Africa Briefs: Industry educates employees amid Ebola outbreak; Angola, Nigeria to lead Africa growth

West Africa has been hit hard by the largest Ebola epidemic in history. Sierra Leone, Guinea and Liberia have seen the highest number of infections. In mid-October, the World Health Organization (WHO) raised the total death toll from the current outbreak to 4,493 people, nearly all from West Africa. That’s from a total of nearly 9,000 believed to have been infected so far. The region could face up to an additional 10,000 new cases a week within the next two months, according to WHO.

The oil and gas industry has been proactive in educating its crews and the communities in which it operates. “The efforts that we implemented, i.e., the awareness campaign so that people are clear about Ebola, its transmission modes and practical ways to avoid it, have been positively received by our employees,” Lee Hogan, Director of QHSE for Seadrill, said.

The drilling contractor currently has operations offshore Nigeria, Ghana, Congo and Angola and has a local onshore office in each country. Of those countries, only Nigeria had a small number of confirmed Ebola cases so far. However, on 20 October, the WHO declared Nigeria free of the Ebola virus transmission.

“One of the things that we first embarked upon is getting the medical and scientific facts together with our company medical director and other subject matter experts from the medical field specializing in infectious control and Ebola,” Mr Hogan explained.

Management plan

To ensure the safety of employees and crew members and to eliminate any unnecessary concerns, Seadrill developed a comprehensive Ebola management plan. Its main components included:

• Ebola education and awareness – Communications with employees, family members and crew members onboard rigs;

• Practical ways to reduce the risk of viral transmission throughout facilities;

• Screening requirements;

• Quarantine and management of suspected cases;

• PPE requirements; and

•Managing travelers and expatriates.

The education and awareness campaign ensured employees and crews were aware of the

scientific and medical facts. The company invited medical professionals to meet with employees at awareness sessions beginning

in July. “Our goal was for employees to get factual information directly from medical professionals and subject matter experts,” Mr Hogan said.

He noted that questions asked by crew members during those education sessions revealed that “there was concern amongst some employees about Ebola, primarily due to media reporting being sensationalized on how Ebola could affect them.”

Mr Hogan emphasized that, for the average expat employee in the oilfield – for example, someone who flies into a West African country, stays overnight in a local company-approved hotel or staff house, then flies out to the rig and back home again – the risk of Ebola exposure is low.

While developing its Ebola management plan, Seadrill worked through a series of “what-

if” scenarios to develop a plan of action if the situation were to escalate, Mr Hogan explained. The management plan separates the countries of operation into different levels of risk, each requiring different actions. These include, for example, actions required if there are no confirmed cases in country, actions for confirmed cases in country, actions for multiple cases in country in more than one district or state, and actions required if there is widespread transmission throughout the country.

Mr Hogan noted that other drilling companies operating in Africa have implemented similar management plans, and the industry has been actively discussing action plans. “It’s in the interest of everybody,” he said. Seadrill has also completed four emergency drills to test the effectiveness of its management plan response based on various scenarios.

Disruption in operations

The Ebola outbreak has led to some disruption of E&P programs in West Africa. Because drilling operations across the region still rely heavily on expat workers, “operators may withdraw personnel and halt activities until the Ebola situation is controlled in Guinea, Sierra Leone, Liberia and Nigeria,” John Sisa, GlobalData’s Lead Analyst for Upstream Oil & Gas in the Sub-Saharan Region, stated in a news release on 9 September. “Nigeria is the only country in the region with sufficient resources to contain the outbreak, but there is still a risk of uncontrolled spread of Ebola. As the eighth-largest crude oil producer in the world, there is a substantial threat of supply disruption should the virus spread further in the country.”

Rex Tillerson, CEO of ExxonMobil, recently disclosed that his company’s exploration plans in Liberia are on hold. A Reuters report quoted Mr Tillerson: “We had some drilling plans for some blocks offshore West Africa in Liberia. We are having to look at when it would be prudent to resume operations there because you do have to have shore-based support.”

– By Joanne Liou, Associate Editor

Douglas-Westwood: Angola, Nigeria, Algeria to lead African growth

Angola and Nigeria will continue to dominate the West African drilling market even as Equatorial Guinea and Ghana emerge as major deepwater players in the coming years, Douglas-Westwood Researcher Matt Cook said at the 2014 IADC Drilling Africa Conference in Paris on 1 October. In North Africa, Algeria and Egypt will support production growth despite turmoil elsewhere, he added. Overall on the African continent, “we’re expecting strong growth in both onshore and offshore well completions, with production growing to around 15 million barrels a day equivalent by 2020, which is up around 2-3 million from present day,” Mr Cook said.

In West Africa, deepwater will continue to drive production growth. Last year, deepwater production (greater than 500-m water depths) accounted for 38% of the total. That’s nearly as much as onshore production, which accounted for 44% of the total, Mr Cook pointed out. “This is primarily from Angola and Nigeria. These nations remain dominant and will be joined by Equatorial Guinea and Ghana… We’re quite optimistic about growth in these countries,” he continued.

Angola, in particular, has a robust outlook, with 2017 forecast to be a very busy year due to the TOTAL-operated ultra-deep Kaombo development. “Angola will probably be the offshore jewel in the African crown, with 200 trees to be installed from now to 2020,” Mr Cook said. “With 29 wells alone (in Kaombo), along with a host of other projects in the medium term, we see drilling sustained at much higher levels than previously seen in the last 10 years.” Douglas-Westwood forecasts Angola’s oil production to climb from 2.2 million bbl/day in 2014 to 2.4 million bbl/day in 2020.

Growth is also expected in Nigeria after a decline in onshore and swamp drilling from 2006-2009 due to conflicts in the Niger Delta. Since then, “there’s been a stagnation in drilling. But with the new Petroleum Industry Bill, we’re expecting strong growth – an average 10% per year in well completions,” Mr Cook said. By the end of the decade, Douglas-Westwood expects approximately 80 onshore wells and 80 offshore wells to be drilled per year in Nigeria.

Oil theft, however, continues to be a significant challenge, taking away approximately 10% of total production each year. “One problem that Nigeria needs to overcome is the illegal bunkering of oil, which over the last few years has accounted for around 300,000 to 400,000 barrels of oil being stolen,” Mr Cook said.

In East Africa, he highlighted Mozambique as a potential sleeping gas giant, where exploration has escalated rapidly since just the early parts of last decade. “We saw 38 exploration wells drilled in just a few offshore blocks over the last four years. By the end of the decade, 97 more exploration wells will be drilled, and that’s not even taking into account the 80 subsea wells that will be drilled by ENI and Anadarko.”

Those wells are being planned to support ENI’s ambitious floating gas project; the operator is planning four FLNG facilities on the Area 4 block. “With Mozambique’s excellent geographical location (to gas markets in Asia) and reserves, which went from 4.5 tcf to 100 tcf this year, we expect the potential is excellent for an LNG hub,” he explained.

Looking to North Africa, onshore is where most growth will take place, with 83% of wells drilled and 76% of production to be onshore through 2020. Rocked by the Arab Spring and civil wars over the past three to four years, the region has seen fluctuating oil production, particularly from Libya and Sudan. Gas output from Algeria and Egypt, however, have partly made up for that decline, Mr Cook said.

“Algeria has been a cornerstone in North African production… We’re expecting this significant exporter to keep going, especially with demand from Europe.” The country’s reserves are estimated at 12.2 billion bbl of oil and 159 tcf of gas. Douglas-Westwood forecasts 551 gas wells will be drilled in this country from 2014-2020 and that gas output will climb from 1.6 million boed this year to 1.8 million boed by decade’s end.

The country is also key to Africa’s shale development, Mr Cook said, noting that Algeria ranks third in the world for technically recoverable shale gas reserves – at 707 tcf, according to the US Energy Information Administration. “Algeria, in our opinion, is the No. 1 choice to look out for. It is a serious contender for significant shale production in the future.”

Two key challenges must be overcome, however: water scarcity, which must be addressed through technology, and security. “Following the attack on the In Amenas gas plant last year, Statoil had to pull out of that facility and is now just about to start up operations again,” Mr Cook said. “Another incident such as that tragic incident last year could see investor confidence gone permanently.”

– By Linda Hsieh, Managing Editor

Equipment ownership provision of Nigerian local content act may require immediate focus

The Nigerian oil and gas industry has evolved significantly since 2010, spurred by the local content act. Whereas the country used to be dominated by IOCs and international drilling contractors, today an increasing number of indigenous operators and drilling companies are being established and playing key roles in pushing the market forward. In particular, these local players are picking up onshore and shallow-water assets being divested by IOCs, who are moving instead into the bigger-dollar deepwater projects. Speaking at the 2014 IADC Drilling Africa Conference in Paris on 2 October, Dr Olushola Ismail, Head of Sales & Marketing for Oando Energy Services, discussed the impacts that the local content act has had on the Nigerian E&P sector.

The Nigerian Oil and Gas Industry Content Development (NOGICD) Act was introduced in 2010 to promote indigenous participation in the local oil and gas industry. “The act also serves to support strategic partnering, where there is an international company that is able to transfer knowledge and technology to the Nigerian alliance partner,” Dr Ismail said. It further serves to promote the establishment of support industries and to maximize the utilization of Nigerian human resources.

There are five key provisions of the act, according to Dr Ismail:

• Supply of goods and services by Nigerian vendors.

• Financing, insurance and legal services.

• Employment of Nigerian personnel.

• Equipment ownership by Nigerian companies.

• Training for personnel through institutions approved by the Oil and Gas Trainers Association of Nigeria.

Of these five, it’s the fourth provision around equipment ownership that requires immediate focus, Dr Ismail said. The NOGICD Act already provides exclusive consideration to Nigerian companies in the land and swamp terrains.

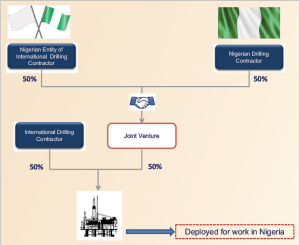

“However, when you look at deepwater, what the act is saying is, international service companies that are providing services through their Nigerian subsidiary must be able to demonstrate that the Nigerian subsidiary owns 50% of the assets that are deployed to the services being provided,” she explained. “What the Nigerian Content Development and Monitoring Board (NCDMB) wants to see is that the Nigerian entity has a vested interest in the equipment that has been supplied for the service.”

In the first few years of the NOGICD Act coming into law, the industry has been afforded some compliance flexibility by the NCDMB, which is responsible for enforcement of the act. “But over a period of time, we’re seeing a shift,” Dr Ismail said. “We’re seeing more enforcement on the side of the Nigerian Content Development and Monitoring Board. We’re seeing more Nigerian companies comply, and it’s making it harder for the companies who are not complying with the law.”

In particular, the equipment ownership provision demands immediate attention because of the level of alliance that’s required for two parties to own an asset, she said. “Today I’m not aware of any multinational or international drilling company that has complied fully with this aspect of the law,” she stated. “We are beginning to see a gradual shift where Nigerian drilling contractors are forming alliances with international drilling contractors who are willing to meet the intent of this scope.”

One challenge to achieving compliance is the willingness of the asset owner to divest a significant percentage of its asset to a Nigerian entity. “In the past, this may have been considered an area where there was room for discussion, but today we’re beginning to see Nigerian companies and international drilling contractors putting their money where their mouth is. They’re beginning to comply. I don’t believe that waivers will be given much longer on this aspect of the law,” Dr Ismail said.

The large initial capital outlay involved is another challenge. “How many Nigerian drilling contractors are able to raise the requisite finance to support this aspect of the law? Not many,” especially when you’re talking upward of $600 million for a deepwater asset. Dr Ismail advised international companies to be careful when selecting their Nigerian partner. “It’s very important that the financial due diligence is a robust exercise, and the company has the right balance sheet to support such investments.”

She further urged international companies not to think of such strategic alliances as simply having agents in the country. “If an international company wants to work in Nigeria, you have to identify the right partner. The right partner is not one that doesn’t know how to add value to the project. If all they want to do is take a percentage of profit or revenue and do nothing, then that is not the right partner. Most of the time, those sort of relationships fail.”

– By Linda Hsieh, Managing Editor

5 principles to follow for reducing risk of anti-corruption violations

In 2007, the US Department of Justice initiated an industry sweep targeting oilfield service companies, instigated by the government’s perceptions of the industry’s business practices. “In other words, it took a dim view of how we did business,” Brady Long, Ensco VP-General Counsel, said at the 2014 IADC Drilling Africa Conference in Paris on 1 October. Since then, the industry has come a long way in developing a sense of trust – not only between contractor and operator but also between contractor and regulator. “That’s not something we often think about, but that has a lot to do with the way anti-bribery laws are enforced around the world,” Mr Long said.

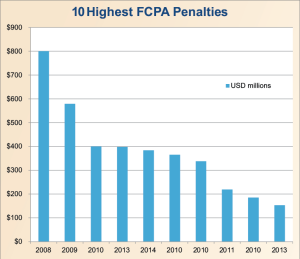

At the same time, anti-corruption in itself has become big money – both for the government and for whistleblowers. Under the US Foreign Corrupt Practices Act (FCPA), more than $4 billion in fines and penalties have been paid to the US government in just the past decade, Mr Long pointed out.

And in September, the US Securities and Exchange Commission announced it was paying a whistleblower $30 million for providing critical information in an ongoing fraud case. “That’s exactly what the US Congress had in mind when they adopted the Dodd-Frank Act,” he said. “They set up this whistleblower program so people would be incentivized to call out instances of bribery and other forms of violations of US securities laws.”

With stringent anti-corruption laws around the world along with an increasing enforcement environment, companies must take steps to mitigate their risks. Mr Long suggested five key principles to keep in mind:

• Know your locations. Mr Long stressed the importance of getting on-the-ground intelligence from people who truly know the business. In some countries, having a local partner is a must – someone who can provide local expertise and relationships. “The problem occasionally is that understanding the ownership of your local partner can be thorny and can take time… It can take a lot of due diligence to get to the bottom of who you’re really doing your business with. That’s certainly something we can all accomplish with planning.”

• Know your controls. These include disbursement policies, vendor selection, certifications and systems for reporting violations. Knowing the approval authorities within your company is also important – who can approve what for what purpose. “These are simple things, but they get companies in trouble from time to time,” Mr Long said.

• Know your business. This includes knowing what your corruption risks are – which relationships with government officials are vital and how to ensure strong relationships without crossing the line. “Also, know your business vulnerabilities – to what extent are you planning, communicating and thinking ahead to try and avoid last-minute issues arising in government offices? That tends to be one of the precursors to a bribe request. Something arrives late, something is not planned for, a shortcut needs to be taken – it puts you in a position of having to make a choice that you don’t want to have to make,” Mr Long said.

• Know your employees. In addition to the basics such as language and professional/educational backgrounds, people’s perceptions of bribery vary significantly around the world. “It’s worth understanding to what extent there’s a gap between your company’s expectations for compliance and your employees’ natural views about it,” he advised. “Do people really understand that the rules are there to follow and not just there as guidelines?”

• Know your vendors. “Most of the time these days, compliance issues arise not from employees directly but from intermediaries. It’s critical that you know who they are and know that they’re going to do the right thing,” Mr Long advised. “Make sure you have vendors with the right reputation – somebody who is going to match your standards of quality and excellence.”

– By Linda Hsieh, Managing Editor