China’s upstream industry to shift focus to domestic natural gas to meet cleaner energy demand

Steep production declines from aging oil fields and capital spending cuts have directly impacted China’s oil production. Against the backdrop, the new guidelines unveiled by the government will break the dominance of state-owned oil companies and force the country’s upstream industry to shift focus to domestic natural gas, according to GlobalData.

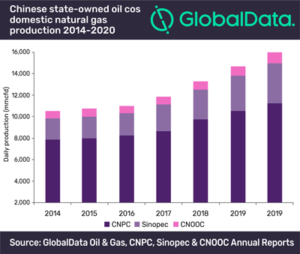

Chinese state-owned oil companies China National Petroleum Corporation (CNPC), China Petroleum & Chemical (Sinopec) and China National Offshore Oil (CNOOC) operate more than 90% of China’s oil-producing fields.

However, prolonged weakness in oil prices, mature conventional reserves, slowing growth in demand and government directives have forced the mainland energy giants to trim capital spending and shift their focus to unconventional resources.

CNPC is the largest national oil company and dominates China’s onshore production. CNPC plans to commercialize its domestic unconventional resources and keep investing in large gas projects in the Tarim, Ordos and Sichuan Basins to increase its total domestic natural gas production from its current level at 9,500 million cu ft/day (mcf) to 11,500 mcf by 2020, of which shale gas will account for 10%.

In line with government directives, Sinopec is also growing its natural gas business, especially unconventional production, which will drive its operational focus over the near term. CNOOC is the smallest of the three but dominates China’s offshore sector. Its investment priority is the core domestic portfolio for offshore China.

The Chinese government also unveiled new guidelines as part of the country’s 13th five-year plan, to open up more acreage to independent participants to diversify investment and participation in the upstream sector. A new mechanism will be implemented to involve the licensing of upstream blocks through a rendering system and their relinquishment upon expiry of the exploration period.

“China relaxed its policy in 2014 to allow private sectors to explore unconventional resources, such as shale gas. Now under the new scheme, eligible companies will be able to apply for licenses to develop conventional oil and gas reserves, which used to be dominated by the NOCs. The reform is also expected to drive the growth of the natural gas market and enhance the capability of sustained energy supply,” Cao Chai, Oil and Gas Analyst at GlobalData, said. “China’s upstream industry is shifting focus to domestic natural gas to meet the cleaner energy demand, which is influenced by the government policies. In the meantime, the latest reform breaks the dominance of the Chinese NOCs by inviting competitions in the upstream exploration and development.”