Oil & Gas Markets

US energy firms reported revenue surge in 2024

More than three-quarters (78%) of companies that participated in the new Survive & Thrive study from the Energy Industries Council (EIC) reported 2024 as a record year for revenue growth. Those companies reported an impressive average growth rate of 24%, the same as in 2023, reflecting their resilience and adaptability.

When asked to forecast their growth rates for 2025, 86% said they expected another 24% average growth next year. However, the EIC took a more cautious view. The optimism reported by the participating companies, the EIC stated in the report, “may reflect the 2025/26 budgets that companies have set, or been forced to accept by their owners, due to their strong growth track record in the previous two years.”

It continued: “Privately, many interviwees shared that they now worry they will not be able to hit these lofty budget targets due to increased market headwinds.” The EIC report further noted a concern that many companies will miss their 2025/26 targets, leading to cost and job cuts later in the year.

Middle East dominance

By region, the Middle East saw 90% of companies experience record growth in 2024, the highest percentage of any region. Further, the Middle East reported the highest average company growth rate at 68%, significantly outpacing other regions, which averaged between 6-20%.

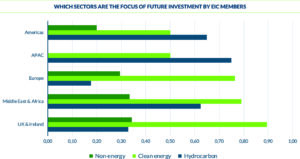

The EIC noted that Middle East countries are embracing diverse energy technologies, which is allowing for multiple revenue streams to aid economic stability and growth. In particular, there is significant investment in both hydrocarbon and renewables in the region, with supply chain revenues from oil and gas being reinvested into “greener” technologies.

In policy terms, regions with less reliance on oil and gas are moving more quickly away from it. This is not necessarily driving growth or profitability, but it does drive faster transition to lower emission technologies as a percentage of the overall primary energy mix.

Energy transition revenues down

The EIC also found a reduction in the number of companies reporting success from energy transition projects. Energy transition revenues (i.e., hydrogen, carbon capture, floating offshore wind) dropped from 9% to 6%. “This decline raises concerns about the effectiveness and feasibility of current net zero investment, policy and regulatory strategies,” the report stated.

Click here to access the EIC’s 2025 Survive and Thrive report.

Upstream oil and gas gets boost from Trump’s OBBBA

US President Donald Trump’s One Big Beautiful Bill Act (OBBBA) represents a significant shift for US energy markets, according to Wood Mackenzie analysis. It provides a big boost to the upstream industry, as it:

- Mandates quarterly lease sales in nine western states;

- Adds 30 US Gulf lease sales over 15 years;

- Reduces onshore royalty rates from 16.67% to 12.5%;

- Reopens Alaska’s Arctic National Wildlife Refuge for competitive leasing;

- Delays methane fees until 2035;

- Allows full deduction of intangible drilling costs; and

- Extends massive bonus depreciation for production real property through 2031.

On the other hand, the OBBBA introduces restrictions for renewable power investments and significant policy uncertainty that could impact long-term investment decisions in assets with 30-year-plus lifespans.

“With such dramatic uncertainty facing new power supply investments, thermal retirements are likely to be deferred, power prices will rise and large loads will be delayed,” said David Brown, Director, Energy Transition Research for Wood Mackenzie. “Without permitting reform, new large load tariffs and domestic technology innovation, the US will risk the edge it has in the global AI race.“

Energy storage also faces challenges. While it maintains Investment Tax Credit eligibility through 2030 under the OBBBA, storage faces onerous Foreign Entity of Concern restrictions that likely preclude purchasing Chinese cells. The risks and costs of supply chain shifts will put downward pressure on storage growth.

Carbon capture, utilization and storage and geothermal will both get boosts, however. Carbon capture developers benefit from expanded 45Q credits, with enhanced oil recovery receiving the same value as geological sequestration. Geothermal retains its primary Inflation Reduction Act incentives and will benefit from mandated annual lease sales, replacing the previous biennial schedule.