2019 NOV census shows robust international land rig utilization but softening in North America onshore

Except for harsh-environment semis, global offshore fleet continues to see a very slow recovery, although 69% utilization is the highest it’s been since 2015

By Tony Crawford, Tarjei Myklebust and Aylar Ibrahimoglu, National Oilwell Varco

Rig demand in this year’s National Oilwell Varco census has shifted in both areas of geographic activity and in rig type. Late 2017 and 2018 demonstrated promising improvements in global land utilization rates and modest recovery in offshore drilling. 2019 can be characterized by strong international rig utilization and demand for land, steadily improving demand for offshore and weakening demand for land rigs in North America. Offshore rig demand in North America is improving slightly, but it has yet to see the type of growth that international offshore is experiencing.

US land rig demand in the 2019 survey period – from 6 May through 20 June – decreased by 7% to 1,121 rigs, compared with 1,209 units a year earlier. Canadian land rig activity dropped sharply by 18% to 154 rigs, down from 188 units in 2018. These numbers translate into 61% utilization in the US and 35% in Canada, down from 65% and 42% last year, respectively.

International land rig activity during the census period was assessed at 2,365 units. Overall utilization rose to 88% from 77% in 2018. This is the result of increased aggregate demand for international land rigs in the Middle East, Asia Pacific, Africa and South America, as well as a change in international reporting methodology in the oil and gas community and some financial markets due to Ukraine now being counted as part of Europe rather than the Former Soviet Union.

• Contractor-owned rigs belong to companies whose primary business is offering drilling contracting services.

• To be considered active, a rig must be drilling at least one day during the 45-day qualification period during the early summer each year.

• Only workable rotary rigs are included; cable tool rigs are excluded.

• To be considered as available, a rig must be able to go to work without requiring a significant capital expenditure.

• Rotary land rigs stacked for an extended period of time, typically three years or longer, are not counted as available. Offshore rigs must not be stacked for longer than five years.

• A rig must be capable of, and normally employed for, drilling deeper than 3,000 ft. Therefore, some shallow drilling rigs are excluded. This ensures well-servicing rigs are not counted.

• Electric rigs include all those that transmit power from prime movers to electrically driven equipment.

• Inland barges include barge-mounted rigs that may be moved from one location to another via canal, bayou or river and drill in sheltered inland waters.

• Offshore rigs include stationary platform units (both self-contained and tender-supported), bottom-supported mobile units and floating rigs (both drillships and semisubmersibles).

Census Highlights

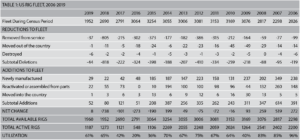

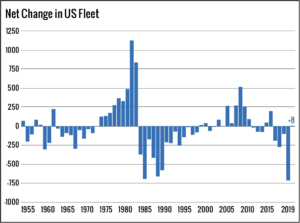

- The available US fleet, both land and offshore, had a net increase of eight rigs for a total of 1,960 available rigs. This change is the result of 44 rig deletions, offsetting a total of 52 rig additions (Figure 1).

- Utilization of the US fleet, combined land and offshore, decreased to 61% from 65% in 2018 (Figure 2).

- Overall international land rig utilization rose and now stands at 88%, up from 77% in 2018.

US Fleet

An available rig is defined as one that is currently active or ready to drill without significant capital expenditure. To be considered available, a land rig must not have been stacked for longer than three years. For offshore rigs, that criteria is five years.

US Rig Additions

There were 29 new rigs manufactured and delivered to the US market at the time of this year’s census (Table 1). In land drilling, demand for pad-capable rigs is now the driver for new orders, as some drillers have fully utilized their existing fleet and require newbuilds to meet future demand. The US demand for horizontal drilling currently exceeds the supply of the highest-spec drilling rigs. In addition to driving new rig orders, some of the larger contractors are working to upgrade some of their rigs to meet these requirements. Increased setback capacity, higher-torque top drives, walking systems and enhanced pipe-handling capabilities are among the most popular upgrades for the US fleet.

US Rig Attrition

If it can be determined that a rig is cold-stacked, it is removed from the count of the available fleet. Extensively damaged rigs are also taken out of the count. Rigs that have moved to other countries are not counted as available in the US; however, they may show up in the international tally.

All rigs removed from the fleet in each of these cases are totaled as “Deletions to the US Fleet.” There was a total of 44 rig deletions this year, compared with last year’s 818-unit decline and a 10-year average of around 266 deletions per year.

The majority of deleted rigs continues to be in the “Removed from Service” category. This number dropped to 37 units in 2019, a sharp decrease from 805 in 2018. In the land segment, most of these removals came from rigs being inactive for more than three years. There were also a number of rigs that were sold at auction to international markets and/or sold for parts. At least one land rig in the US was taken to another country since the last census.

There were four fewer drillships and one fewer semisubmersible in the US offshore fleet in 2019 compared with 2018, while the number of offshore platforms decreased by three. This led to a reduction in the US offshore fleet of roughly 6% compared with the previous census period.

Two rigs have been scrapped in the US Gulf of Mexico since the previous census, as have one semisubmersible and one platform rig. The remaining rigs were either moved to new locations outside the US or were no longer counted as part of the rig census due to the amount of time they have been inactive.

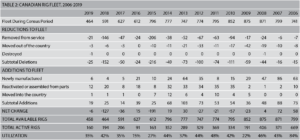

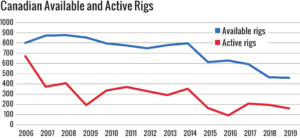

Canadian Fleet

The Canadian available fleet dropped by 1% to 458 units during 2019. Most of these fleet deletions are associated with rigs that were never reactivated after being laid down.

Additionally, at least three rigs moved from Canada to US land drilling markets, including the Permian Basin, as Canadian rig owners sought better returns for their assets. These movements out of country continued after the census period. In contrast, six newbuild rigs entered the Canadian market in the past year, and 12 units were reactivated. The net deletion of six units keeps the available Canadian fleet at its lowest level in 14 years.

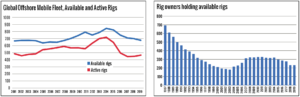

Global Offshore Mobile Fleet

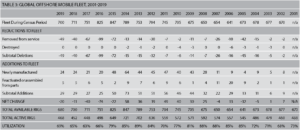

Global offshore rig utilization increased by 4% compared with the 2018 census period and by 6% compared with the second half of 2017, when global offshore rig demand bottomed out. While the 2018 utilization increase was driven mainly by a reduction on the supply side, 2019 utilization was a result of both a reduction in supply and an increase in demand.

A total of 29 rigs entered the offshore fleet during the census period, the same number as in the previous period, while 49 rigs were either removed from the fleet or put into long-term stacking. Although some cold-stacked rigs might be reactivated as utilization increases, many of them will likely be demolished due to increased competition from new rigs entering the fleet and high reactivation costs.

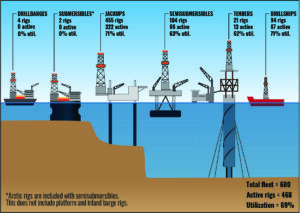

The utilization for the global offshore mobile rig fleet was 69% during the census period. This is the highest it has been since 2015, when utilization rates were dropping rapidly. The 2019 utilization rate is also comparable to rates seen in 2011 and 2003. The 2019 utilization rate is, however, 20% lower than the peak utilization rates seen in 2013.

The number of available rigs in the offshore mobile fleet is 680. That is roughly the same as it was in 2008, when the number of deliveries per year started increasing rapidly to cover an expanding market and rising demand for deepwater rigs. Although some similarities do exist in today’s market to the conditions seen in 2008, at this time no surge in rig deliveries is expected in the near term.

US Drilling Activity

The methodology used to count active rigs for the NOV census is different from other published rig counts. While most other rig counts look at weekly activity, the NOV census counts a rig as active if it has drilled at any time during a defined 45-day period in early summer. For 2019, the window of activity was 6 May through 20 June. This methodology has been set as standard for the NOV rig census since 1955.

The number of active rigs in the US dropped to 1,187 units during the 45-day census period in 2019, which is 7% lower than the number of rigs observed in summer 2018. Overall, US utilization decreased to 61%, compared with 65% in 2018.

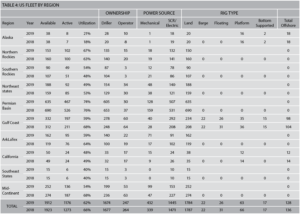

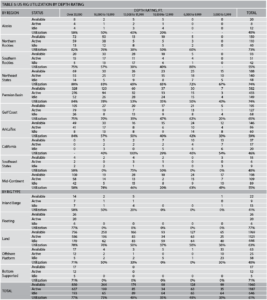

Census results for the US are also calculated by region (Table 4). The regional figures are a combination of land and offshore statistics.

Looking at the US land fleet in more detail (Table 5), rigs can be compared by their drilling depth capacity. The largest rigs – those with a drilling depth capacity greater than 20,000 ft – had the highest utilization rate, at 77%, while those in the 10,000- to 12,999-ft and 3,000- to 5,999-ft ranges had the lowest utilization rates of 35% each.

Canadian Drilling Activity

Year-over-year statistics for Canada have fluctuated with commodity prices and the timing of the spring thaw, when rig moves are restricted in environmentally sensitive areas.

Canadian rig activity this year dropped by 18%, as the active rig count totaled 160 units during the 45-day window, with utilization at 35%.

Segmenting the Canadian fleet by depth capacity, it can be seen that 17% of the available rigs are rated between 10,000 and 15,999 ft, while 43% of the units are rated beyond 16,000 ft.

Canada’s modest offshore fleet of three platforms, three semisubmersibles, one drilling barge and one jackup remained stable, both in terms of number and utilization compared with the 2018 census. The utilization rate for the offshore fleet is 75%.

International Land Rig Utilization

The 2019 international land rig availability is estimated at 2,654 units, of which approximately 2,365 were active during the census period. This yields an utilization of 88% and represents an 11% growth over last year’s 77%, due to an increase in international demand.

Latin America was the region with the lowest land rig utilization, estimated at 73%. Venezuela, Brazil and Argentina are countries in the region with slight declines in rig activity, while Colombia and Mexico are seeing their utilization rates climb and will require the reactivation of old rigs or the addition of new rigs to satisfy demand.

Global Offshore Mobile Activity

A total of 24 new rigs were delivered since the last census period, which is the same as the previous year, but well below the average levels seen between 2009 and 2016. The trend of offshore drillers delaying delivery of their rigs from the yards has continued, as most of them are focusing on getting work for their current fleets. Another reason for delaying deliveries is that offshore drillers are wary of negatively impacting the slow recovery in dayrates.

After bottoming out in 2018, the drillship segment is finally starting to see an increase in demand. Utilization has grown from the low of 59% in 2018 to 71% in the current census period. Jackups have also hit 71% utilization, with modern units seeing much higher utilization rates than standard units.

Although utilization has increased for both segments, dayrates have remained suppressed so far due to new rigs being introduced to the fleet.

This has not been the case for the harsh-environment semisubmersible segment, which was the first segment to rebound. There is almost no available uncontracted supply, which has led to dayrates increasing significantly for this segment in the past two years.

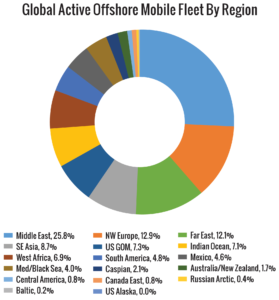

A quarter of the world’s offshore mobile rigs are located in the Middle East, most of which are jackups. Northwest Europe accounts for 12.9% of the mobile offshore rigs, consisting of mostly high-spec harsh-environment jackups and semisubmersibles. The third-largest region in terms of number of mobile offshore rigs is East Asia, with a 12.1% share of the rigs. The US Gulf of Mexico is the largest region in terms of the number of active drillships.

US Industry Trends

The number of individual rig owners holding available rigs is quantified annually. For 2019, the number of rig owners is 231.

In the 2019 census, drilling contractors owned 88.5% of all US drilling rigs, and operators owned the remaining 11.5%. This is roughly the same ratio of drilling contractor versus operator rig ownership as in years past. As the US market continues to tighten, it’s possible that some operators will consider acquiring their own rigs to ensure that they can execute their drilling programs.

Super-spec land rigs continue to be in demand in the US. However, most drilling contractors now believe that the supply and demand for these rigs have nearly equalized, thus indicating a flat trajectory for super-spec rig demand in the coming months.

US Forecast for 2020

Drilling activity in the US is expected to continue trending slightly downward over the next year. Rig counts across the US have diminished, and demand for top-tier land rigs is starting to plateau. It’s now estimated that the market is most comfortable when rig utilization for high-spec land rigs is in the 85-90% range.

In terms of the size of the available US land fleet, retirement levels are considerably lower this year compared with the average level of annual retirement over the past 10 years. This is primarily due to smaller CAPEX budgets and drillers doing more over longer periods of time with existing assets rather than investing in new assets.

For offshore drilling, the prospects for recovery look positive in the US Gulf of Mexico, although the growth will most likely be slow and gradual. This trend is expected to continue until the early 2020s, when market growth combined with the declining condition of the aging offshore fleet are expected to reach a point that will catalyze a newbuild order cycle. DC

National Oilwell Varco’s 66th Annual Rig Census was prepared by Tony Crawford, Director, Business Development and Industry Analysis; Tarjei “TJ” Myklebust, Analyst, Offshore Market; and Aylar Ibrahimoglu, Analyst, Land Market.