Deposition of organic materials, reservoir uncertainty and high CO2 content among key technical challenges

By Katie Mazerov, Contributing Editor

When Earth’s tectonic plates shifted to break up the ancient super continent of Gondwana 180 million years ago, a deposition of sediment and sea water over a hydrocarbon-rich geological layer created a phenomenon now known as pre-salts. Estimated to be as thick as 6,562 ft (2,000 m) in waters as deep as 20,000 ft (7,000 m), the salt layers overlie geological layers that hold a significant portion of the world’s oil reserves, mostly along the continental shelves of Brazil and West Africa. Other pre-salt basins include the Gulf of Mexico (GOM), Norway and the Caspian Sea/Azerbaijan.

Since the first major pre-salt discoveries were made in Brazil’s prolific Espirito Santo, Santos and Campos basins around 2007, the industry has made significant progress in understanding the nature of these promising fields that hold high-quality oil but require an exceptional level of investment and technological development to overcome a multitude of hurdles. Uncertainty, heterogeneity, encrustation, corrosion resulting from high carbon dioxide (CO2) levels, salt mobility and varying degrees of H2S (sour gas) are among the chief challenges operators face in completing wells in pre-salt reservoirs. Such issues, which pose implications for well design and raise the bar for well control, are especially daunting in Brazil, one of the deepest regions globally in terms of both water and well depth.

“Numerous wells previously drilled could be defined as ‘pre-salt,’ although the application in Brazil includes a thick salt layer,” said David Cain, Lead BOP Engineer, COE, Lloyd’s Register Drilling Integrity Services. “In the basins now defined specifically as pre-salt, the salt itself has an immediate effect on well construction because its high creep strain rate impacts the casing program. Generally, in the pre-salts, the operator is likely to set and cement the casing in place immediately after penetrating the salt layer. The mobile salt can push on the side of the casing with so much force, it deforms the casing and risks damaging the liner or cement that provides a barrier.” In many cases, bigger, thicker casing and liner sizes are required.

These obstacles, along with low market prices, are incentivizing the industry to develop new completion systems and methods aimed at delivering efficiency and reducing cost.

Closing the Cost Gap

“The strategic importance of the pre-salts to the Brazilian oil and gas industry remains extremely solid, inasmuch as some fields are responsible for nearly 900,000 bbl/day of oil, exceeding production of some post-salt wells,” said Frederico Carvalho, Latin America Business Development Manager for Superior Energy’s Completion Services Division. The company provides support and R&D to operators in Brazil, including Petrobras. “Oil produced from pre-salt wells already represents 35% of Brazilian oil production that in 2015 reached an average of 2.4 million bbl/day.

“With depressed crude oil prices, there is a huge gap between what operators can pay and what they need to spend to complete a pre-salt well, which costs about $30 million,” Mr Carvalho continued. “The equipment and techniques being used now were developed in 2009 to 2011, when oil prices were $100 per barrel. Our objective is to create cost-effective solutions aligned with specialized systems, including new metallurgies, that can withstand the adverse conditions of pre-salt formations while delivering cost savings.”

Mr Carvalho identified three main technical obstacles directly related to pre-salt well completions:

• Deposition of organic materials, such as paraffins, hydrates and asphaltenes, and inorganic materials, including barium sulfate and calcium carbonate, in the completion and production equipment, which can result in interventions and re-stimulations to restore productivity;

• Uncertainty of the reservoir characteristics and heterogeneity; and

• High CO2 content, which can produce carbonic acid when it comes in contact with water.

Most of the pre-salt wells being developed by Petrobras are long-duration test wells, a strategy designed to reduce costs, Mr Carvalho noted. Standard pre-salt completion configurations include direct and integrated chemical injection mandrels, with direct injection below the completion packers, to mitigate deposition. Intelligent completion systems are also used, such as multiple on-off valves, intelligent packers and downhole temperature and pressure gauges. Production equipment engineered with high-chromium content (25Cr versus the standard 18Cr) to avoid CO2 corrosion also has been introduced. However, delivery time for high-chrome can be as long as 12 months because the metallurgy is rare, he said.

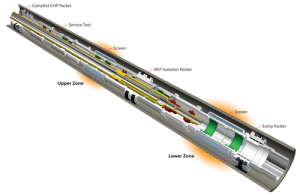

To reduce time and cost, operators are using open-hole completions in many pre-salt wells, 90% of which are vertical and have one to three zones, Mr Carvalho added. “For a two-zone well, we will case the upper zone, leaving the lower zone open-hole to enable intervention, or divide the open-hole section into two zones and produce the well using an open-hole isolation packer.”

Superior has done one pre-salt completion for Petrobras in Brazil using high-chrome material and a highly resistant fluoroelastomer that can better withstand stimulation and well fluids containing high levels of H2S, CO2 and benzene, which can damage conventional elastomers.

For deviated or horizontal multizone pre-salt wells, Superior has deployed its multizone single trip (MST) completion system and has a contract to install one in June for Petrobras in the Campos Basin, Mr Carvalho said. Used to reduce costs in post-salt wells, the Complete MST includes isolation packers, a screen with sliding sleeves and a frac-pack/gravel-pack sleeve to place sand or proppant. The system perforates multiple zones at one time and isolates and completes zones of varying lengths in one trip.

“The industry is continually looking for more efficient, cost-effective methods of completing these wells,” he noted. “This includes developing alternative materials to utilize in place of the expensive high-chrome alloys currently in use, as well as working with emerging technologies, such as dissolving metals for enhancing completion systems.”

Sour Gas and Hydrogen Embrittlement

Along with CO2, the presence of H2S in pre-salt wells also can be problematic. “By itself, H2S is not necessarily corrosive, but when hydrogen gets into the steel equipment, it can lead to stress corrosion cracking and hydrogen embrittlement,” said John Hoefler, VP DTE (Drill Through Equipment) for Lloyd’s Register. H2S also can exacerbate the effects of CO2 in pre-salt wells. “CO2, at 100 parts per million, or 8 to 12% in some reservoirs, can become corrosive at an accelerated rate when mixed with H2S or high-chloride formation water,” he explained. “On the drilling side, 100 parts per million CO2 is not as critical because we use oil-based mud (OBM) and, if necessary, can add caustic fluids to help neutralize the acid. However, on the completion side, there is no longer the protection of OBM, and the production equipment stays in place for as long as decades.”

Further complicating the corrosion issue in Brazil are sulfate-reducing bacteria, which can thrive with little to no oxygen in deepwater and consume hydrogen, depolarizing or interfering with cathodic protection to resist corrosion. “Because a possible byproduct of this chemical reaction is sour gas, it is a good idea to install H2S-resistant equipment, even if the presence of H2S is not anticipated in the well,” Mr Hoefler said.

H2S can usually be handled by selecting resistant materials and does not significantly impact rubber elastomers. Despite its benefits in helping release oil from the formation, CO2 involves a constant process of limiting the cumulative effects of corrosion. “One strategy is to continually trickle corrosion inhibitor downhole through a control line to be dispersed at the bottom of the well so it can flow back with the produced fluid,” Mr Cain said. “This, however, changes the risk profile by adding complexity to the completion design, as those trickle lines are one of several tubulars that pass through the blowout preventer and other well control equipment. Our role as a third party is to facilitate a collaborative process for mitigating that risk.”

Smart Completions Without Intervention

A move is also emerging in Brazil toward state-of-the-art intelligent completion systems to compartmentalize the reservoir, often in conjunction with managed pressure drilling (MPD) in lost-circulation zones, according to Virgilio Porto, Brazil Operations Manager, Completions, for Weatherford. “The pre-salts are ultra-deep environments where saving even one run can save several days of rig time,” he said. “Operators are asking for more tools to optimize capital expenditures and apply intelligent systems without intervention, which will be the future of completions in the pre-salts.”

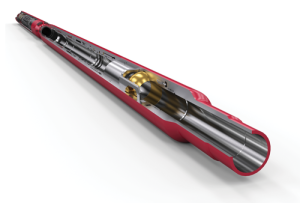

In response to this emerging trend, Weatherford is expanding the use of existing technologies into the pre-salts and deploying radio frequency identification (RFID)-activated tools. “While RFID tools are high end compared to mechanical sliding sleeves or ball valves, customers are looking at reducing the overall operational expense,” Mr Porto said.

Later this year, the company anticipates using its RFID-activated OptiBarrier valve for the first time in a pre-salt basin to isolate lower completion zones following acid treatment, allowing other operations to continue, explained Euan Murdoch, RFID Completions Product Line Manager for Weatherford. “This will deliver significant savings during the commissioning phase and continuing over the lifetime of the well.”

Next year, Weatherford anticipates introducing another RFID tool, the advanced ICD (inflow control device) management system in the pre-salts. Developed in 2015 as the next generation of the advanced reservoir management system, the new system combines an RFID-activated sleeve with the ICD and a screen to individually test zones to tailor water and gas injection rates, a technique that is becoming more commonplace in the pre-salts due to the high amount of produced CO2. “It is more cost-effective to use water and gas injection (WAG) to reinject the CO2 into the reservoir to maintain production drive and maximize recovery rates rather than process the CO2,” Mr Murdoch explained.

“By running WAG in extended-reach wells with multiple discrete zones, we can use the ICD to remotely activate the first zone for an injection test to quantify performance, then deploy RFID tags to tell the tool to close and repeat the test in subsequent zones,” he continued. “This provides operators with enhanced reservoir knowledge to pinpoint where the WAG fluids are going and what rates can be expected from each zone. Operators also can select in advance which ICDs to open to adjust injection rates or test discrete zones so as to tailor a more homogeneous flow distribution across the entire completion.”

The shifting nature of pre-salt formations presents challenges for isolation and protecting the casing strings over time. To overcome that limitation, the company is using cup seal packer technology, which provides an effective seal while exerting less than 200 psi on the borehole to achieve isolation or serve as a foundation to a good cement job, he said.

Additionally, Weatherford has received inquiries from pre-salt operators in Angola about a new technique that combines drilling with liner and off-bottom cementing, Mr Murdoch said. The technique uses an RFID port collar activated by pressure cycles and RFID tags, which enables the cementing of multiple stages in one trip. An annular packer provides a competent cement foundation.

“We run the liner with the drill bit on the bottom and, rather than cementing through drill bit as usual, we send a pressure cycle to open the port collar 50 to 100 ft above the bit,” he explained. “After reaching bottom, we drop a dart to isolate the liner and bit, pressure up to set the packer, then send a pressure pulse to open the port collar. This provides a path above the packer and back up to the surface, which results in a very good cement job.” The port collar can be closed with an RFID tag or a mechanical dart. The first run of the system is planned this summer in the North Sea.

Larger Casing, Liners

The trend toward intelligent completions in Brazil also reflects a shift from sandstone to carbonate formations, which are inherently more complex and heterogeneous in terms of porosity, explained Nitish Rai, Senior Account Representative for Halliburton in Brazil. The company is using intelligent tools from its SmartWell systems portfolio, along with sand control systems, to actuate control valves and sliding sleeves from the surface. “We use downhole sensors to monitor the wellbore, measuring flow, temperature and pressure at any point during production,” he said.

When it comes completion design, well architecture, formation pressure and wellbore cleaning are important considerations for handling the bigger casing strings, such as 9 5/8 to 16 in., typically needed to produce in the pre-salt basins. This also impacts selection of liners and liner hanger systems.

Earlier this year, in a job for Repsol Sinopec Brazil in the Campos Basin, Halliburton installed a VersaFlex liner hanger system and implemented wellbore cleanout technology prior to setting production packers in a well with fluid loss issues. “We ran an 11 ¾-in. liner across the base of the salt into the formation and set the liner hanger system just inside the 14-in. casing,” Mr Rai explained. Wellbore cleaning tools, which have been successful in deepwater and pre-salt environments, were then used to clean out the casing before running the 9 5/8-in. production packers. “This configuration enabled us to move forward with the completion.”

The pre-salt casing designs require multiple casing strings to navigate through more complex formations, explained James Williford, Global Product Champion, VersaFlex Liner Hanger Systems for Halliburton. “Significant investments and larger casing strings that are commonly associated with pre-salt projects necessitate a reliable large-bore liner hanger system to run and cement a large liner through what might be a plastic flowing or dynamic formation, while providing a competent gas-tight liner-top seal for the life of these high-cost wells. As an example, 5,000 to 8,000 psi is not considered a high-pressure environment. However, it can exert a tremendous amount of force on the larger cross-sectional areas that are common to pre-salt casing designs.”

Halliburton’s liner hanger systems have been deployed in all pre-salt regions, including the cooler, shallower Azerbaijan, to perform critical functions, such as wash-and-ream, and run the liner to bottom and obtain a reliable seal at the wellbore interface for cement. “Once on the bottom, the tool systems allow for rotation and reciprocation during cementing of the liner hanger system,” he said. “After the cement is placed, the liner top is set, which anchors the system and provides a gas-tight liner-top seal with redundant, hydraulically energized sealing elements to eliminate any remedial cementing work and reduce nonproductive time (NPT).”

To overcome issues associated with the consistently moving and clastic rheology of pre-salt formations, Halliburton has used big-bore liner hanger systems, developed in 2010 based on existing expandable liner technology, specifically to enable development of complex pre-salt wells with especially large casing strings. “The primary objective was to reduce the NPT operators were experiencing while landing a pinpoint supplemental wellhead casing adapter,” Mr Williford said. “This system can wash-and-ream to run the liner to bottom. After cementing, the hanger is set to achieve a liner-top anchor and seal without requiring a precise, pre-determined location and avoid NPT issues in getting the casing shoe all the way to bottom.”

The big-bore systems range from a 13 5/8-in liner with a 16-in. casing, to an 18 5/8-in. liner with a 22-in. casing. Halliburton has successfully run more than 275 big-bore system installations in Brazil’s pre-salts as well as the GOM, West Africa (Angola, Republic of Congo, Gabon), Norway and Azerbaijan. DC

Complete MST is a trademark of Superior Energy Services. SmartWell and VersaFlex are registered trademarks of Halliburton.