Southeast Asian upstream M&A could hit $14 billion

According to a new report by Wood Mackenzie, Southeast Asia could take center stage in the region’s upstream M&A activity in 2019, with up to $14 billion worth of assets potentially switching hands.

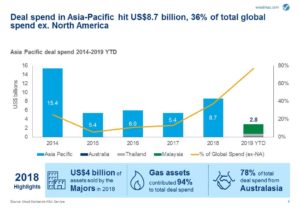

Upstream M&A in the Asia Pacific region is off to a strong start this year, with $2.8 billion worth of deals already announced in Q1 2019. This includes Murphy Oil‘s $2.1 billion divestment of its Malaysia business to Thailand’s national oil company PTTEP. With the exit, Murphy Oil will focus on its core positions in US Gulf of Mexico, North American onshore and Latin America.

“We have observed for a while now the trend of oil majors exiting countries in the region as their portfolios mature and contracts expire. Drawn to more commercially compelling opportunities elsewhere, Southeast Asia is also becoming a non-core region for large- and mid-cap international oil companies (IOCs),” Andrew Harwood, Research Director at Wood Mackenzie, said.

Asia-Pacific upstream deal spend hit $8.7 billion last year, accounting for over a third of global spend, excluding North America. This increase in activity was primarily driven by a reshuffling of portfolios in Australia and New Zealand. However, Southeast Asia is set to feature more prominently in 2019, with more than 5.4 billion BOE of predominantly gas assets potentially coming to market.

Alongside retrenchment by traditional E&P players, 2019 M&A potential will also be driven by regional NOCs farming down assets to bring in technical and financial partners to manage newly expanded portfolios. In fact, two of the region’s biggest portfolio owners, PERTAMINA and PTTEP, must spend a collective $32 billion over the next five years to maintain their domestic supply outlook.

“Pre-development projects that have been stalled during the oil price downturn is also another theme for smaller players and new entrants to take note of. As economic conditions improve, there could be new owners and new capital looking to monetize these assets,” Mr Harwood added.

With the region’s M&A stakes stacked high, it begs the question: Who are the potential buyers?

“The M&A bear view would be that there is a smaller universe of potential buyers, but we think regional NOCs, Middle Eastern operators and regional specialists continue to be active players shoring up assets in Southeast Asia,” Mr Harwood said.

“Recent global corporate activity will have a knock-on effect on Southeast Asia portfolios. And changes in the regional investment climate following recent elections, fiscal adjustments and exploration success could spur new activity. The dominoes in Southeast Asia’s M&A space have already started to fall,” Mr Harwood concluded.