Report: Global shale developments to drive higher HP land fleet

Worldwide deviated/horizontal drilling to boost number of higher horsepower rigs by 28% by 2016, analysis shows

By Calum Shaw, Douglas-Westwood

North America continues to lead the way in drilling and workover rig supply, although the majority of rigs are now operating outside of the US and Canada. Douglas-Westwood’s data shows that the global supply of land rigs is provided by more than 450 contractors, with the latest count exceeding 9,500 capable rigs.

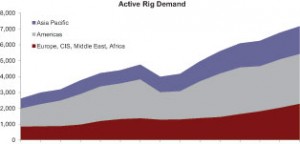

The growth in land rig demand since the beginning of the 21st century has been exceptional. Worldwide, the number of rigs drilling for oil and gas increased by more than 100% between 2002 and 2008. North America accounted for a large proportion of this growth, although other key regions, including Russia and Middle East and North Africa (MENA), contributed substantially as well. It is estimated that at the start of 2008 an average of more than 6,200 rigs were actively drilling worldwide. However, demand faltered in 2009, with the effects of the global economic crisis reducing the operational rig fleet to an estimated 4,800. Although drilling demand fell in all the primary hydrocarbon-producing regions, almost all of this demand reduction was led by North America – a drilling market highly sensitive to oil and gas prices. The widespread use of short-term contracts facilitated the rapid cutback of well requirements, compounding the steep decline in rig demand.

Outside North America, however, reductions were far less severe. While key markets, such as the mature provinces of Russia, saw decline, much of this was driven by exploration and appraisal. Due to the need to offset production decline in mature regions, ongoing development activity remained far more stable. The combination of a less sensitive international drilling market and higher proportion of drilled wells present outside of North America led to a less dramatic downturn than in previous cycles.

Furthermore, many operators work on yearly contracts, leading them to react more slowly to market trends and movements.

Demand growth and recovery

The future outlook is clear: North American demand has been re-incentivized through growth in oil prices, with activity in the region potentially reaching historic levels by 2016. This is also the case internationally, with strong demand growth expected over the next five years and beyond. Douglas-Westwood estimates that growth in rig demand will average in excess of 4% per annum over the next five years, with strong growth within key markets on each continent.

In Latin America, Colombia will become a focus and is expected to account for over 50% of the growth forecast for the Latin American land rig fleet. Key MENA countries, including Saudi Arabia, Iran and most notably Iraq, are all expected to see substantial growth in the volume of rigs playing a part in the drilling landscape. In countries such as Algeria, Egypt and Libya, an increasing proportion of rig demand will be driven by horizontal and deviated drilling, with companies seeking to maintain production in maturing oil fields.

Douglas-Westwood analysis concludes that total drilling demand may push the number of operational drilling rigs in the global fleet to over 9,000 by 2016, with 60% of that demand coming from regions outside of North America. Growth of this size inevitably requires an increased volume of drilling rig construction, both to increase the number of rigs currently available in the international markets and to repair and replace existing fleets, which have suffered from a lack of investment over the last few decades.

Increased transparency on the part of Chinese contractors, particularly China National Petroleum Corp (CNPC) and its subsidiaries, confirms the Chinese count as higher than those of Canada and Russia, while a number of other countries are again experiencing growth following the economic downturn. The increased activity and demand requirements are not solely emanating from North America, with higher growth rates now evident in all other regions, particularly Eastern Europe and the FSU, Latin America and Asia.

The development of Chinese rig-building firms continues as opportunities to enter the global market grow. Competition between manufacturers of rig components in frontier and international markets is strong. Nearly 150 companies now provide drawworks worldwide, with many of these also providing mud pumps and top drives. Development outside North America is still thought to provide more opportunities for oilfield service companies than oil and gas producers, due to the number of national oil companies existing within the frontier markets acting as a barrier to entry for foreign oil and gas companies.

Unconventional development

The development of unconventional gas outside North America will also have a profound effect on the global rig fleet. North America has experienced a steep increase in high-horsepower (HP) drilling rig demand as a result of rapid shale and tight-gas development over the past five years, with deviated and horizontal drilling expected to increase in excess of 15% over the next five years. While the vast majority of rigs involved in unconventional development in North America are high spec and of good quality, the size and specification of existing rig fleets in other regions will need to be increased dramatically to meet predicted exploration, appraisal and development drilling demand.

Although growth will be common across all regions, Europe and Australia are expected to see the largest demand increases. To meet the forecast production figures for European shale gas, high-HP rig construction in the region would need to increase dramatically.

Global land rig outlook by the numbers

- Rig demand growth will average over 4%/year over next 5 years.

- Total drilling demand may push the number of operational drilling rigs in the global fleet over 9,000 by 2016, with 60% of demand coming from regions outside of North America.

- North American horizontal drilling will increase over 15% in next 5 years.

Replacing older fleet

The existing fleet of rigs continues to age. The maintenance and replacement of this fleet is necessary to ensure its suitability for continued, accelerated and, in many cases, more complex drilling programs. Older rigs are likely to be used but for the drilling of infill wells (i.e., wells drilled on existing fields in an attempt to bolster declining production).

Well complexity and depth are increasing across the globe. The depth of wells is also increasing in key environments such as Russia and MENA while deviated drilling is increasing, particularly in prolific gas-producing basins. As a consequence, between 2011 and 2016, the global fleet of higher HP rigs, used primarily in deviated and horizontal drilling, is set to increase by 28%, compared with 14% for lower HP rigs over the same period.

Newbuild activity continues in response to increased demand and the need to replace aging rigs. In recent years, rig-manufacturing capacity has been put under pressure, and firms across the world have prospered as a result. Recent activity has remained strong. While economic turmoil and socio-political instability has reduced the number of rigs required working in certain markets, this has had less of an impact than in previous cycles, and demand remains relatively high.