Global supply/demand forecasts, OPEC agreement signal modest recovery could be within reach

However, uncertainty around OPEC deal to cut production means it’s too early to predict impact on oil prices

By Alex Endress, Editorial Coordinator

The downturn is still in full swing, but the seeds of optimism are beginning to sow within the industry. In late September, OPEC agreed to cut oil production during a meeting in Algiers. This is the first time in eight years that the oil cartel has agreed to reduce production levels. And with analysts predicting that global oil supply and demand are near a rebalance and that oil prices will average above $50/bbl next year, the hope of a rebound – if only a modest one – now seems within reach.

“With the uncertainty that remains around how the OPEC decision will pan out, at this time we are still forecasting Brent will average $51/bbl during 2017. However, despite the subdued uptick, we expect US production to trough during mid-2017 and begin rebounding from there,” Jenna Delaney, Senior Energy Analyst – Oil at S&P Global Platts, said.

If the OPEC production cuts take place as announced, it would reinforce forecasts for strengthened rig demand. Platts RigData currently expects the average annual US rig count to grow by 131 rigs next year. This would be a 29% increase over the 2016 estimated rig count of 449.

“Our price forecast is fairly subdued because prices need to gradually grow in order for supply and demand to be able to continue on the course to bring this market to correction,” Ms Delaney said, comparing the $51/bbl forecast to this year’s expected average price of $43/bbl. “If prices rise too soon, that fundamental correction won’t occur.”

Under the OPEC announcement – which came against analyst expectations, it should be noted – member countries will reduce their current output of 33.4 million bbl/day to between 32.5 million and 33 million bbl/day by next year. As part of the deal, Saudi Arabia is expected to reduce its production by 350,000 bbl/day. Iran, Nigeria and Libya are exempted from the production cuts, as Iran is committed to increasing production after export sanctions were recently lifted. Libya and Nigeria are rebuilding oil production after terrorists recently attacked production facilities.

Further details about the deal are not available – they’re expected to be outlined at OPEC’s next meeting in Vienna on 30 November – but analysts already seem to be doubting that these production cuts will give much of a boost to the global oil price, especially since OPEC countries had all been producing at very high levels. Before the OPEC deal, Saudi production levels had actually increased slightly, from an average of 10.1 million bbl/day in 2015 to 10.6 million bbl/day in August.

On the demand side, there has been slow but steady growth. Platts expects global oil demand to grow from 94 million bbl in 2015 to 97 million bbl in 2017. While analysts’ timelines vary, several also appear to expect that the world will begin to dig into oil stockpiles next year. At about 96 million bbl of total liquids supply, the world is currently 700,000 bbl oversupplied, according Platts.

“Over the course of the year, that has been progressively getting better, and we believe it will continue to get better next year,” Ms Delaney said. “As a whole, we expect to be able to actually bring down our stocks in the US on year-on-year basis in 2017 rather than being oversupplied and to see improvement in the global balance, as well.”

ExxonMobil recently emphasized its confidence in the long-term outlook for oil demand. “We believe that oil demand is growing significantly,” said Rob Gardner, Manager, Economics and Energy Division, Corporate Strategic Planning Development, ExxonMobil. Mr Gardner was speaking at the 2016 Deloitte Oil & Gas Conference in Houston on 21 September. “Oil remains our primary fuel out through 2040,” he said, noting that ExxonMobil expects oil demand to increase from both the transportation and chemicals sectors. By 2040, the company expects the transportation sector to grow by 20% and the chemicals sector to grow by 55%, Mr Gardner stated.

Oil prices increase in 2017

As oil prices sank from around $100/bbl in 2014 to below $30/bbl in Q1 2016, the industry’s first option was to cut capital expenditures. “It was a matter of survival,” said Tom Ellacott, Senior VP of Corporate Research at Wood Mackenzie.

Looking from 2015 to 2020, global upstream capital spend has been reduced by $1 trillion as many long-term projects were deferred and exploration budgets were slashed to free up capital, he said. “None of the companies had a choice but to cut spend very aggressively.” A study of 56 companies, including supermajors, NOCs and independents, found that E&P spend in Q2 2016 had fallen by 49% – or $230 billion – since the downturn began in 2014.

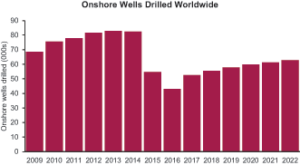

Upstream budgets cuts hit the US lower 48 especially hard. As a result, only 21,488 onshore wells were drilled in the US last year, down from 40,853 in 2014, according to Douglas-Westwood. The firm expects that only 10,456 onshore wells will be drilled this year. “There have been massive reductions from US onshore operators,” Douglas-Westwood Analyst Matt Cook said.

With such drastic drops in wells drilled, production declines seem inevitable. The US Energy Information Administration (EIA) expects US onshore production to decrease from 9.4 million bbl/day in 2015 to 8.8 million bbl/day in 2016 and then to 8.5 million bbl/day in 2017.

And yet – despite these anticipated production drops, global crude production could still increase this year over last year. Douglas-Westwood attributes this to offshore projects coming online that were sanctioned pre-downturn, as well as gains from Russia and Middle Eastern countries that have ramped up production to fight for market share. “Some of this is projects that are already on stream and are ramping up, and some that have recently come on stream.” Total liquids production is expected to add up to 89.4 million bbl/day in 2016, a slight increase from 88.9 million bbl/day in 2015, Mr Cook said.

The demand side of the picture is more complicated. Although there has been steady growth through the downturn, the threat of a slowdown still hovers over the industry’s hopes of recovery. The majority of demand growth in 2017 is expected to come from the historically high-growth countries – most notably, India and China.

In India, a lot of energy infrastructure remains under development, but it remains to be seen which form of energy will be favored, Ms Delaney said. “It is a very large country, which makes it complicated to build out infrastructure and to deploy things like pipelines across the country. What type of energy they target will be very interesting to monitor.”

Growing concerns around the world for climate change could tip things in favor of renewables. “India is very interested in natural gas and plans to pursue renewable alternatives, but its heavy dependence on coal will persist for quite some time,” she said.

In China, too, demand growth has been tapering off compared with previous years. “We are also seeing numbers out of China that are concerning,” Ms Delaney commented. “We are seeing that China’s economy is has been shifting, which partly accounts for why their demand growth hasn’t been as steep recently. They are moving away from aggressive industrialization toward a period where the infrastructure they needed has been built out.”

At Wood Mackenzie, the forecast is for oil demand to keep growing in China. “Despite its slower GDP growth and its slowdown in industrial activity, the reason we’re still seeing demand growth in China is because there’s been a switch in the product breakdown,” said Ann-Louise Hittle, Vice President of Research Macro Oils. Back in 2011, 80% of China’s demand growth was driven by gas-oil distillate, which is used for industrial activity such as trucking and moving of raw materials. As Chinese GDP has started to slow down, coal and natural gas consumption began to decline, but demand for oil has remained constant, she said. That’s because there’s been a rising middle class in China over the past five years, which is starting to purchase more personal cars and SUVs.

Globally, Wood Mackenzie projects demand could outweigh supply on a monthly basis by as early as Q4 2016. “Demand growth is coming in at about 1.3 million bbl/day this year,” Ms Hittle said. “We’re actually in a situation where total world oil demand could be higher than total world oil supply for the fourth quarter of this year.” Assuming the world begins to draw down stocks in Q4 2016, Wood Mackenzie forecasts Brent will move between $50-$52/bbl in Q4 and average $54/bbl for 2017. The company expects Brent to average $63/bbl in Q4 2017.

Signs of industry adapting

Even if oil prices don’t get back to $100-plus levels, analysts believe the industry is on its path back to profitability. In particular, they cite initiatives taken by operators to re-engineer cost structures to bring down breakeven pricing for both offshore and onshore developments.

“If you take a look at the lower 48, you can really extract learnings and efficiencies from the huge amount of wells being drilled. It’s a very evolutionary type of process,” Wood Mackenzie’s Mr Ellacott said. “That’s one reason why the costs react quite rapidly there.” In fact, companies have reported that wells in the Permian can now be profitable at below $40 oil, although “between $50-$60/bbl is where a lot of tight oil wells can really come into the money, driving increased activity.”

In 2017, Douglas-Westwood projects 20,068 development and E&A wells to be drilled onshore US. That is almost double the 10,456 wells expected for 2016.

In the deepwater, too, Wood Mackenzie sees the industry adapting to low oil prices. “Rather than targeting 100% of the reserves in a development, you might just look at recovering 80% that are most economically attractive,” Mr Ellacott said. “The projects have been right-sized to really improve the economics.”

Despite these adjustments, Douglas-Westwood expects there will be a slight decrease in offshore wells as a whole, including in the number of deepwater wells, which the firm classifies as those in greater than 1,640 ft (500 m) of water depth. Its forecasts call for 187 deepwater development wells drilled in 2016 and 182 in 2017. The industry has already seen steady declines in this area, as deepwater wells drilled decreased from 224 in 2014 to 197 in 2015. The shallow-water well count is projected to be 2,383 versus 2,362 in 2016, according to Douglas-Westwood.

“There’s still work to do to improve the economics of quite a few of the projects, particularly in deepwater,” Mr Ellacott said.

Still, Wood Mackenzie forecasts that oil prices will rise high enough to bring back deepwater investments, because they have to in order to meet future oil demand. “The high-cost sources of supply, mainly in deepwater, will be needed to meet the gap between supply and demand that we’re projecting,” Mr Ellacott said. “We see that, based on our demand projections, by 2025, the industry needs to start developing some of these sources of higher-cost supply that have been deferred. That means that we’re going to have to see higher oil prices because otherwise these projects aren’t going to get sanctioned.”

For those who think North American shale oil will be enough to sustain long-term demand, Ms Hittle says Wood Mackenzie has a different view: “The world cannot survive on US tight oil growth.” US tight oil growth is likely to provide an insulating effect on oil prices by keeping them subdued with incremental production, but “we believe we’re in a world where the current low oil prices cannot be sustained in the medium to long term.” Wood Mackenzie projects that oil prices could average $80/bbl by 2025 to allow the industry to explore and develop more deepwater resources.

“The oil market has a tendency to adjust every 10 years,” Mr Ellacott said. “The price will go up – we saw it go up to $120/bbl not too long ago. It’s a very fickle market, but it’s resilient and very adaptable.” DC

- Platts expects global oil demand to grow from 94 million bbl in 2015 to 97 million bbl in 2017. At about 96 million bbl of total liquids supply, the world is currently 700,000 bbl oversupplied.

- Wood Mackenzie forecasts Brent will average $54/bbl for 2017. In Q4 of 2017, the average could rise to $63/bbl.

- In 2017, Douglas-Westwood expects 20,068 development and E&A wells will be drilled onshore US, almost double the 10,456 wells expected for 2016.

- Douglas-Westwood’s forecasts call for 187 deepwater development wells drilled in 2016 and 182 in 2017. The shallow-water well count is projected to be 2,383 drilled versus 2,362 in 2016.