Growth beneath the surface

Increasing footage drilled, frac stages point to robust activity despite weak US rig count as unconventional drilling gathers steam worldwide

By Joanne Liou, associate editor

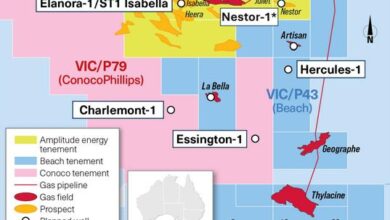

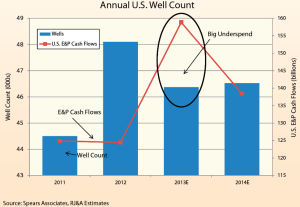

US onshore rig count fell this year, but the decline in this longtime benchmark belies the sector’s underlying strength. Some analysts say the more telling numbers are well counts, footage drilled and the number of frac stages completed. “There’s been a massive separation between the key activity indicators in our business in the oilfield industry. Historically, we have always relied on the rig count as the key metric to analyze and forecast oil service company earnings and revenue,” Marshall Adkins, managing director of Raymond James & Associates, said. “Not anymore. The well count is separating from the rig count, while the footage drilled and frac stages are up meaningfully more than the rig count.”

Rig count also doesn’t seem closely correlated to oil prices anymore either. Strong oil prices breaching $100 in the past two years have translated to higher E&P cash flows – typically this will lead to higher service activity. In 2013, however, that hasn’t been the case. “Even though E&P cash flows are up this year, we’re looking at the rig count down some 6% this year,” Mr Adkins said. “Spending in the E&P world is significantly outpacing the percentage decline in the rig count.”

Horizontal drilling is allowing US oil and gas production to grow at a double-digit pace using fewer rigs but substantially more frac stages per well. “The proliferation of horizontal wells with multistage fracturing has completely blown up the rig count as the best oilfield spending metric,” a Raymond James brief stated.

Studying market outlook from the demand side, analysts also note that global demand for natural gas continues to increase faster than demand for crude oil. “Natural gas is growing not quite twice as the demand for crude oil but close,” Roger Ihne, principal and Mid-America Oil and Gas Client Portfolio leader at Deloitte, said. Although the world currently consumes only about half as much natural gas as crude oil, “the question is what that’s going to look like in 20 to 30 years’ time.”

Consumption of natural gas is estimated to grow from 113.0 Tcf in 2010 to 185.0 Tcf in 2040 – almost a 64% jump – according to the International Energy Outlook 2013 from the US Energy Information Agency (EIA). Part of the growth is driven by government policies seeking to reduce greenhouse gas emissions, which makes natural gas an attractive energy source, particularly for electric power and industrial sectors, the report explained. Meanwhile, worldwide consumption of petroleum and other liquid fuels is expected to increase by approximately 32% between 2010 and 2040, from 87 million bbl/day to 115 million bbl/day.

Outlook by the numbers

E&P spending

Although the industry is in a relatively flat energy price environment, revenues and cash flows for E&P companies have gone up by more than 10% over the past year. Eventually, this will support more oilfield service activities. “We’re seeing a lot of unusual things in terms of E&P spending versus E&P cash flows, and our forecast is for a remarkably healthy oil service industry next year in the face of modestly lower oil prices, and the reason is simple: The E&P business underspent cash flows in 2013 because of higher than expected oil prices, infrastructure constraints and the Chesapeake Energy slowdown,” Mr Adkins said. “In 2014, we expect E&P companies to reverse that trend and overspend.”

According to Raymond James reports, 2014 E&P cash flows in the US are expected to be down as much as 10%, but overall spending will likely be up by 5% to 10%. While that higher spending might not show up in the rig count, it should show up in more footage drilled and more frac stages pumped than in 2013, the firm believes.

Analysts at Raymond James cite several factors that have depressed spending behavior over the past year. First, the majors have increased their market share, accounting for 9% of the rig count compared with 6% in previous years. These companies tend to have less variable and less aggressive budgets. Second, as the largest onshore operator in the US, Chesapeake’s restructuring has had a significant market impact. Chesapeake operated approximately 140 rigs in 2011 but now operates only about 70 rigs. Just one company accounted for half of the decline in the total rig count since 2011, according to a Raymond James brief.

Lastly, significant infrastructure constraints and transportation growing pains have deterred some of the drilling and completion activity that could have otherwise occurred in 2013.

Another turn in industry behavior is the budget increases that E&P companies are devoting to completions compared with two decades ago, when more costs were associated with drilling. “It’s flip-flopped,” Mr Adkins said. “You’re spending all of the money on directional drilling and the multistage fracturing. When we look at the rig count relative to the available spending dollar, the rig count is not improving as fast as the spending dollars are.”

Oil/gas companies also are committing more dollars to development projects in horizontal plays and tight formations. This development phase of unconventional resource plays is lending itself well to a manufacturing-type or factory drilling environment via multi-well pads and fast moves pad-to-pad, which continues to lead to improved efficiencies. “If wells are taking 20 days today, the expectation is for them to average fewer days next year, although well complexity is a variable worth watching that could slow the efficiency gains,” John Lindsay, president and COO of Helmerich & Payne, said.

Well and rig counts

Approximately 48,100 wells were drilled onshore US in 2012, and that number is expected to go down this year by 4% to approximately 46,400, based on data from Spears and Associates. In 2014, that trend is expected to reverse slightly, with the well count achieving a very modest 0.2% year-over-year gain to 46,500, according to Raymond James. The group is also optimistic that US spending and total footage drilled will each increase by approximately 5%. Rig count, however, is expected to drop by approximately 3% from 1,762 active rigs to 1,717.

Looking at natural gas specifically, recovery has been slow since pricing collapsed two years ago to $2/Mcf, and no significant increase is forecast for the near term. Raymond James’ September report put natural gas at $3.75 for the next 18 months. “Ultimately, demand will slowly lift prices higher, but that’s really 2016 and beyond,” Mr Adkins said.

Mr Lindsay agreed that natural gas prices will likely remain below $4 in 2014 but is optimistic on its long-term outlook. “We’re going to be hard pressed to see any strength from natural gas prices. I think we would need closer to $5 gas to really make a difference regarding the rig count,” he said. “Long term, I’m bullish on gas, and I think we’ll continue to build some demand in the US and hopefully have the capability to export significant amounts of LNG that obviously would help the industry tremendously.”

For now, though, oil and liquids-rich plays remain the target for the majority of H&P rigs. In the US, the company has 249 active rigs, of which more than 50% are targeting oil and an additional 40% are targeting oily and liquids-rich gas, leaving only approximately 7% for dry-gas plays. The company also has 26 active rigs outside the US, from South America to the Middle East and North Africa. Most are working on conventional oil projects except for two rigs in Abu Dhabi drilling for natural gas.

Similarly, approximately 85% of Precision Drilling’s rigs in North America are targeting oil and liquids-rich plays. For non-North American rigs, that percentage actually goes up to 100%. Precision’s eight rigs in Mexico, three in Saudi Arabia and two in Iraq also are targeting oil. “ We are anxious to expand our footprint in the Arabian Gulf. Our large rigs are well suited for the deep complex wells we are drilling. We believe further expansion is possible as we continue to redeploy our large US rigs to these opportunities,” Kevin Neveu, president & CEO of Precision Drilling, stated.

The company deployed its first rigs in the Middle East to Saudi Arabia in January 2012 and will mobilize two additional newbuilds to Kuwait in mid-2014. Since the Middle East remains a relatively new operating region for Precision, challenges remain, Mr Neveu said, particularly around personnel recruitment. “We are still trying to build our infrastructure base and overcome some of the start-up challenges,” he said. The two newbuilds for Kuwait are part of Precision’s Tier-1 Super Series fleet, designed for deep drilling. “They’re 3,000-hp drilling rigs designed for extremely deep, high-pressure, high-temperature drilling,” he added. “The potential of Middle Eastern shale drilling is interesting but still a long ways off.”

The overall rig count in the US has been trending sideways in the past six months, Mr Lindsay noted. “Historically in this business, rig count is typically increasing or dropping off the table as we saw in 2008 or 2009, so it’s unusual to see the overall industry rig count trending sideways in the way that it is.”

A significant factor has been the continued shift toward AC-drive rigs, which are still adding market share amid a declining rig count. “It’s very encouraging because that’s all H&P is working today – AC-drive FlexRig 3, 4 and 5s. Our customers in general are trending toward picking up more AC rigs,” Mr Lindsay said.

H&P footage per day has increased by 23% from 2011 to 2012 and has increased by an additional 14% in 2013, all attributed to better drilling efficiency. Rig count-wise, the company has seen fairly stable numbers this year, with approximately 249 active rigs now in the onshore US versus 239 a year ago. Industrywide, the total US rig count was approximately 1,781 in August, according to Baker Hughes data, down from 1,919 rigs ending 2012. Outside the US, the August rig count was 1,267, slightly up from 1,234 ending 2012.

Relatively new to the US shale business, BHP Billiton entered the US market in February 2011 with a 487,000-net-acre Fayetteville acquisition. The company bought 100% of Chesapeake Energy’s upstream and midstream Fayetteville interests for US$4.75 billion. That was followed in August of the same year with the acquisition of nearly 1 million net acres in the Eagle Ford, the Haynesville and the Permian Basin from Petrohawk for $12.1 billion.

“The challenge last year – we were relatively new to the shale industry. We were ramping up rigs at the time, and while doing that we were trying to orient new contractors and new employees,” Rod Skaufel, BHP asset president for shale, said. “It was a good learning year as our cost and time performance improved in every field.” Now, the company is in the process of reducing operations for next year from 40 rigs to 26. The bulk of these rigs will continue development drilling programs in the Eagle Ford and Haynesville and appraisal drilling in the Permian.

The 14-rig reduction is expected to help the company’s focus on safety and operational performance. “We’re better positioned this year not only because we’ve got two years behind us, but you have activity levels that are better aligned to the staffing within the organization.”

Like many operators, BHP has deployed most of its resources to exploit the liquids-rich plays. Only 20% of its rigs are drilling for dryer gas in the Haynesville. “We’re continuing to drill the Haynesville because our acreage is the most prolific part of the play, and we want to continue to build our technical understanding of the field,” Mr Skaufel said. “We have wells that can produce 10 to 15 Bcf that, even at today’s prices, are highly economical.”

Looking at rig capability, Mr Skaufel said the ability to skid continues to be highly valuable, even though rig moves are occurring less frequently in the development phase. “If it takes you three days to move but 12 hours to skid, you make up a lot of time having that skid capability,” he said. “For bigger rigs, when you move to the next pad, speed is important. We’ve been putting emphasis on our rig move operation for our Flex 5s.”

BHP has deployed H&P FlexRig 5s, which the operator believes are better suited for development drilling. It has been drilling four to six wells per pad with those rigs, skidding between wells. For appraisal and held-by production drilling, however, the company believes that greater rig mobility offsets skidding capability. In that case, the company opts for the FlexRig 3s.

In both cases, BHP said it favors AC rigs for its North American operations. “You have better control and more constant horsepower at the bit,” Mr Skaufel said.

Efficient rigs

Part of what’s driving the demand for AC rigs, like the advanced-technology FlexRigs, is the fact that extended-reach laterals are getting even longer and multi-well pad drilling is becoming more prevalent. “Bits are becoming more aggressive; downhole motors have higher horsepower ratings. Mud pumps are being run harder and at higher pressures,” Mr Lindsay said. “The rigs in general are working harder today than they did last year and particularly than they did five years ago, which puts a lot of pressure on contractors to have excellent systems and the best people to operate and maintain the rigs.”

Being able to drill multiple wells via pad drilling can boost the economics considerably, for both drilling contractor and operator. Back in the early 1990s, it was pad drilling that provided the greater efficiency to enable Canada’s heavy oilfields and SAGD (stream-assisted gravity drainage), according to Precision Drilling.

“Most of the efficiency improvements that we’re seeing right now are from deploying high-efficiency rigs onto pads and drilling a series of wells from the pad,” Mr Neveu said. “Pad walking systems move the rig from well to well very quickly and minimize the amount of nonproductive time for the rig. It’s a logistics improvement as opposed to drilling, rate of penetration improvement. Typically when you move from the completion testing phase to the production-style drilling on pads, a 50% to 60% reduction in total well construction times is achievable.”

In the past 36 months, Precision has delivered 63 newbuild Super Series rigs, half of them going to the US market. These horizontal drilling units feature walking systems, automated pipe-handling systems, and many are suitable for cold-weather operations. The company also completed 18 Tier-1 upgrades, which included improving mobility, adding hydraulic horsepower and improving the rigs’ drilling control systems.

Overall, contractor efforts are leading to more efficiency, and the evidence can be seen in the fact that rig count is down but well count going up. Mr Lindsay attributes the overall industry efficiency improvement to the AC-drive market share growth, adding that he believes the industry will continue to eliminate the older SCR and mechanical rigs from the fleet. In a declining rig market, AC-drive rigs have actually picked up 10% market share over the past year, he stated. H&P has more than 150 FlexRig 3s, 75 Flex 4s and 18 of the newest-generation FlexRig 5s that are designed for multi-well pad drilling and longer laterals.

Assuming oil prices remain above $85 and natural gas prices hold steady, Mr Lindsay said, the H&P fleet will continue to expand in 2014. “We have 20 AC FlexRigs stacked today, and over time, we should put those rigs back to work. We’ll also continue to build new rigs, and hopefully our customers will continue to contract newbuilds.”

By the end of this year, H&P expects to have brought on approximately 25 AC-drive FlexRigs. “We are budgeted to build two rigs a month through the calendar year,” he said. “If demand is significant enough for us to remain at two rigs a month in 2014, we should remain at two a month.”

Utilization and dayrates

Utilization of H&P’s AC-drive rigs has been running at approximately 93% compared with 84% for the overall H&P US land fleet, which includes 33 SCR rigs. The SCR-powered fleet includes the FlexRig 1s and 2s that were built in 1998 and 2001. “They haven’t worked since the end of 2012, and we really don’t expect to see them running in 2014 unless demand from our customers changes,” he explained. “The overall business is shifting to utilizing newer-technology, AC-drive rigs.”

That shift is not just reflected in H&P numbers but also in industrywide stats. Mr Lindsay explained that overall industry AC-drive rig utilization for US land is approximately 86%, while mechanical rig utilization is below 50% and SCR utilization is below 60%. “These utilization rates give you an indicator as to why you’re going to continue to hear drilling contractors in the US build more AC rigs, because of the nature of what the customer is demanding today and the type of the wells that are being drilled.”

Eventually, he believes, AC rigs will effectively replace the older conventional fleet for the high-end part of the market. “Rather than a retooling effort like we saw five years ago, this is a replacement cycle.”

Precision is focused on utilization of their Tier-1 rigs. “We believe that the industry’s utilization of Tier-1 rigs designed specifically for horizontal drilling, high mobility and maximum efficiency is in the 85% range,” Mr Neveu stated. Out of a fleet of approximately 325 rigs, Precision considers 203 to be Tier 1. “With the strong oil prices and the improved gas prices relative to earlier this year, that utilization should be equal to or at least better next year.”

Like the rig count, US dayrates are projected to remain relatively flat in 2014, at least for the higher-end rigs. Other assets, however, may run into pricing challenges. “Many believe that the older conventional rigs will continue to come under pressure, and when that happens, contractors typically reduce pricing on older rigs to try and maintain activity,” Mr Lindsay said.

For Precision, average dayrates in the US increased slightly in Q2 2013 to $23,850 from $23,145 for the same period last year. In Canada, rates rose from $20,649 to $22,276. These increases came about partly due to more Tier 1 and upgraded rigs entering the fleet, according to the company’s Q2 financial report. “We expect operating margins to remain flat into next year,” Mr Neveu said.

He added that availability of longer-term contracts has trended softer in the past six to 12 months. “However, in some areas, we are seeing demand for longer-term contracts start to pick up, which might tell us our customers expect activity to begin to rebound.” Precision’s current contracts are generally three to five years for newbuilds, while renewal contracts are in the range of six months to two years, Mr Neveu said.

H&P has a one-third to two-third mix of spot market and term market contracts that have remained steady in the past six months. The FlexRig 3s and 5s have been securing longer-term contracts, typically two to three years.

North American hot spots

According to Douglas-Westwood analyses, the Permian Basin in West Texas and southeast New Mexico continues to be a stronghold for activity, accounting for 22% of all onshore drilling in the US. Since 1999, rig count in that region has risen from 51 to a whopping 442, and it currently produces 1 million bbl/day of oil, R. Michael Haney stated in a Douglas-Westwood report. The US Department of Energy reported that domestic oil production for the week ending 4 October averaged 7.8 million bbl/day. “The opportunities are substantial due to stacked payzones layered on top of each other, allowing producers to tap oil at varying depths from a single vertical well. The Bonespring and Wolfcamp plays epitomize this idea,” Mr Haney stated. “Together, the two could pump 1 million barrels of oil per day by 2018.”

H&P has added more than 10 rigs to the Permian in the past year. “We’re over 50 rigs working in the Permian basin today,” Mr Lindsay said, “and we’ll continue to grow the footprint there.” Business is also picking up in the Niobrara, where H&P added five rigs this year for a total of 16.

Overall, however, it is the Eagle Ford that still accounts for the majority of H&P operations, at approximately 80 rigs, but Mr Lindsay is cautious about the play’s 2014 outlook. “Our Eagle Ford rig count will remain relatively flat, even possibly down slightly,” he said. “It depends somewhat on efficiencies and pulling rigs out of the Eagle Ford to go to the Permian, possibly depending on the demand in the Permian.”

For Precision, Mr Neveu expects oily areas to remain the strongest plays in the US, but he also thinks gas drilling could improve. “Natural gas drilling in the US next year could be on the rebound after several quarters of reduced activity,” he said.

Over the longer term, prospects for Canadian LNG exports could also drive up gas-directed drilling in Canada. Multiple projects are in the planning phase to export LNG from British Columbia to Southeast Asia and East Asia, which could lead to a substantial increase in drilling, Mr Neveu explained. These include LNG Canada – a joint venture among Shell Canada, Korea Gas Corp, Mitsubishi Corp and PetroChina Company – and Kitimat LNG – a joint venture between Apache Canada and Chevron Canada. “The expectation is that the exports begin around the 2017 to 2018 time frame, with drilling likely to begin in 2014 to 2015,” Mr Neveu said.

The US is also chasing LNG opportunities, and Mr Neveu said gas exports could balance out supply/demand and lead to an increase in gas drilling later into 2014. As of September, the US government had granted four permits to export LNG. Cheniere Energy’s Sabine Pass plant in Louisiana, the first to receive export approval in the US, is expected to go online in Q4 2015.

Outside North America

Around the world, unconventional drilling continues to pick up, albeit at a slower pace than it did in North America earlier in its shale boom. “Other parts of the world haven’t drilled as many wells as (North America),” Mr Adkins said. “They don’t know exactly where these shale plays are, and they don’t know what the characteristics are to the same degree that we did here in the United States. We’ve drilled through these previously uneconomic shales for over 50 years, and we know the petrophysical properties and exact location of all of them. That isn’t the case in the rest of the world. More importantly, the US already has much of the infrastructure to transport this shale oil and gas to the end markets. That is not in place for the rest of the world. It will take time.”

Sixteen of the 26 rigs H&P operates outside the US are FlexRigs, and the company expects that count to grow in 2014, even if relatively slowly. “South America and the Middle East are probably our two areas of greatest potential for international growth,” Mr Lindsay said. In addition to FlexRigs, the company is building a new 3,000-hp AC rig with a 1.5 million-lb hookload capacity for operations in Colombia. “The FlexRig fleet has really been designed to drill 8,000-ft range up to 25,000-ft measured depth range wells, with 5,000 to 14,000 ft of horizontal section,” he said. “This rig is our first opportunity to build an ultra-deep AC-drive rig designed for the international market.”

The operator in Colombia committed to a long-term contract for the newbuild 3,000-hp rig after seeing advantages of AC-drive technology in shallow vertical drilling, as well as more complex horizontal and directional drilling, Mr Lindsay explained. The ultra-deep directional wells in Colombia can take from 180 days to a year to drill. “There’s a real opportunity for efficiency gains. The customer believes there could be 15% to 20% savings in drilling times.” The new rig, H&P Rig 900, is being built in Houston and scheduled for delivery in spring 2014.

In Europe, the International Energy Agency projects that unconventional gas could meet 10% of the European Union’s energy demands by 2035. One major player is Chevron, which continues to develop a portfolio of shale projects across Central Europe. “We’re undertaking seismic survey programs and have commenced exploratory drilling activities in Poland and Lithuania and plan to commence exploration activities in Romania during the fourth quarter of 2013,” Andrew Rawicki, onshore Europe operations manager for Chevron Upstream Europe, said. “In Ukraine, we recently had a significant step forward in the PSA approval process.”

In southeastern Poland, Chevron has drilled four vertical exploration wells with a 1,500-hp rig from Exalo Drilling. In March 2012, Chevron completed drilling its first well in the Grabowiec concession, which was followed by a diagnostic fracture injection test in December of that year. Further wells were drilled in three other concessions, and the well in Zwierzyniec underwent a fracture stimulation this summer.

Future need for more rigs in Europe will depend on seismic and geological data since the exploration is just beginning. “We’re going to let the rocks dictate what our future activity is,” Mr Rawicki said. In northeastern Romania, Chevron owns and operates the Barlad Shale concession, a 1.6 million-acre (6,350-sq-km) license, according to the company’s Romania fact sheet. A 248-mile (400-km) 2D seismic acquisition program was completed in 2011, and the company planned to spud an exploration well in late 2013. In the Dobrogea area of southeast Romania, Chevron also planned a 2D seismic program in Q4 2013.

Another factor for future activities is being able to establish trust with each local community where exploration will take place. “We put a lot of effort into ensuring that communities in which we work see us as partners, and that starts by being incident-free, transparent in our activities and making social investments in the areas of economic development, education and health,” Mr Rawicki said. As part of efforts “to be a good neighbor,” Chevron has invited local communities to rig sites to learn about shale drilling. In May, to mark the commencement of Chevron’s work in the Polish Krasnik concession, local residents toured the site guided by technical specialists.

Gaining support

In China, mounting political pressures are compelling the government to invest in shale development. This is driven in part by growing domestic energy needs and by increasing concerns among its own citizens with coal-related pollution. “They clearly identify shale gas as an emerging area that they need to invest in,” Deloitte’s Mr Ihne said, noting that China is estimated to have the largest shale gas resources in the world. The US EIA estimates China has 1,115 Tcf of technically recoverable shale gas resources, the highest of 41 countries based on a 2013 assessment.

In the Chinese government’s five-year plan for social and economic development initiatives released in 2011, aggressive targets were set for the country’s shale gas production. “In five years, they are hoping to get to 20% of where we’ve come to in the US in about a five-year period, where we’re currently producing about 10 trillion cubic feet a year. China is trying to increase to 2 trillion cubic feet a year.” It is still too early to tell if the goal is reachable, he added.

Challenges include limited infrastructure and uncertainty about the shale geologies in China, but momentum continues to build. Mr Ihne notes that the government has shown acceptance of shale development and more willingness to invest through joint ventures between Chinese NOCs and foreign companies. In March, China National Petroleum Corp and Shell signed a production-sharing contract (PSC) for shale gas exploration, development and production in the Fushun-Yongchuan block in the Sichuan Basin. In July, Hess Corp also signed a PSC with PetroChina to explore and develop the 800-sq-km Malang shale oil block of the Santanghu basin in China’s northwest region.

Like China, Argentina is expected to see growing investments in shale in 2014. One approach has been instituting different gas pricing tiers. “One of the tiers is specifically associated with new gas, commanding a higher price than what would be considered conventional gas or already producing gas,” Mr Ihne explained. “It actually incentivizes for an investment into the country to help specifically unlock shale gas.” Further, at the end of 2012, the Argentinian government announced its new Gas Plus program to almost triple natural gas prices to $7.50/million BTU to encourage conventional and shale drilling.

Although some governments in South America and Europe have tried to limit shale development, energy policies are slowly evolving to welcome more investments and allow more activity. In the UK, tax cuts have been proposed.

Under current UK law, oil and gas development projects are potentially subject to three taxes, including a 30% corporation tax and a supplemental tax of 32%. For fields that received development approval prior to 16 March 1993, an additional petroleum revenue tax (PRT) is applied, resulting in an 81% total tax rate. “The government is proposing for income derived from a shale gas development to receive an exemption in relation to the supplementary tax charges of 32%, which means there will only be a 30% rate of tax charged in relation to shale gas developments,” Darren Spalding, attorney at Bracewell & Giuliani, said.

Companies currently receive tax relief from a “ring fence expenditure” supplement for six accounting periods to balance losses associated with drilling. “For up to six years after you’ve done the drilling, you’re maintaining the time value of money so that when you finally start making profit, the losses that you have to set off against are essentially in today’s terms rather than maybe five years ago when you incurred the expense,” Mr Spalding explained. For shale gas developments, the government is proposing a 10-year time period.

The UK government is analyzing feedback on the tax incentives proposals and plans to publish responses by year-end and potentially propose legislation in 2014. Any proposed outcomes of the consultation will be included in the Finance Bill 2014, which would come into effect next year, Mr Spalding explained.

In July, the UK Department for Communities and Local Government published a planning guide for onshore oil and gas to help operators streamline the approvals process. “There are a number of layers of regulatory approvals that you need to go through as a developer in order to get a shale gas project up and running,” Mr Spalding noted. “This guidance is supposed to help streamline that process for developers.”

Finally, the UK government this year established the Office of Unconventional Gas and Oil to streamline the planning and permitting processes for developers. “It’s going to be the new regulator for the shale gas industry in the UK,” Mr Spalding stated. The department is responsible for encouraging and overseeing energy development in the UK, including licensing for exploration and production. “It’s all rather new. The potential rewards are very big, and the (UK) government has clearly thrown its political support behind it to try to create a favorable investment environment.”