Operator spending cuts may lead to 10% fall in 2020 land rig count

US onshore activity likely to suffer as cautious operators rein in budgets, plan to drill and frac fewer wells next year

By Linda Hsieh, Editor & Publisher

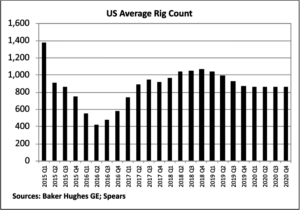

Another tough year is in store for the US land drilling and completions market in 2020. John Spears, President of Spears and Associates, said he expects the Baker Hughes rig count to fall by 10% next year. “That’s a function of the fact that the operators are going to be extremely careful about their capital spending programs. They are going to be mostly focused on trying to improve profitability and returns to shareholders, and not so much in terms of growing production. We think that means activity will move lower in the US next year.”

Under an assumption of oil prices staying in the mid-$50s, the US land rig count is expected to average 860 in 2020, he said. That compares with an average of 960 for 2019.

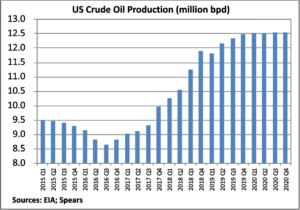

A similar reduction is expected for the number of wells drilled – falling from 23,000 this year to 21,300 next year. In this scenario, Mr Spears also forecasts fairly minimal growth in US crude oil production in the coming year, which will rise from an average of 12.3 million barrels per day to 12.5 million barrels per day.

While the major operators – which account for 20% of working land rigs in the US – have been increasing their activity this year, “the sense I get is that most of them are at a point now where they want to hold at these levels, and just run it for a few years. They’re sort of in a holding pattern,” Mr Spears said.

In contrast, the publicly traded independents and the privately held operators have both been sharply pulling back their activity this year and will continue to be more cautious about their spending for the foreseeable future. This means that US drilling and completion spending will most likely trend downwards in 2020. Mr Spears estimates such spending will total $134 billion in 2019 but fall to $120 billion next year, a similar 10% decline to the rig count.

When looking at rig rates, he said that they have actually increased by about 10% between mid-2018 to mid-2019. “Some of that comes from the enhanced suite of services that drilling contractors are offering, like directional drilling. Some of it reflects what was a pretty tight rig market over those 12 months. However, from mid-2019 to 2020, I think we’ll see rig rates soften again just because we’re right in the middle of activity falling, which will put pressure on dayrates.”

Not surprisingly, the Permian Basin, where about half of all working US land rigs are located, will continue to attract the bulk of investments in 2020. “The areas that will probably be the weakest next year are going to be those shale gas plays around the Marcellus, Utica and Haynesville,” Mr Spears said. “The operators in those areas are so driven by gas prices, which are so low that they’re under a lot of pressure to shrink activity.” Parts of the Eagle Ford are also gas-prone, he added, which means it could also see a bigger decline than the US as a whole.

Spot natural gas prices, which averaged $2.30 per million BTU in 2018, will likely fall to an average of $1.90 this year. In 2020, natural gas prices are forecast to rise up slightly to around $2.25, helped by a drilling slowdown in gas-rich areas. “That’s an improvement, but still well below breakeven for most places,” Mr Spears pointed out.

Looking at cost per well, he noted that there will likely be a 2-5% reduction next year. And the cost of drilling – which represents about 20% of overall well costs – will probably be the weakest area. Prices for drill pipe, casing and tubing have already fallen significantly this year but will likely stabilize at current levels. And stimulation costs are also depressed, especially for pressure pumping, he said. Frac sand prices, on the other hand, have been rising slightly this year – albeit from very low levels – as the proppant market began to normalize supply and demand; they will likely stabilize in the coming months.

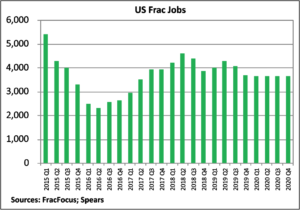

Mr Spears forecast that the overall frac market – contrary to what might be suggested by reportedly high numbers of drilled but uncompleted (DUC) wells – will be soft in 2020. Spears and Associates, which recently began tracking frac activity in addition to drilling activity, expects the number of frac jobs in the US to fall from 16,100 in 2019 to 14,600 in 2020.

“The operators in (the shale gas plays) are so driven by gas prices, which are so low that they’re under a lot of pressure to shrink activity.”

– John Spears, Spears and Associates

At the end of August 2019, the US Energy Information Administration (EIA) was reporting 7,950 DUCs in the United States’ tight oil and shale gas regions. “We think that number is closer to 5,000 wells,” Mr Spears said. “What we found is that about three months elapse between the time drilling is complete and when the frac job takes place. So normal inventory is about three months of drilling activity, and at today’s levels of drilling, that would equate to about 5,000 wells… Unfortunately, if the frac backlog is not as large as reported, then there’s also not a pent-up demand for frac work to get done.”

Still, despite a soft frac market, Mr Spears said he expects the industry to push ahead on hydraulic fracturing innovations. In fact, this is the part of well construction where he sees the most change taking place. “Operators are continuing to optimize the process – how close they put the laterals together, how close they put the frac stages, how they do the frac jobs. Everything is being optimized from both a cost and a productivity standpoint. This has been the biggest area for a few years, and I think it will continue to be the main focus for a lot of companies going forward.” DC

This article includes reporting by DC Contributor Emily Lincke.