural gas prices falling to $3.50 per MMBtu or less, operators have shifted their focus to the liquids-rich and oil plays in North America. However, the abundance of shale gas and its potential as a clean energy source for power generation, as well as its potential for export, makes it a game-changer for helping the US achieve energy self-sufficiency, said Peter Robertson, independent adviser to Deloitte’s oil and gas group.

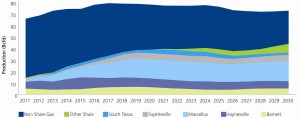

“Shale gas production grew from 2% in 2005 to more than 20% in 2010 of total natural gas production,” Mr Robertson said. “Liquefied natural gas (LNG) facilities built prior to the shale boom in anticipation of large import volumes are sitting idle now, and some people are even talking about converting those facilities to export LNG.”

In a market study, “Navigating a fractured future: Insights into the future of the North American natural gas market,” Deloitte found:

- Low prices will create demand;

- But higher prices will be needed to sustain production to meet demand;

- Gas demand for power generation is likely to increase significantly during this decade;

- The large volume of domestic natural gas supplies could keep prices relatively low even as demand increases; and

- By 2030, shale will become the dominant supply source in the US for natural gas.

Over the next 10 years, gas prices will rebound into the $4 to $6 range, and price basis differentials among Henry Hub, the west and the northeast will shrink, eventually converging in the mid-2020s, Mr Robertson said. “The US uses about 25 trillion cubic ft (tcf) of gas per year. But as demand increases, it will be the cost of production – drilling costs, higher taxes – that will drive prices higher. The good news is that this is a very repeatable process, and we’re getting better at it.”

Economic implications

Among the key implications of the shale gas abundance on the US economy are the fact that domestic natural gas prices are considerably lower than in most other parts of the world; the positive impact on other industries, such as petrochemicals, power generation and other related manufacturing; and the resulting employment and increase in gross domestic product (GDP). A key barrier is public perception about environmental risks.

Natural gas prices in Europe and Asia are two or three times higher than US prices, said Roger Ihne, principal and Mid-America Oil and Gas Client Portfolio leader at Deloitte. “The US has the second-lowest cost market for natural gas, behind the Middle East. Innovations in technologies to turn natural gas into a more liquid form, such as diesel, and efforts to create an LNG export market will have a huge impact. “Lower US LNG imports means reduced trade deficits,” he continued. “Over the last five years, the US has saved over $60 billion in the amount of the energy it would have had to import in LNG from other nations.” The natural gas market also created nearly 400,000 direct and indirect jobs from 2005 through 2010, he added.

Worldwide demand for natural gas continues to increase at nearly 2% a year, with the Middle East and Asia, including Australia, being the highest-growth regions, Mr Ihne said. Global gas production is also expected to increase, from 111 tcf in 2008 to 180 tcf in 2035. Current estimates put worldwide technically recoverable natural gas at 6,622 tcf, with 1,931 tcf in North America.

“We have a rare opportunity to produce energy at an affordable rate for the US and the world,” Mr Robertson said. “Innovation in this industry has always come from the US, and we remain at the front end of this boom. But we must do it right, from operations to public relations to environmental stewardship.”