From revolution to evolution

Hydraulic Fracturing innovations target strategic fracture placement, re-fracturing of existing wells for next bump in recovery

By Katie Mazerov, Contributing Editor

Fracturing – commonly referred to with the slang term “fracking” – has become a household word, propelled by the unconventional boom that has swept across the North American landscape over the past 15 years. Hydraulic fracturing, however, has been part of the oilfield lexicon for decades. Only when the process was combined with horizontal drilling to tap vast and prolific shale plays did the term emerge as a political and environmental hot button.

Fracturing – commonly referred to with the slang term “fracking” – has become a household word, propelled by the unconventional boom that has swept across the North American landscape over the past 15 years. Hydraulic fracturing, however, has been part of the oilfield lexicon for decades. Only when the process was combined with horizontal drilling to tap vast and prolific shale plays did the term emerge as a political and environmental hot button.

Fast-paced advances in fracturing technology have taken unconventional oil and gas development to new heights, going from the fracturing of a single well with a 1,000-ft lateral to multi-well pads and horizontal sections exceeding 10,000 ft, with upwards of 100 stages in some plays. What began in tight, low-permeability gas reservoirs has moved to oil. Alongside techniques such as multistage fracturing, environmentally friendly proppant designs have emerged, as well as systems for managing water and other resources. Automated processes also have been developed for blending the right amount of proppant, adjusting pumping pressures and determining the correct completion strategies for a given play.

“The shale revolution has become an evolution that signifies the industry’s expanding knowledge of where to drill and where to place wells,” said George King, Distinguished Engineering Advisor for Apache Corp. “Today, it is not so much the actual fracturing technology that is improving. It is the placement of the fractures within wells and our understanding of where the natural fractures are located. It’s all about reservoir engineering and petrophysics.”

Many experts believe this shift in thinking holds the key to taking unconventional production into the next decade, developing new wells and reinvigorating old wells through re-fracturing. It also represents the culmination of a process that began decades ago.

“The technique of hydraulic fracturing has been around for more than 60 years, used commonly in conventional tight gas wells in Texas, Louisiana, Ohio, Pennsylvania, Colorado, Wyoming and New Mexico, said Rachel Heinle Rabun, a Petroleum Engineer with Heinle & Associates, a Denver consulting firm that provides valuation and appraisal of oil and gas properties. “In the early days, fracturing one vertical well was equivalent to fracturing one stage of a horizontal well today. Initial recovery rates of 2% have increased to 8-10% with horizontal drilling, which although still low, represent a significant increase.”

The next bump in recovery will be understanding the fracture networks, she said. “Modeling fractures in unconventional reservoirs is extremely difficult because conventional models don’t work. Currently, there is a huge amount of research going into understanding where the fracture is going, which is typically in the path of least resistance.” By better understanding the fractures, operators can implement “intelligent fracs,” using new technologies to select the best production zones to target.

“We will see more distributed temperature sensing (DTS), a technique currently being used by operators in Colorado’s Denver-Julesburg (DJ) Basin, which holds an estimated 74 million bbl of oil equivalent (boe) original oil in place per sq mile,” Ms Rabun said. In this case, fiber optics are used to sense temperatures along the lateral, with readings interpreted through thermal dynamics into something that is similar to a production log that relates heating and cooling effects to fluid flow.

“Over a 4,000-ft lateral, an operator can see how much and where fluid flow is occurring in order to better determine perforation spacing, frac design and fluid flow,” she said. “This approach also will be beneficial in re-fracturing unconventional wells, which companies are starting to seriously pursue.”

On the regulatory side, the industry is paying close attention to Colorado, a politically balanced state where politicians, environmentalists and oil and gas companies have worked together to put in place some of the most stringent fracturing regulations in the US, Ms Rabun continued. These stakeholders were successful in keeping a number of anti-fracturing measures, including strict setback rules for drilling, off the November 2014 ballot.

Increased education about hydraulic fracturing also is critical, she said, noting that a key factor in bringing hydraulic fracturing to the forefront was the 2010 anti-fracturing movie “Gaslands.” “In at least 50% of the environmental science classes I have visited in Colorado, teachers use the film as an educational tool. We need to make sure educators are using good, factual materials to teach students about the industry,” said Ms Rabun, who regularly visits schools throughout the Denver metro area.

An engineered approach

Hydraulic fracturing in the unconventionals began with a rig-centric approach that focused on increasingly powerful, higher-spec rigs for drilling efficiency. This was followed by a well-centric approach, using concepts like pad drilling to increase well intensity, explained Dr Alejandro Peña, BroadBand Integrated Completions Services Manager for Schlumberger.

The third phase is stage-centric. It intensifies the number of stages, incorporating methods such as zipper fracturing, where half the wells on a pad are perforated while the other half are fractured. Intervals are spaced evenly along the lateral, increasing the stages to maximize drainage. “This is where much of the industry is today. However, we are starting to see a transition to more engineered, cluster-centric completions, using reservoir data to strategically place fractures,” Dr Peña said. “Operators are realizing that successful well development is not only about the number of stages but also ensuring that every cluster we stimulate actually contributes to production.

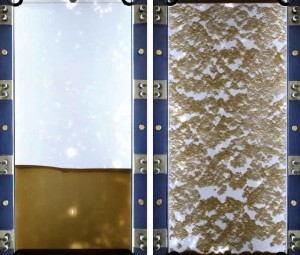

“When we look at average daily production logs in the various basins across North America, the same picture is emerging from all of them,” he continued. “Despite the fact that we are drilling longer laterals, increasing the stage counts, expending more horsepower and using more proppant material with this repetitive, geometric approach, overall average daily production per well is growing scarcely or not growing at all. Several factors influence this outcome. Most notably, about 40% of clusters are not being stimulated on average. Also, conventional methods have a limited capacity to transport proppant to keep the fractures open so they can contribute to production.”

The challenge is to strategically place the clusters and redirect proppant away from the path of least resistance into a greater number of fractures, while also transporting proppant farther and higher into the fractures to keep them open. “The industry has a significant opportunity to embrace a new generation of technology that enhances wellbore coverage and reservoir contact to increase oil and gas production and recovery,” Dr Peña said.

The Schlumberger BroadBand technology platform includes two services, BroadBand Sequence and BroadBand Precision, both encompassing components for wellbore coverage, reservoir contact and modeling and measurements to understand the rock for fracture placement.

BroadBand Sequence, launched in February 2014, uses a composite pill that combines degradable particles and fibers at the face of the fracture. A bridge provides temporary isolation to redirect additional fluid and proppant to other clusters, initiating fractures that otherwise would have been missed. The technique is applicable for both cemented and open-hole plug-and-perf completions.

The method has been implemented in more than 2,500 operations in more than 200 wells in six countries. In the Eagle Ford Shale, three wells of an eight-well, three-pad project were completed with the service within the existing completion and design strategy to enhance the potential for all perforated clusters to be stimulated. After six months, average production per well increased by 22%, according to Schlumberger. In northern Mexico, this sequenced fracturing technology was applied to successfully re-fracture three stages of a well and complete three multistage exploratory wells. The method reduced stimulation time by 65% compared with previously completed exploratory wells and reduced the number of bridge plugs and decreased wireline interventions by 45%, according to Schlumberger.

In two re-fracturing studies in the Haynesville Shale, BroadBand Sequence operations increased gas production rates by 10- to 30-fold, Dr Peña said. “By incorporating this method to redistribute proppant along the wellbore, operators are seeing average production increase by more than 20%, using the same volumes of proppant and water without increasing completion time, often reducing costs.”

BroadBand Precision incorporates an engineered fluid to provide control of proppant and fluid placement by stimulating one entry point at a time using cemented coiled tubing (CT) fracturing sleeves that can be shifted open or closed at will, he explained. “Each fracture is opened, then isolated with a retrievable packer from toe to heel to ensure all volume is placed properly.” The service, set to formally launch in February 2015, can be deployed on coiled tubing or by a workover rig. The technique has already been deployed in the Fayetteville and Eagle Ford plays and in the Permian Basin.

Multistage Fracturing

One of the most significant step-changes in the evolution of hydraulic fracturing has been multistage fracturing. It enables operators to fracture and stimulate a high number of stages, or intervals, in a continuous operation, creating more opportunities to access the lateral.

The Multistage Unlimited Frac-Isolation system, developed by NCS Multistage, enables each stage or interval of a horizontal well to be fractured independently, effectively replacing conventional open-hole packer systems and the plug-and-perforation method used commonly in cased holes. Last year, NCS set completion records of 94 and 104 stages in the Bakken, said Tim Willems, President, US and International Operations for NCS Multistage.

Sleeves are activated by CT and run as part of the production casing/liner in cemented or uncemented wellbores. Fractures typically are placed every 95 or 135 ft but have been placed as close as 62 ft in horizontal wellbores. “By treating each stage independently, we know where the fractures are initiated and how much sand is placed in each fracture,” Mr Willems said. “By exposing more reservoir to stimulation, we can drain the wellbore more effectively. At the same time, we can move on from nonproductive intervals.

“When multiple intervals are fractured simultaneously, we can’t determine how much sand and water are going into individual clusters,” he continued. “In plug-and-perf operations, it is common to have three or more clusters fractured at one time. One interval may take 50-100% of the fluid, while others may take little or none, leaving the operator with an inconsistent fracture network that will leave production behind.”

Having CT in the well during fracturing is advantageous because pressure and temperature gauges can be positioned above and below each isolated frac stage to gain a good database understanding of the fracture operation. “We can read real-time bottomhole pressures at the surface during the frac,” Mr Willems said. “The information is used to preempt screen-outs and aid in optimizing future fracture effectiveness.”

The advantage of having CT in the hole also enables operators to efficiently circulate out screen-outs and move to the next stage. “With standard open-hole ball-drop completions, the operator may have to rig up a CT unit and drill out ball seats to remove the sand in the wellbore,” he said. The ability to circulate also reduces fluid requirements and eliminates bull-heading of acid or displacing of plugs or balls. “This helps the operator avoid displacing the frac and reduces the fluid required, which has environmental benefits,” he added. Because the sleeves are activated by CT, rather than balls, operators gain full borehole internal diameter, leaving nothing to drill out when the operation is complete.

Understanding the Reservoir

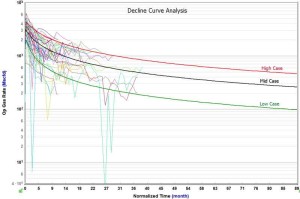

While hydraulic fracture technology has come a long way in enabling the industry to push forward in the unconventional sector, there remains a lot of room for improvement when it comes to recovery rates and improving field economics, especially in light of falling oil prices.

“It is well-known that when it comes to completion efficiency associated with horizontals, a good portion of the production is coming from only 30% of actual treated intervals, based on the post-operation diagnostics we do,” said David Adams, Vice President, Operations Technology, North America for Halliburton.

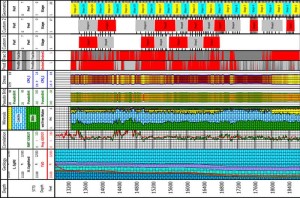

Underlying that performance is the fact that most laterals are still completed with evenly spaced intervals that are staged and fracture-stimulated, he said. “In essence, the industry is doing completions blindly.” To counter that, operators often run LWD/MWD tools or some type of open-hole logging device to understand and characterize the reservoir to know more accurately where to place the fractures. That can be an expensive proposition.

“When we were drilling vertical wells, we ran standard triple-combo logs that provided all the information we needed to locate the best-quality rock, where to place the perforations and where to complete the well,” Mr Adams noted. “The cost to acquire that same information in a long horizontal is almost prohibitive with the margins we’re seeing in the unconventionals.”

To address that limitation, Halliburton last year introduced the FracInsight service. It takes all existing data to gain the reservoir characterization information that is available for vertical wells so as to understand the reservoir quality throughout the entire lateral, he explained. An offset pilot well is drilled to obtain the reservoir characteristics. That information is combined with the directional drilling information and gamma ray, which is done in every horizontal well.

“We’ve created a rigless operation that allows us to better characterize the reservoir so we can optimize where we place the fracture treatments throughout the entire lateral,” Mr Adams said. “By placing the treatments precisely where they need to go and right-sizing them according to the quality of the rock, we can increase actual production. Although the same volume of water and proppant is being pumped, operators are seeing incremental production because they are doing a better job of effectively stimulating the lateral.”

At the same time, the data is helping operators to reduce costs because it tells them where not to fracture. “We’ve recognized there is often a good portion of the lateral that should not be fracture-stimulated at all,” he continued. “By avoiding bad areas of the lateral and, thus, reducing the number of stages, we’re seeing completion costs reduced by as much as 40%.” Eliminating nonproductive sections is also helping operators to reduce water and proppant use. “If we drain a larger area of the reservoir, we can reduce the number of wells and our overall footprint.

“Using the information to effectively geosteer the sweet spot, we’ve increased productivity from 30% of the lateral to nearly 100% of the lateral, boosting actual recovery rates by as much as 15-25%,” Mr Adams said. “In addition, the information obtained on one well can be used on subsequent wells to further optimize recovery. We’re getting smarter and smarter on each well.”

Designed to work with Halliburton’s CYPHER Seismic-to-Stimulation service collaborative workflow that integrates geoscience and reservoir, drilling and completion engineering, the FracInsight service also can function as a standalone service. “Not only does the technology look at reservoir quality, it looks at the geomechanical properties of the rock and how the rock stresses are impacted when the rock is fracture-stimulated,” he added. The service is initially targeting the US unconventional market but is applicable in any unconventional horizontal completion.

Applying Science

Early this year, Weatherford will introduce FracAdvisor, a system that integrates and weighs 11 rock and reservoir attributes to evaluate the reservoir and plan for or mitigate issues at various phases of the well life cycle, explained Nicole Braley, Global Strategic Marketing Manager, Weatherford. “As operators continue to be challenged with technical complexities, they are seeing the benefit of using applied science to evaluate the subsurface rather than the traditional approach where wells are completed geometrically. The crux rests on geomechanics, which combines mathematical components and geophysics to quantify the way rock fractures will respond to various factors, such as changes in pressure, stresses and redistribution of fluids within the rock.”

The system will look at reservoir and completion quality to understand how a particular well will behave when hydraulically fractured and how the rock will contribute to hydrocarbon production. “By understanding the subsurface, operators can more strategically position stages, determine what kind or how much proppant to use, or where to place packers,” Ms Braley explained.

The automated technique was designed to address two of the biggest challenges operators face in the unconventionals: nonproductive time (NPT) and high initial production (IP) rates that decline quickly, she noted. “We believe applied science can mitigate these issues and reduce well production variance, even in adjacent fields.” The system initially will be introduced in the US, Canada, Colombia and Argentina.

The 11 attributes are divided between a reservoir index, including volumetrics, porosity, permeability, total organic content, kerogen and water saturation; and a completion index –brittleness; closure stress; anisotropy; unconfined compressive strength of the rock and density of natural fractures and faults, explained Islam Mitwally, US Region Business Development Manager, Petroleum Consulting, for Weatherford. “As the industry has moved from vertical to horizontal wells, we’ve learned that rock and reservoir properties change as we move farther away from the pilot hole,” he explained.

The system weights the attributes of each unique play. “For example, if brittleness is the biggest contributor in a specific play, we give it a higher weight,” he said. “If the rock is easy to break but holds no hydrocarbons, it won’t be economic to fracture. If the rock is hard to break and requires a lot of force but has a lot of oil, the value proposition may be there.”

The attributes are plugged into the system to give the customer the optimum strategy for fracturing the well. The objective is to combine like rock with like rock in the same stage for maximum impact. “We look at the geology and make some stages shorter, others longer, to take into account similar rock and reservoir properties,” Mr Mitwally continued. “We want to avoid a scenario where different closure stresses, which require two different proppants, are in the same stage. Without understanding where natural fractures are located and which part of the reservoir isn’t naturally fractured, we can’t design the stages.”

The technique also can be used to identify candidates for re-fracturing, which is gaining traction in the US unconventional market. “Now that the unconventional plays have been established, operators are taking a second look at existing wells, looking to maintain value in light of rapidly declining IP rates,” Ms Braley said. She estimates that approximately 1,500 wells were re-fractured in the US in 2013. “Rather than blindly re-fracturing, operators need to identify the best well candidates for re-fracturing. Not all wells should be re-fractured.”

Correcting past mistakes

Re-fracturing is not a young technology. It dates back to the 1950s when vertical wells in tight sands and chalk formations were being re-fractured with success, said Apache’s George King. The practice died out in the 1960s as technological improvements reduced the need for such operations. However, the industry’s push into shales in the late 1990s launched a whole new learning curve for innovation.

Although only 1-2% of unconventional wells today are being re-fractured, Mr King believes the re-fracturing market has a future as the industry gains greater understanding the subsurface. “As we get more data around the natural fracture networks, we will see companies going back into early wells to re-fracture, which is an opportunity to correct past mistakes,” he said. “The first shale wells in the Barnett were fractured with the wrong fluids and the wrong rates. With improvements in technology, operators have gone back and re-fractured some of those older wells with a success rate of 85%. In some cases, sharp increases in initial recovery rates were even better than the rates they had seen initially.”

Like initial hydraulic fracturing endeavors, re-fracturing hinges on understanding the rock and the reservoir. In addition to the presence of oil and gas, fractures need to intersect with an existing fracture network. “We’ve learned that many of the early wells captured a lot of fluid via the regional fracture systems that go through shales, so we likely won’t see much improvement in those wells,” he said.

It is also important to look at how the wells around a potential candidate well are performing. If the surrounding wells are not performing, the well in question may not be a good candidate. Conversely, “if we have some high-performing wells around a poor one, those good wells may have siphoned off a lot of oil and gas through the regional fracture system,” Mr King said. “That is why you must have good reservoir engineering and petrophysics before you set up a re-fracturing campaign.”

Some experts predict re-fracturing will ramp up quickly as operators increasingly focus on how to get more hydrocarbons out of the ground. “Boosting a reservoir’s production without the cost of drilling a new well and then fracturing it will be the next wave in the unconventionals, especially if oil prices remain low,” said Hans-Christian Freitag, Vice President, Integrated Technology for Baker Hughes.

“More science is being applied, along with better understanding of the subsurface and the use of better diagnostic tools to determine where to place fractures,” he said. Improved reservoir understanding has already been shown to be effective in some re-stimulation campaigns. “Being able to rejuvenate wells to achieve production rates that are higher than when wells were initially completed is something we’ve never experienced in conventional sandstone or carbonate reservoirs. This opens the door to significantly increasing recovery from unconventional reservoirs without drilling a large number of additional wells.”

Mr Freitag acknowledged that wells must undergo a “robust screening process” to determine which ones to target for re-fracturing from both a commercial and a technological point of view. “There are three characteristics that drive production – the rock itself must contain hydrocarbons; the well must have maximum reservoir contact, and the reservoir rock must be connected to the wellbore, which is achieved through fracturing or re-fracturing.

Rejuvenation and Sustainability

Re-fracturing also must be considered as just one method of rejuvenating production in a well. “In some cases, a well may have sanded up or experienced scale buildup, and if cleaned out using CT or other intervention methods, can be effectively brought back to higher production levels through the installation of artificial lift,” he said, noting that well intervention in unconventionals has ramped up over the past year as operators push to make older wells more productive.

Well rejuvenation, which reduces the need to drill new wells and to expand roads and infrastructure in communities, is also a key aspect of sustainability, Mr Freitag said. This extends to the industry’ social license to operate, an issue companies are addressing with greater automation, water management initiatives, chemical disclosure, fuel savings and more efficient use of fracturing fluids

Well rejuvenation, which reduces the need to drill new wells and to expand roads and infrastructure in communities, is also a key aspect of sustainability, Mr Freitag said. This extends to the industry’ social license to operate, an issue companies are addressing with greater automation, water management initiatives, chemical disclosure, fuel savings and more efficient use of fracturing fluids

Baker Hughes uses an advanced treatment monitoring and analysis system to maintain real-time control of the hydraulic fracturing treatment. Pumping and blending equipment management and control software facilitates an automated operations process, minimizing the number of personnel on location while improving safety and reliability of oilfield operations.

In late 2014, the company introduced the REAL Connect portfolio of diversion technologies in various unconventional plays in North America. The service leverages diverter systems to redirect the fracturing fluid to the perforation clusters and reservoir sections where it is needed for maximum stimulation performance. The solid particulate diverters have been applied successfully in new wells and in the re-stimulation of mature wells, delivering improved production rates.

In a series of proactive steps to support the industry’s social license to operate, Baker Hughes is using natural gas for frac vehicles in the field and working with customers to conserve freshwater by using brines and other non-potable water for frac fluid design. Last year, the company began disclosing 100% of the hydraulic fracturing chemical ingredients it pumps, a move aimed at increasing transparency and public trust. The move has been well received by operators, regulators and the general public, Mr Freitag noted.

Click here to watch a video interview with Baker Hughes’ Hans-Christian Freitag to find out how re-fracturing and rejuvenation can provide relief in the current economic climate.