Upbeat outlook for Africa’s offshore rig market as utilization stabilizes

Westwood Energy analysis shows marketed utilization for jackups has hit 90%; floater segment also poised for growth following encouraging discoveries in 2019

By Jessica Whiteside, Contributor

Hot on the heels of last year’s commercial-grade discoveries, improved supply-demand dynamics appear to be priming the African rig market for potential future growth.

At the IADC Drilling Africa Conference in Accra, Ghana, on 18 February, RigLogix head Terry Childs of Westwood Energy Group described the continent’s drilling outlook as showing “promise” and “potential.” But he had a caveat.

“There is quite a bit of potential here. The underlying theme, though, is time,” Mr Childs said, noting that projects may not start when they should or when they’re scheduled.

Some of the conditions needed to nurture that potential are starting to emerge. These include greater stability in global oil prices, with the consensus oil price outlook touted to remain within $65-$75/bbl for the next few years; improved rig utilization rates; and a series of encouraging discoveries that are reinforcing operator interest in offshore Africa as a positive environment for exploration investment.

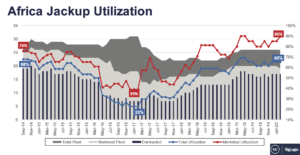

Jackup supply stabilized

RigLogix data suggests that the world’s offshore rig fleet remains oversupplied, with drillships sitting at 68% marketed utilization, semisubmersibles at 69% and jackups at 79%.

The picture for jackups in Africa, however, is significantly better. Back in September 2014, the marketed utilization rate for jackups on this continent was 76%. After the industry downturn hit, the disparity between available and contracted jackups sank utilization to a dismal 39% by early 2017.

However, after a few years of fluctuations, demand has gradually inched back up to approach the marketed supply. In fact, as of early 2020, the marketed utilization rate for jackups in Africa hit 90%, with 18 of 20 available rigs under contract. An additional six units are cold-stacked, and Mr Childs said the region’s jackup supply should remain relatively stable for the rest of the year.

Most of the jackup activity can be found in Angola and Nigeria, he added, but demand will also come from Cameroon and Gabon.

In terms of age, the jackups in Africa are a fairly even mix of newer and older rigs. Fourteen – a little over half of the fleet – are 15 years or younger, and 11 of the remaining 12 are 35 years or older. “As you can see with the utilization, age isn’t keeping those rigs from working,” Mr Childs said.

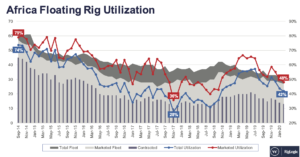

The future is floating

While jackups will continue to be a presence in the region, he noted that floating rigs are definitely the future for offshore Africa. “There’s certainly a lot more going on in that arena,” he said.

Unlike the jackup market, which is currently dominated in this region by two companies – Borr Drilling and Shelf Drilling, each with five contracted units – there are no dominant players in the floater market. Maersk Drilling, Pacific Drilling, Saipem, Seadrill/Sonadrill, Transocean and Valaris all have floating rigs working here.

“You see a lot of different companies that all have two rigs here,” Mr Childs said. “I think that speaks to how a lot of rig owners … view this market on the floating rig side and the potential that it has.”

The exploration and appraisal activity undertaken in the region last year underscores the growing importance of floaters. Mr Childs reported that, of the 18 exploration and four appraisal wells completed off the coast of Africa in 2019, all but one involved floating rigs. Although the depth of individual wells drilled in 2019 spanned from 380 ft to more than 10,000 ft, the average water depth was 5,889 ft.

Despite this, the floating rig fleet has not gained back the activity level it enjoyed before the downturn. Today, drillships dominate Africa’s floater market, with 24 drillships and only four semisubmersibles.

The marketed utilization for floaters as of early 2020 was only 48%, but Mr Childs said the number is a bit misleading because of the 13 rigs stacked at Las Palmas in the Canary Islands, which is included in the African data. Still, that utilization rate indicates an improvement on the rock-bottom 36% recorded in November 2017.

Mr Childs said he expects to see some movement in the floater supply as the year goes on. Three floating rigs are scheduled to leave the African market in 2020, but two more will be coming in for contracts later in the year. In addition, some of the stacked units in Las Palmas are reportedly being bid for work in other parts of the world and could leave the region, reducing local supply.

He presented two forecast scenarios for floating rigs in 2020. The first, predicated on every project starting on time, suggests incremental floating rig demand will double in 2020 – pushing utilization into the 92% range – and reach 23 units on hire by Q1 2021. However, Mr Childs said there’s more likely to be a more measured improvement trend – with 62% utilization, postulating that as many as nine programs slated to begin in 2020 could slip into March 2021 or beyond.

“We think it’s a very positive outlook for this region, assuming that the timing of these things doesn’t keep getting pushed to the right,” he said.

Dayrates stable

Dayrates for jackups in Africa are doing well compared with some other parts of the world but are still far off the pre-downturn heyday. The average dayrate for jackups in Africa is now around $65,000, down from $162,000 in September 2014. However, rates appear to be responding to utilization improvements, with recent fixtures for modern, high-spec units mostly over $90,000, Mr Childs said.

For floating rigs, dayrates have fallen far from the 2011-2013 period, when rates routinely topped $600,000. Most floating fixtures are now longer-term contracts said to be in the $280,000 range, according to Westwood data, though there are some outliers with higher figures.

High-impact results

Africa’s 2019 offshore drilling programs generated 11 high-impact wells, including two each in Angola, Egypt, Ghana, Mauritania and Senegal, as well as one in South Africa. The successes included two major discoveries by BP that were among the year’s biggest discoveries worldwide – the Greater Tortue Ahmeyim-1 well offshore Senegal and the Orca-1 well offshore Mauritania.

Such high-impact wells made up seven of the 10 exploration wells confirmed as commercial discoveries in Africa in 2019 – and their success is inspiring further interest. BP, Total and several other companies are planning to return to the region this year for further exploration and appraisal work.

“You’ll certainly see work going on as a result of all the discoveries made,” he said. “Again, it’s another positive indication of the potential that this region holds.”

Mr Childs’ presentation described a 2020 drilling program for Africa featuring 27 planned or potential wells, 12 of them not covered by a current rig deal. Of the total, only three are appraisal wells and the remainder are focused on exploration. Operators will be pursuing high-impact wells off every coast, he said.

“That part of it certainly looks promising,” he said.

Subsea trees uptick

Another trend that points to a rise in demand for rigs in Africa is installation of subsea trees. More than 1,300 such installations are expected worldwide from 2020 through 2024, including close to 200 in Africa, according to Westwood.

“That’s another indicator that there will be quite a bit of rig demand generated as some of these projects move forward,” Mr Childs said. “It just all builds up, and it should make for a good market going forward.” DC