Asia Pacific: Utilization on the rise but dayrates still refuse to budge

Demand for rigs is swinging upward, but drilling contractors are still challenged to maintain safety, efficiency amidst extreme cost focus

By Linda Hsieh, Managing Editor

- Increased drilling activity by national oil companies is boosting rig utilization rates, particularly for local drilling contractors.

- Continued oversupply will limit potential for dayrate improvement, likely through 2018; more rig scrappings are need to achieve a balanced market.

- Drilling contractors are increasingly being asked to provide more services at the rig site, but companies must consider additional risk vs potential rewards.

Much of the work that is being awarded in this region are short-term programs that are not in continuation. This means that rigs are still frequently going idle for short periods of time, even though overall there has been more work to go around.

Local drilling contractors have also been seeing higher fleet utilizations over the past few months, another indication that the market is tightening. National oil companies in the region typically give preference to their local drilling companies, so it makes sense that local drillers would see improvements in rig utilizations before other companies do.

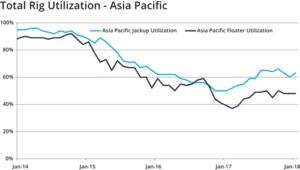

Jackups saw 63% utilization in 2017 on a total rig basis, which includes cold-stacked rigs but excludes newbuilds under construction, according to Clarksons Platou Asia. That compares with 50% utilization a year ago. Floater utilization also crawled upward, reaching 48% in 2017, compared with 39% in 2016.

Another positive sign can be seen in contract lengths for jackups, which averaged 216 days in 2017 versus 187 days in 2016. “2017 has had a nice mix of one year-plus contracts, mixed with short well-based contracts,” Morten Haugan, Managing Director of Offshore Rigs for Clarksons, said. Although contract lengths for floaters did not fare as well – the average dipped to 93 days last year versus 136 in 2016, Mr Haugan noted his optimism for seeing upward movement this year. “I would not be surprised to see contract lengths edge higher in both markets based on tendering activity. We may see several one- to two-year opportunities for jackups and six- to 12-month opportunities for floaters,” he said.

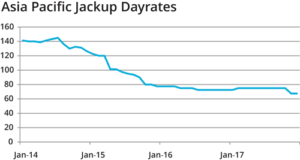

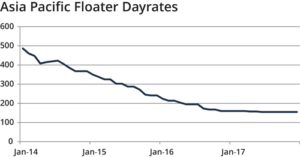

Despite these encouraging signals, dayrates still have yet to budge and are unlikely to rise much this year. Floater dayrates remain between $120,000 to $170,000, similar to year-ago levels, and modern jackups are commanding only $50,000 to $70,000/day, also relatively unchanged from 2016. “Significant jackup supply in the region limits the potential for dayrate improvement,” Mr Haugan said, noting that the industry still requires more rig retirements than what have transpired over the past couple of years before the market will balance out.

Worldwide, the industry scrapped 29 floaters in 2017, four of which came from the Asia Pacific. Eleven jackups were retired in the same year, with two of them coming from this region. On the other end of the pipeline, a whopping 83 newbuilds are on the books for potential delivery this year. Of course, “actual deliveries will depend on market strength and access to financing,” Mr Haugan said, although he pointed to at least seven firm jackup deliveries and up to four firm floater deliveries. In 2016, 22 newbuilds were delivered, 10 of which remained in Asia Pacific. In 2017, 17 rigs were delivered, with only five staying in the region.

Strong recovery in rig utilization

For UMW’s seven jackups, utilization rates in 2017 were significantly higher compared with the year before, and Mr Megat said he expects that trend to continue in 2018. “In 2016, we were looking at around 20% utilization, and for 2017 we were upwards of 90%,” he said, adding that he expects utilization to stay at around 90% this year. A big driver of this increased activity are the national oil companies that must meet their country’s energy needs, regardless of oil prices. “Some countries are experiencing amplified depletion rates because of the slowdown in drilling over the past few years, and that is affecting their ability to produce.”

Over the past year, UMW reactivated five of its seven rigs, mostly during the summer season when operators prefer to drill because they don’t have to worry about monsoons. All seven UMW rigs are currently working in Malaysia, primarily for Petronas but also for Repsol and Hess. The company also anticipates starting operations for ConocoPhillips in Q2 this year, also in Malaysia. The UMW NAGA 4 will drill two firm wells with an option for two additional wells.

Despite increasing activity levels, the market remains very cost-focused, Mr Megat said. In particular, operators are increasingly asking drilling contractors to take on additional responsibilities in the overall drilling operation. “For example, it’s becoming very common for drilling contractors to deal with towing vessels for rig moves. Instead of dealing with multiple contracts, operators are asking their drilling contractors to manage a bigger scope of operations.”

While Mr Megat recognizes that it’s become much more common for drilling contractors to provide integrated services, he also urged companies to recognize the additional risks that they are taking on. “There’s not much fat left in the pie,” he said. “When you add new services, you add new risk, but you may not get the return you want because all the services inside that pie have been commoditized.”

In fact, unless something changes, it will become very hard for drilling contractors to sustain their businesses under the current dayrate model. “We really need to look at how we do business,” he said, noting that cost reductions for drilling contractors have already been so deep that any further cuts will start impacting performance and sustainability. And if drilling contractors can’t grow the pie anymore because of restrictions on well costs, they may need to go out and find a new pie.

Mr Megat pointed to Southwest Airlines as an example. When the airline started in the early 1970s, it wasn’t looking to compete with bigger airlines for the customers who were already flying. “Their targets were people who were driving from Houston to New Orleans and figuring out how to get them to fly instead. They basically created a new marketplace.”

For the drilling industry, while Mr Megat said he doesn’t believe that anyone has found the ultimate solution yet for drilling contractors, he urged companies to step out of their comfort zones and seek out-of-the-box solutions. “As drilling contractors, we’re so accustomed to just running rigs and turning the bit to the right… We have to focus more on what the customer wants and creating value propositions, instead of just focusing on all the same steps that every drilling contractor does.”

Ultra-competitive market

For international drillers like Vantage Drilling, staying competitive in the Asia Pacific can be a challenge, with national oil companies giving preference to their locally based drillers. “For us, we’re being very competitive in terms of how we manage our business financially and being aggressive with our rates,” said Alisdair Semple, Director of Marketing for Vantage. “At the same time, we’re also looking at the big picture. We have a reputation that we want to uphold, so we want to make sure we have positive cash flow and that we’re delivering high-quality service to our clients, without sacrificing on safety. But there’s no doubt that the market here is fiercely competitive.”

Vantage recently took its Platinum Explorer drillship out of warm stack to work for ONGC in India on a three-year field development program. Its Topaz Driller jackup drilled three extended-reach wells for Ophir Energy in Thailand in 2017 before moving on to a new contract in Indonesia with a subsidiary of Petronas, PC Ketapang. It was recently announced that, after completing its program in Indonesia in early 2018, the Topaz Driller will mobilize to Cameroon in West Africa to work for New Age Cameroon.

The third rig that Vantage has in the region – the Aquamarine Driller jackup – has been drilling development wells since late 2015 for Carigali-PTTEPI Operating Co (CPOC) in the joint development area between Malaysia and Thailand. Although that contract concluded at the end of January 2018, Vantage recently announced a letter of award for a new 18-month contract with CPOC, with four options of three months each, to continue drilling in the same area for Phase 4 of the development drilling campaign. Work will be carried out in Blocks B-17, C-19 and B-17-01.

While Vantage has seen success in keeping most of its rigs busy, Mr Semple expressed concerns with the extreme focus on dayrates and continued squeezing of costs he’s seen in this downturn. Compared with 2016, dayrates in 2017 have fallen even lower, he said. “I think we’re very close to the lowest that we can be and continue to drill safely and efficiently,” he said, adding that any increase in dayrates is unlikely to take place in 2018 due to the continued oversupply of rigs in the market. “However, there is a preference by oil companies to contract ‘hot’ rigs from an

experienced contractor with a proven operational and safety tack record, such as Vantage,” he added.

“Ultimately I think more rig scrapping is still needed to balance the market out, and certainly that hasn’t happened enough in the jackup sector. We’ve seen more in the floater segment but not in the jackup space. As we head into a potential recovery in 2019 and 2020, I think scrapping and consolidation of assets will be a major contributor to a better rig market environment.”

PTTEP to drill 280 wells in 2018

Thailand and Myanmar will remain key focus areas for PTTEP in the coming year, said Chayong Borisuitsawat, Acting Executive Vice President, Operations Support Group for the Thai NOC. The operator drilled 250 wells in 2017, and this year is planning to drill 280 wells – 250 in Thailand and 30 in Myanmar.

In Myanmar, PTTEP anticipates drilling appraisal and exploration wells in blocks M9, M11 and onshore MOGE3, perhaps in Q3 or Q4, according to Mr Borisuitsawat. In Thailand, PTTEP continues to hone operational efficiency through its factory drilling approach, under which an offshore well can take fewer than six days to drill. He attributes recent performance gains offshore Thailand to having offline capabilities on drilling rigs and notes that PTTEP now requires all

rigs moving into Thailand to be able to do offline work. For operations in all regions, the operator kept 10 rigs contracted in 2017 and expects that number to remain unchanged this year.

In addition to Myanmar and Thailand, PTTEP may also move forward with one exploration well in Malaysia and one in Australia. PTTEP’s total spend for drilling activities in all projects in 2018 is estimated at $1.07 billion.

“The main challenge right now is how we can work with our drilling contractors to overcome the difficulties of the current market,” Mr Borisuitsawat said, noting that safety, security, health and environment (SSHE) remain core focus areas in PTTEP’s engagement with its contractors. For his part, he encourages contractors to develop competency for their personnel and improve SSHE practices in the workplace to eliminate undesired impacts. He also expressed concerns with how contractors can attract competent personnel as they start to reactivate rigs, especially in light of how much talent has already been let go during this downturn. Adoption of digital technologies is also being prioritized, he said, as PTTEP considers what infrastructure investments are needed to digitalize its producing fields. Collaboration with contractors will also be important to ensure that “we can go at the same pace,” he said.

On PTTEP’s side, cost reduction initiatives are still taking center stage through its Spend Smart campaign. “It is allowing us to save costs by having more collaboration between the asset management team and the drilling team. We’re now planning almost two years ahead, and that’s allowing us to find areas where we can have more optimization and to take advantage of economies of scale,” Mr Borisuitsawat said, adding that cost optimization initiatives are also ongoing on the procurement side.

“We’re trying to create long-term partnerships so that we don’t have to keep a lot of inventory on hand. They can supply the equipment when we need it. It’s another inventory management method that allow us to improve efficiency and reduce cost in drilling activities.” DC

DC Editorial Coordinator Eva Vigh contributed to this article.